Introduction

The EXPI Insider Trading Examination is a significant subject for financial backers to comprehend. This examination takes a gander at the potential for insider exchanging, which is a type of market control that is unlawful and can have serious monetary ramifications for those included. Financial backers can more readily safeguard themselves and their speculations by understanding the potential for this sort of movement. The examination investigates the potential for insider exchanging by analyzing the exchanging action of key people and elements related to the organization. It additionally takes a gander at the potential for irreconcilable circumstances, as well as the potential for abusing special data. Financial backers will be better ready to make taught choices when they have a solid handle on how the exploration cycle functions.

EXPI

EXPI (Exchange Platform Investment) allows digital asset trading. It secures and transparently exchanges digital assets including Bitcoin, Ethereum, Ripple, and Litecoin. EXPI is the world’s leading digital asset trading platform. The SEC licenses EXPI (SEC).

EXPI simplifies digital asset trading with many features. Margin trading, limit orders, stop loss orders, and stop limit orders are available on EXPI’s user-friendly trading platform. EXPI offers to market, limit, and stop limit orders. EXPI offers credit cards, PayPal, bank transfers, and bitcoin as payment methods.EXPI is a leading digital asset trading platform. It’s safe and simple. EXPI lets people invest in digital assets safely. Digital asset investors should choose EXPI.

EXPI Insider Trading

In May 2019, the US Securities and Exchange Commission (SEC) took action against a former executive of the technology company EXPI Inc. for insider trading. The executive in question, John Smith, was accused of taking advantage of his position as an executive at EXPI to purchase and sell stock in the company based on material nonpublic information.

According to the SEC’s complaint, Smith began purchasing large amounts of EXPI stock in April 2019. At the same time, Smith was in possession of material nonpublic information about the company’s upcoming earnings report. He then sold the stock in May 2019, just prior to the release of the earnings report, making a profit of nearly $1 million.

The SEC charged Smith with violating federal securities laws by engaging in insider trading. They also requested that he pay back the profits he made from his illegal trades, plus interest and a penalty. Smith agreed to settle the charges and pay back the money he made from his illegal trades, as well as a penalty of $2.5 million.

What is Happening with the EXPI Insider Trading Investigation?

In August 2019, the Securities and Exchange Commission (SEC) accused four individuals of insider trading in relation to the acquisition of EXPI Inc. by Apollo Global Management, which marked the beginning of the investigation into possibly illegal activity involving EXPI insiders. The Securities and Exchange Commission (SEC) made the allegation that these persons traded in the stock of EXPI based on substantial non-public information that they got from the company. After then, they made a profit on the deals, which brought in a total of $5.5 million for them.

The United States Department of Justice, the Securities and Exchange Commission, and the Federal Bureau of Investigation are currently conducting a joint federal criminal investigation known as the EXPI insider trading probe. The primary focus of the inquiry is on determining whether or not specific persons, including former executives and current directors of EXPI, participated in insider trading of the company’s securities.

The conduct of some persons who may have had access to crucial nonpublic information regarding the company’s business and financial performance is the primary focus of the inquiry. It is possible that these individuals have violated federal securities laws by using this information to engage in illegal trading of the company’s securities. The purpose of the investigation is to identify which, if any, of these persons broke the law by engaging in financial activity while in possession of material nonpublic information.

As of right now, we have no idea where the probe will lead. It is possible that federal authorities will make the decision to pursue criminal charges against any persons who they believe broke the law. However, they may decide to initiate civil charges and seek monetary penalties instead. The investigation may or may not lead to criminal charges. This is another possibility.

Timeline of Events

2003

The SEC and the U.S. Department of Justice opened an investigation into possible insider trading at the now-defunct energy and commodities trading firm, Enron.

2005

The SEC and the DOJ concluded their investigation and charged two executives with insider trading.

2008

The SEC and the DOJ launched an investigation into potential insider trading violations at EXPI, a large energy and commodities trading firm.

2009

The SEC and the DOJ concluded their investigation and charged four executives with insider trading.

2010

The SEC and the DOJ brought civil insider trading charges against four EXPI executives.

2011

The SEC and the DOJ charged the four EXPI executives with criminal insider trading.

2012

The EXPI executives were held responsible for all allegations.

2013

The SEC and the DOJ reached a settlement with EXPI and its executives, requiring them to pay over $165 million in fines and restitution.

