Introduction

The Kenneth Robinson insider trading scandal is one of the most outrageous examples of corporate greed and manipulation in modern history. In 2011, Kenneth Robinson, a middleman, was found guilty of orchestrating a massive $32 million insider trading scheme. He was able to take advantage of confidential information that he received from investment bankers and use it to benefit his clients to the tune of $32 million in profits. This article explores how Robinson was able to get away with this crime and why he was eventually caught. It will also delve into the wider implications of this scandal, and how these types of insider trades can be prevented in the future.

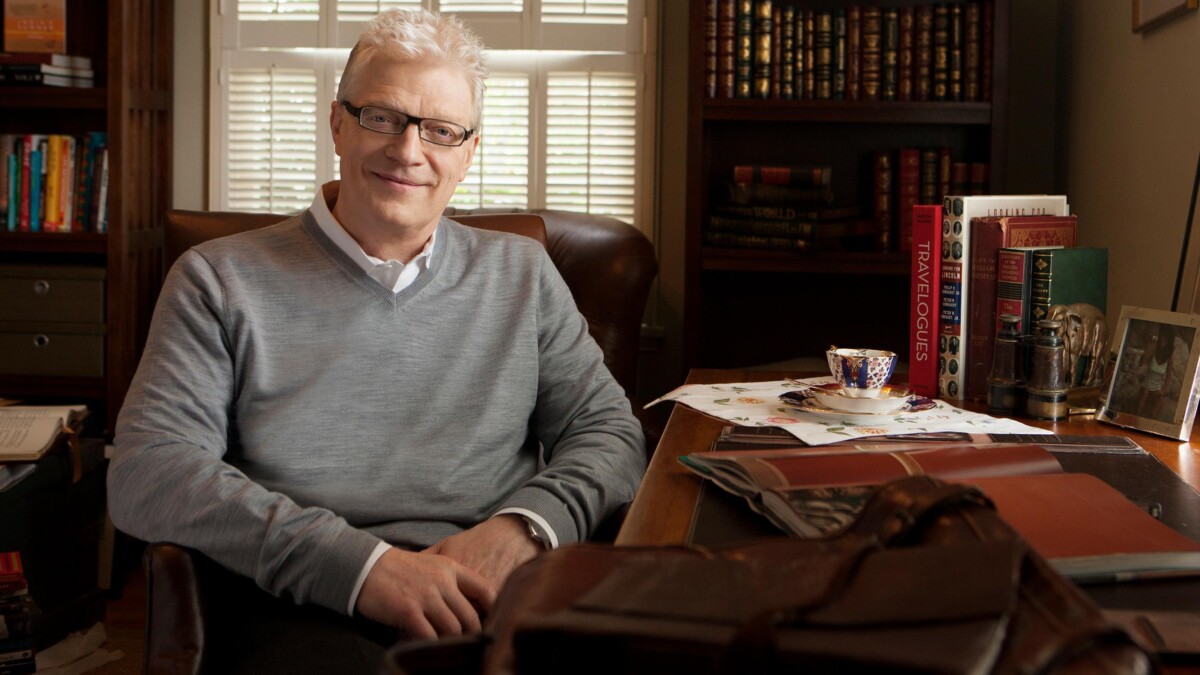

Kenneth Robinson

Kenneth Robinson is a British educator, author, speaker, and advocate for creativity. He is noted for his commitment to education, particularly in the areas of creativity and improving the quality of life for those in educational systems, particularly outside of the traditional modes. Robinson is known for his acclaimed TED talks and is the author of Out of Our Minds: Learning to be Creative, a book that has been praised by educators around the world. He works to promote innovation in education, inspiring students of all ages to express themselves and find their passion.

He has received numerous awards for his work in creativity and education, including the 2011 TED Prize, the 2019 Action for Happiness Award, and the 2019 Global Education Catalyst Award. Robinson is a sought-after speaker who often takes part in international conferences and events. He is also a frequent contributor to the BBC, as well as to other media outlets. Robinson believes that education is not just about preparing children for the workplace but for life and that fostering creativity and innovation is essential to that aim. He is also an advocate of education reform and in particular, increasing access for disadvantaged students.

Middleman Admits To Insider Trading

Kenneth T. Robinson, the suspected go-between in an insider trading conspiracy, was careful to avoid official scrutiny.Utilizing pay phones and disposable cellphones, he allegedly relayed data pertaining to corporate transactions obtained by a Washington lawyer through a New York City trader.

The government claims that in order to collect his cut of the profits, he would frequently meet merchants in Atlantic City. Which is where he could use gambling as a pretext for making cash withdrawals. The government claims that he hampered efforts to establish a connection between the lawyer. They provided the suggestions and the trader whom acted on them by acting as an intermediary between the two parties.

However, he relaxed his guard and made some transactions on his own in 2009. And again this past year, making him easier to catch. Because of that slip-up, police were able to zero in on his residence and arrest him.

