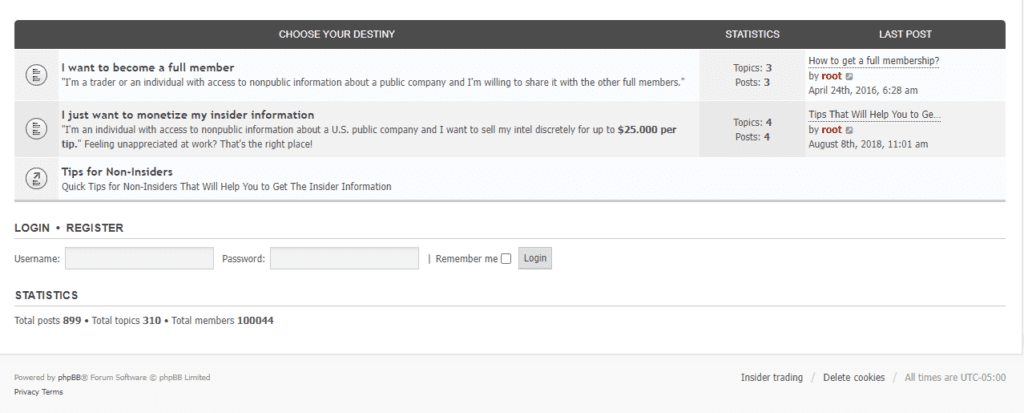

We recently analyzed insider trading on the Dark Web and came across The Stock Insiders website. It stood out with bold claims of being the oldest and Only Insider Trading Forum On The Dark Web or The Dark Side Of The Wall Street. We signed up for the site and contacted the administrator to find out more.

He agreed to give us an interview, offering a rare opportunity to talk about insider trading on the Dark Web with someone who knows a lot about it. It turned out to be an interesting interview about how insider trading works on the dark web. See for yourself.

… you get access to enough non-public information that, if theoretically used for trading, could deliver a large positive alpha every year.

The Stock Insiders admin

Can you introduce us to the Stock Insiders and tell us a bit more about how it works?

Sure. The Stock Insiders is the only discussion forum on the Internet focused on sharing material, non-public information, and insider trading. We were founded more than five years ago, making us one of the longest-running communities on the Dark Web.

How does it work? The simplest explanation is that you scratch my back, and I’ll scratch yours. The idea is actually not new. What makes it different is the use of the dark web in its structure. By ensuring that each link in the chain is anonymous, we have created a safe haven where insiders can easily share their information with other like-minded insiders around the world. Members can benefit from each other’s information while remaining safe. There is no real connection between them in the real world.

But do you admit that you are doing something illegal because you are on the dark web?

Not at all. We could have hosted our website on the Clear Web with a regular .COM domain in a country where insider trading is perfectly legal. The decision to go to the Dark Web was made simply because there is no other viable way to remain anonymous online. So the Dark Web is the essence of the existence of such a safe haven. Besides, the use of the Dark Web is legal in most countries.

Who are the members of the Stock Insiders, and what do they have in common?

Mainly people from investment banking, management consulting or managers of large corporates, and thanks to one of our valued members, we even have direct insight into live investments in public markets. Of course I do not know much about the members, as we all remain anonymous, but I can say that they are all very intelligent, savvy, and of high social status. They are also respectful and experienced professionals in their respective fields.

What information can members find on your website?

As a full member, you get access to enough non-public information that, if theoretically used for trading, could deliver a large positive alpha every year. We are talking mainly about M&A data, earnings reports, regulatory decisions (e.g., FDA), licensing agreements, etc.

How can someone become a member?

Landing your dream job at MBB is probably much easier than becoming a member of The Stock Insiders.

The Stock Insiders admin

First things first, you must prove that you have regular insider access by sharing your first insider post with non-public information. This is then manually verified, and if the level of insider access matches what we are looking for, we will proceed with your application. After your access is verified, other members of our community can ask you some questions before the membership verification is officially complete.

The truth is that becoming a member is very difficult. Landing your dream job at one of the MBB firms is probably a lot easier than becoming a member of The Stock Insiders.

We focus on the quality of members, not the quantity, which defines the level of participation and application requirements. As a rule of thumb, we must be convinced that you will increase the quality of the forum through your membership.

Membership is free of charge. You don’t need to pay to become or stay a member of The Stock Insiders but you need to consistently bring value in the form of insider information to keep your membership active.

It looks like you only accept M&A professionals, right?

No, we are not restricted to M&A professionals. But chances are that as a member you spend most of your time either in investment banking, something else related to M&A or as a manager at a publicly traded company. So the applicants who have a BetaVille subscription and think they have an edge can forget it. We also do not accept day traders or so-called “crypto insiders“.

Membership is also not for sale. Almost every other day, I get an offer from someone who wants to buy their membership. We do not sell memberships. The reason is again our own security.

You say it’s anonymous. But how can you be so sure when so many insiders have been arrested in connection with the dark web?

That’s a correlation, not causation. You have to remember that most people get in trouble for basic mistakes, such as revealing their true identity on the dark web.

The safe haven I was talking about goes beyond the dark web – we spend extra time making sure every single member knows how to fully secure themselves. And I’m not talking about using the latest version of the Tor browser, I’m talking about recommendations for hardware, operating system, encryption tools, and location, and we even help our members with legal aspects, making sure that they have the first level of legal defense if something goes wrong. Just in case.

There aren’t many other websites like The Stock Insiders, where they go the extra mile to ensure the safety of their members.

Isn’t that the responsibility of the members?

It’s mutually beneficial. History has shown us that forewarned is forearmed. The discussion forum must, first and foremost, be secure for all users. Second, the community must have a mechanism in place to minimize the presence of law enforcement officials, and only value-added insiders can be admitted. The list goes on, but the bottom line is that this level of security creates a relatively small, high-quality and compact community rather than a large discussion forum with limited or no control over the security of the members and the forum itself.

You say your members are already successful enough. Why did they join the Stock Insiders?

Maybe that’s why. At a certain level of success, you get bored and this certainly brings some excitement. Also I’ve known most of our members for years, and while I can’t speak for all of them, I’ve observed that many of them simply hate dirty corporate practices and frauds embedded in the business world. And this is their form of revenge. But some of them do it just for fun, others for the money. The motivations are different, but I respect them all.

Thank you very much for the interview. Is there anything else you would like to say to our readers?

Thank you for having me. Be sure to check out The Stock Insiders.

[Editor’s note] To access the website, download Tor Browser from the official website and then open it. Then, in the address bar, type the website URL:

thestock6nonb74owd6utzh4vld3xsf2n2fwxpwywjgq7maj47mvwmid

DOT onion but replace the word ‘DOT’ with a dot (.) instead. Please note that it may take longer than usual to load the website due to the additional network layers that Tor uses to protect your anonymity.

Disclaimer: This article and the information contained herein are not intended to be a source of legal advice. We don’t promote any illegal activities such as insider trading or any other crime.