Introduction

David Einhorn is one of the most successful hedge fund investors of all time. David Einhorn’s Greenlight Capital has had some of the best returns in the industry. The key to Greenlight’s success is Einhorn’s focus on deep-value investing. His strategy involves taking advantage of stocks that are either undervalued or trading below their intrinsic value. By carefully tracking Einhorn’s investments and his capital management, investors can gain insight into how successful fund managers make decisions and allocate their capital.

Explain Who David Einhorn Is

David M. Einhorn has been a prominent short seller and “activist investor” in the United States. Greenlight Capital’s co-founder and president, widely regarded as one of the most successful fund managers in the industry’s history, has earned his reputation due to his role. Greenlight Capital is a hedge fund that specializes in long/short value investing.

Time included Einhorn in its 2013 list of the top ten most influential individuals in the world. In the novel Fooling Most of the Guys All of the Time, Einhorn details his experience shorting the stock of Allied Capital, a middle-market financial services firm that he believed was artificially inflating its stock price.

David Einhorn’s Greenlight Capital

As previously reported, Greenlight Capital is the investment firm of David Einhorn. In 1996, he and co-founder Jeffrey Keswin launched the fund with a meager $900,000. Currently, its population exceeds 7 billion.

David Einhorn’s Greenlight Capital, however, has seen far weaker returns in recent years compared to its earlier years. Fewer possibilities, a larger money supply (which helps conceal the zombie businesses), and a soaring bull market could all be to blame. Greenlight specializes in the challenging art of the short side. In addition, inflation and productivity increases put the deck against you.

In What Kinds Of Assets Does David Einhorn’s Greenlight Capital Specialize?

David Einhorn’s Greenlight Capital focuses on investing in stocks and bonds issued by public companies. The firm is well known for not only engaging in short-selling activities but also long-term equity investments. After Einhorn’s 2008 short-bet on Lehman Brothers, Greenlight gained widespread attention. In addition to private equity and fund-of-funds management, Greenlight maintains a fund-of-funds affiliate called Greenlight Masters.

Updates For The First Quarter Of 2023 On David Einhorn’s Greenlight Capital

Summary

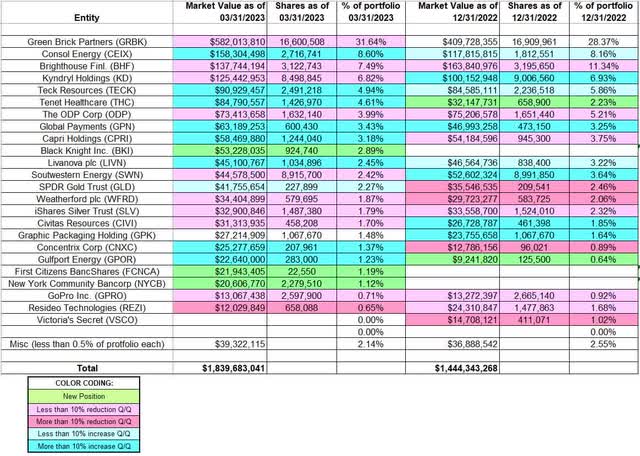

- With somewhat adverse 1.3% returns for the quarter, Greenlight Capital’s 13F portfolio saw a 27% increase in value to $1.84B in Q1 2023.

- Black Knights Inc., First Citizen BancShares, and New York Communities Bancorp all saw increased holdings, while Victoria’s Secret saw a decrease.

- Continental Energy, Vedanta Resources, International Payments Caprice Holdings, LivaNova, the SPDR Gold Trust all saw substantial stake gains.

- This article relies on Einhorn’s 5/15/2023 Form 13F filing with the SEC.

Greenlight Capital valued David Einhorn’s 13F asset at $1.84B this quarter. As a result of adding to their net-long position, it rose to $1.67B from $1.41B in the previous quarter. According to Einhorn’s Q1 2023 letter, the fund’s performance was -1.3% for the quarter, while the S&P 500 Index gained 7.5%. David Einhorn Greenlight Capital’s return from its beginning in 1996 has averaged 12.6% each year, whereas the S&P 500 index has averaged 9.1% per year. The fund with partner stakes invested the initial public offering of Greenlight The Capital Re (NASDAQ: GLRE).