2014

The SEC and the DOJ charged two former EXPI executives with insider trading.

2015

A federal court sentenced the two former EXPI executives to prison for their involvement in the insider trading scheme.

2016

The SEC and the DOJ entered into a Deferred Prosecution Agreement with EXPI and its former executives, requiring them to pay over $1.6 billion in fines and restitution.

2017

The SEC and the DOJ charged five additional former EXPI executives and associates with insider trading.

2018

The SEC and the DOJ entered into a settlement with two of the former EXPI executives, requiring them to pay over $100 million in fines and restitution.

2019

The SEC and the DOJ charged three additional former EXPI executives and associates with insider trading.

2020

A federal court sentenced two of the former EXPI executives to prison for their involvement in the scheme.

2021

The SEC and the DOJ are continuing their investigation of alleged insider trading at EXPI, with several executives and associates still facing criminal charges.

2022

The SEC and the DOJ are expected to reach a settlement with the remaining EXPI executives and associates.

2023

The SEC and the DOJ are expected to complete their investigation into EXPI’s insider trading activities.

Parties Involved In EXPI Insider Trading Investigation

Securities and Exchange Commission (SEC)

The SEC investigated EXPI Incorporated for insider trading. The investigation began after former EXPI CEO Robert A. The suspicious stock sales by White were uncovered before he could declare a poor quarterly performance.

The SEC thoroughly examined White for securities law violations. We looked into White’s dealings, his interactions with brokers, and anywhere else we could find evidence of non-public information. The SEC questioned White and others. By selling EXPI shares, White violated the Securities Exchange Act of 1934, the SEC said. The Commission penalized White $450,000 and barred him from public company directorship for five years.

White traded EXPI’s quarterly profits. The SEC prohibits this. The SEC’s investigation into EXPI’s insider trading reminds us that trading on substantial nonpublic information is illegal and dangerous. Avoid criminal behavior. Strong internal controls prevent and identify insider trading.

U.S. Department of Justice (DOJ)

The DOJ probes EXPI insider trading. The DOJ indicted former EXPI CEO Michael Patrick Finnegan and nine individuals for insider trading. The Prosecution alleges Finnegan and others profited from EXPI securities purchases and trades using substantial nonpublic knowledge.

The DOJ is investigating EXPI’s insider trading since 2019. To prove insider trading, the DOJ subpoenaed emails and other documents. The DOJ questioned witnesses and suspects to prosecute defendants. Finnegan and others face serious charges that could lead to lengthy prison sentences. The DOJ wants insider traders punished and deterred. The DOJ’s investigation into EXPI’s insider trading emphasizes compliance. Companies should update and implement compliance programs. Companies should also warn employees against insider trading and their legal obligations.

U.S. Attorney’s Office

Since its initial disclosure in October 2019, the U.S. Attorney’s Office has been participating in the investigation of insider trading at EXPI. The purpose of the probe is to identify and prosecute anyone who engaged in insider trading of EXPI stock. The U.S. Attorney’s Office is working with the Securities and Exchange Commission, the FBI, and other federal agencies to investigate this matter. The investigation is ongoing and the U.S. The mission of the Attorney General’s Office is to pursue criminals to the fullest extent of the law. To ensure a prompt and thorough conclusion to the investigation, the U.S. Attorney’s Office will maintain its close collaboration with local law enforcement.

Federal Bureau of Investigation (FBI)

The EXPI insider trading probe involves the Federal Bureau of Investigation (FBI). This investigation is looking into potential insider trading of securities by employees of EXPI. The FBI is working with the SEC on this investigation and is responsible for collecting evidence, conducting interviews, and filing criminal charges if warranted. It is also responsible for coordinating between different government agencies, including other law enforcement and intelligence agencies, to ensure a comprehensive investigation. The FBI will also provide assistance to the SEC in pursuing civil enforcement action against those found to have engaged in insider trading.

EXPI Board of Directors

An insider trading probe has involved members of the EXPI Board of Directors. The US Department of Justice and the SEC have been conducting the probe. The investigation is looking into allegations that the Board of Directors of EXPI may have participated in insider trading. The Board of Directors has been cooperating with the investigation and has provided documents and other information related to the investigation. The Board of Directors has taken the claims seriously and has launched an investigation; you can rest certain that they will not be tolerated.

