Introduction

Controversies and allegations of insider trading are common in finance and securities trading. In this case study, we dive into the convoluted network of claims surrounding Steve Buyer, a significant person in the financial world. Insider trading, or trading on non-public, crucial information, has long been a problem in the financial world. Steve Buyer’s situation is no exception, garnering widespread attention and raising concerns about ethical behavior, regulatory monitoring, and the implications of such actions. This study aims to examine the Steve Buyer insider trading claims, shining light on the case’s essential components and ramifications.

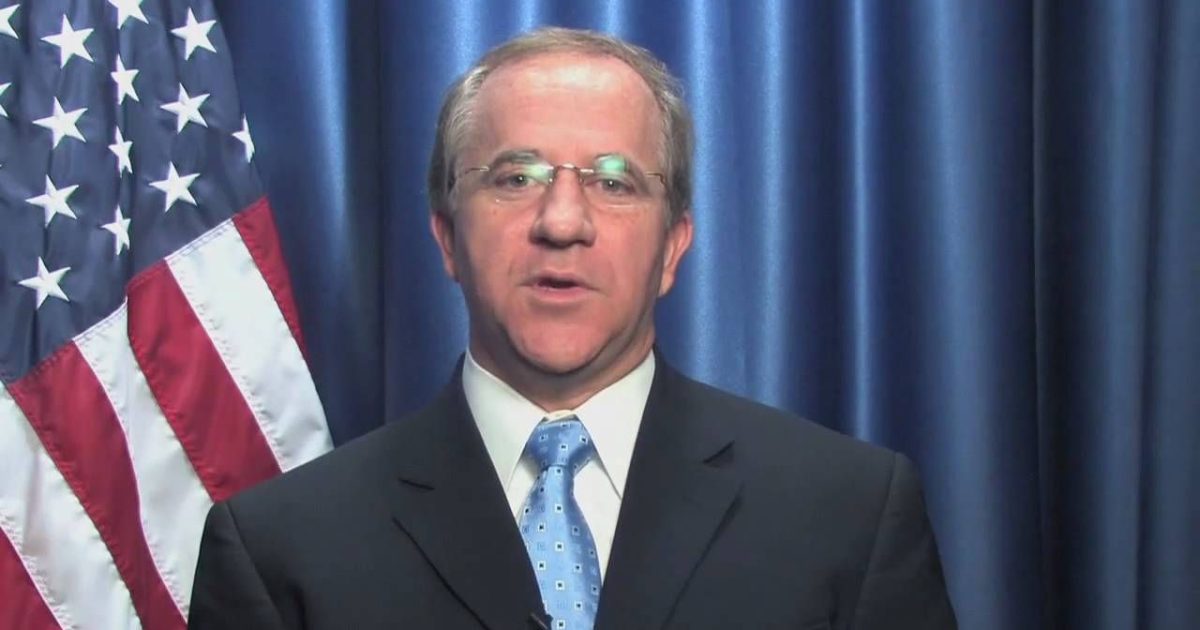

Background Information On Steve Buyer

Steve Purchaser is a noticeable figure in money and business, known for his broad vocation in venture banking and corporate authority. Brought into the world on November 26, 1960, in Rensselaer, Indiana, Purchaser went to Purdue College and procured a degree in business and financial matters. He later went to Harvard Business School to get an Expert of Business Organization (inA) degree, which made him even smarter about money.

Mr. Purchaser’s profession in the monetary area started at an esteemed venture bank, where he immediately ascended to the company’s pecking order because of his remarkable scientific abilities and sharp knowledge of market patterns. He received honors for his contributions to the field and gained recognition for his leadership roles in various prominent financial institutions.

Overview Of Insider Trading Allegations

Steve Purchaser is currently embroiled in a contentious dispute that includes allegations of insider trading. Insider exchanging alludes to the unlawful act of trading security, like stocks, bonds, or choices, in light of non-public, material data about the organization giving those protections. Securities laws and regulations forbid such behavior because it gives unfair advantages to those with privileged information and undermines the integrity of financial markets.

These claims against Steve Purchaser spin around dubious stock exchanges and correspondence records that propose he might have approached private, non-public data about an organization’s monetary well-being and future execution. The nature and degree of these claims have brought severe worries in the local financial area and have provoked administrative specialists to start examinations.

