Super Micro Computer (NASDAQ: SMCI) went from an under-the-radar server maker to a Wall Street star virtually overnight.

Riding the AI/data-center wave and partnerships with Nvidia, SMCI’s stock has more than tripled in 2024, up over 200% since January 2024.

By March 2024 the company joined the S&P 500. Yet with that meteoric rise came investor scrutiny. SMCI however, has not been charged with any crime, and an internal review even found no evidence of corporate misconduct or fraud.

Still, retail traders are fixated on insider selling. SEC filings show executives and early employees unloading millions of dollars of shares at or near SMCI’s highs, and online chatter has heated up.

This article breaks down the biggest insider sales since the AI-runup began, and how investors have reacted.

TL;DR

- SMCI stock soared 200%+ in 2024, driven by AI demand and S&P 500 inclusion.

- No fraud or misconduct found, but insider sales triggered retail suspicion.

- CEO, co-founder, and CFO sold $30M+ in Dec 2023; more big sales followed in Feb and May 2025.

- Some Reddit users called it “routine,” others saw “pump and dump” signs.

- Verdict: No charges filed, but insider timing continues to raise eyebrows.

SPMCI Insider Trading Allegations

December 2023: CEO, CFO and Others Cash In

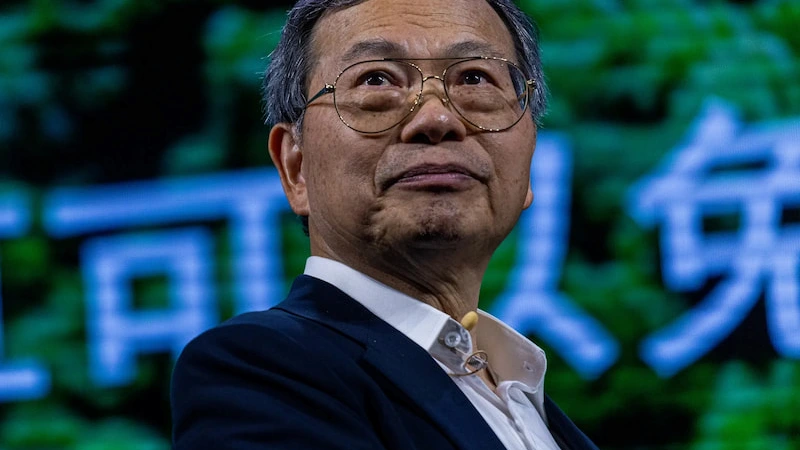

SMCI’s biggest selling spree came as 2023 wound down. On December 5, 2023, the day of its Q3 report, SMCI insiders took profits in a big way. CEO Charles Liang and his wife Sara Liu (co-founder/SVP) each sold 50,000 shares at about $252.18, netting roughly $12.6 million a piece. The new CFO, David Weigand, sold 20,000 shares (about $5.0 million) that same day.

Even a company director, Robert Blair, unloaded 800 shares .

By December 7 the CEO and Sara Liu had already received new large option grants (1,000,000 shares at $45) as reported later, underscoring that these sales were part of scheduled compensation plans.

In all, insiders sold roughly 121,300 shares on Dec. 5–7, 2023, worth over $30 million at the then-record prices.

The sudden sell-off gave skeptics pause. Some on Reddit pointed out the wave of offerings SMCI made in early December, and saw the insider sales as more bad news.

Others on SMCI forums noted that the Liangs and CFO still held enormous stakes, so these sales were “practically nothing” relative to their 60–70 million share positions.

In short, profit-taking at peak prices looked normal to some investors, but to others it looked like executives banking gains just as the stock topped out.

Early 2024: Continued Profit-Taking Amid AI Hype

The selling didn’t stop in January. In late January 2024, as SMCI rocketed toward $800–$900 on AI momentum, the Liangs sold again, albeit much smaller lots.

On Jan. 31, 2024, Charles Liang and Sara Liu each sold 962 shares at about $476.10, roughly $458,000 a piece.

By February 2024 the stock was setting new highs, and more insiders hopped off the train. The largest move was Feb. 14–15: SVP of Worldwide Sales Don Clegg dumped 28,727 shares at $874.57, raising $25.1 million. (Clegg left the company soon after.)

