Introduction

The SEC charges dozens of individuals, companies, or groups of people every month for frauds related to everything from securities and penny stocks to cryptocurrencies. However, there have only been 10 charges filed by the SEC in 2022 that related to insider trading. Each one is notably more interesting than the other.

Below, we’re going to talk about these SEC investigations and charges while explaining what these perpetrators did and how.

#1. Ramkumar Rayapureddy (pharma)

- Who? Ramkumar Rayapureddy is the Chief Information Office of the pharma company Viatris Inc., previously called Mylan N.V.

- When? SEC charged him on November 10, 2022

- How much? He was charged $8 million

The $8 million slap on Rayapureddy from Viatris came mainly because of his involvement in disbursing confidential information related to FDA and Pfizer.

The SEC filed a complaint in the US District Court for the Western District of Pennsylvania alleging that Rayapureddy, a resident of Pennsylvania, gave his friend and former coworker Dayakar Mallu material nonpublic information about Mylan’s unannounced drug approval by the FDA, financial results, and an upcoming merger with a division of Pfizer Inc. between at least September 2017 and July 2019.

In its lawsuit, the SEC accused Rayapureddy of breaking Rule 10b-5 and Section 10(b) of the Securities Exchange Act of 1934. It also demanded an officer and director bar, disgorgement, and a civil penalty in addition to a permanent injunction.

#2. Three people and their friends

- Who? Amit Bhardwaj (CISO, Lumentum Holdings), Brijesh Goel (investment banker), and Seth Markin (former FBI trainee) passed information to their friends about different companies at different times

- When? SEC charged 9 people on July 25, 2022

- How much? The combined value of these charges is over $6.8 million

In a joint action, the SEC charged a group of people back on July 25. The main culprits were Amit Bhardwaj, Brijesh Goel, and Seth Markin. They were all involved in separate insider trading scandals where they passed information regarding various corporate announcements and events to their friends. This led to a total of 9 people being charged by the SEC.

Nine people were charged with insider trading by the Securities and Exchange Commission in connection with three different alleged schemes that resulted in ill-gotten gains totaling more than $6.8 million.

Three chief players have been charged: a former chief information security officer (CISO), an investment banker, and a former FBI trainee. It is alleged that each of them provided sensitive material to acquaintances who later used it for financial gain. The SEC filed its enforcement actions in federal district court in Manhattan, and the Southern District of New York’s U.S. Attorney’s Office announced simultaneous criminal charges in each case.

The Market Abuse Unit’s (MAU) Analysis and Detection Center, which employs data analysis technologies to find unusual trading patterns, was the source of all three of the actions revealed.

#3. Bernard L. Compton (Domino’s Pizza)

- Who? Bernard L. Compton was an accountant at Domino’s Pizza and misused confidential financial data to make illegal gains

- When? SEC charged him on April 21, 2022

- How much? He was charged with a civil penalty of roughly $1,921,400

The SEC made public a court-approved settlement that mandated a former Domino’s Pizza accountant from Michigan to pay a fine of almost $2 million for insider trading in the company’s stock.

The SEC filed the complaint on April 13, 2022, in the U.S. District Court for the Eastern District of Michigan, alleging that Bernard L. Compton traded ahead of 12 of the company’s earnings announcements between 2015 and 2020 using secret financial information he obtained while serving as an accountant at Domino’s Pizza.

Compton violated the antifraud provisions of Section 10(b) of the Securities and Exchange Act of 1934 and Rule 10b-5 thereunder, according to the SEC’s complaint.

#4. Harpreet Saini & John L. M. Natividad (IT)

- Who? Harpreet Saini & John Lester Mandac Natividad from Ontario, Canada

- When? SEC charged them on September 30, 2022

- How much? They were charged $1.6 million

In major news where bad actors misused their position in a press release agency, a type of organization that gets a lot of information from public companies, SEC took action against two Canadian nationals for insider trading against US companies.

The SEC’s complaint, filed in the District of New Jersey, charged Saini and Natividad with violating the antifraud provisions of the Securities Exchange Act of 1934. The SEC’s complaint alleged that Harpreet Saini and John Lester Mandac Natividad, both of Ontario, worked for a newswire distribution company that specialized in corporate press releases from at least May 2018 to July 2021.

They had access to the company’s internal press release distribution system, which allowed them to preview the headlines, times, and publication dates of upcoming announcements. It is alleged that Saini and Natividad combined traded ahead of more than 1,600 announcements released by their employer and habitually sold out of their positions after the market reacted to the news in the press releases.