The Federal Bureau Of Investigation And The Securities And Exchange Commission

The Department of Justice and the Commission on Securities and Exchanges accused dealer Garrett D. Bauer and business lawyer Matthew H. Kluger of participating in a 17-year scam that netted over $32 million in profits since 2006. This allegation was made possible in part by Robinson’s cooperation.

In court filings 45-year-old Robinson was referred to as “Coconspirator 1.” But his guilty plea showed that he was the putative middleman.

The prosecution has recommended a jail sentence of 70 to 87 months as part of the accepted plea agreement. I down from a maximum sentence of 45 years in prison and penalties of over $10 million.

According to the authorities, Robinson, a resident of Long Island, was formally registered because a trader but spent much of his professional life in the mortgage industry.

The Information Provided By The Source Was Not Included In The Court Filings

Under the condition of anonymity, the source revealed information not included in court documents. Including that Robinson and Bauer had previously been under investigation by the government when Robinson drew additional attention by trading on his own.

But Robinson was the one who revealed that Kluger had leaked the material, the person said.A few weeks ago, the author left Wilson Sonsini Macarthur & Rosati to work for Cravath Swaine & Moore, who is Skadden, Arps, Slate magazine, Mcdermott & Flom, Fried, Frank, for example, Harris, who was Shriver & Jacobson’s theory then Skadden, Arps, Slate magazine, Metzger & Flom in Washington.

Both The Federal Bureau Of Investigation And The Internal Revenue Service Paid Robinson A Visit To His Residence

Agents from the FBI and the IRS visited Robinson at his house. And soon after, Robinson agreed to have discussions with his suspected business partners taped.

In its charges accused Bauer and Kluger, the government extensively cited evidence from the tapes.

Federal officials claim that on March 17, Kluger called them and threatened things “could get ugly” if investigators looked into his finances.We expect the FBI to arrive at my place on horseback at any moment. They’re coming in all night and I can’t sleep due to keep worrying about it,” Bauer purportedly stated in a call on March 18. “Look, we screwed up; there’s no getting around that.”Kluger allegedly speculated on one among the calls about whether or not Robinson would “flip.” The tide, however, had turned on Robinson.

In the 1990s, while Kluger was an associate for the summer at Cravath, federal officials said he hatched the plot after realizing he had access to confidential information about pending mergers and acquisitions. The government claims that he then enlisted the help of his friend Robinson, whose agreed to find investors willing to buy and sell equities based on the information provided.

The government claims that Kluger provided Robinson with inside information, which Robinson then passed along to Bauer.

Robinson Told The New Jersey U.S. Attorney’s Office That He Made At Least Two Transactions

Hewlett-Packard’s announced acquisition of 3Com in November 2009 and Intel’s announced acquisition of McAfee in August 2010. A brokerage business initially suspected Bauer of insider trading as far back as 1999. TFM Investment Group claimed in a private lawsuit that Bauer acted with “non-public material information” when he purchased options before a Clorox sale in 1998. The judge ruled that the case should be dropped since TFM failed to disclose where Bauer had obtained his “inside information.” The lawsuit has already been publicized by the newspaper The New York Times.

U.S. Attorney’s Office spokeswoman Rebekah Carmichael confirmed on Monday that Bauer had been freed off a $4 million bond. Carmichael said one of the requirements is that he has his mother serve as his custodian and live with him.

The authorities had Kluger detained until his transport to New Jersey. Kluger, now 50 years old, is the son of Pulitzer Prize–winning author and former Simon & Schuster executive editor Richard Kluger. “Simple Justice,” on the historic Supreme Court case Brown v. Board of Education, while “Ashes to Ashes,” about the cigarette business, are both works by Richard Kluger. Richard Kluger stated that both he and his wife were completely taken aback by the allegations and “knew anything about any of this.”

How A Middleman Orchestrated A $32 Million Scheme

In July 2018, federal authorities arrested two individuals in Long Island, New York, for their roles in orchestrating a fraud scheme . They were accused of bilking shareholders out of over $32 million. The two individuals had hired a middleman who served as the broker between investors and companies. And was paid a commission for his services.

The scheme involved the middleman promising to arrange meetings between companies and investors. It is in exchange for a commission on any deals that were completed. The middleman no doubt understood the importance of trust in any investment opportunity . And how important it would be to use an intermediary to establish credibility between parties.

Unfortunately, instead of arranging legitimate meetings between companies and investors, the middleman instead used his position to help fraudsters conduct a pump-and-dump scheme. This is a type of stock market fraud where shares of a thinly traded company — one with little to no revenue — are artificially hyped up to lure in inexperienced investors. The tricksters then dump their shares at inflated prices, pocketing the difference.

