Introduction

A long-standing problem in the financial markets is insider trading, which is defined as the unlawful act of trading stocks based on substantial non-public information. Insider trading involving high-profile persons and companies has surfaced multiple times throughout the years. These cases show the requirement for administrative measures to safeguard transparent business sectors while likewise enlightening the moral problems looked by those functioning in the monetary area. Here we investigate a couple of the biggest insider trading cases , separating the particulars of the unlawful activities, the aftermath for the people concerned, and the more extensive impacts on the worldwide monetary framework.

The First Cases Of Insider Trading

Historically, insider trading has taken many forms; the financial and commercial sectors were common places for its earliest manifestations. The idea behind insider trading is that certain people might get an unfair edge in the market by trading stocks based on non-public knowledge. There are a number of instances in history that show that insider trading did occur. Even if laws against it did not come into effect until the twentieth century.

South Sea Bubble (1720)

The South Sea Company of England was implicated in the South Sea Bubble. Which is considered one of the first financial bubbles in history. Rumor had it that government officials and other insiders had taken use of their access to confidential information. It is to profit from the soaring stock prices just before the bubble burst. Financial market abuses can be prevented with the help of legislation, as this occurrence has shown.

Railway Mania (1840s)

There was a period in the UK known as “Railway Mania” when investors tried to cash in on the railway construction boom. Many people engaged in insider trading because they had special knowledge about future railway developments and wanted to profit from it. The difficulties of unregulated markets and the necessity of protections against insider trading were brought to light during this time.

Evolution Of Insider Trading Laws

Over time, financial crises and the significance of maintaining market integrity led to the formalization of rules and regulations around insider trading. Important turning points in this development include:

Securities Act Of 1933

The Securities Act of 1933 was passed by the United States government following the stock market crisis of 1929. While this law did not seek to outright prohibit insider trading. It did seek to increase market openness by mandating that, during initial public offerings, businesses disclose material information to potential investors.

Securities Exchange Act Of 1934

Market regulation took a giant leap forward with the passage of the Securities Exchange Act in 1934. To combat insider trading, the rules and regulations pertaining to the acquisition and sale of securities (Section 10(b) and Rule 10b-5) were employed. The legal basis for punishing individuals involved in fraudulent practices was laid out by these provisions.

Chiarella v. United States (1980) And Dirks v. SEC (1983)

The breadth of insider trading laws was defined by legal cases like Dirks v. SEC and Chiarella v. United States. A violation of a fiduciary obligation or a duty of confidence and trust is necessary for an act to be considered unlawful. And the decisions differentiated between unlawful insider trading and lawful information-sharing.

Insider Trading And Securities Fraud Enforcement Act Of 1988

Lawmakers in the 1980s created the Insider Trading and Securities Fraud Enforcement Act in reaction to several high-profile insider trading cases, such as the one involving Ivan Boesky. The penalty for insider trading offenses were enhanced and the prosecution of those involved was made easier by this legislation.

SEC’s Rule 10b5-1 (2000)

Trading based on substantial nonpublic information is considered a violation of the Securities and Exchange Commission’s (SEC) Rule 10b5-1. Which has a precise definition of insider trading and criteria for evaluating whether this occurs. This rule clarified the law and made it easier to enforce.

Biggest Insider Trading Cases

Jeffrey Skilling

Among Jeffrey Skilling’s numerous convictions while serving as Enron’s CFO, insider trading stood out as the most serious. He accomplished this by concealing the company’s severe financial problems from the investing public. When he started selling his shares, the insider trading started. Investors were unaware of the company’s fragility, but Skilling, as CFO and a plan architect, was aware of it. Skilling was found guilty on 19 counts by a federal jury in 2006, one of which was insider trading.

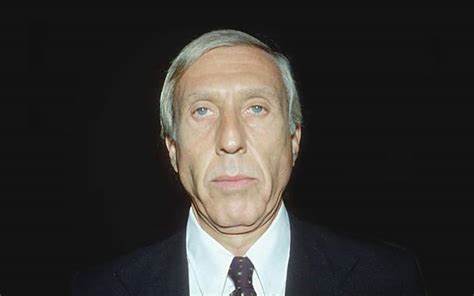

Ivan Boesky

In the 1980s, investors utilized high-yield corporate bonds, orchestrated by Michael Milken, the self-styled “junk bond king,” to finance leveraged buyouts and mergers and acquisitions. But things went south for him when word got out that he was helping out Ivan Boesky, a successful stock picker. Boesky worked as an investment banker in the field of arbitrage. Which attempts to profit from the short-term holding of assets (such as gold) by purchasing them in one market and then selling them in another. Here, Boesky became rich trading the stocks of companies involved in mergers after Milken alerted him to the possibility. Boesky pled guilty to the felony charge of manipulating securities. And promised to cooperate with the SEC’s investigation, which led to Milken’s capture.