#5. Sheng Fu & Ming Xu (mobile apps)

- Who? Sheng Fu, the CEO of Cheetah Mobile, and Ming Xu, its former president

- When? SEC charged them on September 21, 2022

- How much? Civil penalties of $556,580 and $200,254 apart from future securities trading limitations

The CEO and former President of Cheetah Mobile Inc. were charged by the Securities and Exchange Commission with insider trading for allegedly using a supposed 10b5-1 trading strategy to sell the company’s securities while in the know of material nonpublic information.

Following the SEC’s decision, Sheng Fu and Ming Xu averted losses of about $203,290 and $100,127, respectively, in 2016 by selling 96,000 Cheetah Mobile American Depository Shares.

Originally based in China, Cheetah Mobile sells a range of digital items, such as mobile games and other applications. The SEC ruled that the Securities Act of 1933’s antifraud provisions were all breached and that Sheng Fu was also responsible for Cheetah Mobile’s violations of the Exchange Act’s issuer reporting requirements.

#6. Stephen Buyer (Former Indiana congressman)

- Who? Former Indiana congressman Stephen Buyer

- When? SEC charged him on July 25, 2022

- How much? Disgorgement of ill-gotten gains with interest, penalties, permanent injunction, office bar, and potential disgorgement from his wife Joni Lynn Buyer

After leaving Congress in 2011, the SEC’s complaint claims that Buyer established the Steve Buyer Group, a consulting company that offered services to T-Mobile among other clients. Buyer and a T-Mobile executive played golf in March 2018, at which time Buyer heard about the company’s then-secretive acquisition of Sprint.

The SEC filed a case in federal district court in Manhattan accusing Buyer of breaking Rule 10b-5 and Section 10(b) of the Securities Exchange Act of 1934. A permanent injunction, disgorgement of ill-gotten earnings, interest, fines, and an officer and director bar against Buyer are all requested in the case.

Additionally, Buyer’s wife, Joni Lynn Buyer, who benefited when Buyer made illegal trades in her brokerage account, was also sued for disgorgement. The SEC’s investigation.

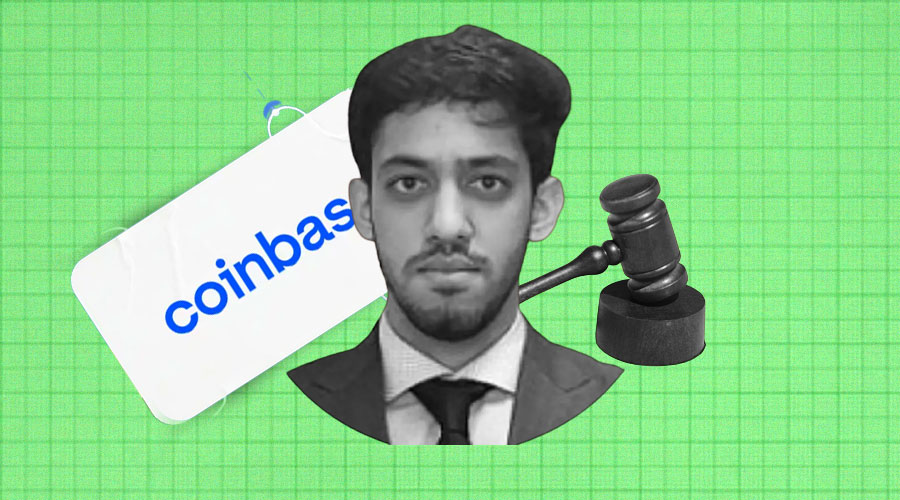

#7. Ishan Wahi and two (crypto)

- Who? Ishan Wahi (Coinbase product manager), his brother Nikhil Wahi and his friend Sameer Ramani

- When? SEC charged them on July 21, 2022

- How much? The three were charged with a permanent injunction, disgorgement of ill-gotten gains, civil penalties, and criminal charges from the US Attorney’s Office

In major crypto news, SEC booked 3 including Coinbase’s manager for insider trading action. A former product manager for Coinbase, his brother, and a friend were charged with insider trading by the Securities and Exchange Commission for allegedly orchestrating a scheme to trade ahead of several announcements regarding specific crypto assets that would be made available for trading on the Coinbase platform.

According to the SEC’s complaint, Ishan Wahi assisted in organizing Coinbase’s public listing announcements, which contained information about the crypto assets or tokens that would be made available for trading. The SEC’s complaint claims that Coinbase treated such information as secret and instructed its employees not to use it as the basis for any trades or to tip off other parties.