Stephens’s Purchaser Is Blamed For Making Illegal Stock Buys, Adding Up To $15 Million By Utilizing Data Acquired Through Insider Trading

After Purchaser left Congress in 2011, he began a counseling firm called the Steve Purchaser Gathering, and T-Portable was supposedly one of his clients. The purchaser learned about T-Portable’s covertness acquisition of Run in the Spring of 2018 while playing golf with a T-Versatile chief.

When the consolidation was revealed the following day, the Buyer had already invested $568,000 in his accounts, a shared service with his cousin, and a form with a space designated for a partner. After the purchase was announced in April 2018, the buyer quickly realized a profit of almost $107,000.

After Guidehouse LLP publicly announced its acquisition of Navigant Counseling, Inc. in 2019, Purchaser invested over $1 million in equity in Navigant Counseling, Inc. The buyer made the buys utilizing a wide assortment of records, including his own. He shared services with his better half and youngster, her narrative, and the history of the equivalent collaborator he had utilized for the Run buy. On the day when the Navigant purchase was disclosed in August 2019, the purchaser allegedly made a profit of approximately $227,000 by selling nearly all the shares he had purchased across all his accounts.

Securities And Exchange Commission Involvement

As per the SEC, financial backers who benefitted from his admittance to material, nonpublic data overstepped government protection regulations and disintegrated public confidence and trust in the decency of our business sectors. The buyer is a well-prepared, legitimate, proficient, former legislator, and investigator. Thus, “we have conceded to doing everything without exception an option for us to keep up with and improve public certainty by evening the odds while considering the Purchaser responsible for wrongfully benefitting from his entrance.”

In a claim recorded in Manhattan government court, the Securities And Exchange Commission (SEC) charges that the Purchaser defied Norm 10b-5 and Segment 10(b) of the Protections Trade Demonstration of 1934. One of the most important parts of the defense is that buyers shouldn’t have to do things after the sale, like give back money they got illegally, pay fines or interest, or take on leadership duties. Joni Lynn Purchaser, the buyer’s wife, is also involved because she allegedly makes money off of her husband’s questionable business choices. The US Attorney’s Office also worked on crime cases in the Southern Region of New York Territory.

Jessica Regan, Timothy Halloran, and Carolyn Winters drove the SEC request. D. Mark Cavern is going up the test. Mr. Halloran, working under the course of Ms. Armstrong, will deal with the case. The U.S. Lawyer’s Specialization for the Southern Region of New York, the Government Department of Examination, and FINRA are entirely thankful to the Protections and Trade Commission for their work on this case.

Key Players And Organizations

Steve Buyer

Steve Purchaser, the focal figure in the insider exchange claims case, assumes a crucial part of the unfurling occasion. His significance in the situation has multiple layers. In this insider trading case, Steve Buyer is the main suspect. Claims suggest that he utilized non-public data to execute stock exchanges. If someone were to validate these actions, they would seriously violate privacy regulations. Steve Purchaser’s status as a previous U.S. Senator adds importance to the case. His alleged involvement in insider trading increased public interest in the proceedings, given that he held a position of public trust and responsibility.

Whenever viewed as blameworthy, Steve Purchaser faces possibly cruel lawful repercussions. These could include hefty fines, time in prison, or the loss of any illegal gains. His case clearly illustrates the legitimate results that even high-profile people can look for protection against infringement. The allegations could severely harm Steve Buyer’s reputation and its legal implications. This harm stretches out not exclusively to the monetary and political domains but in addition to his remaining according to the general population.

Administrative Offices Included

Securities And Exchange Commission(SEC)

The SEC upholds government protections, regulations, and guidelines. In this situation, their essential obligation is researching and possibly arraigning insider exchange infringement. The SEC actively gathers evidence regarding the alleged activities of insider trading. This proof incorporates monetary records, correspondence information, and exchange accounts, among different snippets of data. The Securities and Exchange Commission (SEC) can bring civil charges against individuals or organizations for securities violations. If they find sufficient evidence, they might take Steve Buyer to court.

Department Of Justice (DOJ)

The Division of Equity’s contribution is essential because of its liabilities in criminal authorization. The DOJ is authorized to pursue criminal charges against individuals linked to insider trading. Should the case rise to a lawbreaker level, the DOJ might assume control over the indictment. The DOJ teams up intimately with the SEC in numerous insider exchange cases. This participation guarantees a far-reaching examination and, if vital, a planned lawful reaction.

Potential Victims Or Affected Parties

Investors, financial backers, and the general population: The general public, investors, and shareholders emerge as potential parties impacted by the alleged insider trading activities. Their jobs and importance envelop different angles. Financial consequences can arise from insider trading. Assuming such activities lead to falsely swelled or emptied stock costs, investors and financial backers might experience monetary misfortunes or pass up possible increases.

