Introduction

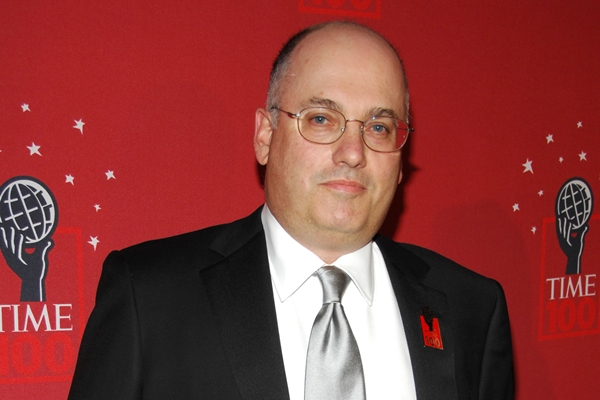

The Steven Cohen insider trading embarrassment has been a continuous issue since 2013, and it has as of late seen restored consideration. SAC Capital Advisors founder and billionaire hedge fund manager Steven Cohen was accused of buying securities with inside information for personal gain. Cohen has survived the investigation and is continuing his career in finance, despite the charges. In this blog entry, we will investigate the subtleties of the Steven Cohen insider exchanging embarrassment, the resulting examination, and how Cohen has had the option to endure everything.

Steven Cohen Insider Trading Scandal

One of the most well-known financial scandals of the twenty-first century was the Steven Cohen Insider Trading Scandal. Insider trading by Steven Cohen in 2008 was the subject of the scandal. It was alleged that Cohen and his company used material non-public information to guide their trading decisions, resulting in profits of hundreds of millions of dollars and avoidance of losses.

The examination concerning SAC Capital Guides and its supposed insider exchanging exercises started in late 2007. It went on for a few years before the U.S. Justice Department in 2013 brought criminal charges against the company. Cohen was accused of different counts of protections extortion and neglecting to regulate his vendors, recommending he was the provocateur.

Illegal Short-Selling

Short-selling activities were involved in the illegal insider trading scandal involving Steven Cohen. Steven Cohen, an investor and manager of a hedge fund, asked SAC Capital Advisors to carry out the study. U.S. specialists found proof that Cohen took part in insider exchanging somewhere in the range of 2009 and 2013. The Protections and Trade Commission (SEC) documented common charges against him in 2013.

Insider trading in the stock market by Cohen and his company was the subject of the scandal, which involved the illegal use of insider information. This permitted Cohen to make beneficial exchanges in view of data that was not accessible to the overall population.

Cohen was accused of insider exchanging as well as unlawful short selling. This is a type of stock exchanging where a merchant sells shares they don’t possess in that frame of mind of repurchasing them at a lower cost and afterward creating a gain.

Cohen was captured and accused of five charges of protections misrepresentation, each conveying a greatest sentence of 20 years in prison. He consented to a supplication bargain in January 2018. Served two years in jail and paid a $1.8 million fine.

The dangers of illegal short-selling were made clear by the insider trading scandal involving Steven Cohen. Furthermore, the requirement for rigid guidelines to safeguard financial backers. Additionally, it demonstrates the significance of ethical business practices. Moreover, the need for more severe punishments for those who violate the law.

Insider Trading

The Steven Cohen insider trading scandal was a major financial scandal that began in 2013 and lasted until 2019. The Securities and Exchange Commission (SEC) alleged that Cohen had engaged in insider trading between 2007 and 2013 and had failed to properly supervise employees who had access to material nonpublic information. The SEC also alleged that Cohen had failed to prevent the misuse of such information. The case against Cohen was long and complex, involving the SEC, the U.S. Attorney’s office in Manhattan, and a grand jury.

However, he agreed to pay $1.8 billion in penalties and disgorgement, including $900 million to the SEC and $900 million to the U.S. Attorney’s office. The case against Cohen has been a major milestone in the fight against insider trading. It has also served as a reminder to corporations and financial institutions that they must comply with securities laws. It ensures that their employees do not misuse material nonpublic information.

Backdating Options

In the late 2000s, the Securities and Exchange Commission (SEC) began investigating Steven Cohen. The SEC alleged that Cohen and his firm had engaged in a number of illegal activities, including backdating options.

Backdating options involves the manipulation of stock option grant dates to take advantage of a lower stock price. By granting options with a date prior to the actual date, a company can increase the options’ value. It is because the exercise price is lower than the current market price. This practice is illegal and can result in civil and criminal penalties for those involved.

