Introduction

Federal Reserve insider trading has long been a source of interest, conjecture, and scrutiny. The Federal Reserve, as one of the most powerful financial institutions in the United States, plays a critical role in influencing the nation’s economy. On the other hand, insider trading has gotten a lot of attention because of its potential to undermine market integrity and fairness. We hope to shed light on the relationship between the Federal Reserve and insider trading in this investigation, deconstructing the myths and reality surrounding this complex junction of finance and regulation.

The Federal Reserve

Historical Background

Creation Of The Federal Reserve System

In 1913, the Central Bank Framework was laid out as a reaction to the monetary frenzies and banking emergencies that had tormented the US in the late nineteenth and mid twentieth hundreds of years. The United States’ central banking system was established by President Woodrow Wilson’s signature on the Federal Reserve Act. Its primary goals were financial stability, money supply regulation, and economic expansion. The need for a lender of last resort to stop bank runs and financial instability prompted the creation of the system.

Contribution To Monetary Policy

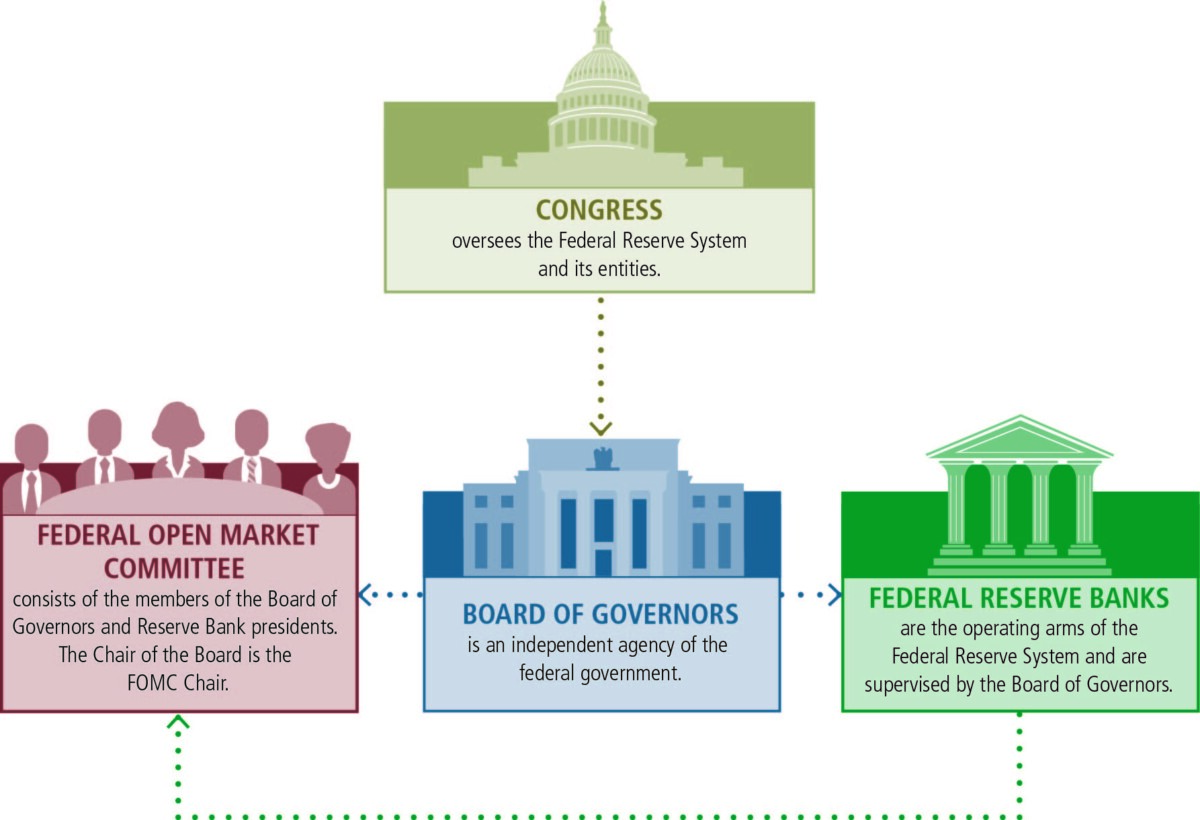

The Federal Reserve heavily influences the United States’ monetary policy. The Federal Open Market Committee (FOMC) determines the federal funds rate, which influences the cost of lending and borrowing money in the economy. Which comprises members from the Board of Governors and regional Federal Reserve Banks. Through open market tasks, the Central bank trades government protections to control the cash supply and accomplish its double order of value dependability and total work. The Federal Reserve’s money-related arrangement instruments incorporate loan cost changes, forward direction, and quantitative facilitating. Which it conveys to answer monetary difficulties like expansion, downturn, or financial emergencies.

The Federal Reserve Board Of Governors’ Structure

Board Of Governors

The Federal Reserve System’s central decision-making body is the Board of Governors, which has its headquarters in Washington, D.C. It comprises of seven individuals delegated by the Leader of the US and affirmed by the Senate. They space out the members’ 14-year tenure to dilute their collective power.

The Central bank chooses the Seat from among the Lead representatives and appoints them to serve a four-year term. The Leading body of Lead representatives is liable for setting critical money-related arrangements, administering and managing banks, and guaranteeing the steadiness of the monetary framework.

Territorial Federal Reserve Banks

The Central Bank Framework partitions into 12 territorial banks in significant urban areas across the US. The implementation of monetary policy, the supervision, and regulation of banks in their districts. The provision of various financial services to depository institutions are all responsibilities of these regional banks. The Board of Governors has oversight and direction over the regional banks, even though they have some autonomy. Each regional bank’s president and board of directors represent their respective districts’ interests.

