Introduction

Both the noteworthy artificial intelligence (AI) credit innovation and the insider trading that has occurred inside Upstart Holdings Inc. Corporate positions have brought the organisation much consideration. Under Paul Gu’s authority as fellow benefactor and boss technologist, Upstart has utilised state-of-the-art AI procedures to prepare for reasonable advances. Financial backers are interested in ongoing insider exchanges, however, especially critical deals made by key leaders. The importance of insider trading at Upstart Possessions Inc. is analysed in this examination, which looks to enlighten the organisation’s future and make sense of its consequences for investors.

Who Is Paul Gu

A Co-Founder And Current Cto Of Upstart Holdings, Inc

Paul Gu, who is both a co-founder and the company’s Chief Technology Officer (CTO) , is a vital participant in Upstart Holdings Inc. Gu was a fundamental piece of Upstart’s initial development and origination stages as a fellow benefactor and his thought-filled as the organization’s bedrock. His involvement from the beginning demonstrates his commitment to Upstart’s goal and his belief in the potential of technology to alter the loan process.

Contribution To The Development Of Upstart’s AI-Powered Loan Platform

In addition to his role as co-founder, Gu led Upstart’s groundbreaking AI-driven financing platform development. Gu was in charge of Upstart’s technical teams and developed a system that uses artificial intelligence (AI) to pinpoint a customer’s creditworthiness with unparalleled accuracy by utilizing his extensive knowledge of both technology and the financial sector. Through his oversight, Upstart’s platform, which sifts through mountains of data with cutting-edge machine learning algorithms, is now able to offer financing options that are more inclusive and predictive. Gu’s technical know-how and strategic leadership are largely to blame for Upstart’s current dominance in AI-driven lending.

Knowledge Of Data Science And Technology

Gu’s career has been built on his extensive knowledge of technology and data science, which he has acquired through formal education as well as through experience in the real world. While going to class and working in an assortment of tech-driven positions, Gu acquired precious bits of knowledge that he used to help establish Upstart. He has the vital ability to arrange the complexities of planning state-of-the-art simulated intelligence arrangements because of his instructive experience, which probably gave him solid groundwork in software engineering or a connected discipline. Gu is appropriate for the position of boss innovation official at Upstart Property Inc., as his experience in the tech business exhibits his ability to utilize information-driven systems to tackle troublesome issues.

Upstart Holdings Inc Overview

Upstart’s AI Loan Platform: A Brief Overview

Changing the customary loaning process, Upstart Holdings Inc. runs a computer-based, intelligence-driven loaning stage. Upstart’s platform analyzes massive amounts of data with cutting-edge AI technology to determine a borrower’s creditworthiness precisely in contrast to conventional methods. Upstart, in contrast to more conventional approaches to credit scoring, makes use of sophisticated machine learning algorithms to identify patterns and anticipate outcomes in the future. Upstart can provide affordable loans to a greater number of people than ever before, including those who have been unfairly neglected by more conventional lenders.

The ability of Upstart’s AI lending platform to offer individualized loan deals based on each applicant’s unique financial profile is an important feature. Borrowers can apply for advances rapidly and effectively utilizing the stage’s simulated intelligence-driven appraisal and intuitive UI. They will make decisions quickly. In addition to the fact that this worked-on system makes the credit guaranteeing process more effective, it likewise further develops the borrower experience overall.

Bank-Bank Partnership To Revolutionize Consumer Finance

Through a network of banking partners, Upstart’s AI lending platform can fund consumer loans. Upstart is attempting to change the game for borrowers and moneylenders the same by collaborating with notable banks to further develop the credit endorsement process. Upstart grants banks access to its cutting-edge AI technology through these alliances, enhancing their capacity for risk assessment and loan approval.

By working with Upstart, banks can improve approval rates, decrease default rates, and improve operational efficiency. Banks might acquire proficiency, cut down on physical work, and accelerate the advance endorsement process by coordinating Upstart’s man-made intelligence controlled guaranteeing into their credit start work processes. Moreover, Upstart’s foundation permits banks to connect with underserved or credit-tested populaces, permitting them to develop their client base while as yet overseeing risk really.

