Introduction

Welcome to the tale of the uncovering of the R. Cultivate Winans insider trading scandal . One of the most well-known instances of white-collar crime in the financial sector, this case of insider trading serves as a reminder of the importance of honesty and openness in the stock market. This case likewise fills in as a wake-up call for the people who might be enticed to utilize data not accessible to general society for individual increase. We will look at the events that led up to the scandal, the consequences of the scandal, and how the industry has changed since then in this article. We will also take into account what we can learn from this case. So come along with us as we investigate the insider trading scandal involving R. Foster Winans.

How The Embarrassment Created

Winans’ Job At The Money Road Diary

During the 1980s, R. Encourage Winans was a correspondent and manager at the Money Road Diary (WSJ). He was one of the financial industry’s most well-known and respected reporters. The WSJ’s Heard on the Street column was written by Winans. He had access to information and articles that had never been published and were unavailable to the general public.

In 1983, Winans was blamed for giving non-public data to two merchants, Kenneth Felis, and Peter Nye, in return for installments. Before the stories appeared in the WSJ, it was alleged that Winans passed them on to the two brokers. The two dealers then utilized this data to make beneficial exchanges the securities exchange.

Winans was prosecuted on 32 counts of mail and wire extortion, protections misrepresentation, and scheme. He was blamed for making more than $31,000 in benefits from these unlawful exchanges. Additionally, he was charged with defrauding the WSJ and its readers.

Winans was tracked down blameworthy on every one of the 32 includes in 1985 and condemned to year and a half in jail. He likewise needed to pay a $30,000 fine and $31,000 in compensation to the WSJ. Winans wrote A Scandal on Wall Street, a memoir of his time in prison, following his release. He later worked in the monetary business as an expert and monetary examiner.

The Money Road Diary Insider Exchanging Embarrassment is much of the time refered to act as an illustration of the risks of insider exchanging. The fact that Winans was a part of the scandal serves as a reminder that people with access to private information have a responsibility to use it responsibly.

The Heard On The Street Column

The Wall Street Journal’s Heard on the Street column has been around for a long time. The segment is composed by a group of journalists who cover the monetary business sectors. Offer readers up-to-date and comprehensive market coverage. It focuses on the activities of influential investors as well as the strategies and financial moves of large corporations.

The section frequently furnishes perusers with an inside check the business sectors out. It provides a market trend, stock, and investment analysis. Additionally, it sheds light on the strategies that successful market investors employ to profit.

The column’s witty and frequently humorous style has earned it a reputation. as well as its in-depth and insightful market coverage. It has been commended for its capacity to give perusers a thorough glance at the business sectors and the powers driving them.

Since its publication in the early 1980s, the column has been regarded as a must-read for anyone interested in the stock market. It is refreshed routinely and gives perusers the most recent news and investigation on the business sectors. The section is generally perused by both expert and beginner financial backers, as well as monetary counsels.

The Heard on the Road segment has turned into a foundation in the monetary world. It is generally viewed as one of the most significant and powerful wellsprings of data on the business sectors. It is a must-peruse for anyone with any interest in the financial exchange, furnishing them with an exceptional and thorough gander at the business sectors.

Winans’ Scheme

Winans’ Plan was a false stock control plot that worked somewhere in the range of 1869 and 1872 and was executed by two siblings, William and Charles Winans. The siblings had the option to make a huge number of dollars by controlling the cost of stocks on the New York Stock Trade (NYSE). They accomplished this by purchasing large quantities of stock and then rapidly selling shares to create artificial demand for the stock. This gave the impression that the price of the stock was going up, but in reality, the stock was worth nothing like what they were trading it for.

The siblings had the option to make a fortune by exploiting the way that the NYSE was a moderately new market, and not very much controlled. They had the option to buy enormous blocks of stock without drawing in an excessive amount of consideration from the market controllers. Additionally, the brothers had relationships with a number of well-known people on Wall Street, which allowed them to learn about upcoming market shifts before anyone else did. This permitted them to trade stocks with flawless timing, guaranteeing that they benefitted from the plan.

