Introduction

The integrity of financial markets is seriously jeopardized by insider trading, in which individuals use nonpublic knowledge for their own financial benefit. Congress is crucial in establishing and strengthening the laws that control insider trading as the regulatory environment attempts to make sense of the intricacies of this illegal activity. In this discussion, we will examine the complex topic of “Insider Trading Legal for Congress,” looking at past, present, and future tendencies in legislation that have helped create more open and honest financial markets.

Securities Laws

The Securities Act Of 1933

After the 1929 stock market crisis, the government saw the need to reassure investors and passed the landmark Securities Act of 1933. This act sought to give investors access to relevant and accurate information regarding securities offered for public sale as a reaction to the Great Depression’s excesses and lack of transparency. Company registration with the SEC and the provision of a detailed prospectus outlining the financial health and risk aspects of the business to potential investors were both mandated by the Act, which established the idea of full disclosure. The Securities Act of 1933 aimed to encourage openness and safeguard investors from deceitful actions in the issue of securities by requiring this disclosure.

An Act Concerning The SEC From 1934

As a development to the Securities Act of 1933, the Protections Trade Demonstration of 1934 made the SEC the vital organization liable for controlling the Securities markets. This law regulated secondary trading of securities in addition to their issuance in order to lay the groundwork for effective and equitable markets. Securities exchange enlistment, specialist and seller guideline, and the denial of fake securities market action were significant highlights. The Securities Exchange Act of 1934 empowered the SEC to meet the challenges posed by the ever-changing financial markets by laying the groundwork for ongoing regulation and supervision and preventing fraud.

Steps Ahead In The Oversight Of Insider Trading

1988 Sec Case Involving Texas Gulf Sulphur Co

When the SEC lost its case against Texas Gulf Sulphur Co., it was a turning point in the regulation of insider trading. The Second Circuit Court of Appeals for the United States considered the meaning of “materiality” in insider trading prosecutions and reached a historic ruling on the subject. If someone possesses nonpublic knowledge about a corporation and a reasonable investor would deem it vital. They are required by the court to reveal this information. This decision established precedent for future cases. Changing the way courts assess the legitimacy of insider trading in relation to corporate insiders’ disclosure duties. And also highlighted the importance of substantial information.

Cases Such As Dirks V. Sec (1983) And Chiarella V. United States (1980)

The insider trading legal landscape was further defined by the instances of Dirks v. SEC and Chiarella v. United States. In Chiarella, the High Court clarified that main individuals who had a trustee commitment to the company whose stock was exchanged needed to report or quit exchanging. At the same time, the “tipper-tippee” liability framework was set up in Dirks v. SEC. This meant that those who received and traded on important nonpublic information may be held liable for insider trading if the person who gave the information exceeded their duty and got a personal profit. The limits of insider trading liability were further defined by these decisions. It established legal concepts that would influence future enforcement actions and interpretations of insider trading laws.

Insider Trading

Securities-Related Insider Trading

Assuming you approach classified data about a firm, you might be participating in insider trading. Assuming that you utilize that information to trade supplies of that organization for your own monetary advantage. Because of their commitment to the organization’s well-being, officials, chiefs, and workers actively engage in this unlawful conduct at an excessively high rate. Shunning involving private data for one’s own advantage is a piece of this guardian obligation. Being in control of significant, nonpublic data that, whenever uncovered, could impact the activities of financial backers is the fundamental part of insider trading. This immoral act can cause financial markets to not function as they should because it gives some people an unfair advantage over others.

The Value Of Fair And Transparent Financial Markets

Assuming we believe the economy should run as expected, we really want monetary business sectors that are both fair and straightforward. By making everything fair, straightforwardness keeps the market liberated from bends brought about by data imbalance. Efficient markets, crucially reliant on open marketplaces, require timely and accurate transmission of information.

By creating information imbalances, insider trading undermines the concept of fair play and reduces market efficiency. Another significant variable is financial backer trust, which is subject to the possibility that the monetary business sectors are straightforward and fair. The presence of insider trading has the ability to sabotage this trust. Which thusly could put financial backers and influence the strength of the market in general down.