The SEC found that Cohen and SAC had used backdated options to their advantage. The backdating allowed them to make more money when their stock price went up. As they were able to purchase options at a lower price. The SEC also found that Cohen had failed to disclose the backdating or properly account for it in the company’s financial statements.

The insider trading scandal resulted in a number of fines and penalties for Cohen and SAC. It includes a $1.8 billion civil penalty. Cohen paid the SEC $1.2 million and agreed to a two-year ban from working in the securities sector.

Fraudulent Investment Advice

In 2013, the Securities and Exchange Commission (SEC) charged Cohen’s firm, SAC Capital Advisors, with insider trading and accused Cohen of failing to supervise employees who were trading on insider information. According to the SEC, Cohen’s employees were able to generate millions of dollars in illegal profits by trading on inside information obtained from various sources, including company insiders, analysts, and even family members.

At the heart of the scandal was the allegation that Cohen himself had participated in insider trading. The SEC alleged that Cohen had received non-public information about potential stock trades and had acted on it, making profitable trades before anyone else had access to the same information. Cohen denied these allegations, but was ultimately found liable for failing to supervise his employees and was ordered to pay over 1.8 billion dollars in fines and penalties.

The scandal also raised questions about the ethical standards of Wall Street and the use of insider information in trading. It revealed the risks of taking financial advice from insiders, who have the ability to artificially increase or decrease stock prices for their own benefit.

Illegal Campaign Contributions

In 2013, Steven Cohen, the founder of SAC Capital Advisors, and his firm were charged with insider trading. As a result, Cohen was fined and banned from managing outside money for two years. At the same time, it was made public that Cohen had made illegal campaign contributions to a number of political candidates.

The illegal contributions were made in the name of SAC Capital Advisors, or one of its subsidiaries. The contributions were made in order to gain political favors, such as favorable legislation or access to non-public information. This was a violation of campaign finance laws and the Federal Election Commission regulations.

In addition to the fines imposed on Cohen and SAC Capital, the Securities and Exchange Commission also announced that it was imposing a $1.8 million civil penalty on Cohen.

It was also revealed that Cohen had used SAC Capital to make illegal campaign contributions to a number of political candidates. This included contributions to the campaigns of Senator Chuck Schumer, New Jersey Governor Chris Christie, and former New York City Mayor Michael Bloomberg.

How did the scandal come to light?

The Steven Cohen insider trading scandal was first exposed in December 2016, when the US Securities and Exchange Commission (SEC) filed a civil enforcement action against Cohen’s hedge fund, SAC Capital Advisors. The charges alleged that Cohen had violated federal securities laws by failing to prevent insider trading in certain stocks by his employees and associates.

At the heart of the case was a former SAC portfolio manager, Mathew Martoma, who had allegedly traded on inside information provided to him by a doctor working on clinical trials for two drug companies. Martoma was accused of passing the insider information on to Cohen, who in turn used it to make illegal trades that resulted in profits and avoided losses.

The SEC’s complaint against Cohen sparked an investigation into his activities by the Department of Justice in the U.S. Attorney’s Office in the Southern District of New York. That includes one count of criminal securities fraud, four counts of making false statements to SEC investigators, and six counts of failure to supervise. Cohen ultimately pleaded guilty to all of the charges. It resulted in a $1.8 billion settlement with the SEC as well as additional sanctions from the Financial Industry Regulatory Authority.

What are the investigations made of Steven Cohen in the insider trading scandal?

Allegations of Insider Trading

The primary focus of the investigation into Steven Cohen and his firm, Point72 Asset Management, is the alleged receipt and use of non-public, material information in connection with securities trading.

Regulatory Enforcement Actions

The Securities and Exchange Commission (SEC) and the Department of Justice (DOJ) have taken enforcement actions against Cohen. Point72, and several of its employees in connection with the alleged insider trading. These enforcement actions have included fines, charges, and other penalties.

Civil Lawsuits

In addition to the regulatory enforcement actions, Cohen and Point72 have faced a number of civil lawsuits from investors and others who claim to have been harmed by insider trading. The lawsuits allege a range of misconduct, including insider trading, fraud, and failure to supervise employees.

Denials of Wrongdoing

Despite the ongoing investigations and legal challenges, Cohen and Point72 have consistently denied any wrongdoing and have defended themselves against the allegations in court.