Cases of insider trading can damage people’s faith in the financial markets. The public’s impression of market decency and straightforwardness is fundamental for their proceeding with support and confidence in the monetary framework. The data pertained to an impending consolidation announcement that had not yet been disclosed. Regulatory agencies and the legal system take their preferences into account when determining penalties and compensation.

Allegations And Evidence

Nature Of Alleged Insider Trading

The idea of the supposed insider exchanging Steve Purchaser’s case is central to the examination. The term “insider trading” refers to the act of buying or selling securities while in possession of material, non-public information about the security, thereby violating a fiduciary duty or another relationship of trust and confidence. Allegations suggest that Steve Buyer had access to secret information regarding a publicly traded business while serving as a board member. The data related to an impending consolidation announcement that had not yet been disclosed.

A significant rise in his holdings just before a major announcement may suggest insider trading. Utilizing non-public data to exchange protections would comprise a break of this obligation. The charges determine that Steve Purchaser bought large numbers of a portion of the Company’s pieces without further ado before the consolidation declaration. The timing raised doubts that he could have utilized the data to make a beneficial exchange.

Steve Purchaser purportedly exchanged a portion of the Company’s regular stock. Ordinary stock addresses proprietorship in an organization and regularly accompanies casting ballot rights and the potential for profits. Insider exchange cases frequently include direct buys or deals of regular supply and utilizing choices and subordinates. These monetary instruments consider hypotheses on the value development of the fundamental stock.

Examination Of Accessible Proof

Monetary Exchanges

The examination of monetary exchanges is significant in surveying the legitimacy of the insider exchanging claims. In this situation, the accompanying details of economic exchanges are under a magnifying glass:

Exchange Timing

Investigators examine the timing of Steve Buyer’s stock purchases after the merger announcement. Curiously, planned exchanges might propose insider exchange.

Volume Of Exchanges

The volume of Partnership’s stock bought by Steve Purchaser is of interest. His holdings are rising significantly just before a major announcement may indicate insider trading.

Profitability

Investigators look at the profitability of Steve Buyer’s trades. It raises doubts about insider exchanging, assuming he understood critical gains soon after the consolidation declaration.

Correlation With Past Way Of Behaving

Comparing Steve Buyer’s stock trading behavior before and after the alleged insider trading event can yield insights. Any deviations from his past ways of behaving might be considered dubious. Sophisticated data analysis methods like pattern recognition algorithms can find unusual trading patterns or connections to other market activities.

Correspondence Records

Correspondence logs are another key source of evidence in insider trading investigations, particularly regarding the time the information in question was received or used to make a decision. Agents inspect Steve Purchaser’s email and instant message interchanges during the pertinent period. They search for any messages indicating the belonging or scattering of inside data. Investigators scrutinize call logs for suspicious interactions that coincide with the purported insider trade.

Steve Purchaser investigates meeting minutes for possible references to the merger. He pays special attention to those that feature the company’s top executives or other board members. Investigators scrutinize call logs for suspicious interactions that coincide with the alleged insider trade

Well-Qualified Feelings And Witness Declarations

In order to concoct a convincing case, it is common practice to rely on qualified assumptions and witness testimonies to provide context and credibility to the claims and evidence.

Financial Specialists

Relevant authorities may request experts in the financial sector to investigate trading records, calculate the prospective profits or losses from the alleged crime, and report their findings.

Lawful Specialists

Legitimate specialists assist with interpreting protections, regulations, and guidelines, giving direction on whether Steve Purchaser’s activities comprise insider exchanging and whether there are any likely safeguards.

Criminological Specialists

Criminological specialists assess computerized and correspondence records, assisting with revealing stowed away or erased data that may be pertinent to the situation.

Witness Declarations

Firsthand accounts provided by witnesses present during relevant meetings, conversations, or transactions may either support or refute the allegations. This can incorporate individual board individuals, chiefs, or people engaged with the consolidation.

Character Testimonials

They may call character witnesses to testify about Steve Purchaser’s reputation and ethical conduct, both in his professional and personal life, to establish or challenge the validity of the charges.

Legal Proceedings

Overview Of Legal Actions Taken Against Steve Buyer

Common And Criminal Accusations

The insider trading charges against Steve Purchaser have resulted in the initiation of the customary and lawful criminal procedures.

