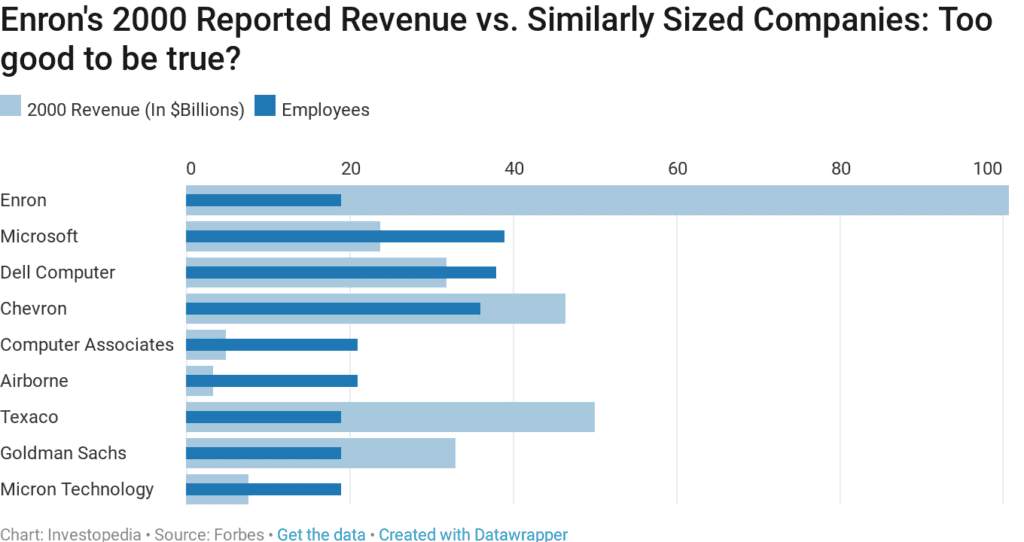

The Enron scandal was a major corporate scandal that took place in 2001. It involved false accounting and fraud, as well as bribery and criminal activity. The scandal ultimately led to the collapse of Enron Corporation, one of the nation’s largest energy trading companies at the time, which resulted in the loss of thousands of jobs and hundreds of billions of dollars in shareholder value.

Financial frauds come in different shapes and sizes. Some are significantly bigger than others. Jeffrey Skilling’s insider trading scandal is definitely one of the more popular ones. The Enron CEO, among other things, conspired with other high-level executives to fraudulently inflate the company’s revenues using accounting while hiding debts in many subsidiaries.

This wasn’t, however, an Enron-only job. There was considerable negligence from the likes of credit rating agencies, investment banks, and even the SEC.

What is the Jeffrey Skilling Scandal?

The Jeffrey Skilling insider trading scandal is one of the most widely publicized crimes in corporate history. In 1999, Enron Corp. CEO Jeff Skilling was convicted of conspiracy, fraud, and insider trading. He was sentenced to 24 years in prison and ordered to pay a $45 million fine. The case was part of a larger investigation into the corruption at Enron that led to its collapse in 2001. The company’s collapse helped trigger the largest economic crisis since the Great Depression.

Enron’s main business was natural gas trading, which it bought and sold on the commodities exchanges. In 1997, Enron began making its own deals to buy and sell natural gas but also began selling other products like electricity that were not related to natural gas at all. Over time, Enron became increasingly involved in financial transactions involving its own stock, which had risen by more than 1,000 percent by 1999.

Skilling’s scheme was simple: He would have his employees purchase shares in Enron using company funds without filing any paperwork with regulators or otherwise involving themselves with the company itself.

The Jeffrey Skilling insider trading scandal is a scandal that occurred in the early 2000s. Skilling was an executive of Enron who was convicted of insider trading. The scandal involved the company committing fraud, lying to regulators, and using accounting methods to hide its losses.

Skilling was responsible for many aspects of Enron’s accounting practices during his 15 years with the company. He helped develop its earnings management strategy, including its “off-balance sheet” financing tactics that hid debt from investors. According to court documents, Skilling also approved changes to Enron’s financial statements after they were issued by its auditor, Arthur Andersen PLC (AAP), even though he knew such changes would increase reported profits by $2 billion over five years.