R. Foster Winans

The Wall Street Journal’s “Heard on the Street” feature was written by R. Foster Winans on a weekly basis. Though he appeared to be an outsider, it is difficult to escape the ties that bind the New York financial media to the traders who share their city. In the end, Winans became entangled in a plot to inform a stockbroker about the content of his next column. Even before the news leaked across the United States, the broker knew he could make money off of the knowledge. So he split the earnings with Winans. Winans, whose share was around $30,000, became a shining example of how financial journalism can enable some really ambiguous ethics when the plan was discovered in the end.

BusinessWeek/Goldman Sachs

A number of subsequent insider trading convictions appear to have been modelled after the actions of Eugene Plotkin and David Pajcin. The most high-profile of their insider trading instances is likely to sound familiar, but they were involved in other others. Pajcin worked for Goldman Sachs before joining Plotkin there as a research analyst. They banded together to enlist the help of a Merrill Lynch employee who leaked to them details about the investment bank’s massive mergers, including the one between Reebok and Adidas.

Following in Ivan Boesky’s footsteps, Plotkin and Pajcin began purchasing shares in firms that were due to be bought in order to sell them for a rapid profit once the news spread. Another one of their schemes, similar to R. Foster Winansan’s, was paying someone to work at one of the printing companies that produced BusinessWeek. So that they could take copies of the magazine before they were released to the public.

James McDermott Jr.

It appeared like James McDermott Jr. was enjoying the good life. He worked as the chairman and CEO of the Wall Street investment firm Keefe, Bruyette & Woods, making $4 million a year. At the end of the day, he went home to his wife and two children. But underneath McDermott’s stiff banking facade was reality. His 1999 arrest stemmed from accusations that he had spoken with his mistress, a Canadian adult film star, about five impending bank mergers. After McDermott was arrested, Kathryn Gannon—also known as Marilyn Star—made $80,000 by trading on her advanced knowledge. After five months in prison, he finally admitted guilt on one count of insider trading.