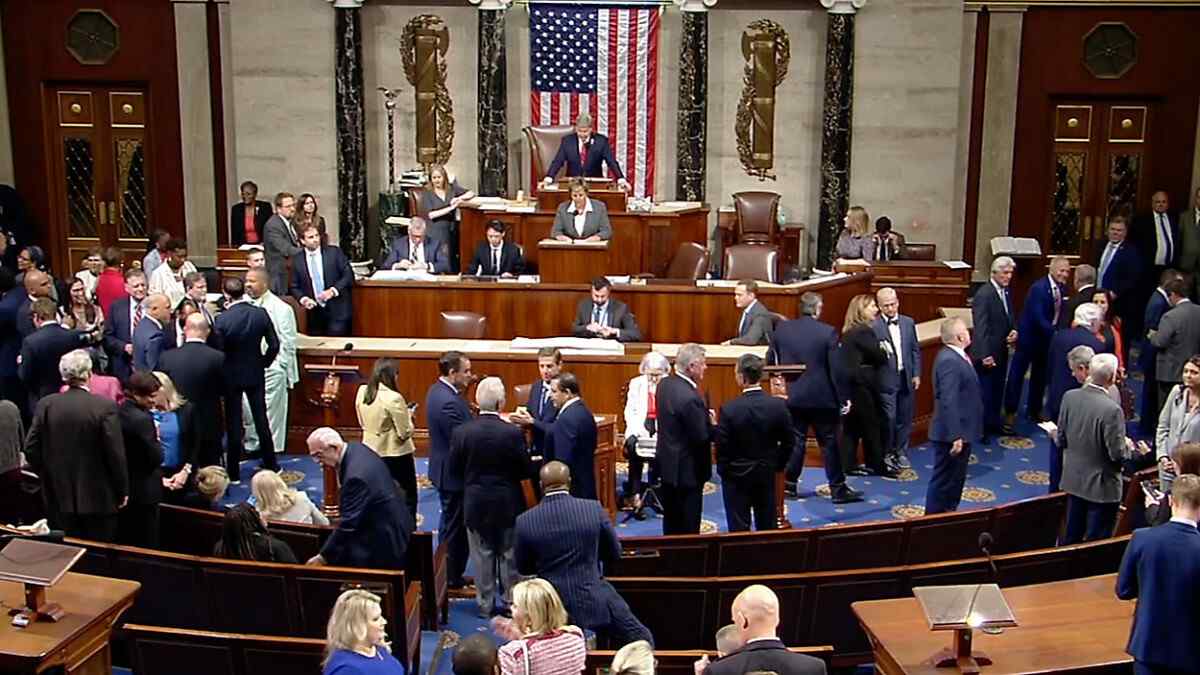

A Synopsis Of The Function Of Congress

The Power Of The United States Congress

The US Constitution gives Congress the power to control exchange, giving Congress the legitimate position to direct monetary business sectors. Striking guidelines like the Securities Act of 1933 and the Securities Exchange Act of 1934 have utilized this power. Not only did these acts create the SEC, but they also set the stage for extensive securities regulation.

The Enforcement And Regulation Of Securities

Congress has delegated authority to the SEC to enable it to carry out its regulatory functions. Its purpose is to safeguard investors, regulate the securities markets, and enforce federal securities laws. The ever-changing financial sector necessitates that Congress routinely analyzes and revises securities legislation. Congress has shown its dedication to strengthening regulatory measures and penalizing insider trading with notable legislation like the Insider Trading and Securities Fraud Enforcement Act of 1988. To keep the financial markets open and fair, Congress must keep an eye on the SEC to make sure the regulatory structure is working.

Why It’s Critical To Combat Insider Trading

Effect On Honesty In The Market

A major danger to the honesty of the market is insider trading. The distortion of stock prices and the creation of an uneven playing field undermine fair competition. This distortion can compromise the integrity of market indicators and discourage honest participation. It can provide some people undue benefits.

Promoting Trust And Safety For Investors

Preserving investor trust and safety requires action against insider trading. Investor confidence in the market is based on principles of equity and justice. Assuring investors that the market follows regulations meant to prohibit and penalize unfair behavior, legal protections against insider trading are in place. As a result, investors feel more comfortable making well-informed financial decisions, which helps maintain market stability.

The Law

Securities And Exchange Commission (SEC)

Position And Authority

Concerning the rule of the US money related business areas, the Insurances and Exchange Commission (SEC) is indispensable. The Securities Exchange Act of 1934 laid out the Securities and Exchange Commission (SEC), which is responsible for implementing government protections regulations, overseeing key market members, and directing the protections business. The SEC must perform a wide range of tasks, including registering securities, enforcing disclosure regulations, and protecting investors from deceptive and manipulative practices. Protecting the validity of the market and guaranteeing monetary sponsor approach uncommon information is the commitment of the SEC’s managerial oversight.