Also Read: To understand what it takes to be a master in insider trading, Raj Rajaratnam is the perfect example. Gain insight into the person who earned millions by reading further.

How Did Jeff Skilling Do This Fraud?

Jeffrey Skilling’s big idea for Enron was that by using off-balance-sheet partnerships and special purpose entities to hide their debts, they could hide their true financial situation from shareholders. This strategy allowed them to continue to grow even after their debt load increased as a result of investment losses and other factors.

Enron was a huge, highly profitable energy company that collapsed under the weight of its own hubris. In the years leading up to its bankruptcy and eventual sale to Arthur Andersen in 2001, Enron had created a culture of excessive risk-taking and corruption that was so pervasive it even brought down its own CEO.

The Jeffrey Skilling insider trading scandal is one of the most famous scandals in American finance. It involves a group of traders who traded on inside information they gained from trading with Enron and other companies. Then-Enron CEO Jeff Skilling was convicted of insider trading and sentenced to 24 years in prison.

Jeff Skilling is the former chief executive officer of Enron. During his tenure as CEO, he oversaw a number of major projects, including the development of natural gas trading and storage facilities. He also spearheaded the company’s move into internet services, energy trading, and other areas.

In 2002, Skilling was convicted on 19 counts of securities fraud and conspiracy stemming from his involvement with Enron’s collapse.

In 2005, Skilling was sentenced to 24 years in prison after being found guilty on 19 charges, including securities fraud, insider trading, and lying to auditors. In 2010, he was released after serving 18 months at a Federal Correctional Institution in Colorado.

The Enron insider trading scandal was an example of the misuse of inside information by certain employees. In 1999, Enron CEO Jeffrey Skilling was fired by the company’s board. The company went bankrupt in 2001, and many people were arrested and charged with various crimes related to the scandal.

During his time as CEO, Skilling had been taking advantage of a loophole in Enron’s own accounting rules to make himself rich. He was able to use this loophole because he refused to pay taxes on most of his earnings from stock options.

In addition to using this loophole, he also had a lot of personal knowledge about how Enron did business that could have been used against him if he had decided to cooperate with prosecutors. For example, he knew about the company’s manipulations of its books and accounting practices through his involvement in numerous meetings and negotiations with senior executives at Enron over those issues (such as how much money should be given back to investors when they found out about problems with the company’s accounting).

Read More: In certain nations, engaging in insider trading is a punishable offense; in others, it is allowed by law. This piece of writing examines the regulations and rules concerning insider trading by nation.

What Exactly Did the Enron CEO Do?

The Enron CEO, Jeff Skilling, was convicted of fraud and conspiracy in 2006. He was sentenced to 24 years in prison.