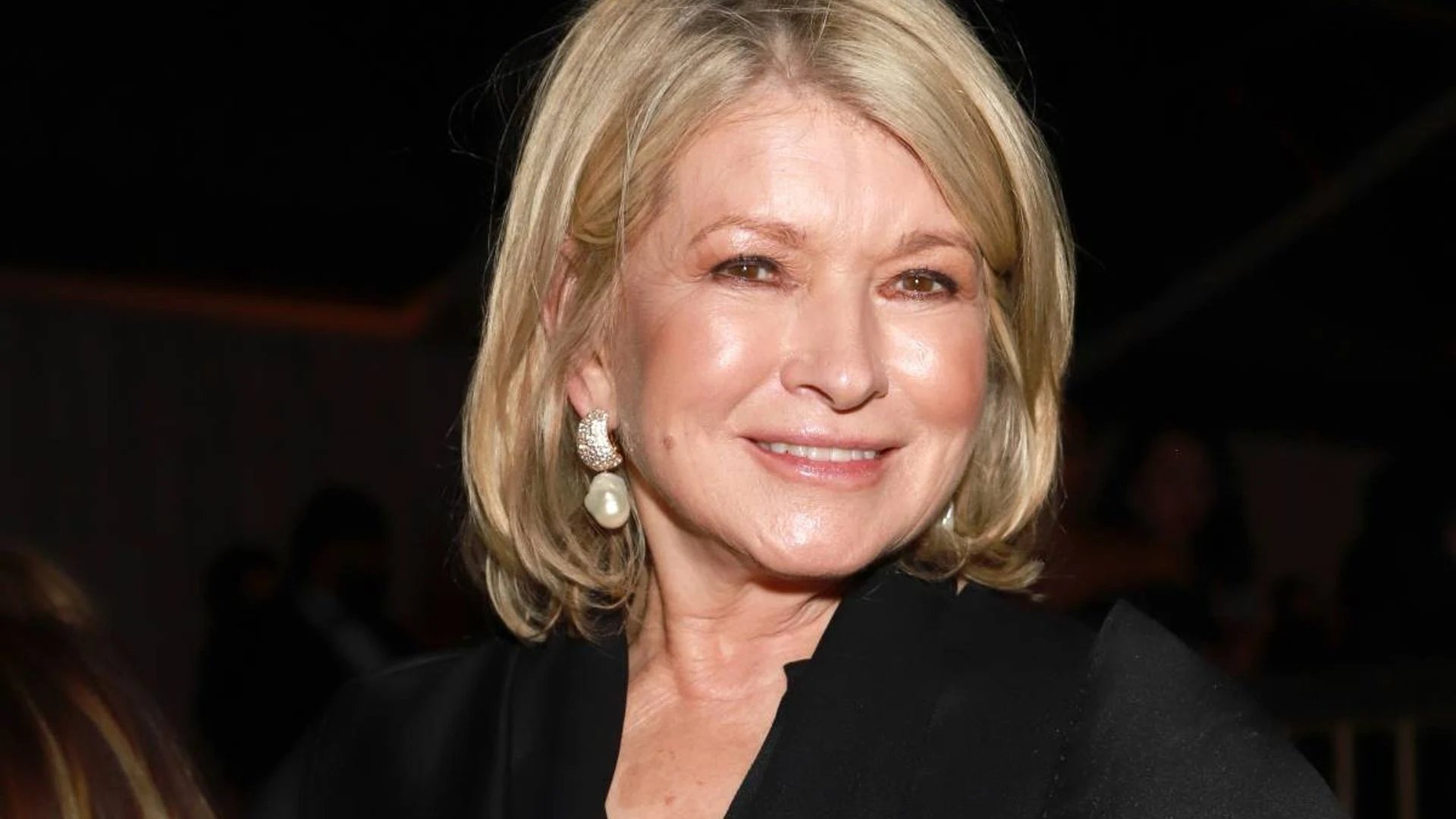

Martha Stewart

Selling branded home goods and sharing advice on how to live a gracious life through her magazine, books, and television appearances helped Martha Stewart build her fortune. However, Stewart got herself into trouble because of a tip. Stewart was indicted by the SEC in June 2003 for securities fraud together with her former stockbroker, Peter Bacanovic. The allegations claimed that 18 months prior. Bacanovic had provided Stewart with an unlawful tip concerning the stock she held in ImClone Systems, Inc., a biopharmaceutical industry.

Stewart was informed by Bacanovic that other important clients, including the CEO and daughter of ImClone, were selling their shares ahead of negative news from the FDA. Even Stewart, who was found guilty of obstruction, conspiracy, and making false statements in connection with a federal inquiry. Sold off her shares to prevent a catastrophic loss. She spent five months behind bars at a federal prison.

Raj Rajaratnam

Raj Rajaratnam’s journey to billionaire status appears, at first glance, to be an incredibly inspiring tale of immigrant success. His family emigrated from Sri Lanka to the US in 1981 so he could get an MBA. He worked his way up to the position of lending officer at Chase Manhattan Bank. Specializing in computer startups, two years after finishing college. He began his career as an investor and hedge fund manager in 1991 while serving as president of Needham & Company, an investment bank.

In 1997, he departed from the company and, along with other investors, acquired a hedge fund, which he rechristened the Galleon Group. Both Galleon and Rajaratnam became billionaires when their assets hit $7 billion. But while he was climbing the corporate ladder, Rajaratnam neglected some basic business ethics. Sentenced to eleven years in prison in 2011, he was found guilty of fourteen offenses. Nine of which were related to securities fraud.

Steven A. Cohen

After his initials, the legendary Wall Street trader Steven A. Cohen founded the phenomenally profitable hedge firm SAC Capital Advisors. But as the company expanded and its profitability skyrocketed, the importance of maintaining transparency slipped. A large-scale SEC insider trading lawsuit exposed that certain SAC Capital employees frequently avoided disclosure requirements for non-public information, enabling them to amass substantial profits. Two SAC workers generated huge illicit profits utilizing leaked information regarding clinical trials; this case ultimately contributed to SAC’s troubles. Cohen was spared prison time and harsher punishments because he was found to have failed to provide adequate oversight instead of encouraging the practice. However, he was fined almost $2 billion in 2013 and banned from handling outside funds for two years as a result of the case.

