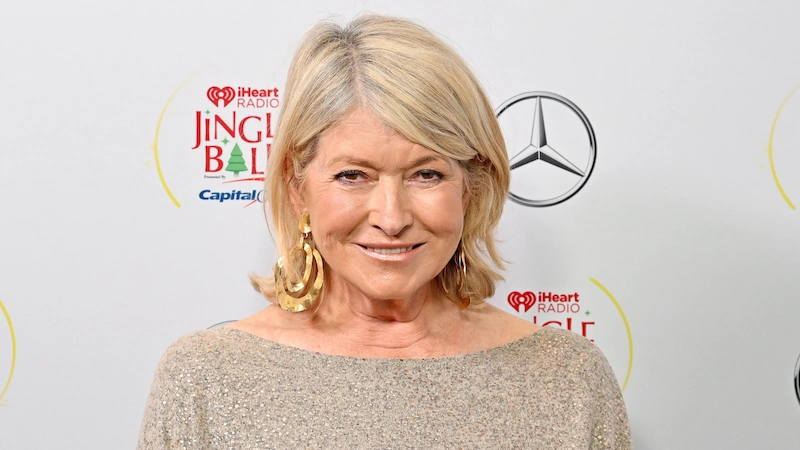

Martha Stewart, a famous American businesswoman, TV personality, and founder of Martha Stewart Living Omnimedia, was once known as the ultimate homemaking guru.

In 2001, however, she became involved in a highly publicized insider trading scandal that shocked her fans and the business world. What started as a single stock sale snowballed into a criminal case that led to her conviction and prison time.

This article breaks down who Martha Stewart is, how the insider trading scandal started, a timeline of key events, and why her actions were illegal under U.S. securities law.

TLDR

- On 27 December 2001, Martha Stewart sold all 3,928 of her ImClone shares after a tip that the company founder’s family were dumping theirs.

- The FDA rejected ImClone’s cancer drug the next day, the stock dived, and she dodged about $46,000 in losses.

- Stewart and her broker claimed they’d set a “sell at $60” order, but phone logs and a broker’s assistant proved it was a cover-up.

- A 2004 jury found her guilty of conspiracy, obstruction, and lying to investigators. She served five months in prison, five under house arrest, and paid a $30,000 fine.

- The court never convicted her of insider trading, yet her name is still linked to the offence.

Who Is Martha Stewart and How the Insider Trading Scandal Began

By the late 1990s, Martha Stewart had built a vast media and lifestyle empire. Her company( Martha Stewart Living Omnimedia)went public in 1999, even making her the first self-made female billionaire in the U.S.

However, everything changed at the end of 2001. In December of that year, Stewart sold her personal stake in a biotech company called ImClone Systems just before bad news about the company became public.

This well-timed stock sale immediately raised red flags. Investigators soon questioned Stewart (herself a former stockbroker) about whether she had insider knowledge prompting the sale, which she denied.

However, evidence later suggested that Stewart did act on a non-public tip and then lied about it to federal investigators. What followed was a two-year legal saga that would tarnish her reputation and put her behind bars.

Martha Stewart’s Insider Trading: The Tip and the Timing

The heart of the scandal was Martha Stewart’s sale of 3,928 shares of ImClone Systems stock on December 27, 2001. Here’s what happened:

ImClone’s Inside News

ImClone was awaiting an imminent decision from the U.S. Food and Drug Administration (FDA) on its experimental cancer drug Erbitux. On December 26, 2001, ImClone’s founder and CEO, Sam Waksal, privately learned that the FDA was going to reject (refuse to file) ImClone’s application for Erbitux.

This was material, bad news that had not yet been made public. Waksal knew the stock would likely plunge once the news came out.

Waksal Tries to Dump Shares

Upon learning this, Waksal immediately tipped off family members. On December 27 (the very next morning), Waksal and his daughter frantically instructed their brokerage (Merrill Lynch) to sell all of their ImClone shares before the news got out.