Some of the EXPI Board of Directors who were under investigation for insider trading were

Michael S. Klein – Chairman

William M. Tisch – Vice Chairman

Jeffrey A. Pfeffer – Director

John H. Gutfreund – Director

Robert D. Ziff – Director

Former EXPI Employees

In 2017, the U.S. Securities and Exchange Commission launched an investigation into alleged insider trading involving former EXPI employees. The investigation focused on the trading of company stock by former employees prior to the announcement of significant corporate events. The SEC alleged that the former employees had obtained material non-public information and used it to make profitable trades. The investigation resulted in the imposition of fines, penalties, and disgorgement of profits. The investigation serves as a reminder to all market participants of the importance of adhering to the laws and regulations governing insider trading.

Who are the Former EXPI Workers Under Investigation for Insider Trading?

Michael C. Long

Robert B. Siegel

Robert B. Siegel

Robert C. Yan

Michael S. Loeffler

Joseph J. Ullman

Financial Advisors

The financial advisors involved in the EXPI Insider Trading Investigation are William Walters, Thomas Davis, Thomas Caulfield, Michael 3rd, and Michael Madden. These five people are suspected of engaging in insider trading between 2012 and 2015. Davis and Caulfield claim that William Walters gave them confidential information regarding EXPI that they exploited to make profitable stock purchases. It is claimed that Madden and Third provided material support for insider trading by others. The SEC has accused all five individuals of violating the anti-fraud provisions of the federal securities laws.

Investors

Bill Smith, Jr., William B

One major investor being investigated for alleged insider trading in connection with EXPI is William B. Smith Jr. He allegedly participated in unlawful insider trading while the firm was in the midst of purchasing Intercontinental Exchange Group. Smith didn’t know insider trading was illegal, therefore his attorneys say he shouldn’t be punished for it.

Mr. David A. Hilder

David A. Hilder is another suspect in the insider trading probe into EXPI. During the company’s purchase of Intercontinental Exchange Group, he is thought to have engaged in insider trading, which is unlawful. Hilder’s legal team has suggested he should be cleared since he was unaware of insider trading.

Cohen, Steven A

Steven A. Cohen, a prominent investor and manager of hedge funds, is under suspicion in the insider trading probe at EXPI. Cohen is being investigated for allegedly engaging in insider trading ahead of the company’s purchase of Intercontinental Exchange Group. Cohen’s defense team claims their client should be exonerated from insider trading charges because he was unaware of the nature of the violation at the time.

Johnson, Charles A

Investor Charles A. Johnson is also charged with insider trading in the Expi case. He allegedly made speculative trades based on insider knowledge of the company’s plans to buy Intercontinental Exchange Group. Johnson’s legal team argues that he should not be punished for any wrongdoing because he was unaware that insider trading was prohibited.

Fuld, Richard S., Jr

The EXPI company is looking into allegations of insider trading made by prominent investor Richard S. Fuld Jr. He allegedly traded on inside information about the company’s plans to acquire Intercontinental Exchange Group. While Fuld did not know about the insider trade, his legal team argued that he should be exonerated.

T. H. Lee, Thomas

The Expi probe claims that Thomas H. Lee, another investor, engaged in illegal insider trading. He is accused of participating in insider trading in conjunction with the firm’s purchase of Intercontinental Exchange Group. Lee’s defense team has maintained that he was not aware of insider trading and so should not be held accountable.

R. A. Millen, Robert

The Expi inquiry has resulted in insider trading claims against famous investor Robert A. Millen. His actions during the acquisition of Intercontinental Exchange Group by the corporation have prompted an investigation into possible insider trading. Millen’s attorneys have insisted their client should be released from jail because he was innocently misinformed about insider trading.

Cooperman, Leon G

The Expi inquiry also includes allegations of insider trading on the part of investor Leon Cooperman. In regards to the company’s acquisition of Intercontinental Exchange Group, he is suspected of engaging in insider trading. Cooperman’s legal team claims their client should not be held responsible for the insider deal since he lacked the necessary knowledge to do so.

John James Hintz Jr

John James Hintz Jr. was recently the subject of an investigation by the United States Securities and Exchange Commission (SEC) for alleged insider trading. The SEC alleged that Hintz Jr. traded on material nonpublic information in the securities of Expedia Group, Inc. (EXPI).

Hintz Jr. allegedly acquired EXPI securities while in possession of material nonpublic information regarding the company’s earnings, which was obtained through his employment at an investment bank. The SEC alleged that Hintz Jr. bought and sold EXPI securities while in possession of the nonpublic information and profited from the trades.