Implications for the Financial Industry

The outcome of the investigations and lawsuits involving Steven Cohen and Point72 will have significant implications for the financial industry, particularly with regard to insider trading and the responsibilities of hedge fund managers and their firms.

What happened next?

After the Securities and Exchange Commission (SEC) opened its investigation into Steven Cohen’s trading activities, the U.S. Attorney’s office in Manhattan initiated a parallel criminal investigation. The U.S. Attorney’s office subpoenaed testimony and documents from SAC Capital Advisors and several former employees of the firm. Among those targeted in the investigation were portfolio manager Mathew Martoma and analyst Sandy Winick, both of whom had worked closely with Cohen. In early 2013, Martoma was arrested and charged with securities fraud and other charges related to his trading activities.

He was blamed for utilizing inside data to exchange the loads of Spirit Company and Wyeth Drugs. The company earns more than $276 million as a result. Notwithstanding criminal allegations, the SEC tried to force a monetary punishment of more than $600 million on SAC Capital Counselors. It would have been the SEC’s largest ever fine for an investment company.

At last, neither Martoma nor Cohen had to deal with criminal penalties regarding the insider exchanging charges. He likewise consented to be banned from the protections business for a very long time. Cohen has continued to be a successful investor despite this significant penalty.

What was the result of the examination?

Thusly, Cohen and his mutual funds were hit with various charges after a delayed examination. Martoma was allowed a nine-year sentence in jail in the wake of being viewed as at real fault for illicitly exchanging two stocks.

Cohen’s business practices were substantially altered as a result of the investigation. He carried out a more thorough consistence framework and employed a free consistence specialist. Furthermore, he arrived at a settlement with survivors of the unlawful tasks for nearly $400 million. In addition, he established a number of brand-new policies and procedures to stop similar actions from occurring in the future.

The aftermath from the examination has been huge, as it has prompted expanded investigation of mutual funds and their chiefs. By the by, while the SEC had the option to bring charges against Cohen. They have not yet had the option to consider him responsible for the activities of his workers. This has made many inquiry the adequacy of existing administrative frameworks and their capacity to guarantee consistence.

Regardless of the cruel discipline that Cohen got, the case has at last filled in as a useful example for financial backers all over the place. It shows the significance of avoiding potential risk while pursuing venture choices and features the requirement for more prominent oversight inside the monetary area.

Conclusion

The insider exchanging undertaking including Steven Cohen was a huge occasion in the realm of money. It has raised awareness of hedge funds’ business practices and moral standards. SAC Capital Advisors pleaded guilty and received a record-setting fine as a result of the SEC and Department of Justice investigation. Steven Cohen’s Point72 Asset Management, which he owns and runs, has survived the scandal unscathed and maintains a strong market position. The decision for the situation fills in as a convenient sign of the meaning of maintaining moral principles in strategic policies and the repercussions of violating regulations overseeing protections.

Frequently Asked Questions

1. What was the scandal surrounding Steven Cohen’s insider trading?

The Steven Cohen insider exchanging embarrassment included charges of insider exchanging exercises by SAC Capital Counsels, multifaceted investments established by Steven Cohen. The US Protections and Trade Commission (SEC) and the Branch of Equity sent off an examination concerning the firm.

2. What was the investigation’s conclusion?

SAC Capital Advisors pleaded guilty to securities fraud as a result of the investigation. They paid a record-breaking fine of $1.8 billion. For this situation, the genuine Steven Cohen was not the subject of any allegations.

3. How has the scandal affected Point72 Asset Management, which Steven Cohen founded?

In spite of the embarrassment, Point72 Resource The executives has kept on working. It continues to be one of the industry’s largest and most successful hedge funds. Notwithstanding, the examination brought up issues about the administration practices and morals of the firm.

4. What does the result of the case propose about the significance of moral strategic policies?

The result of the case fills in as a sign of the significance of moral strategic policies and the outcomes of disregarding protections regulations. It features the requirement for organizations and people to act with honesty and straightforwardness in their monetary dealings.

5. What significance did the insider trading scandal involving Steven Cohen have?

A significant occurrence in the world of finance was the insider trading scandal involving Steven Cohen. That brought to light the ethical and business practices of hedge funds. It raised concerns regarding the managers’ accountability and the place of hedge funds in the financial sector.