Scott London/Bryan Shaw

Scott London was an accomplished executive and partner at KPMG, one of the “big four” accounting companies that dealt with large corporations. Bryan Shaw, a golfing companion of London’s, ran a floundering jewelry firm in Southern California. London saw an opportunity to help out a buddy and began giving him money-making suggestions after expecting his friend would just make a small bit of illicit profit. However, it became a slippery slope regardless of its origin. Despite accepting money and costly gifts from Shaw. London maintained he was unaware of the exact amount of money Shaw made from the deals—$1.27 million was the final figure. London received a 14-month prison term after being found guilty of insider trading in 2013. Cooperation with authorities resulted in a reduced sentence of five months for Shaw.

Phil Mickelson

Even though Phil Mickelson became famous on the golf course, he was also involved in an insider trading case that quickly rose to the top of the heap because of his involvement. Billy Walters, a golfing buddy of Mickelson’s and a legendary figure in his own right for his role in developing a computerized betting system that made him rich, was also a friend of Mickelson’s. But in the end, Walters got into trouble because of his connection to Dean Foods board member Tom Davis.

Walters had previously promised Davis financial backing, which supposedly resulted in a deal where Davis would regularly provide Walters with inside information so that Walters could make money selling Dean Foods stock. It appears that Mickelson passed along his gambling ideas to Walters, who was also a buddy of his. No one was able to prove that Mickelson knew who had given Walters his tips, therefore he evaded prosecution. Ultimately, Walters received a 10-million-dollar fine and a five-year prison term in 2017.

The “Octopussy” Ring (2020)

Case History And Synopsis

Because of its sophisticated sophistication and use of unusual means to facilitate unlawful actions in financial markets, the “Octopussy” ring attracted attention in 2020 when financial regulators and law enforcement authorities identified it. The investigators came up with the moniker “Octopussy”. To describe the network because of its complex and multi-layered structure. Which is similar to an octopus’s extensive tentacles. The case’s development against the background of more linked worldwide financial markets highlights the difficulties regulatory bodies encounter in identifying and avoiding cross-border securities fraud.

Details Of The Case

Worldwide Network For Insider Trading

Collaborating to acquire and use non-public information for stock trading. The Octopussy ring included a web of people from several nations. The worldwide insider trading network was characterized by the following:

Diversity In Location

Authorities had a tough time tracking and monitoring the ring’s actions because its members were based in major financial hubs throughout the world.

Market Penetration

People in the network were not limited to the banking sector; they had ties to the IT, pharmaceutical, and finance industries as well. The ring was able to target a diverse range of equities because to its diversified approach.

Utilization Of Non-Traditional Means Of Communication

In order to coordinate trading activities and transmit sensitive information, the Octopussy ring used unorthodox communication routes. Among these were:

Digital Money

An extra degree of obscurity and complexity was added to the ring’s operations by using cryptocurrency for transactions. Authorities had a hard time tracking money transfers and identifying individuals because of this medium choice.

Secrecy Techniques

In steganography, participants hid and transmitted data inside digital items that appeared to be harmless, such photos or documents. In order to evade conventional forms of monitoring, the ring relied on this clandestine means of communication.

Legal Implications

All those involved in the insider trading operation faced legal ramifications. As the Octopussy ring was being investigated by law authorities. Potential legal consequences encompassed. Notable ring members were apprehended and charged with conspiracy, insider trading, and securities fraud. Those who helped carry out the illegal operations were also pursued in the court proceedings. The authorities took action to prevent the future distribution or concealment of the criminal earnings by freezing assets linked to the insider trading ring. The goal of freezing assets was to cut off the funding for these kinds of illegal businesses.

International Collaboration And Government Reaction

In response to the Octopussy ring’s global reach, regulatory organizations and law enforcement authorities from many jurisdictions worked together. The regulatory response and worldwide cooperation comprised. To gain a thorough grasp of the Octopussy network’s operations, regulators and law enforcement agencies shared information and worked together. The development of a cohesive plan to dissolve the ring relied heavily on this information exchange.

In order to get to the bottom of the insider trading, authorities from different countries worked together to overcome jurisdictional barriers and begin joint investigations. Everyone, no matter where they were, should be held responsible for their acts, and that was the goal of this group effort. Regulators reevaluated their systems in the wake of the Octopussy case and made changes to better monitor the market and fix security holes that sophisticated insider trading networks had been using.

Regulatory Changes And Lessons Learned

Effects On Laws And Enforcement Regarding Insider Trading

Insider trading rules and enforcement methods have undergone substantial revisions as a result of the “Octopussy” case and other high-profile instances of insider trading. The following changes have been implemented by regulatory agencies as a result of lessons learnt from these cases: Sophisticated insider trading rings can do enormous financial damage, thus regulatory agencies have pushed for and enacted harsher punishments for anyone convicted of insider trading. Making ensuring the costs are higher than the benefits will help build a stronger deterrence.