Up The Ante

New York Community Bancorp (NYCB), First Citizens BancShares (FCNCA) and Black Knight Inc (. (BKI): Intercontinental Exchange (ICE) is purchasing BKI, a merger-arbitrage investment created this quarter at a cost-basis of $60.59, for $75 per share in cash and equity. The FTC has filed suit to prevent the merger. The price of the stock as of right now is $56.12. FCNCA represents a negligible 1.19 percent of the portfolio position, bought this quarter at prices ranging from $509.50 to $973.50, and the stock is currently trading at $1285.50. NYCB’s 1.12% investment was initially made at prices between $6.40 and $10.40 per share; at its current price of $10.95, the company is trading above that range.

Disposal Of Stakes

Victoria’s Secret Corporation (VSCO): The 1% investment in VSCO was acquired in Q4 2021 for values ranging from $47 to $59. The second quarter of 2022 saw a 70% increase in stakes with values ranging from $28 to $51. In the previous quarter, costs fell by 40% between the range of $29 and $48. Prices ranging from $30 to $46 were paid for the disposals this quarter. The current price of shares is $18.

Bath and Body Works (formerly L Brands) spun out VSCO in 2021, and the company’s shares began trading at $46 apiece in August of that year. According to Greenlight’s Q1 2023 letter, after 18 months of holding the investment, it was closed with a minor loss.

Raising The Stakes

After the merger with Consolidated Coal Resources was finalized in December 2020, Consol Energy (CEIX) became a significant (top three), 8.60% portfolio holding. Each unit of Consol Coal was exchanged for 0.73 shares of Consol Energy. Greenlight received these shares as compensation for a stake they held in Consol Coal. In the first quarter of 2021, prices fell by 30%, to a range of $6.75–$12.20. After that, in the second quarter of 2021, sales dropped by 25% to a range of $8.75–$18.70. Prices between $35.50 and $77.50 witnessed a net increase of 23% over the past three quarters. This quarter, costs between $51 and $64 saw another 50% surge. The current price of CEIX is $63.

Teck Resources

TECK represents a sizable (top 5) 5% of the portfolio purchase made in the second quarter of 2020 at values around $7 and $12.25. The price of a share of stock is $42.51 right now. A 40% stake increase occurred in Q4 2020 at pricing between $11.25 and $18.85, while a 25% stake reduction occurred in Q1 2021 at values between $18 and $23.75. A share might have been doubled between Q1 and Q3 2021 at values between $19.50 and $26.80. During the next three quarters, 55% of sales were made between $26 and $46. Prices between $26 and $44 have increased by 25% during the past three quarters.

World Paying Network (GPN)

Currently, 3.43 percent of the portfolio is invested in GPN. It opened in the last quarter of 2021 with prices ranging from $118 to $161. The 47% stake was sold off in the third quarter of 2022 for values ranging from $108 to $137. The previous two quarters have seen a stake rise of 120% at prices ranging from $93 to $125. Shares have risen above $100.

The Capri Group (CPRI)

The 3.18 percent stake in CPRI cost between $40.50 and $67 in 2021. The first quarter of 2022 showed a reduction of 12%, followed by an increase of 20% the following quarter. The price range of $41 to $68 has since increased by a third. Current price of shares is $37.

The $56 cost-basis for Greenlight.

LivaNova Plc

The 2.45% holding in LIVN was accumulated during the course of the six quarters ending in Q3 2022 at values ranging from $44 to $92. The current price of shares is $47.43. This quarter, investments between $41 and $58 rose by 23%.

Gold Trust (GLD) Of SPDR

The third quarter 2020 purchase at prices around $167 and $194 yielded the 2.27 percent GLD holding. The first quarter of 2021 showed a 70% increase in sales at $158-$183. A 140% stake gain at prices between $167 and $192 was seen in the first half of 2022. In the most recent two quarters, costs between $151 and $170 dropped by 24%. Price as of right now: $182. The rate of growth this quarter was 9.1%.

Corporation Concentrix (CNXC)

The third quarter of 2022 saw a 150% stake increase from the previous 1.37% CNXC position at prices between $110 and $137. This quarter, prices increased by 115% to a range of $118–$151. The price of the stock as of right now is $83.44.

Gulfport Energy (GPOR) And Tenet Healthcare (THC)

Last quarter, at a cost of $48.51, we acquired a 2.23 percent stake in THC. At the moment, one share of stock costs $72.81. This quarter, investments between $49 and $62 rose by 117%. An investment of 1.23 percent of the portfolio was made in GPOR during Q2 and Q4 at prices ranging from $61 to $97 per share. The current price is $101.