They contacted Merrill broker Peter Bacanovic’s office with these orders. (Notably, selling on such insider knowledge is exactly what Waksal himself would later be arrested for.)

The Tip to Martha Stewart

Peter Bacanovic, who happened to be Martha Stewart’s stockbroker as well, got word of the Waksals’ massive sell-off. Bacanovic was vacationing in Florida on Dec. 27, but he was in touch with his assistant, Douglas Faneuil, who was handling the Waksal trades.

Knowing that the Waksals dumping their stock signaled something was very wrong, Bacanovic told Faneuil to tip off Martha Stewart about it.

This was a breach of Merrill Lynch’s rules (brokers aren’t allowed to share one client’s confidential transactions with another), and it set the stage for Stewart’s own trade.

Stewart Sells Her Shares

Later on December 27, 2001, Douglas Faneuil passed the message to Stewart that Waksal and his family were selling all their ImClone stock. Stewart immediately instructed Faneuil to sell all 3,928 shares of her ImClone holdings, which he did promptly.

The total proceeds were about $229,000 for Stewart. Crucially, this sale took place one day before the FDA’s decision became public.

By selling on Dec. 27, Stewart avoided losses estimated around $45,673 that she would have incurred had she held the stock even one more trading day.

The Next Day – Public News Breaks

After markets closed on Dec. 28, 2001 (the day after Stewart’s sale), ImClone publicly announced that the FDA had issued the rejection letter for Erbitux. On the next trading day (Monday, Dec. 31, 2001), ImClone’s stock price plunged, falling about 16–18% immediately.

Over the next month, the stock fell even further (about 75% down at one point) as the bad news sank in. Thanks to the tip-off, Stewart had neatly avoided that hit to her portfolio.

Martha Stewart’s Insider Trading Investigation: Lies and Cover-Up

Stewart’s suspiciously timed sale didn’t go unnoticed. In early January 2002, just weeks after the trade, officials began looking into possible insider trading around ImClone. Stewart and Bacanovic tried to explain the trade as innocent, providing a story to regulators that would later unravel. Here’s how the investigation unfolded:

The $60 Story

On January 7, 2002, Peter Bacanovic (Stewart’s broker) told attorneys from the Securities and Exchange Commission (SEC) that before all this, he and Martha Stewart had an arrangement to sell her ImClone shares if the price fell below $60 per share.

According to Bacanovic, this pre-set agreement, not any insider tip, led to the sale on Dec. 27. A few weeks later, on Feb. 4, 2002, Martha Stewart herself told the SEC, FBI, and federal prosecutors the same story.

She claimed she had a standing order with Bacanovic to sell ImClone if it dropped to $60. At the time, ImClone’s stock was hovering around $58–$60, so this explanation could sound plausible if true.

Red Flags Emerge

Investigators were not entirely convinced by the $60-stop-loss explanation. The timing was just too coincidental, and there was evidence of unusual trading by insiders.

In June 2002, the hammer fell on Sam Waksal, he was arrested on June 12, 2002 and charged with insider trading for his attempts to dump ImClone stock and tip off others ahead of the FDA news.

Waksal eventually pled guilty to those charges and, in 2003, was sentenced to over 7 years in prison. The focus then intensified on Stewart’s role.

Whistleblower in the Brokerage

The big break in the case came from inside Merrill Lynch. Broker’s assistant Douglas Faneuil – the person who actually took Waksal’s sell orders and passed the tip to Stewart eventually came clean.

On October 2, 2002, Faneuil pleaded guilty to a misdemeanor charge for accepting a payoff (benefits from Bacanovic) to keep quiet about the true reason for Stewart’s stock sale. In other words, Faneuil admitted there was an illegal tip and that he was pressured to cover it up.

This directly contradicted Stewart and Bacanovic’s account. Faneuil’s cooperation was a turning point that brought the truth to light. Stewart’s sale was triggered by insider information about the Waksals’ trades, not a pre-set $60 trigger.