The plan finished when the Winans siblings were gotten by government agents, who revealed the way that the siblings had been falsely controlling the securities exchange. In 1872, they were both captured and accused of misrepresentation. They were in the long run sentenced and condemned to jail however were acquitted by President Award in 1877.

The Winans’ Plan is viewed as one of the earliest instances of securities exchange control, and their story fills in as an illustration for those hoping to put resources into the securities exchange. It is essential to keep in mind that stock prices can be artificially inflated or deflated, and prior to investing, investors should always conduct research and due diligence.

The Investigation And Prosecution

The R. Foster Winans insider trading scandal was the subject of a thorough investigation that included witness interviews and extensive records review. The investigation found evidence that a Wall Street Journal reporter named Winans had been using his access to the newspaper’s Heard on the Street column to inform co-conspirators in advance of upcoming stories. Before the stories were published, the co-conspirators traded based on the information, earning a significant profit. Notwithstanding Winans, the examination distinguished three others engaged with the plan.

Winans had used his own brokerage account to make trades, and the co-conspirators had set up a fake company to hide their activities, according to the investigation. The co-conspirators also transferred money to a number of offshore accounts to further conceal their actions.

As a feature of the examination, the U.S. Protections and Trade Commission (SEC) directed interviews with various people, including Winans, his co-schemers, and other Money Road Diary representatives. The SEC likewise explored monetary records, including telephone records, investment funds, and bank proclamations. The SEC also looked into how insider trading affected the stock prices of the companies involved in the scheme.

Results Of The Investigation

The examination brought about criminal accusations being brought against Winans and his co-plotters. Winans was condemned to 15 months in jail, trailed by three years of managed discharge. The other co-conspirators received sentences ranging from five months to three years in prison.

The SEC imposed financial penalties on Winans and his co-conspirators in addition to criminal penalties. Winans was required to pay $1,750,000 in disgorgement and fines by the SEC, and the other co-conspirators were required to pay $2,500,000 in total.

Winans and his accomplices were also subject to a cease and desist order from the SEC, preventing them from participating in any further insider trading activities.

Foster Winans Insider Trading Scandal Investigation Methods

Document Examination

Document examination was an important part of the investigation into R. Foster Winans’ insider trading scandal. Investigators looked at documents such as trading records, telephone records, and diaries to determine if any of the parties involved had conducted insider trading.

Interviews

Investigators interviewed individuals involved in the scandal, such as R. Foster Winans and his associates, to determine their involvement in the case. They also interviewed members of the Wall Street Journal staff to determine if any of them had knowledge of the scheme.

Surveillance

Investigators conducted surveillance on R. Foster Winans and his associates to determine if any of them had been involved in insider trading. They also monitored financial markets to look for any suspicious activity that may have been related to the case.

Analysis of Financial Data

Investigators conducted a detailed analysis of financial data related to the case. This included analyzing trading patterns, stock prices, and other financial information to determine if R. Foster Winans and his associates had engaged in any illegal activities.

Computer Forensics

Investigators also conducted computer forensics to determine if any of the parties involved had used computers to aid them in their insider trading activities.

Analysis of Regulatory Filings

Investigators also analyzed regulatory filings, such as SEC filings, to determine if any of the parties involved had violated any laws or regulations related to insider trading.

The Insider Trading Controversy Involving R. Foster Winans: Who Are These People?