Obligations Of The Central Bank

Money Related Strategy

The essential obligation of the Central bank is to direct money-related arrangements pointed toward accomplishing stable costs and the most fantastic economic business. The Central bank utilizes different devices to impact financing costs, cash supply, and economic credit conditions. Its activities plan to moderate inflationary tensions and invigorate monetary development during times of downturn or low work.

Monetary Steadiness

Guaranteeing the steadiness of the monetary framework is an essential capability of the Central Bank. This incorporates checking and tending to foundational gambles, forestalling monetary emergencies. And giving liquidity to economic business sectors during seasons of pressure. During and after the financial crisis of 2008, the Fed’s role in ensuring financial stability gained particular prominence.

Regulation And Supervision

The Federal Reserve oversees and regulates banks, holding companies, and other financial institutions to keep the banking system safe. To prevent failures that could have broader economic repercussions. It conducts stress tests, establishes and enforces prudential standards, and evaluates banks’ risk management practices. The Federal Reserve’s administrative endeavors intend to safeguard investors. Keep up with the monetary framework’s trustworthiness, and advance fair and straightforward economic business sectors.

Insider Trading

Trading Based On Non-Public Information

The term “insider trading” refers to the act of buying or selling securities in financial markets based on essential, confidential information about a company. Most of the time, only a select few people with a fiduciary duty to the company, like corporate executives, directors, employees, or people with wuniquecial relationships, have access to this information.

Insider exchanging can take different structures, including trading stocks, bonds, choices, or other monetary instruments. The primary component is that the broker has data not yet unveiled to people in general. And they utilize this data for individual addition or to keep away from misfortunes.

For instance, assuming that an organization’s President realizes that the organization will declare record-breaking income, they can’t lawfully purchase extra portions of the organization before the public arrival of this data. Insider trading would result from this.

Implications For The Law And Morality

There are legal and ethical aspects to insider trading. From a lawful viewpoint, many jurisdictions, including the US, restrict it. There are numerous justifications for this prohibition. It damages the market’s integrity and investor confidence and may result in unfair advantages for a select few. Additionally, insider exchanging can mutilate market costs, making it hard for different financial backers to go with informed choices.

Because it allows insiders to profit from their privileged access to information at the expense of ordinary investors. People widely regard insider trading as unethical and unfair. It disregards the standard of a level battleground in monetary business sectors, where all financial backers ought to approach similar data.