Diminished Bets

Green Brick Partnerships (GRBK) is the largest holding in the 13F portfolio, accounting for almost 32% of the total value. The purchase of the share occurred as part of the JGBL Builder Finance to BioFuel Energy rebranding and acquisition deal. After the purchase was finalized in October 2014, Greenlight became a 49% shareholder. After the deal closed, David Einhorn assumed the role of chairman of the board. The first quarter of 2021 witnessed a 28% underwritten offering sale at $20.50 per share. The price of the stock as of right now is $55.69. They have a 38% stake in the company. This quarter, there was a very little cut of only 2%.

The following was included about GRBK in their Q1 2023 letter. It generated the most revenue for them during the period. This was after a year of significantly poor results.

Finance Firm Brighthouse

At 7.49%, BHF is a sizable (top-three) holding in the portfolio. The position was initiated in the third quarter of 2017 and expanded by almost sixty percent in the subsequent quarter, with an aggregate cost basis of $57.92. Sales increased by over 70% in the fourth quarter of 2018 at prices between $29 and $46.50. Currently, a share of stock costs $44.42. Minimal cuts have been made throughout the last six quarters.

BHF began trading in July 2017 as a spinoff of MetLife’s (MET) U.S. Retail division (annuities and life insurance).

Kyndryl (KD) Investments

At its current price of $12.43, KD accounts for 6.82% of the portfolio, making it a sizable (top five) holding. There was a slight reduction of 6% this quarter.

The ODP Corporation (ODP): ODP is a 4% portfolio position that will be predominantly grown over the three following quarters until Q4 2021 at prices between $36 and $50. The stock price is $43.80 as of right now. The second quarter of 2022 saw a 20% growth in stakes at values ranging from $29 to $46. The remaining two quarters saw some minimal cuts.

The $44 cost-basis of Greenlight.

Southwest Natural Gas

In the first quarter of 2022, at an average price of $6.58, the portfolio allocated 2.42% of its value to SWN. Current pricing for the stock is $5.26. The third quarter of 2022 saw a 48% growth in stakes at values between $5.6 and $8.10. Last quarter, prices rose by the same amount, from $5.50 to $7.25. Minor cuts were made during the third quarter.

(WFRD) Weatherford Plc

WFRD, which represents 1.87% of the portfolio, was acquired in Q1 2022 at an average price of $32.27 and is currently trading at $65.29. In the most recent quarter, costs dropped by 22% from the range of $32 to $51. Minimal cuts were made over the last fiscal period.

Silver ETF (SLV) For iShares

At its current price of $22.27, SLV accounts for 1.79 percent of the portfolio’s existing position in Q3 2021 at prices between $20 and $24.50. The reduction in the last two quarters was minimal, amounting to about 5%.

Civitas (CIVI) Resources

At prices between $56 and $71, the 1.70 percent CIVI holding increased by around two-thirds last quarter, and it is now worth $71.24. Minimal cuts were made over the last fiscal period.

Corporate GoPro (GPRO)

A 0.70 percent stake in GPRO was amassed throughout the first half of 2021 at values ranging from $7.50 to $13.50. Sales increased by 20% in the fourth quarter of 2021 at prices between $8.5 to $11.60. Right now, you can buy a share of stock for $4.18. There has been some minimal cutting in the last few quarters.

Technology For The Home (REZI)

In Q2 of 2020, between $3.95 and $12.50, a 0.65% investment in REZI was purchased. There was a 33% increase in sales between $10 and $22.50 in the second half of 2020, and a 45% increase between $21 and $31.50 in the third quarter of 2020. A further 15% reduction occurred in the fourth quarter of 2021. The stake increased by 30% in the next quarter at values ranging from $23 to $27. This quarter, sales between $16.75 and $20 increased by 55%. Shares have risen to $17.42 today.

Stayed The Same

This quarter, a tiny holding of 1.48% in Graphic Packaging Holding (GPK) was maintained. Changes to Greenlight’s 13F holdings of stocks during Q1 2023 are detailed in the attached spreadsheet.

The Financial Philosophy (Strategy) Of David Einhorn

David Einhorn is well-known for his audacious market predictions and for “whistleblowing” when he suspects financial wrongdoing. He has on multiple instances discovered suspicious behavior that borders on outright fraud. This has made him a highly scrutinized investor on Wall Street.

The short-selling methods for which Einhorn is famous are among the most challenging in the financial industry. When he maintains a long position at firms he thinks are undervalued and short shares of businesses that he believes are overvalued or have accounting concerns, he employs shorting positions such as hedges, a bull-short equity strategy that is more like pairs trading.