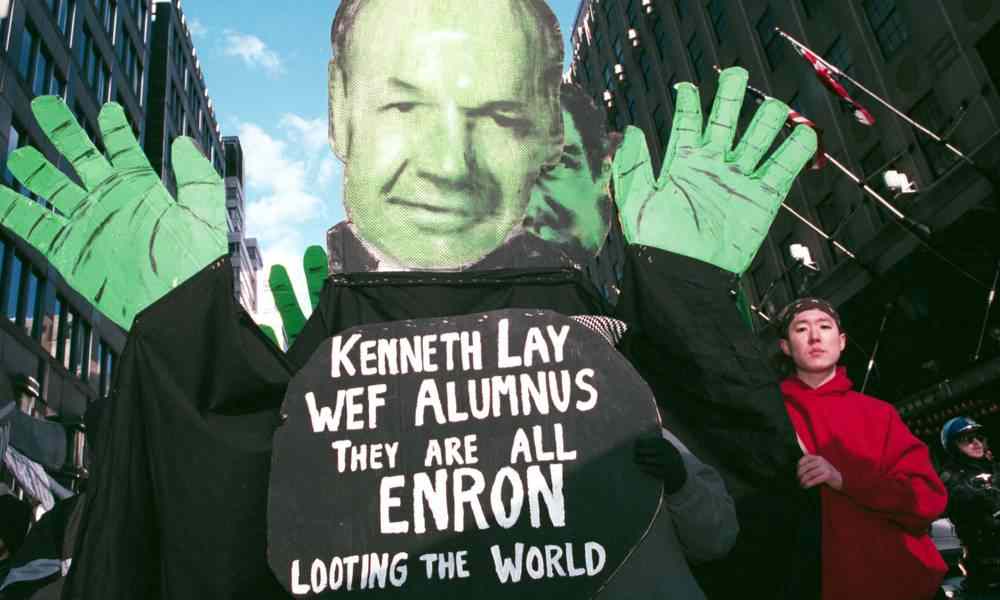

Enron was a very large energy company that traded electricity on the New York Mercantile Exchange. The CEO, Kenneth Lay, who was also the chairman of Enron, was accused of misleading investors about its finances and making false statements about the company’s earnings. These actions were considered unethical because they led to the collapse of Enron’s stock price, which resulted in millions of dollars being lost by shareholders who had purchased shares during this time period.

The Enron scandal is a case of alleged insider trading.

In August 2001, Enron filed for bankruptcy. In December 2002, former CEO Jeffrey Skilling was convicted on 19 counts of fraud and conspiracy for his role in the scandal. He was sentenced to 24 years in prison and ordered to pay $42 million in restitution. Skilling appealed his conviction but the appeal was rejected by the Supreme Court in 2007.

Jeffrey Skilling is the former CEO of Enron, who was convicted on 18 counts of conspiracy, fraud, and making false statements. He was sentenced to 24 years in prison by a federal judge in Houston.

Enron’s collapse was one of the most famous corporate scandals in history. In December 2001, the company announced that it had lost $2 billion in earnings during its third quarter due to accounting irregularities. The following month, Enron announced plans to restate earnings for two years because of undisclosed losses from partnerships that were supposed to be profitable. The company also announced that it would restate its earnings from 1998 through 2001, resulting in a $3 billion write-down.

Skilling was implicated several times over his role at Enron: once when he was arrested after failing to testify before Congress about the financial irregularities; again when he pleaded guilty to securities fraud charges; again when he went to trial for insider trading; again after being convicted as well as sentenced for both crimes; and again when he filed a claim with the Securities Exchange Commission alleging that he had been wrongfully terminated from his position as CEO.

What Did Enron Do That Was Unethical?

The biggest scandal that Enron faced involved its accounting practices. Enron used complex financial instruments to hide debt from investors and make it appear as if it had more money than it actually did. This practice is referred to as “cooking the books.” It is considered unethical because these practices hid information from investors that could have been used to make decisions regarding Enron’s business practices and operations.

Enron was one of the largest energy companies in the United States, but it collapsed under its own weight after a series of accounting scandals. The company’s main offices were located in Houston, Texas, and Washington D.C., but it also operated in more than 25 countries around the world.

In 2000, Enron’s stock price reached an all-time high of $90 per share during a period of rising oil prices worldwide. However, by 2001 the company began to suffer from financial problems as customers suffered from lower energy prices due to oversupply caused by competition from other oil companies and new technology such as hydraulic fracturing (fracking). To compensate for these losses, Enron began to sell off assets like its power plants and pipelines in order to raise money for itself while maintaining its stock price above $70 per share at all times.

Who went to jail because of the Enron insider trading scandal?

Jeff Skilling, Enron’s former chief executive and architect of the company’s high-risk business strategy, was sentenced to 24 years in prison for his role in the scandal. The case against him represented one of the biggest insider trading scandals in history.

Enron once stood for “energy network resources,” but by 2001, it had become a symbol of corporate excess and greed. The company collapsed under its own weight, filing for bankruptcy protection in 2001 and becoming the largest bankruptcy filing in U.S. history.

The scandal led to the downfall of CEO Ken Lay, who was convicted on all counts after a three-week trial in Houston last year. Lay was later sentenced to six years in prison but died before serving any time behind bars. His conviction was overturned on appeal last year, but an appeals court reinstated it later that month.

Skilling’s sentencing marked another occasion where Enron employees have been punished over their roles in the scandal, including a former Enron account manager who received a 15-year sentence for her role in avoiding taxes on $30 million worth of bogus profits she helped generate from fraudulent trades made by her co-defendants during the period when Enron was imploding under its own weight.