Results-Enforcing Methods

The SEC’s enforcement strategy is multifaceted and includes regulatory oversight, litigation, and investigation. Common activities for the recuperation of unlawfully procured riches, spewing of benefits, and common punishments are conceivable authorization activities. The SEC can also file criminal charges together with other law enforcement agencies. By passing on major areas of strength for a that violators of protections rules will have to deal with serious damages. The implementation instruments expect to satisfy twofold obligation, penalize those who are to blame and discourage other wrongdoing in the future. The SEC must take strong enforcement measures to prevent wrongdoing if financial markets are to remain trustworthy and free of manipulation.

Prohibitions On Insider Trading

What Are Insiders?

Any individual with access to private corporate information, including executives, authorities, employees, and others, qualifies as an insider regarding restrictions on insider trading. People who get material nonpublic data as a result of a relationship of trust. And certainty with the organization are likewise remembered for the definition, which goes past customary corporate insiders. Identifying the insiders is one of the most crucial steps in stopping the misuse of confidential information.

Actions And Deals That Are Not Permitted

A wide range of things fall under the umbrella of “insider trading. Which is an endeavor to prevent individuals from bringing in cash off of their inside information. Investment decisions influenced by substantial nonpublic knowledge are illegal. As is the practice of disclosing or “tipping” other people about such information so they can trade on it. Substantial nonpublic information obtained illegally is also covered by the rules for ‘outsiders’ engaging in trading.” The goal of insider trading legislation is to level the playing field and eliminate unfair advantages in the market by explicitly outlining forbidden conduct.

Rule 10b-5 Of The Sec

Components Of A Breach

Central to the prohibition of fraudulent actions in the securities markets is SEC Rule 10b-5, a critical rule under the Securities Exchange Act of 1934. Financial backers probably depended on the erroneous data. There probably been scienter (the goal to delude or control), and there probably been a critical distortion or oversight for there to have been an infringement of Rule 10b-5. Many types of securities fraud, including insider trading, rely on this rule as a foundation for their prosecution.

Consideration Of Impertinence And Confidential Information

When discussing insider trading and SEC Rule 10b-5, the issue of materiality is essential. Any information that might influence an investor’s choice to buy or sell a security is material. Not only that, but it can’t be in the public domain; this highlights the value of nonpublic knowledge. Rule 10b-5 reaffirms the SEC’s dedication to preserving the honesty and equity of the stock markets. It serves as a precaution by making it illegal to trade based on substantial nonpublic information.

The Role Of Congress

The 1988 Legislation Addressing Insider Trading And Securities Fraud

The 1988 Insider Trading and Securities Fraud Enforcement Act introduced significant changes to current securities regulations. It marked a turning point in the United States’ governmental reaction to insider trading. There were two main provisions in this law that attempted to make insider trading regulations more stringent.

Among the most noteworthy features of the Act was the clear escalation of punishments meted out to individuals convicted of insider trading. Recognizing the seriousness of the offense, Congress aimed to discourage insider trading by making the penalties more severe. Authorities imposed sanctions with the dual purpose of punishing wrongdoers and discouraging future infractions. Thus reiterating the will to uphold the credibility of financial markets.

The Act was critical in developing a more precise and comprehensive legal definition of insider trading. Congress sought to clarify the legal foundation for enforcement . And eliminate uncertainty in interpretation by providing a more explicit definition of insider trading. In order to create a stronger and more equitable securities market, it was essential that the legal system and regulatory agencies be able to better detect and punish cases of insider trading.

The STOCK Act

In 2012, Congress passed the STOCK Act in response to concerns about insider trading, recognizing the necessity for openness and responsibility among elected officials. Members of Congress and their staff are now squarely subject to the insider trading laws enacted by the STOCK Act. By making this move, Congress shows that they perceive the meaning of keeping up with the public’s confidence in the public authority. And holding lawmakers to similar moral norms as most of us. Legislators’ adherence to this clause demonstrated their dedication to avoiding the appearance of bias or improperness.