Common Charges

The Protections and Trade Commission (SEC) typically records standard charges in supposed insider exchanging instances. These charges include money-related punishments, vomiting of poorly-ent gains, and directives to forestall future infringement. Standard charges still need to convey that the gamble of detainment can bring significant monetary disciplines.

Criminal Accusations

The Branch of Equity (DOJ) may bring criminal allegations in additional severe insider instances exchanging. Assuming indicted on criminal accusations, Steve Purchaser could confront detainment, significant fines, or both. Criminal charges require a higher obligation to prove claims and present more severe results.

Court Choices And Decisions

Starter Hearings

Primer hearings are significant beginning phases in the official actions against Steve Purchaser.

Proof Show

Both the indictment and safeguard present their underlying proof and contentions. The purpose of this stage is to determine whether or not there is enough evidence to proceed to a full trial.

Movements And Lawful Difficulties

The defense may challenge the legality of the investigation, suppress evidence, or drop charges. These movements are tended to by the court.

Bail And Delivery

If Steve Purchaser is arrested, initial hearings may also address bail arrangements and conditions of release pending trial.

Preliminary Results

The trial is the central event in the judicial proceedings, where the evidence against Steve Purchaser undergoes thorough examination

Jury Choice

A jury is chosen to hear the case and render a decision. The composition of the jury has a significant impact on the fairness of the trial.

Show Of Proof

The evidence includes documents, expert testimony, and remarks from witnesses. The indictment demonstrates responsibility without question, while the protection plans to lay out uncertainty or honesty.

Verdict

Following considerations, the jury delivers a decision. Assuming that Steve Purchaser is liable, the court will continue to condemn him. He feels vindicated. Thus, the issue is closed without further legal action being taken.

Appeals

Regardless of the outcome of the trial, either party may file an appeal challenging the trial itself or the legal proceedings leading up to the verdict. Requests can fundamentally broaden the lawful cycle.

Impact And Implications

Insider exchanging charges and their legitimate results have sweeping outcomes for the people required and the monetary business sectors, corporate administration, and public discernment. Steve Purchaser’s allegations of insider trading allow us to spot a few noteworthy outcomes and recommendations.

Monetary Outcomes

If Steve’s Purchaser is found guilty, he may face substantial financial penalties, including fines, the disgorgement of ill-gotten gains, and compensation to affected parties. These punishments act as a hindrance against future insider exchanging.

Market Effect

The case might have transient market influences, mainly if it includes a high-profile individual like Steve Purchaser. Unexpected stock cost variances in the ensnared organization (ABC Partnership) could influence financial backers and market solidness.

Financial Backer Certainty

Effective arraignment and punishments can upgrade financial backers’ trust in the decency and uprightness of monetary business sectors. Investors are more likely to participate when they believe insider trading is rigorously prosecuted and deterred.

Notoriety Harm

Individual And Expert Standing

Steve Purchaser’s proficient standing might experience unsalvageable harm, no matter the preliminary result. Insider exchange charges can spoil a singular’s appearance, influencing their professional possibilities and public character.

Discouragement Impact

Exposure encompassing the case can act as an obstruction for others pondering insider exchanging. Seeing the outcomes looked at by high-profile people can prevent others from taking part in comparative exercises.

Point Of Reference Setting Impacts On Insider Exchanging Cases

Legitimate Point Of Reference

The result of Steve Purchaser’s case might start a lawful trend for future insider exchange cases. It can influence how prosecutors handle similar issues, the standards of evidence needed, and the severity of imposed penalties.

Implementation Needs

Administrative bodies like the Protections and Trade Commission (SEC) and the Division of Equity (DOJ) may change their authorization needs and methodologies in light of the examples gained from this case. They might distribute more assets to insider exchanging examinations or seek after unambiguous enterprises or people all the more forcefully.

Models Learned And Expected Changes

Corporate Administration and Morals: The case highlights the significance of powerful corporate administration and morals inside public corporations. Associations might rethink their inward controls, consistency projects, and preparation to forestall insider exchanging episodes.

Administrative Oversight

Administrative bodies might consider modifications to protection guidelines and implementation rehearses. They might fix detailing necessities, improve observation instruments, or smooth the insightful cycle.

Public Mindfulness

High-profile insider exchange cases like this can raise public mindfulness about moral issues in finance. This uplifted mindfulness can prompt public conversations on the requirement for straightforwardness, reasonableness, and uprightness in monetary business sectors.

Change Recommendations

Policymakers might present official or administrative changes to reinforce punishments for insider exchanging, shutting lawful provisos, or improving informant insurance.