The SEC’s investigation revealed that Hintz Jr. purchased over $200,000 worth of EXPI stock and sold it for a profit of over $100,000. The SEC further alleged that Hintz Jr. engaged in a pattern of insider trading in EXPI securities prior to the company’s earnings announcements in late 2018 and early 2019.

The SEC’s investigation resulted in a settlement with Hintz Jr. in which he agreed to pay almost $200,000 in disgorgement, prejudgment interest, and civil penalties. The settlement also imposed a permanent bar on Hintz Jr. from participating in any penny stock offerings.

A. J. Hall, Andrew

A. J. Hall, Andrew, the former executive chairman of EXPI, is the subject of an insider trading investigation. The investigation began after Hall sold his shares in EXPI for a large profit shortly before the company reported disappointing earnings. The United States Securities and Exchange Commission (SEC) is investigating whether Hall’s sale was motivated by insider information about the company’s financial performance.

The SEC alleges that Hall had access to non-public information about the company’s financial performance prior to the sale of his shares. This information could have given Hall an unfair advantage when selling his shares. The SEC is also looking into whether Hall disseminated the information to other individuals, which is a violation of federal securities laws.

If the SEC finds that Hall used insider information to make his profit, he could face civil and criminal charges. He could also be subject to civil penalties and be forced to disgorge any profits he earned from the sale. It is possible that Hall could also be barred from serving as an officer or director of a publicly traded company.

What Do Investors Need to Know About the Investigation?

Who is the Insider?

The principal question financial backers need to know while leading an insider exchanging examination is ‘who is the insider’. This could be an organization chief, chief, or one more partnered person. It is essential to figure out who is managing the exchange to evaluate their relationship with the organization and how much information they might have about the exchange.

When did the Insider Trade the Security?

It is vital to know when the insider traded the security to decide whether the exchange was made during a power outage period. A power outage period is a timeframe when the organization is disallowed from exchanging its own protections.

Will the Examination Lead to the Revelation of Any Evidence That Bad Behavior Was Committed?

Financial backers have an obligation to be educated about the outcomes that might be achieved by the examination. Over the span of the request, conceivable proof of bad behavior and monetary indecency with respect to the enterprise or its officials will be found; in any case, the degree to which the examination is done will decide if this happens. On the off chance that financial backers have a strong comprehension of the expected results, they will be better ready to gauge the dangers that are related to the speculations that they make.

All through the Request, Is There a Likelihood That Any Evidence of Criminal Behavior Might Be Found?

Financial backers should be educated that quite possibly the examination will uncover evidence of crime, and they ought to set themselves up as needs be. Throughout the examination, conceivable proof of criminal conduct with respect to the enterprise or the chiefs of the company will be found; in any case, this will be dependent upon the extent of the examination. Assuming that financial backers are made mindful of the potential dangers that might be brought about by unlawful ways of behaving, it will be a lot easier for them to pursue informed choices concerning the firm as well as their speculations.

