Introduction

Innovations in technology, shifts in customer tastes, and fierce market rivalry have all shaken up the digital streaming industry. In this context, the pioneer in the streaming market, Roku Inc., has lately been under investigation for significant insider trading. There have been concerns over the valuation and future prospects of Roku Inc., since President of Consumer Experience Gidon Katz has been heavily involved in selling company shares. In our investigation, we thoroughly examine these insider transactions and try to figure out if Roku can handle the potentially confusing world of insider trading.

Roku Inc. Company Profile

Roku’s Status As An Early Game Changer In The Streaming Market

Roku, Inc. is at the cutting edge of the consistently changing streaming business. Roku has been an industry pioneer, upsetting the manner in which individuals appreciate computerized content. The company has played a significant role in the rapid rise to prominence of the streaming industry due to its commitment to innovation and pioneering role.

As the requirement for on-request diversion keeps on rising, Roku’s obligation to giving inventive arrangements has set its situation as a streaming industry pioneer. The Roku stage has turned into a precept for straightforwardness, assortment, and usability in the streaming media industry, as an ever increasing number of individuals ditch link and satellite television for online other options.

Roku’s Products And Services

Roku is focused on offering a wide assortment of streaming choices that are both expanded and open. It shows in its broad item and administration portfolio. The organization’s streaming players are notable for their usability and capacity to change standard televisions into brilliant, web associated devices. These gadgets feature Roku’s commitment to building a comprehensive streaming climate by working with simple admittance to a wide assortment of streaming suppliers.

Roku has extended its product offering to envelop brilliant televisions furnished with its own streaming innovation, as well as streaming players. On the off chance that you’re searching for a television and a streaming stage, this coordination makes it a lot simpler for you to utilize both. This strategy has expanded Roku’s prominence and fortified the organization’s situation on the lookout.

At the core of Roku’s contributions is the Roku Channel, which offers a hand-picked combination of free and paid media to endorsers. The Roku biological system is flourishing in light of the fact that the organization pays attention to its clients’ preferences and gives them a wide assortment of diversion options. This, thus, draws content makers and promoters.

Roku’s Job In The Digital Entertainment Landscape

Roku’s impact extends far beyond its own offerings as a key player in the development of the digital entertainment industry. The vast world of streaming media, which includes live sports, movies, TV shows, news, and more, is easily accessible through Roku. With the assistance of the organization’s foundation, content makers, promoters, and watchers can all cooperate in a commonly useful relationship.

Regardless of how the computerized media outlet changes, Roku is consistently out in front of the bend with regards to new innovation and customer patterns. Its flexibility and commitment to client bliss make it a significant facilitator of the constant progress to computerized utilization. The critical effect that Roku has had on the fate of computerized diversion is a demonstration of its proceeded with significance in a time where comfort, decision, and custom-made encounters are vital.

An Explanation Of The Most Current Roku Insider Trading

Gidon Katz, the company’s President of Consumer Experience, has been at the center of recent allegations of insider trading at streaming industry powerhouse Roku Inc. Katz has been heavily involved in selling Roku Inc. shares for the past year, with the most recent transaction occurring on November 16, 2023, and involving 10,159 shares. Katz has sold a total of 35,605 shares in the last 12 months, with no purchases recorded during this time. This move is the latest in a sequence of transactions.

Investors and market experts have taken notice of the regularity and magnitude of insider sales, particularly when they originate from a senior executive such as Katz. Those inspired by the fate of an organization would do well to watch out for insider trading activity since it is generally accepted to be a basic sign of the sentiments and certainty levels of notable individuals inside the association.

Gidon Katz’s Position As Roku, Inc.’s President Of Consumer Experience

As Leader of Consumer Experience, Gidon Katz is an indispensable piece of Roku Inc. He is responsible for the customer-facing parts of the business and ensuring they’re running great at this job. Making and executing intends to increment client contribution and bliss is a piece of this. Given his situation, Katz has broad information on the internal functions of the business, as well as its techniques on the lookout and its associations with clients. As a result, his trading activities are highly consequential, and deciphering the reasons for his recent share sales is essential for understanding the trajectory of the company.

Katz has substantial influence over Roku Inc.’s success and stock price as a result of his decisions and actions. His views on the company’s future, possible worries, and other elements that might be impacting his choices can be uncovered by examining his insider trading habits.

How Insider Trading Patterns Illustrate Business Dynamics

Investors that want to know how a company is doing can use insider trading patterns as a good indicator. Key insiders, including executives, have in-depth understanding of the inner workings, financial status, and future goals of their organization. Therefore, they can demonstrate their faith (or lack thereof) in the firm’s future performance by purchasing or selling company shares.

The lack of insider purchases at Roku Inc. over the last year, in conjunction with the business’s continuous pattern of insider sales, begs the issue of how internally the company feels about its near-term growth prospects and stock value. Nevertheless, it is essential to view such findings in a broader context, taking into account aspects such as overall business performance, trends in the industry, and current market conditions. Investors should do a thorough research before making investment decisions, and insider trading is just one part of that investigation. However, it can offer useful insights.

Examining Insider Trading Behavior

A Review Of The Most Recent Insider Sale By Gidon Katz

Recently, Gidon Katz, Roku Inc.’s President of Consumer Experience, sold 10,159 shares on November 16, 2023, and another 1,968 shares on November 3, 2023, demonstrating a substantial amount of insider trading. The 35,605 shares that Katz has sold in the last year are part of a bigger trend that includes these transactions. Importantly, insider purchases have not occurred over this time.

Katz spearheads Roku’s initiatives to increase customer engagement and happiness in his position as President of Consumer Experience. Concerns regarding the reasons for the sell-off and its possible effect on investor confidence arise when a prominent executive like Katz decides to sell a large number of shares.