Consistency Measures

Organizations might execute stricter consistency measures, including worker preparation on insider exchanging regulations, to forestall coincidental infringement and encourage a culture of moral lead.

Financial Backer Training

The case might provoke drives to instruct financial backers about the dangers and results of insider exchanging, engaging them to settle on informed venture choices.

Public Perception And Media Coverage

Media Portrayal Of Steve Buyer And The Case

The media is critical in forming a public impression of legitimate cases, including insider exchange charges and well-known people like Steve Purchaser. The depiction of Steve’s Purchaser and the patient differs.

Sentimentality Versus Objectivity

A few news sources might take a dramatist approach, zeroing in on lecherous subtleties or expected embarrassments to support evaluations or readership. Others take a stab at objectivity, introducing current realities fairly and impartially.

Political And Philosophical Focal Point

Contingent upon their political affiliations or belief systems, news sources might unexpectedly approach the case. Some might underscore Steve Purchaser’s political history, while others focus on the lawful viewpoints.

Impact Of Hypothesis

Media inclusion can sometimes include theory or guesses about Steve Purchaser’s responsibility or guiltlessness. This hypothesis can shape general assessment before the case is chosen.

Public Opinions And Reactions

General conclusions and responses to the topic are affected by media inclusion. However, they can likewise be molded by private convictions and encounters.

Compassion or Judgment

A few individuals from general society identify with Steve Purchaser, accepting that he is free and clear by default. Others might criticize him because of the claims and media inclusion.

Political Connection

Steve Purchaser’s political alliance might spellbind conclusions. Allies from his party might mobilize behind him, while political rivals might utilize the case to scrutinize his party or philosophy.

Assumptions For Responsibility

General society frequently anticipates that public authorities should be held to higher moral and legitimate norms. If the charges are validated, this case might build up open requests for responsibility from chosen sources.

Impact Of Media On Legal Procedures

Media inclusion can affect legal actions, possibly influencing the reasonableness of the preliminary.

Jury Impact

Pretrial exposure can shape expected legal hearers’ perspectives. Media inclusion that is one-sided or sensationalized may make it difficult to track down an impartial jury.

Legitimate System

Lawful groups on the two sides might change their methodologies regarding media inclusion. Guard lawyers might look for a difference in setting, while examiners might be careful about looking for capital punishment if a popular assessment is unequivocally against it.

Requests And Difficulties

If media inclusion is considered biased or fiery, it can become a reason for demands or difficulties during the preliminary or post-conviction procedures.

Conclusion

The Steve Buyer insider trading case is a harsh reminder of the challenges in maintaining financial market integrity. It emphasizes the importance of stringent regulatory monitoring and ethical behavior in the financial business. While this case has generated many questions, it also allows stakeholders to rethink and improve their commitment to market openness and fairness. Legal actions and outcomes involving such patients will continue to shape the landscape of insider trading laws, and the lessons derived from this case should guide efforts to prevent and address similar situations in the future.

Frequently Asked Questions

1. What Is Insider Exchanging, And Why Is It Unlawful?

Insider exchanging is trading security in breaking a guardian obligation or other relationship of trust and certainty while possessing material, non-public data about the safety. It is unlawful because it subverts the decency and trustworthiness of monetary business sectors, giving a few people an unjustifiable benefit over others.

2. Who Is Steve Purchaser, And For What Reason Would He Say He Is Associated With Insider Exchanging Charges?

Steve Purchaser is an unmistakable figure in the monetary business who has been blamed for participating in insider exchange. He purportedly utilized non-public data to make stock exchanges, possibly benefitting to the detriment of different financial backers.

3. What Are The Possible Outcomes Of Insider Exchanging For People Like Steve Purchaser?

People seen as at legitimate fault for insider exchanging can deal with severe damages, including fines, detainment, and common claims. They may likewise be prohibited from exchanging protections in the future and face harm to their expert standing.

4. What Are The Ramifications Of The Steve Purchaser Case For The Monetary Business?

The Steve Purchaser case highlights the significance of moral lead and administrative oversight inside the monetary business. It fills in as an advance notice to others about the severe insider outcomes exchanged and the requirement for straightforwardness and reasonableness.

5. How Could People And Associations Forestall Insider Exchanging?

Forestalling insider exchanging requires administrative consistency, schooling, and moral behavior. Organizations can lay out severe inside controls, direct representative preparation programs, and empower an honorable culture. Administrative specialists likewise assume a vital part in implementing insider exchanging regulations and indicting wrongdoers.