Aims For An Exceptional Loan Experience And Automated Processes

The essential goal of Upstart is to guarantee that moneylenders and borrowers the same have an extraordinary encounter while utilizing their advance administrations. With the utilization of computerized reasoning, Upstart intends to significantly alter the manner in which individuals apply for credits by making the cycle more smoothed out, impartial, and open. Upstart has fostered an artificial intelligence lending platform to eliminate the biases and inefficiencies inherent in traditional lending methods, ensuring that borrowers from diverse backgrounds are on neutral ground.

Computerization and productivity are vital to Upstart’s foundation, which plans to develop the borrower experience further while additionally smoothing out the supporting system. Upstart assists in managing an account by handling credit applications all the more productively and inexpensively via mechanizing manual activities and using artificial intelligence-driven direction. This limits the time and assets required for credit endorsing. The emphasis on mechanization upgrades the speed and productivity of loaning while likewise diminishing the possibilities of blunders and working on the general nature of advances.

Examining The Relationship Between Insider Buy/Sell And Stock Price

How Insider Transactions Affect Stock Valuation

Executives, directors, and other insiders’ stock purchases and sales provide important information about a company’s financial situation, future growth potential, and general market mood. To ensure that investors are informed, companies must report these transactions to the SEC through Form 4 filings. Because insiders often act on information that is not yet public knowledge, it is essential to analyse their transactions. Insiders have intimate knowledge of the company’s operations, strategies, and prospects. Therefore, their purchasing or selling habits might reveal how confident they are in the company’s future success.

Investors can learn more about the inner workings of a company, especially how the top brass values its stock, by keeping tabs on insider transactions. When insiders purchase a stock, it usually means they are bullish on its growth potential or think it’s cheap, whereas when they sell, it could mean they’re worried about how much the stock is worth or that they have emergency financial needs. In order to assess investment opportunities and make educated decisions, investors can benefit greatly from keeping tabs on insider activity.

Paul Gu’s Previous Insider Transaction Summarised

Upstart Holdings Inc.’s co-founder and chief technologist, Paul Gu, recently sold 10,000 shares of company stock, committing insider trading. The deal happened on December 13, 2023, as revealed in a Form 4 filing with the SEC. Investors and market watchers should pay attention to Gu’s decision to sell a significant portion of his holdings because he is a key executive within Upstart.

Gu may have been trying to sell off some of his Upstart shares through an insider sale. The filing needs to explain his decision. He could be diversifying his portfolio, managing his personal finances, or believing that the stock is now fairly valued. The impact of Gu’s insider transactions on Upstart’s stock price is significant because of his central role in the company’s technical advancement and strategic direction.

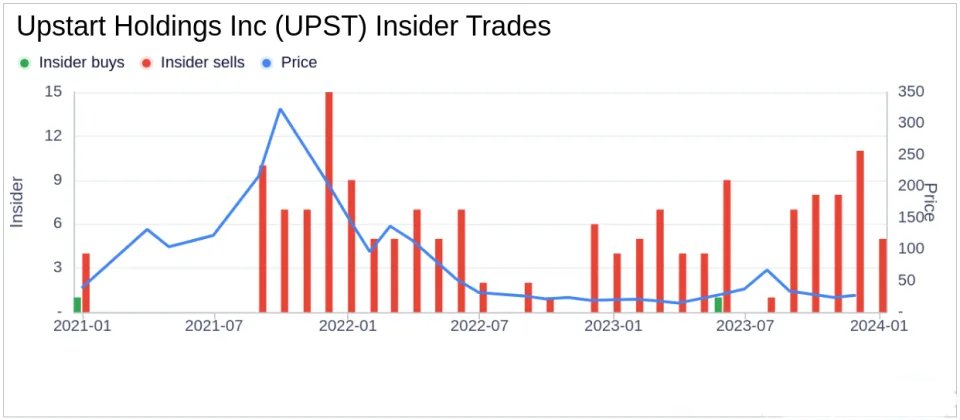

Insider Transaction Pattern In The Past: An Uneven Distribution Of Purchases And Sales

Paul Gu has been selling off his holdings in a regular rhythm over the last year, according to his insider trading records. The information that is currently available indicates that over this time, Gu has done nothing but sell 180,530 shares of Upstart stock. This striking difference between insider sales and purchases highlights a common pattern of insider selling among the company’s top executives.