The STOCK Act imposed strict reporting requirements, compelling Members of Congress to promptly declare their financial activities, promoting transparency. By making elected officials’ financial dealings more openly available to the public. The goal was to reduce fears of conflicts of interest and encourage greater responsibility on their part. The Demonstration looked to encourage a general public that was more open. And responsible by making monetary exchanges accessible to the general population. This is because to determined to recover public trust in the public authority.

New Proposals For Lawmaking

There have been legislative suggestions to further strengthen the legal framework around insider trading in response to developing market dynamics and technological improvements. A number of recent suggestions have centered on reviewing current legislation in depth in order to find and fix any weak spots or loopholes. Legislators are working to close any loopholes. That insider traders can use by updating the legal framework to reflect changes in market activities and technology.

In light of recent developments in the financial markets, there have been demands for new rules. That would effectively limit insider trading. These suggestions frequently call for stricter monitoring systems, closer cooperation among regulatory agencies, and harsher punishments to discourage wrongdoing. Building a regulatory framework that discourages unethical behavior and encourages honest trade is the objective.

Difficulties And Debates

Insider Trading Laws That Are Unclear

One of the well established issues with insider trading regulation is the absence of an unmistakable meaning of “material nonpublic data. Finding a happy medium between avoiding overly restrictive definitions. And giving clarity for enforcement is a common challenge in the legal framework. It is difficult to develop a generally applicable definition due to the ever-changing character of financial markets. Where the relevance of information may differ. Ambiguities in this definition can impede the identification and prosecution of insider trading cases.

As financial transactions involve both inside and outside parties to corporations, the complexity of identifying who is considered an “insider” increases. Insiders in positions with indirect access to information are difficult to define, in contrast to key executives and directors who are obvious cases. The proliferation of third parties engaging with corporations as consultants, contractors, or otherwise blurs the line between insiders and outsiders. Legal proceedings can become clouded by ambiguity in this area, which could lead to inconsistent enforcement.

Problems With Enforcing

The burden of proof is heavy when it comes to proving insider trading violations. As it typically requires proof of knowledge and intent. Proving that a trade was made based on material nonpublic information can become even more challenging when dealing with complex market players who may use tactics to conceal their actions. It is as of now hard to implement regulations that require verification of plan . Since it is intrinsically challenging to discover an individual’s psychological state when an exchange happens.

Challenges With International Cooperation And Cross-Border Issues:

Insider trading regularly crosses global limits, making issues with locale. It can be challenging to coordinate investigations and enforcement actions across jurisdictions. Because every nation has its own laws, procedures, and levels of cooperation. This raises questions about the efficacy of enforcement actions. And could result in regulatory arbitrage, in which individuals take advantage of differences in jurisdiction to avoid prosecution.

Real-Life Examples

Major Cases Involving Insider Trading

Martha Stewart (2004)

In one of the most high-profile insider trading cases, lifestyle entrepreneur Martha Stewart was accused of selling shares in ImClone Systems. Investigators found Stewart guilty of obstruction of justice and providing false statements, not insider trading. It brought attention to the difficulties in establishing intent and knowledge. The case demonstrated the complexities of establishing insider trading violations and the possible ramifications of such violations beyond the main accusations.

Raj Rajaratnam (2011)

In a milestone case including insider trading by mutual funds, Raj Rajaratnam was tracked down liable on various charges of protections extortion and trick. Proving insider trading within the framework of complicated financial transactions is no easy feat, and this case highlighted the difficulties of using wiretaps to obtain evidence. Rajaratnam’s conviction demonstrated the government’s determination to pursue high-profile cases in order to preserve market integrity.

Effects On Laws And Their Implementation

Insights Gleaned From Notable Cases

Cases involving high-profile insider trading have provided lawmakers and enforcement agencies with important lessons. The financial and legal communities have better understood the importance of adjusting legal frameworks to new problems, overcoming difficulties in gathering evidence, and demonstrating intent. These cases clearly indicate that we should characterize insider trading more unequivocally. Solid authorization instruments are essential, and we should address legitimate ambiguities. We use the knowledge gained from these cases to improve laws and enforcement tactics.

Impact On Changes In Regulations

In response to high-profile insider trading cases, regulators frequently work to fill loopholes in the law. In light of worries raised by these cases, controllers like the Securities and Exchange Commission (SEC) may rethink and update current guidelines. The importance of taking proactive steps to prevent and detect insider trading is highlighted. And the impact can go beyond specific cases to influence broader regulatory approaches. Reporting requirements, monitoring methods, and penalties may all undergo revisions . This is because of the result of regulatory changes to better reflect the gravity of infractions.