Insider Trading Regulations SEC Regulations

The Securities and Exchange Commission (SEC) is the primary regulatory body in charge of monitoring and enforcing insider trading laws in the United States. The SEC’s principles and guidelines on insider exchanging are intended to safeguard the respectability of monetary business sectors and guarantee fair treatment, everything being equal.

Key Sec Guidelines Connected With Insider Exchanging Include

- Rule 10b-5 of the Securities Exchange Act of 1934, which makes it illegal to use deceptive or manipulative practices in securities trading, including insider trading, prohibits insider trading.

- Insiders must report their protection exchanges, giving straightforwardness to the general population.

- The foundation of “power outage” periods during which insiders are limited from exchanging organization stock to forestall any appearance of inappropriateness.

- The authorization of severe punishments for infringement, including fines, spewing of badly gotten gains, and detainment.

Punishments For Insider Exchanging

- The punishments for insider exchange can be extreme, concerning expected and criminal outcomes.

- Monetary penalties that frequently amount to ill-gotten gains in addition to additional penalties.

- Criminal accusations, which can prompt detainment.

- Exclusion from filling in as an official or overseer of a public corporation.

- Harm to one’s professional and personal reputations.

- High-profile cases, such as the conviction of corporate leaders like Martha Stewart and Raj Rajaratnam, have shown insider exchange’s serious, legitimate outcomes.

The Myth Of Insider Trading At The Federal Reserve

The idea of insider exchange inside the Central Bank is a point that has earned colossal consideration and contention, frequently filled by confusion and an absence of figuring out about the foundation’s job, guidelines, and moral principles. Skepticism toward large financial institutions and a general lack of understanding of the Federal Reserve’s operations are the primary causes of this myth. As a general rule, the Central bank works inside a severe lawful and moral structure that disallows insider Trading by its authorities. We should dive further into the legend of insider exchanging at the Central Bank by tending to a portion of the every day misguided judgments and explaining the genuine practices and guidelines set up:

Myth 1: Central Bank Authorities Benefit From Insider Trading

One of the most persevering fantasies encompassing the Central Bank is the conviction that its authorities, including individuals from the Leading Group of Lead representatives and territorial Central Bank presidents, participate in insider exchange to benefit from their admittance to delicate data. This perception is frequently based on mistrust of large financial institutions, and the belief that influential people are immune from investing rules.

Reality

Insider trading is explicitly prohibited by a comprehensive legal and ethical framework to which Federal Reserve officials are subject. The purpose of this framework is to ensure that members of the institution do not use their exclusive access to information for their financial gain. Central issues to consider while exposing this fantasy include

Severe Consistence Measures

Central bank workers, including individuals from the Leading Group of Lead representatives and provincial Central Bank presidents, are considered “covered people” under government protection regulations. They are dependent upon severe guidelines that restrict exchanging of material non-public data. Infringement of these guidelines conveys serious punishments, including fines, detainment, and end of business.

Set Of Rules

The Central Bank keeps a robust set of rules and moral rules that all representatives should comply with. The significance of avoiding conflicts of interest and upholding the highest standards of integrity in all professional endeavors is emphasized in these guidelines.

Control And Monitoring

The Central bank has inner components set up to screen and implement consistency with insider exchanging guidelines. These components incorporate thorough preparation programs, revealing necessities for protections exchanges, and normal reviews. Employees who are found to have broken these rules face serious consequences.

Transparency

The conduct of Federal Reserve officials reflects the bank’s commitment to transparency. The institution ensures that its actions are accountable and subject to public scrutiny by actively communicating its policies and decisions to the public.

Myth 2: Central Bank Activities Advantage Money Road Insiders

Another common misconception is that Wall Street insiders, such as large financial institutions and well-connected individuals, gain the most from the Federal Reserve’s monetary policies and actions. The Federal Reserve’s policies, such as interest rate adjustments and quantitative easing, are criticized for allegedly serving the financial sector’s interests at the expense of the general public.

Reality

The Central bank’s essential mission is to advance monetary dependability and monetary market trustworthiness to help the more extensive economy, not to lean toward explicit vested parties or people. To expose this legend, taking into account the accompanying points is fundamental

Double Order

Congress has given the Federal Reserve the responsibility of ensuring price stability and maximizing sustainable employment. Its approach choices are made in light of these objectives, as opposed to serving the interests of specific foundations or people.