The SEC’s complaint, filed in federal district court in Seattle, Washington, charges Ishan Wahi, Nikhil Wahi, and Ramani with violating the antifraud provisions of the securities laws. In a parallel action, the US Attorney’s Office also announced criminal charges for all three.

#8. David Roda and friend (online gambling)

- Who? David Roda, software engineer at Penn Interactive Ventures (held by Penn National Gaming)

- When? SEC charged him on June 13, 2022

- How much? Roda was charged with disgorgement with interest and penalties. His friend was charged $11,000+ in disgorgement and penalties

Philadelphia-based David Roda tipped his friend, Andrew Larkin, of the online gambling company’s acquisition plans, leading the latter to purchase 375 shares of Score Media. The stock price increased by 80%. Both sold their holdings and made about $560,760 and $5,600 respectively.

In connection with the $2 billion purchase of Toronto-based Score Media and Gaming, Inc. by the parent company, the SEC announced insider trading charges against David Roda, a former software engineer at Penn National Gaming’s subsidiary Penn Interactive Ventures.

Roda and Larkin, both from Philadelphia, were accused of breaching the antifraud sections of the securities laws in the SEC’s complaint. In addition to agreeing to a permanent injunction against breaking those rules, Roda also consented to pay disgorgement, prejudgment interest, and a civil penalty.

Larkin has consented to be permanently restrained from breaching the antifraud provisions of the securities laws and to pay more than $11,000 in disgorgement and penalties without admitting or disputing the claims made in the SEC’s complaint.

#9. 3 with family members (software)

- Who? Hari Sure, Lokesh Lagudu, and Chotu Pulagam, software engineers at San Francisco-based cloud computing company Twilio, and their friends & family

- When? SEC charged them on March 28, 2022

A total of 7 Indian-origin people were charged in a million-dollar scheme. Conversing in an Indian language about the value of the company stock, they also passed information to family members and close friends.

These three Twilio software engineers and four family members and friends were charged with insider trading by the SEC for allegedly making over $1 million in profits through insider trading before the company’s first quarter 2020 earnings announcement on May 6, 2020.

Twilio, Inc. is a cloud computing communications company based in San Francisco. According to the SEC’s complaint, despite being informed of a company policy forbidding insider trading, Sure, Lagudu, and Chotu Pulagam allegedly used the brokerage accounts of their family members and close friends to knowingly tip off or trade Twilio options and stock ahead of the company’s earnings announcement on May 6.

#10. David Schottenstein and friends Kris Bortnovsky and Ryan Shapiro (cannabis)

- Who? David Schottenstein and his two close friends, all from Florida

- When? SEC charged him on January 6, 2022

- How much? The 3 individuals and 2 investment companies they used were charged with civil penalties and permanent injunctions. Criminal charges were also announced.

David Schottenstein allegedly made over $600,000 through insider trading involving DSW and Rite Aid’s attempt to acquire Aphria – a Canada-based cannabis brand.

The SEC filed charges against 3 residents of Florida for trading before significant market announcements involving Rite Aid Corporation and DSW Inc. Schottenstein allegedly got inside information frequently and used it to make trades ahead of the August 2017 DSW earnings release and the December 2018 tender bid to purchase Aphria.

Additionally, Schottenstein is accused of receiving information and trading before Albertsons Companies, Inc. and Rite Aid announced their intention to merge in February 2018.

In conclusion

The SEC does a lot of work against frauds of all types all year round. Specifically for insider trading, it also creates and revises regulations. For example, on December 14, 2022, SEC adopted certain powerful amendments that aimed to modernize the 10b5-1 rule. This rule is directly associated with insider trading plans.

Over time, SEC’s rules and regulations have improved a lot. Focusing on insider trading, they try to come up with at least one major update in a year. However, the bulk of their work is for uncovering and charging perpetrators of financial fraud. With ever-increasing complexity in capital assets, securities, and other financial resources comes an ever-increasing complexity in ways to game the system.

And it’s the SEC’s responsibility to combat and contain such behavior which can damage the economy. Apart from charging individuals, groups, companies, and even large MNCs and governments, the SEC also pays bounties to whistleblowers. These are rare events but the bounties are very generous. One of the biggest amounts paid was in September 2021 when the SEC issued nearly $36 million to a single whistleblower. Generally, this amount is $1-20 million.

Hopefully, our dive into the 10 insider trading cases investigated and charged by the SEC in 2022 was an enjoyable read for you. Which one did you find to be the most interesting?