With Faneuil’s testimony secured, federal prosecutors and the SEC had the evidence they needed to formally go after Martha Stewart and Peter Bacanovic. The cover-up was falling apart.

Stewart’s Assistant

Another noteworthy witness was Ann Armstrong, Martha Stewart’s assistant. Armstrong testified about a critical piece of evidence: a phone log. On the day of the stock sale, Bacanovic had left a phone message for Stewart.

Armstrong revealed that Stewart personally altered a log of that message, essentially changing the record of the call. (It was implied this was to align with the $60 story.) However, Armstrong also gave testimony that somewhat aided Stewart: she said Stewart later asked to change the log back to its original form and never explicitly asked Armstrong to lie.

The defense used that to argue Stewart wasn’t intentionally covering up but had perhaps panicked initially. Still, the fact that Stewart edited a phone message record was viewed as suspicious by the jury.

Indictment: Charges Against Stewart and Bacanovic

After months of gathering evidence, a federal grand jury in New York indicted Martha Stewart and her broker Peter Bacanovic on June 4, 2003.

The indictment was nine counts in total and included charges of conspiracy, obstruction of justice, making false statements, and securities fraud. These charges basically boiled down to allegations that Stewart and Bacanovic lied to investigators and tried to interfere with the investigation of the ImClone trade.

One count, the most serious on its face, was securities fraud. However, this particular securities fraud charge was a bit unusual as it wasn’t for insider trading per se (Stewart wasn’t directly charged criminally for insider trading in this indictment).

Instead, this count alleged that Stewart had deceived the shareholders of her own company (Martha Stewart Living Omnimedia) by publicly proclaiming her innocence, thereby ostensibly manipulating her company’s stock price.

Many legal observers saw this charge as a stretch, and it would later be dismissed by the judge before the case went to the jury.

On the same day as the indictment, the SEC also filed a civil lawsuit against Stewart and Bacanovic for illegal insider trading of ImClone stock. That civil case sought to have Stewart disgorge the approximately $45k in losses she avoided and to bar her from serving as a director of any public company.

In response to the criminal indictment, Martha Stewart resigned from her roles as chairman and CEO of her company, Martha Stewart Living Omnimedia, on June 4, 2003 (though she remained a board member and chief creative officer.

Martha Stewart’s Insider Trading Trial

Martha Stewart’s trial began in January 2004 and quickly became a media frenzy.

Verdict – Guilty on All Other Counts (March 5, 2004)

After days of deliberation, the jury delivered a harsh verdict. Martha Stewart was convicted on all four remaining counts against her. In essence, the jury found that she conspired to obstruct justice, obstructed justice, and lied to federal investigators (the counts included two counts of making false statements, one count of conspiracy, and one count of obstruction).

Her co-defendant Peter Bacanovic was also found guilty on four out of five counts (he was acquitted on one count of falsifying a document).

Verdict in Martha Stewart’s Insider Trading Case

After her conviction, Martha Stewart vowed to appeal but also took steps to prepare for the worst (at one point even requesting to start serving any sentence as soon as possible to put the ordeal behind her).

On July 16, 2004, Stewart returned to federal court in New York for sentencing. Judge Cedarbaum could have sent Stewart to prison for up to 16 months under federal guidelines, but opted for the minimum end of the range.

Stewart was sentenced to 5 months in prison for her crimes, plus 2 years of supervised probation after release. As part of that probation, she was ordered to spend 5 months under home confinement (house arrest) following the prison term. The judge also imposed a $30,000 fine, which, while a small sum for Stewart, was the maximum fine allowed for her offenses.

Stewart’s broker Bacanovic received the same sentence (5 months in prison, 5 months home confinement, probation) as Stewart did. Ultimately, Stewart decided not to drag out the appeals for too long. She began serving her prison sentence in October 2004 at a minimum-security federal prison camp in Alderson, West Virginia (fittingly nicknamed “Camp Cupcake” by the media).

Although the final ruling didn’t convict her of insider trading, people still viewed ‘Stewart’ as synonymous with the scandal.