Ideas For The Future And Current Trends

Insider Trading And New Technologies

Applications Of AI In The Field Of Monitoring

One promising trend in the increasingly digital financial markets is the use of artificial intelligence (AI) for monitoring and surveillance. Artificial intelligence algorithms outperform more conventional approaches when it comes to analyzing massive volumes of market data, spotting anomalies, and possibly detecting insider trading. Regulatory authorities now have powerful tools at their disposal to keep up with the ever-changing tactics used by insider traders. The integration of machine learning models that improve the ability to detect subtle indicators of suspicious activity.

Blockchain As A Tool For Openness

The adoption of blockchain technology could greatly improve the openness of the financial markets. Financial transactions can be recorded in a way that is both transparent. And impossible to alter using blockchain technology’s distributed and immutable ledger system. This technology can achieve a more secure and open trading environment by reducing the likelihood of unauthorized access to sensitive information. Authorities will be better able to probe and punish cases of insider trading if they use blockchain technology to record all transactions.

Enhancing The Legal Structure

Revision Requests

In response to new threats in the financial sector, lawmakers are constantly reviewing existing securities laws and considering new ones. Definitions, penalties, and gaps found in recent cases might be the subject of proposed changes. To make sure the legal framework is clear enough to combat new forms of insider trading, lawmakers are constantly revising it. Legislators can foster a legal climate that adapts to new technologies and market trends by maintaining a proactive stance.

Collaboration On A Global Scale And Requirements

Combating cross-border instances of insider trading requires international cooperation due to the global nature of financial markets. Regulatory bodies should strengthen international standards and cooperation mechanisms to enhance information sharing. Problems with jurisdiction, extradition, and enforcement actions can be better handled . This could be solved when countries work together according to established norms and standards. When nations work together more effectively, it becomes easier to track down and punish insider traders in different countries.

Raising Investor Knowledge

Fostering Moral Action

Fostering ethical behavior within financial markets is greatly aided by investor education. The significance of trading with publicly available information, the dangers of insider trading, and the wider effect on market integrity can all be emphasized through educational programs. Insider trading can be reduced and financial markets can be kept open and fair if market participants are encouraged to act ethically.

Promoting The Disclosure Of Doubtful Behavior

An important step in preventing and detecting insider trading is giving people the tools they need to report questionable activity. Market participants can be educated about the reporting mechanisms and whistleblower protections through educational campaigns. Regulators can improve their capacity to investigate and act swiftly on allegations of insider trading . This is possible if they encourage individuals to report possible instances of this practice.

Conclusion

The terrain of “Insider Trading Legal for Congress” develops as a changing scene, molded by laws, problems, and trends of the future. The stability and confidence of financial markets depend on Congress as it works out the kinks in the definition and prosecution of insider trading. Assuring a fair and transparent financial ecosystem for all, Congress strives to create an environment where insider trading is confronted with strong legal deterrent through continual adaptation, strengthened legal frameworks, and a commitment to global collaboration.

Frequently Asked Questions

1. In Response To Insider Trading, What Legislative Actions Has Congress Taken?

The STOCK Act and Insider Trading and Securities Fraud Enforcement Act of 1988 are two significant bits of regulation that Congress has passed. Which force announcing prerequisites and approvals on individuals from Congress.

2. What Effect Do High-Profile Insider Trading Cases Have On Congress’s Ability To Pass New Laws?

It is entirely expected for high-profile cases to compel legislators to overhaul definitions, reinforce disciplines, and fix provisos in the law.

3. When It Comes To Identifying Insiders And Defining Substantial Nonpublic Information, What Obstacles Does Congress Have To Overcome?

There has to be clear legal boundaries because Congress is having trouble with definitions of “material nonpublic information” and “insider” status.

4. If Congress Wants To Keep An Eye Out For And Stop Insider Trading, How Might Technology Help?

To aid Congress’s fight against insider trading, technological developments like blockchain and artificial intelligence provide instruments for effective oversight and openness.

5. If Congress Is Serious About Tackling Insider Trading, What Global Factors Must It Prioritize?

To successfully combat and punish cases of insider trading on a global scale. Congress must address cross-border challenges, highlighting the significance of international collaboration and standards.