When investors and market experts notice an imbalance between insider buys and sells, especially over a long period, it might be a warning sign. However, insiders may sell their shares for many valid reasons; however, a consistent pattern of selling could indicate that the company’s prospects differ from appearances or that its stock is overvalued. Insider trading, such as Gu’s trades, is common at Upstart Holdings Inc. and calls into question the insider’s faith in the company’s future success and value.

Intrinsic Selling Pattern Analysis: Uncertainty or Diversity?

Paul Gu’s most recent transaction stands out as an example of the constant pattern of insider selling, which begs the question of why people do it. One probable explanation is that important executives like Gu and other insiders need to have faith in the stock’s ability to rise in the near future.

Insider selling, especially when occurring in large quantities and over an extended period, could indicate concerns about the future of the firm or its market value. Amidst a larger trend of insider selling, Gu’s choice to sell 10,000 shares on December 13, 2023, suggests that individuals closely acquainted with Upstart’s activities and prospects are being cautious.

Another possible motivation for insider selling is a desire to diversify one’s portfolio or the necessity to liquidate assets for different reasons. Although executives like Gu deeply invest in the company’s success, their choices regarding stock ownership may also influence their financial aspirations or responsibilities. In order to reduce their exposure to risk and secure their financial futures beyond their employment at Upstart, they should diversify their investment portfolios by selling their shares in the company. Thus, while assessing the relevance of an insider’s sales activity, it is crucial to take into account the wider context of their financial status and investment strategy.

Market Valuation And Stock Price

Value Of The Market And Stock Value

The sum of all the stock market values of Upstart Holdings Inc.’s outstanding shares is called its market capitalization. Take the current stock price of the company and multiply it by the total number of outstanding shares to get this value. With a share price of $40.03 as of the most recent insider transaction date, Upstart’s market cap was $3.786 billion. To get a feel for how much a firm is worth, investors look at its market capitalization.

Evaluation Of GuruFocus Power (GF Power)