In this particular pump-and-dump scheme, the middleman masqueraded as the “owner” of a fake consulting firm . And concocted a fake biography so that he could persuade unwitting investors to purchase shares of the thinly traded company. They paid his commission fees, with the middleman receiving 6.25% of any investments. For his part in the scheme, he accepted at least $40,000 in commissions.

Ultimately, the scheme was uncovered by the U.S. Securities and Exchange Commission, which brought charges against the two individuals, and the middleman who had orchestrated the entire affair. All three were convicted of fraud and placed under court-ordered supervision. Their sentences included prison time, restitution, and additional penalties.

People Who Took Part

Kenneth Robinson

Kenneth Robinson was a former executive at Wells Fargo Securities and the alleged mastermind of the insider trading scandal. He is accused of leaking confidential information about upcoming mergers and acquisitions. As well as advising another individual on how to use the information for profitable trades. Robinson allegedly earned over $7 million through illegal insider trading between 2013 and 2016.

Corey Smith

Smith was an executive assistant to Robinson and allegedly acted as an intermediary between Robinson and members of the insider trading rings. He is accused of making beneficial trades with the insider information provided by Robinson. Smith allegedly made over $3 million in illicit earnings from the trades.

Eric Johnson

Johnson worked as a market intelligence analyst at Wells Fargo and allegedly provided Robinson with confidential information about upcoming mergers and acquisitions. He is also accused of communicating this information to other members of the insider trading ring.

Jason Belk

Belk worked as a day trader and allegedly used information provided by Johnson and Robinson. It is to make highly profitable trades in Wells Fargo and other companies. Belk is accused of profiting over $1 million in illegal gains through insider trading.

Amy Henley

Henley was an investment banker at Wells Fargo who allegedly provided Robinson with confidential information about upcoming mergers and acquisitions. She is accused of using the information to benefit her own investments and those of her family and friends.

Aftermath

Steve Burke, chairman of NBCUniversal, resigned after being implicated in Robinson’s selection to the Cloudera board of directors and subsequent investigation. Eventually, Robinson was indicted and disciplined by the U.S. Department of Justice as well as the Commission on Securities and Exchange Commission. He was convicted guilty of trading on behalf of others . And given a 30-month prison term, a $17.4 million asset forfeiture, and a $625,000 fine.

Cloudera was not immune to the fallout of the controversy. The Department of Justice and the Securities and Exchange Commission filed an action against them because they did not take the necessary precautions to prevent Robinson from having access to confidential information. The conclusion was fines of $5.5 million and disgorgement of $2.5 million levied against Cloudera.

Conclusion

The Kenneth Robinson Insider Trading Scandal showed the devastating effects of illegal insider trading on the United States economy. The middleman in the ring, Kenneth Robinson, orchestrated a $32 million scheme that involved trading on confidential information about publicly-traded stocks. Robinson’s actions not only caused U.S. investors to suffer losses but also threatened their trust in the financial system. As a result of his actions, Robinson was forced to pay back $32 million and was given an 11-year prison sentence. The case serves as a reminder to both investors and financial professionals to always adhere to the laws and regulations surrounding insider trading to protect the markets and avoid such situations.

Frequently Asked Questions

1. What is the Kenneth Robinson Insider Trading Scandal?

The Kenneth Robinson Insider Trading Scandal was a scam orchestrated by a middleman called Kenneth Robinson. Robinson was able to illegally make more than $32 million dollars by exploiting the conflict of interests within the financial industry. He used insider trading to illegally buy stock and other securities in companies that had not yet gone public.

2. How did Kenneth Robinson orchestrate the scheme?

Kenneth Robinson orchestrated the scheme by taking advantage of individuals who were not adequately protecting confidential information shared with them by clients. By using inside information, Robinson was able to purchase stock before the companies were publicly traded. He also created fake companies that appeared to be legitimate and then used them to purchase stock at lower prices, increasing his profits.

3. What were the consequences of the scandal?

The scandal resulted in several people being charged with various criminal offenses, including insider trading and securities fraud. Robinson himself was arrested and sentenced to more than twelve years in jail. Other people involved received fines and jail sentences as well. As a result of the scandal, stricter rules were implemented regarding the protections of confidential information and insider trading.

4. What are some legal implications of the scandal?

The scandal has had repercussions on legislation surrounding insider trading. Federal authorities have implemented stricter rules regarding the disclosure of confidential information and the monitoring of transactions in order to prevent similar schemes from occurring in the future. The scandal also highlighted the legal issues that arise when a middleman takes advantage of a conflict of interests in the financial industry.

5. What lessons can we learn from the Kenneth Robinson scandal?

The Kenneth Robinson scandal serves as a reminder of the need for ethical business practices and the importance of upholding the integrity of the financial industry. It is important for people in financial positions of authority to be aware of the potential for exploitation and to take appropriate measures to protect confidential information. By doing so, we can help to prevent similar schemes from occurring in the future.