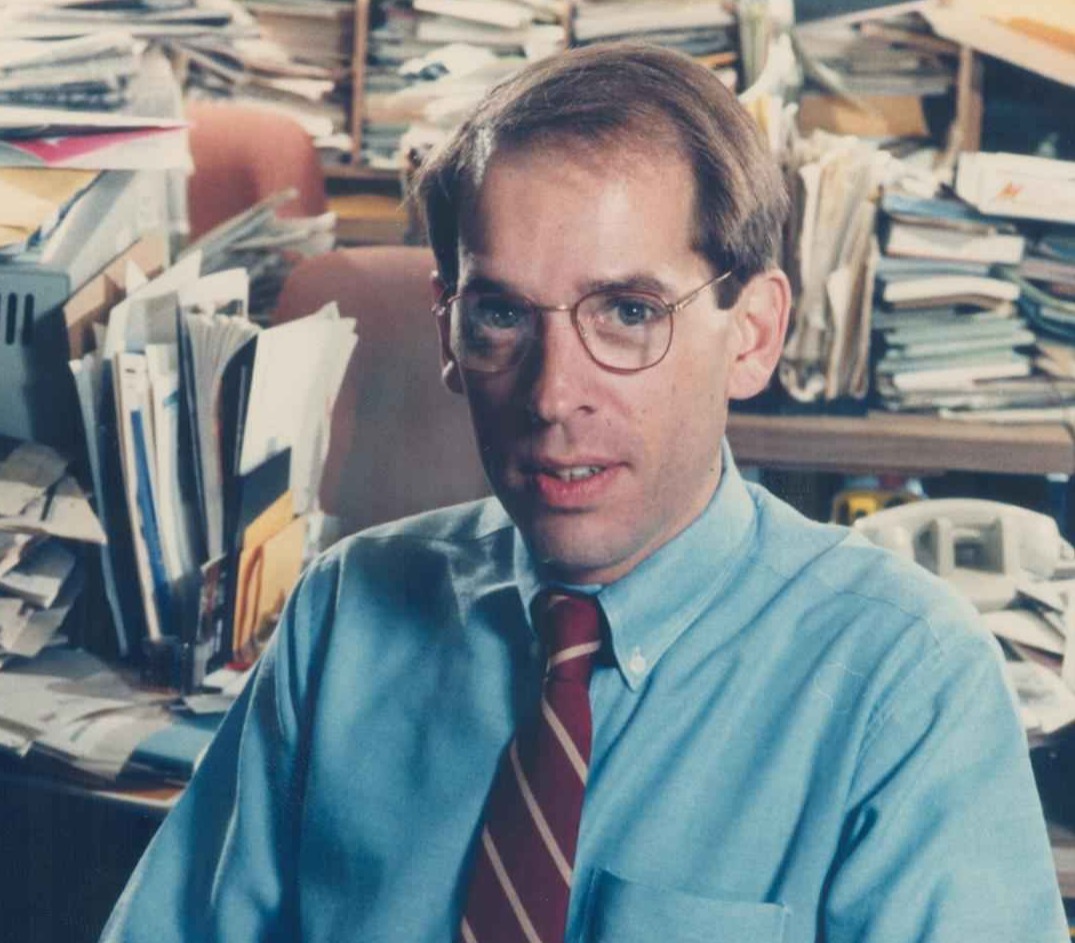

Robert Foster Winans

A former reporter for the Wall Street Journal and the main suspect in the controversy.

Carpenter, David

An ex-assistant editor at the Wall Street Journal was also implicated in the controversy.

K. F. Felis, Kenneth

A former stockbroker who, along with Winans and Carpenter, was accused of criminal activity.

P. N. Brant, Peter

A shareholder who allegedly benefited from the insider trading scheme.

What Are The Institutions Involved In The R. Foster Winans’s Insider Trading Scandal?

Salomon Brothers

Salomon Brothers were the Wall Street brokerage firm that employed R. Foster Winans. The firm was implicated in the scandal when it was discovered that Winans had been sharing confidential information with the firm’s clients in exchange for money.

Kidder, Peabody & Co

Kidder, Peabody & Co. was a Wall Street brokerage firm that is alleged to have received inside information from Winans and used it to purchase stocks before they became public knowledge.

Shearson/American Express

Shearson/American Express was another Wall Street brokerage firm that was implicated in the R. Foster Winans insider trading scandal. The firm was accused of receiving inside information from Winans and then trading on it.

The Wall Street Journal

The Wall Street Journal was the newspaper that employed R. Foster Winans as a columnist. It was through his column that he was able to share inside information with his readers, which was then used to make profitable trades.