In early 2002, Skilling pleaded guilty to fraud charges related to the collapse of Enron’s energy trading business. In June 2005, he was sentenced to 24 years in prison by Judge Leonie M. Brinkema of U.S. District Court in Alexandria, Va., for his role in the Enron case and other business dealings with Enron executives who had pleaded guilty to criminal charges related to their actions at the company.

Andrew Fastow was a top executive at Enron and the architect of its aggressive accounting. He was convicted of conspiracy, fraud, insider trading, and lying to auditors in 2002. He was sentenced to 24 years in prison. Enron filed for bankruptcy and ceased trading in 2002. Fastow is currently serving his sentence at the federal prison in Lewisburg, Pa., according to the Federal Bureau of Prisons website.

Jeff Skilling became the youngest CEO in history when he took over as CEO of Enron in 2001. He served as CEO until November 2001 and resigned shortly thereafter due to a pay-to-play scandal involving an energy trading partnership with Cheniere Energy Corp., which was headed by then-Vice President Dick Cheney. Cheney had approved $3 million in loans from Enron’s finance arm that helped him buy a home while he was VP.

Does Enron Still Exist Today? Where is Jeff Skilling From Enron Now?

Enron doesn’t exist today. Its last business, called Prisma Energy, was sold off back in 2006. Jeff Skilling served 12 years in prison. He came back to Houston, Texas, after that. He then launched Veld Applied Analytics and is still working on it. Taek Chung, an electrical engineering Ph.D. holder, is the managing director of the company.

Veld Applied Analytics came live around a year ago in 2021 but is not online anymore. According to the now-offline website, it was developing “sophisticated analytical tools to establish and monitor valuation” of assets in oil and natural gas.

Enron is a company that was founded by Jeff Skilling and Kenneth Lay. Enron was one of the most successful energy companies in the United States, and it was a major player in the natural gas industry. But in 2001, Enron filed for bankruptcy and lost its reputation as one of the most powerful companies in North America.

In 2002, Ken Lay died from heart failure at age 65. Jeff Skilling was later convicted on charges of securities fraud, insider trading, and conspiracy. He served a total of 12 years in prison and was released on parole in 2015.

This was the end of Enron and Enron’s CEO, Jeffrey Skilling. However, he continues on and remains to be a topic of discussion among closed accounting circles.

Special Purpose Entities

Exponentially increasing debt sounds like a nightmare to a layman – but to someone like Jeff Skilling, piling debt is just something you need to offset somehow so you can bag even more money, more or less.

He did this (like many other large corporations) through the creation of what we call “special purpose entities” or SPEs. SPEs were central to the Enron scandal. These shell corporations allowed Skilling to hide the losses and debts.

Basically, the losses and debts were mentioned as conventional company expenses under these SPEs and couldn’t be directly linked back to Enron. This allowed Enron to hide its gigantic debt from regulators, the government, investors, and even seasoned professionals.

Closing Remarks

The Enron scandal is one of the biggest corporate scandals in US history. In 2001, Enron became one of the largest corporations in the world by acquiring other companies and creating more than 5,000 subsidiaries. By December 2001, Enron’s debt was $83 billion, with a balance sheet that was created by taking on debt using assets such as homes, businesses, and trading accounts as collateral (Lubbers & Almaraz-Baeza, 2012).

As a result, the value of their assets decreased dramatically when investors realized that these assets were not real or worth what they claimed them to be at some point during the year prior to bankruptcy. The company’s CEO Ken Lay took all these benefits and also added another benefit: manipulating energy prices by buying up power plants that would have been shut down if they could not sell electricity to certain areas at inflated prices (Lubbers & Almaraz-Baeza, 2012).

The Enron CFO, Kenneth Lay, was an unethical man. He had been the CFO of Enron for a long time and knew the company well. He took advantage of his position to make millions while keeping the company afloat. This is illegal, as it is against the law to take advantage of your position.

The CEO and CFO hid the company’s debt from investors and creditors by using special accounting methods that didn’t show up on the balance sheet, which made them seem much healthier than they actually were. This allowed them to issue stock and pay their employees without having to pay off their debts or put money into savings accounts.

When things went bad, they continued using these tactics, knowing full well that they would eventually be caught and charged with breaking securities laws.