Einhorn, who is famous for taking short positions in the stock market, uses a methodical, data-driven approach to selecting the ideal stocks for his hedge fund’s portfolio. The stock market would respond dramatically to even his brief statement on the company’s performance, thanks to his aggressive and unmatched investment style.

In the words of Einhorn, a shareholder must discover answers in the following types of market situations:

- In order to reduce the likelihood of financial loss, a trader must carefully craft his portfolio.

- Investment portfolio diversification is one way for investors to deal with the inherent risk in the financial market. Avoiding tail risk is essential.

- Einhorn advises potential investors to arm themselves with knowledge before putting money into the market.

Critical Thinking Is David Einhorn’s Bedrock

The success of Einhorn’s hedge fund, he says in interviews, is due in large part to his ability to think critically and accept constructive criticism from his colleagues.

He maintains that critical thinking entails the capacity to evaluate the information for its true nature rather than merely accepting it at face value. When something is inexplicable, you must discover its rational explanation. It’s conceivable to arrive at an opposing view of what was supposedly supposed to be common sense when something doesn’t make sense and one questions, challenges or looks at it from a new perspective. According to Einhorn, critical thinking is the bedrock of any successful financial institution

David Einhorn’s Greenlight Capital Einhorn’s hedge fund promotes a culture of transparency and honest self-evaluation. In order to make progress, he encourages his staff and colleagues to challenge everything, even his own investing ideas. After all, a short-selling investor’s core values should revolve around skepticism and the rejection of conventional wisdom.

Notable Investments Made By David Einhorn’s Greenlight Capital

One of the most notable investments made by Greenlight Capital is in Apple Inc. In 2010, Greenlight initiated a position in Apple at an average cost of $210 per share. It was one of the firm’s most successful investments at the time, helping the firm turn its hedge fund returns positive in 2010 for the first time in two years. The fund’s Apple position subsequently reached deliver returns of over 500%, helping the fund drive its strongest returns in 2012 and 2013.

In 2012, the firm began investing in the energy sector with a significant investment in oil and gas producer Energen Corporation. After significant pressure from the firm, Energen sold itself to Atlas Resource Partners in 2018, providing Greenlight with a return of 2x its initial investment.

Greenlight also made notable investments in the healthcare sector in 2013. The firm took a large short position in skeptical drug company Martin Shkreli’s pharmaceutical company Retrophin. Shortly thereafter, Greenlight closed its short position with a gain of 20%.

More recently, Greenlight achieved success with investments in the consumer sector. In 2019, Greenlight Capital purchased a stake in the fast casual restaurant chain Shake Shack for an estimated $106.3 million. The move paid off, as the company’s share price increased dramatically in 2020.

Greenlight Capital’s investment philosophy has been to identify companies with strong fundamentals that have been unfairly discounted for non-operational reasons. Over the years, this has proven to be a successful approach, as evidenced by the fund’s long track record of successful investments.

Conclusion

By closely monitoring David Einhorn and his investments in Greenlight Capital, investors can gain insight into how successful investors make decisions and allocate their capital. Einhorn has a proven track record of investing in stocks that are either undervalued or trading below their intrinsic value. By closely tracking Einhorn’s investments and capital management, investors can get an understanding of how to make profitable and successful investments.

Frequently Asked Questions

1. What types of investments does David Einhorn Greenlight Capital focus on?

Greenlight Capital primarily invests in publicly traded equities and debt instruments, including equity and debt securities of U.S. and international corporations.

2. How does David Einhorn’s Greenlight Capital seek to generate returns?

Greenlight Capital seeks to generate returns through long-term investments in fundamentally undervalued securities and through activist involvement to enhance the value of those investments.

3. How does Greenlight Capital’s investment strategy differ from other hedge funds?

Greenlight Capital focuses on deep fundamental research and activist involvement in order to generate returns. By contrast, other hedge funds may use quantitative models and leverage to generate returns.

4. What is the track record of Greenlight Capital?

Greenlight Capital has achieved an annualized net return of around 10% since its inception in 1996.

5. What are some of the notable investments that Greenlight Capital has made?

Notable investments that Greenlight Capital has made include stakes in Apple, GM, and FCX. Additionally, Greenlight Capital has had a long-term holding in book covers company Aer Lingus for more than a decade and is active in a variety of activism campaigns.