SVP of Operations George Kao also sold modestly that week, about 1,884 shares at $993 ($1.87M)and another 1,608 shares at $649.85 ($1.04M) on Feb. 5.

A long-time director, Sherman Tuan, sold 5,000 shares at $873.98 (≈$4.37M) on Feb. 29.

These sales came on the heels of blowout forecasts and just before SMCI officially joined the S&P 500 (effective March 18, 2024). In fact, SMCI’s stock had already jumped 12.5% on the S&P inclusion news. With prices surging, insiders were cashing in – and it did not escape notice.

Traders on Reddit and social media were torn. Some viewed these sales as sensible tax- or diversification-driven moves. Others were uneasy.

By early 2024 the stock was on a parabolic run, and a few forum posters likened the situation to a classic “pump and dump.”

One WallStreetBets user noted that despite the huge run-up, “not a single insider buy happened while the company is not in a blackout period,” warning readers that lack of insider buying alongside aggressive dilution “is sus” and prompting him to short the stock.

April 2024: Minor Profit-Taking at the Peak

After the S&P lift, the stock kept climbing. In late April 2024, Charles and Sara each again took small chips off the table. On April 29, 2024, they each sold 525 shares at about $869.62 – roughly $456,500 per person. This was well above their earlier sales and near the top of SMCI’s rally (SMCI hit its all-time split-adjusted highs around this period). No other executives sold material amounts that day, suggesting this was mostly a token tax-planning sale by the couple.

The April sale barely registered in headlines, since it was a fraction-of-a-percent of their holdings. Few public comments focused on it: insiders had already done heavy selling earlier, and by then most investors knew the pattern.

Instead, chatter at the time mostly centered on SMCI’s record earnings and growth outlook, with any insider profit-taking seen as minimal.

February 2025: Nasdaq Deadline Sparks New Sales

A more recent cluster of sales came with SMCI’s March 2024 earnings turmoil. After a late Aug 2024 delay in financials, SMCI raced to file its late 10-Q/Ks by the Feb 25, 2025 Nasdaq deadline. The stock popped 22% on Feb. 26, 2025 when the filings were delivered.

Over the next two trading days, insiders sold again.

On Feb. 26, 2025, CEO Charles Liang and Sara Liu each sold 46,293 shares at about $50.17, grossing $2.32 million a piece. SVP George Kao sold 71,720 shares at $50.48 ($3.62M) at the same time.

All these trades closed out significant direct holdings, Quiver’s analysis noted Charles had sold 100% of his then-direct class of shares.

Then on May 16–20, 2025, another round occurred: CFO David Weigand sold 67,000 shares at ~$44.02 ($2.95M), and on May 16-14 CEO Liang and Sara each sold 200,000 shares at ~$45 ($9.0M each), with George Kao adding 28,400 shares ($1.30M) on May 14.

These sales followed SMCI’s recent late-March restatement and were clustered around news flow (e.g. Moody’s downgrading, plus broad market volatility).

The February 2025 selling drew immediate social-media attention. Many traders were already wary of SMCI’s SEC headliners. Some saw the March filings relief rally as the last high, and insiders selling on the heels of that as ominous.

Others defended the insiders: one SMCI-dedicated forum poster pointed out that the $2.3M sale by Sara Liu in Feb (46,293 shares) represented all of her directly held shares, and that she and the CEO still retained over 67 million combined. “selling 46,293 is nothing,” he wrote.

Investors are essentially split between seeing these trades as expected profit-taking or as signs of trouble.

The Verdict: Profits or Red Flags?

After all these events, what’s the takeaway?

There is a clear pattern: SMCI insiders repeatedly sold large blocks of stock at or near market peaks. Every one of the major surge periods in 2023–25 saw executives take profits. This has stoked speculation among retail traders about whether executives might know something negative (a classic “pump and dump” fear).

On the other hand, insiders are neither corrupt nor prophets , they routinely diversify and pay taxes by selling part of their holdings, even in a hot market.

Importantly, no official wrongdoing has been found. SMCI’s board committee found “no evidence of misconduct or fraud” in the accounting issues, and regulators have not charged anyone.