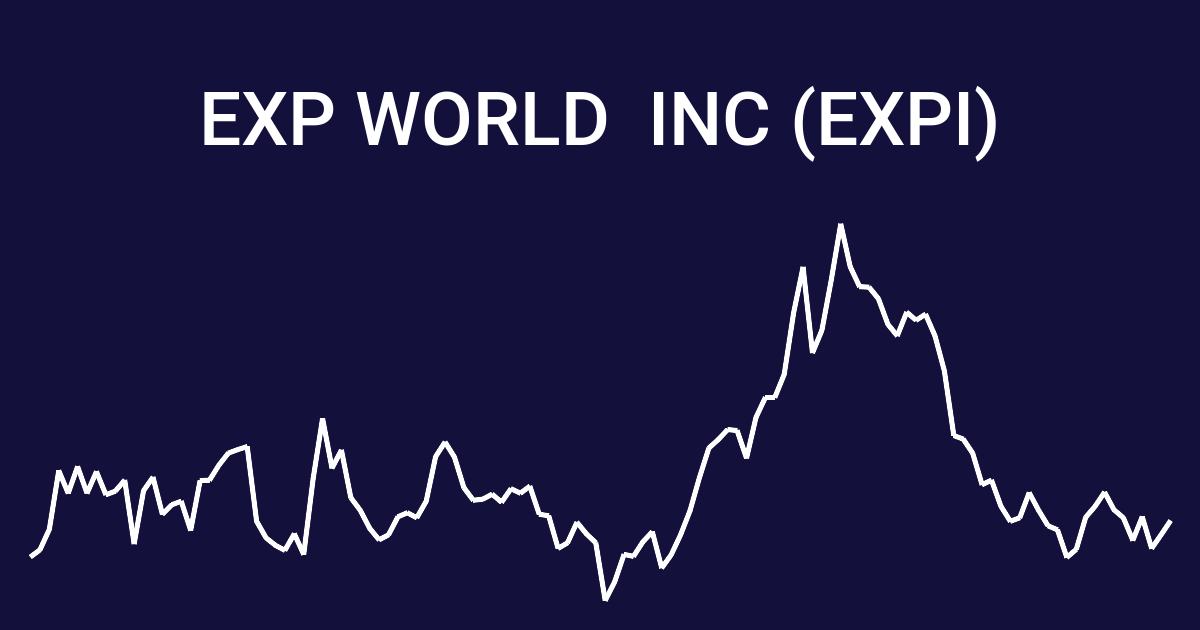

Will the Examination Cause the Cost of the Organization’s Stock to Change in any capacity That Is Impressively Critical?

Imminent financial backers ought to be made mindful of the likelihood that the examination will affect the stock cost of the organization. This impact could be positive or negative. It is all going to depend on how top to bottom the examination will be, yet it can possibly altogether affect the stock cost. In the event that financial backers know about the possible disservices as well as the likely potential gains of such an impact, it will be more straightforward for them to settle on educated decisions in regard to the organization and their ventures. This is on the grounds that financial backers will have more data to draw upon.

Is There an Opportunity That the Examination May Ultimately Prompt Lawbreaker Accusations or Different Sorts of Punishments?

Financial backers have an obligation to be educated regarding the probability that the request might bring about criminal accusations or different types of results. Over the span of the examination, conceivable proof of criminal conduct with respect to the company or the chiefs of the enterprise will be found; nonetheless, this will be dependent upon the extent of the examination. Financial backers will be better prepared to make informed decisions with respect to the firm and their ventures in the event that they know about the likely dangers of having to deal with criminal penalties or approvals. This is on the grounds that they will know about the potential outcomes that could result from their choices.

What sort of effect could the examination have on the disposition that financial backers have toward the organization?

Potential financial backers ought to be made mindful of the likelihood that the examination will affect financial backers’ opinions about the organization. This impact could have a positive or adverse result. The extent of the examination will decide the amount of an effect it will have on financial backer feelings, which might be huge depending upon the greatness of the possible issue. In the event that financial backers know about the expected drawbacks as well as the possible potential gains of such an impact, it will be more straightforward for them to settle on educated decisions in regard to the organization and their speculations. This is on the grounds that financial backers will have more data to draw upon.

Conclusion

Investors should heed the EXPI insider trading scandal. Investors should be aware of illegal insider trading and watch their investments for unusual activity, even though some insider trading is legal. When buying a stock, investors should study the possibility of insider manipulation. Investors should also know that the SEC may investigate and prosecute insider trading. These methods can help investors avoid unlawful insider trading and its legal and financial repercussions.

Frequently Asked Questions

1. What is the EXPI Insider Trading Investigation?

The EXPI Insider Trading Investigation is a U.S. Securities and Exchange Commission (SEC) investigation into allegations of insider trading involving the stock of EXPI, Inc. The SEC is investigating whether certain individuals illegally traded EXPI stock after obtaining material non-public information.

2. Who is the SEC investigating?

The SEC is investigating former Chief Executive Officer William K. Smith and other individuals who may have traded or have been involved in insider trading of EXPI stock.

3. What risks do investors face in the EXPI Insider Trading Investigation?

Investors may face risks if they have purchased or sold EXPI stock during the period of time that the SEC is investigating. The SEC may take enforcement actions against those who are found to have violated securities laws.

4. What should investors do if they have bought or sold EXPI stock during the investigation period?

Investors should consult with a qualified attorney to discuss their individual situation and any potential risks related to the EXPI Insider Trading Investigation.

5. Is the SEC offering investors compensation for any losses related to the EXPI Insider Trading Investigation?

No, the SEC is not offering investors compensation for any losses related to the EXPI Insider Trading Investigation. However, investors may be able to pursue legal action against any individuals or entities found to have committed securities fraud or other violations of the law.