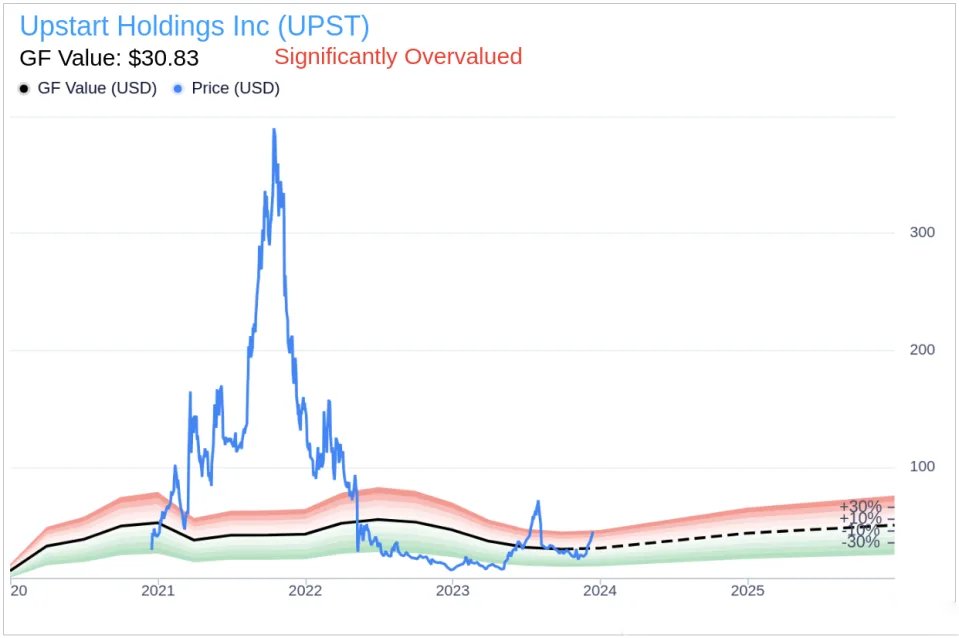

A proprietary statistic known as the GuruFocus Value (GF Value) provides an approximation of a stock’s true worth by factoring in things like past performance adjustments, historical trading multiples, and projections for the company’s future success. Upstart Holdings Inc was assigned a GF Value of $30.83. This evaluation gives shareholders a different view of the company’s worth, one that is based on research of fundamentals instead of market opinion.

Efficiency Ratio

Investors compare the current market price of a stock to its GuruFocus Value using the price-to-GF-value ratio. If a stock’s price is too high, too low, or about right in relation to its estimated intrinsic value, this ratio will show investors. Analysts determined that Upstart Holdings Inc. had a price-to-GF-Value ratio of 1.3. Using this ratio, we can see that GuruFocus evaluated the stock’s intrinsic value to be around 30% more than what it was trading for.

Potential Investors’ Risks And Rewards From Insider Selling And Valuation

Investors thinking about putting money into Upstart Holdings Inc. should pay close attention to the results of the investigation into insider trading and the evaluation of stock value indicators. People may wonder if the insiders are confident in the company’s short-term growth prospects or if they need to diversify their holdings due to the high volume of insider sales, especially Paul Gu’s continuous pattern of sales. The gap between the GuruFocus Value and the market price suggests that the market might be pricing in ambitious growth projections for the future of the firm that aren’t entirely backed by its fundamentals. Therefore, before putting their money into Upstart Holdings Inc., investors should think long and hard about all of these elements, including the insights from insider transactions and the valuation metrics, to determine the dangers and opportunities.

Conclusion

Upstart Holdings Inc.’s insider trading actions reveal emotion among executives and the inner workings of the company. Recent transactions, especially insider sales, may attract attention from investors, but investors should consider these in the context of more basic considerations and market dynamics when making recommendations. Having a grasp on the consequences of insider trading can help investors make well-informed judgments regarding their involvement with Upstart and successfully navigate the intricate loan industry environment.

Frequently Asked Questions

1. Just How Big Of A Deal Is Insider Trading For Upstart Holdings Inc?

Whoever trades on their inside knowledge of a company’s operations is engaging in insider trading. Insider transactions at Upstart, especially those involving high-ranking officials like Paul Gu, can reveal how the company views its stock’s worth and prospects from the inside.

2. To What Extent May Upstart’s Recent Insider Transactions Shed Light On The Future Of The Company?

Given recent insider transactions like Paul Gu selling 10,000 shares, insiders may view the stock price as being very expensive right now. An indication of the level of trust in Upstart’s short-term growth potential among its corporate insiders could be the frequency and magnitude of insider sales, particularly when compared to buying.

3. At What Point Does Upstart’s Market Worth Meet Its True Potential?

Market capitalization and stock price reflecting Upstart’s market valuation may not always reflect its intrinsic value as determined by criteria like the GuruFocus Value (GF Value). Analysts have found that Upstart’s stock price is significantly higher than its GF Value, suggesting that the market may be overvaluing the company.

4. What Are The Possible Causes Of Insider Trading At Upstart Holdings Inc.?

Personal financial decisions, diversification tactics, or insiders’ judgement of the company’s growth prospects could all contribute to insider selling patterns at Upstart. One way to gain useful insights into the inner workings of a firm and the mood of its leadership is to identify the reasons behind insider transactions.

5. When Thinking About Investing In Upstart, How Should They Read The Company’s History Of Insider Trading?

Investors should use a multi-faceted approach when evaluating Upstart Holdings Inc.’s insider trading, taking into account not only this information but also fundamental analysis, market trends, and industry dynamics. The bigger picture of the company’s performance, competitive position, and long-term growth potential is necessary to evaluate insider selling, which is a reason for concern.