Prosecution

The prosecution in the R. Foster Winans insider trading scandal was vigorous and resulted in Winans being found guilty of all charges. The prosecution argued that Winans had misused his position as a financial reporter at the Wall Street Journal to pass on insider information to his accomplices before it was published in the newspaper. As a result, they were able to make substantial profits on stock trades.

Winans was charged with nine counts of securities fraud, five counts of mail fraud, and one count of conspiracy. He was also charged with perjury for lying to the Securities and Exchange Commission (SEC) when questioned about his involvement in the scheme.

At trial, the prosecution presented evidence that Winans had provided his accomplices with information about stocks that would be mentioned in his newspaper column. They also argued that Winans had misrepresented his involvement in the scheme, claiming that he had never been aware of his accomplices’ trading activities.

The jury found Winans guilty of all charges in 1985. He was sentenced to three years in prison and was fined $30,000. Winans’s conviction was later overturned by the Second Circuit Court of Appeals in 1987. However, the charges were reinstated in 1989 and Winans was again found guilty. He was sentenced to time served, which amounted to 18 months in prison.

The Impact On The Financial World

R. Foster Winans was a Wall Street Journal reporter who was convicted of insider trading in 1985. He was accused of using his position to leak sensitive market-moving information before it was published in the Wall Street Journal so that he and two of his associates could profit from the information. This case had a major impact on the financial world, as it was the first major insider trading scandal in the United States.

The case spurred the creation of the Insider Trading Sanctions Act of 1984, which made insider trading a federal offense. This law allowed the Securities and Exchange Commission (SEC) to impose civil penalties on those found guilty of insider trading, while also allowing the Department of Justice to pursue criminal charges.

The R. Foster Winans case also caused a dramatic shift in the way that financial news is reported. The Journal implemented a Chinese wall between its news and editorial departments to prevent any further insider trading. The Wall Street Journal also implemented a number of new procedures to protect its sources and prevent the misuse of information.

R. Foster Winans Case

The R. Foster Winans case also served as a wake-up call for other financial journalists. The case highlighted the importance of ethical journalism practices, and many other financial journalists adopted stricter practices and protocols for reporting sensitive information.

Finally, the case also had a major impact on the financial markets. It made investors warier about insider trading and heightened awareness of the need for compliance with securities laws. As a result, the SEC and other regulatory bodies have become more aggressive in their enforcement of securities laws and regulations.

Overall, the R. Foster Winans insider trading case had a major impact on the financial world. It changed the way financial news is reported, increased awareness of the need for compliance with securities laws, and made investors warier of insider trading.

Conclusion

R. Foster Winans was the first person to be convicted of insider trading, and his case has served as a warning to investors ever since. His case has demonstrated that insider trading is a serious offense and that those who partake in it can face serious penalties. As the importance of financial regulation increases, the need to protect investors from insider trading remains paramount. Ultimately, R. Foster Winans’ story serves as a reminder of the importance of investing responsibly and ethically.

Frequently Asked Questions

1. What is the R. Foster Winans insider trading scandal?

The R. Foster Winans insider trading scandal is a case from the 1980s in which Winans, a financial columnist for the Wall Street Journal, was accused of leaking confidential information from the newspaper to two Wall Street traders in order to benefit from illegal trading.

2. What happened in the Winans insider trading scandal?

Winans was accused of leaking advance information on the stocks and bonds he was covered in the Wall Street Journal in order to make illegal profits. He was convicted of securities fraud and served a prison sentence.

3. Who was involved in the Winans insider trading scandal?

R. Foster Winans was the main figure in the scandal. Two Wall Street traders, Kenneth Felis, and Robert M. Freeman were also accused of participating in the scheme.

4. What was the outcome of the Winans insider trading scandal?

Winans was convicted of securities fraud and sentenced to prison in 1985. The two traders involved were also convicted and sentenced to prison.

5. What legal precedents were set by the Winans insider trading scandal?

The case established the precedent that insider trading involving the media was illegal, and that journalists had a duty to protect their sources. It also established that traders were responsible for their own actions and could not hide behind the media when engaging in illegal activity.