Regulators have made significant investments in cutting-edge surveillance technologies and analytical tools to enhance their monitoring of market activity. Among these methods is the application of AI, machine learning, and big data analytics to spot suspicious trading trends and possible insider trading. The Octopussy case demonstrated the critical importance of effective cooperation between law enforcement and regulatory organizations around the world. To combat the international scope of insider trading networks, new regulations have centered on enhancing cross-border information sharing and coordination. There are now stronger regulatory structures in place to safeguard those who come forward with information, known as whistleblowers, because of the crucial role they play in exposing insider trading operations. To promote reporting and enable more effective enforcement, whistleblower protection laws are put in place.

Shifts In The Way Companies Handle Governance

Companies are rethinking and improving their corporate governance procedures in response to insider trading incidents. Notable alterations to corporate governance comprises. An rising number of companies are implementing insider trading policies that are both thorough and easy to understand. Training programs highlight the repercussions of insider trading and educate employees on the need of complying with securities rules. In order to keep tabs on the trading activity of important staff, we have put in place reporting methods and robust internal monitoring systems. Some examples of this include creating avenues for staff to voice concerns and automating the detection of questionable transactions through the use of technology.

Companies frequently implement limited trading windows, which restrict the times when employees can purchase or sell company shares. Taken before important business events or earnings announcements, this safeguard helps lower the possibility of insider trading. Some businesses have chosen to be more open and honest about their insider trading practices by disclosing more information. Increasing transparency by making insider transactions more apparent to shareholders and the general public is one way to achieve this goal.

How Emerging Technologies Can Help Identify Insider Trading

Insider trading has become much easier to identify because to technological advancements. Financial institutions and regulatory agencies use advanced data analytics technologies to sift through massive datasets in search of suspicious trade trends. Algorithms trained with machine learning data can spot outliers and alert authorities to possibly malicious actions. The use of blockchain technology has been considered in certain situations as a way to make financial transactions more transparent and easier to trace. While there is no silver bullet, blockchain technology has the potential to strengthen financial market integrity and lessen the prevalence of fraud.

Banks and other financial organizations use software to keep an eye out for any indications of possible insider trading in electronic communications and other data sources. Malicious actions that might otherwise go undetected can be located with the use of this program. The use of artificial intelligence (AI) to improve the performance of surveillance systems is on the rise. The ability of AI algorithms to learn and adapt over time increases their effectiveness in detecting increasingly complex insider trading schemes.

Conclusion

The insider trading case landscape is a constant reminder of how difficult it is to keep markets honest. People still try to use privileged information for their own benefit, even though there are strict rules and enforcement attempts. Legitimate fines and mischief to one’s standing are only two of the many adverse results that might result from insider trading. To safeguard financial backer certainty and keep the worldwide monetary framework working appropriately. Administrative organizations should watch out for the steadily changing monetary business sectors and persistently seek after fair and open practices.

Frequently Asked Questions

1. Explain What Insider Trading Is And Why It’s A Crime?

Buying or selling a security while in possession of important non-public information constitutes insider trading. This is done in breach of a fiduciary responsibility or other relationship of trust and confidence. The reason it’s prohibited is that it gives some people an unfair edge in the financial markets while undermining their transparency and fairness.

2. In High-Profile Insider Trading Instances, Who Have Been The Most Prominent Figures?

Martha Stewart, Ivan Boesky, and Raj Rajaratnam are among the well-known individuals entangled in insider trading accusations. Because they used secret knowledge to their advantage in the stock market, these people were subject to legal repercussions.

3. Insider Trading: What Are The Ramifications In A Legal Sense?

Fines, jail time, forfeiture of gains, and civil penalties are all possible outcomes of insider trading prosecution. The degree of intent, the quantity of profit obtained, and the degree of collaboration with authorities are some of the elements that determine the harshness of the sentence.

4. Exactly How Do Authorities In Charge Of Detecting And Punishing Insider Trading Go About It?

Regulatory agencies uncover insider trading using a variety of means, such as market monitoring, pattern analysis of trades, and reports from whistleblowers. Regulatory bodies, police enforcement, and the judicial system frequently work together during prosecutions.

5. How Can Instances Of Insider Trading Affect The Stock Market?

Cases involving insider trading have the potential to raise regulatory attention, undermine market integrity, and reduce investor trust. Further, regulatory changes to enhance enforcement and discourage future instances of illegal trading may be prompted by high-profile incidents.