Accountability To The Public

The Central bank works with a serious level of public responsibility. Its activities and approaches depend upon Congress’s investigation, monetary market members, and the overall population. Central bank authorities routinely affirm before Congress, giving bits of knowledge into their dynamic cycles.

Stabilization Of The Market

Stabilizing the economy as a whole is the goal of the Federal Reserve’s interventions in the financial markets, such as raising interest rates or using quantitative easing. These actions are not intended to help a particular gathering yet rather to address macroeconomic difficulties, including downturns and expansion.

Administrative Oversight

In order to guarantee the stability and safety of financial institutions, the Federal Reserve is an essential regulator and supervisor. This administrative capability is fundamental for keeping a stable monetary framework and safeguarding customers.

Myth 3: The Federal Reserve’s Operations Are Opaque

A few people accept that the Central Bank works in mystery, making it helpless to insider exchanging due to an apparent absence of straightforwardness in its tasks. According to this myth, the institution’s officials are shielded from public scrutiny because its operations are carried out behind closed doors.

Reality

In order to build and maintain public trust, the Federal Reserve places a strong emphasis on transparency in its operations. To expose this legend, featuring the accompanying aspects is fundamental

Open FOMC Gatherings

The Government Open Market Panel (FOMC) holds customary gatherings to talk about and go with choices on financial strategy, including loan costs. Participants in the financial market and the media closely follow these meetings. Point-by-point minutes of these gatherings are delivered to general society, giving bits of knowledge into strategy conversations and goals.

Testimony From The Congress

Central bank authorities, including the Seat of the Central bank, consistently affirm before Congress. For congressional oversight, these testimonies provide transparency regarding the institution’s activities, policies, and goals.

Public Relations

The Central bank effectively conveys its targets and strategy choices to general society through different channels. Reports like the Beige Book and the Money related Approach Report give thorough data about financial circumstances, strategy reasoning, and future monetary projections.

Audits From Outside

The Central bank is dependent upon outside reviews and oversight to guarantee that it sticks to lawful and moral norms. Autonomous reviews assist with keeping up with straightforwardness and responsibility.

Conclusion

Federal Reserve insider trading is a significant topic in finance and economics. While myths and misconceptions about their connection linger, a closer look shows a more complicated reality. The Federal Reserve, as the United States central bank, operates within rigorous regulatory frameworks to ensure financial stability and market fairness. It is critical to grasp the Federal Reserve’s role and functions fully. On the other hand, insider trading continues to be a sensitive problem that necessitates close monitoring and punishment to guarantee market integrity.

As we negotiate the complex world of finance and regulation, we must rely on reliable information and debunk any myths or misconceptions that may cloud our grasp of these critical topics. We may work towards a more transparent and equitable financial system that benefits all stakeholders by doing so.

Frequently Asked Questions

1. What Is The Central Bank, And What Is Its Part In The U.S. Economy?

The United States’ central bank is the Federal Reserve, which is in charge of monetary policy, financial institution regulation, and ensuring the financial system’s stability.

2. Is Insider Trading Allowed Or Not?

Insider exchange is by and large viewed as unlawful in many nations, including the US. Trading securities based on private, important information gives traders an unfair advantage over other market participants.

3. Do Central Bank Authorities Participate In Insider Exchanging?

Insider trading is illegal for Federal Reserve officials, who are subject to stringent ethical guidelines and regulations. Any such act would be against the law and carry severe penalties.

4. How Does The Federal Reserve Stop Its Own Employees From Engaging In Insider Trading?

The Central bank has exhaustive strategies and techniques set up to forestall insider exchanging inside its association. Blackout periods, trade pre-clearance, and ongoing training are all measures taken to ensure compliance with insider trading regulations.

5. What Might Happen To People And The Financial Markets If There Is Insider Trading?

People took part in insider exchanging can have to deal with criminal penalties, fines, and detainment. Additionally, insider trading reduces investor participation and the stability of the market as a whole and can result in a lack of trust in financial markets.