The Annual Total Of Insider Sales And The Non-Occurrence Of Insider Purchases

Looking at the bigger picture of Roku Inc.’s insider trading activity over the last 12 months indicates a pattern of 30 insider sales with no matching insider purchases. This ongoing trend indicates that insiders are not very optimistic about the company’s near-term growth prospects, valuation, or other internal considerations.

The lack of insider purchases, which are often considered as a show of faith in the future of a company, makes the sell-off even more noteworthy. Investors and market analysts who are seeking to understand the sentiments of those actively involved in running Roku Inc. on a daily basis will carefully examine these trends.

Insider Trading And Its Possible Effects On Investor Sentiment

There might be far-reaching effects on investor mood when insiders trade. Potential investors may be wary of Roku Inc. due to the high number of insider sales, including those by prominent personalities like Gidon Katz. Those with insider knowledge can infer a lack of optimism from the size and absence of equivalent purchases of an organization’s shares when insider selling occurs. However, this does not necessarily indicate that the company’s prospects are unfavorable.

When evaluating a company’s performance and future prospects, investors frequently search for insider trading tendencies. Some insiders may feel this sell-off is a sign of impending problems with the company’s valuation, growth prospects, or other internal issues. The stock’s performance and the mood of the market could be affected by this.

Analyzing Stock Prices And Valuations

Share Price And Market Capitalization Of Roku, Inc. On The Day Of Katz’s Most Recent Sale

Roku Inc.’s market capitalization was $11.99 billion as of the day of Gidon Katz’s most recent sell, when the stock was trading at $80 per share. The stock price of Roku is a reflection of how the market currently values the company, taking into account things like its financial performance, growth potential, and investor mood. A key indication of market dynamics, the stock price is susceptible to influences from both inside and outside the company, as well as from industry trends in general.

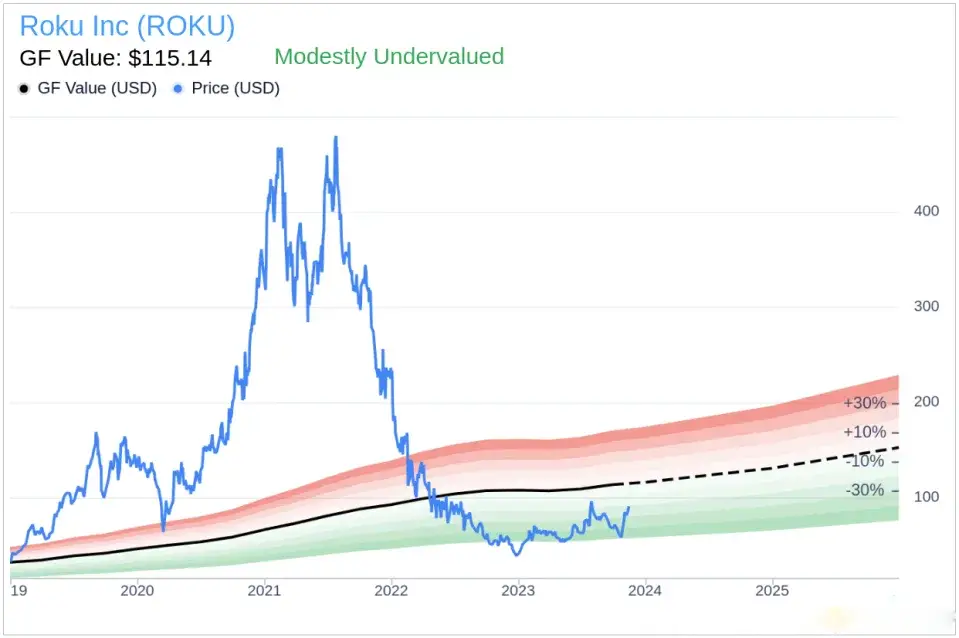

The Guru Focus Value (GF Value) And How It Affects Stock Valuation

The Guru Focus Value (GF Value) measures a stock’s intrinsic worth by factoring in past trading multiples, an adjustment factor exclusive to Guru Focus, and analysts’ projections of the company’s future performance. A GF Value of $177.06 is assigned to Roku, Inc. To compare the market price to, this number is used as a benchmark.

If the GF Value is significantly greater than the market price, it may indicate an undervaluation of the stock, while a lower GF Value could indicate an overvaluation of the stock. The GF Value is a popular instrument among investors for determining a stock’s actual value, independent of short-term market changes.

The Importance Of The Price-To-Gf-Value Ratio For Investors

The Price-to-GF-Value ratio, a crucial measure, calculates by dividing the current market price by the Guru Focus Value. A price-to-GF-Value ratio of 0.45 is determined for Roku Inc. Find out if the market thinks the stock is cheap or expensive with this ratio. The company may be selling at a discount to its intrinsic value if the ratio is less than 1.0, which could indicate a good time to buy. Contrastingly, if the ratio exceeds 1.0, it might indicate that the market is valuing the stock higher than its actual worth.

Guru Focus projections indicate that the market severely undervalues investors in Roku at a price-to-GF-Value ratio of 0.45. But this misalignment between Roku’s current pricing and its true worth makes one wonder how investors see the company’s future success. This ratio is just one of several important fundamental and contextual considerations that investors should make before deciding whether to purchase or sell Roku Inc. shares.

Visualizing Insider Trends And GF Values

Graphical Account Of Roku, Inc.’s Insider Trading

A visual picture of the purchasing and selling tendencies over the past year is provided by the graphical representation of Roku Inc. insider trading activity. The continuous trend of insider selling and the absence of insider buys prominently show Gidon Katz’s most recent transaction. Investors may easily understand the insider trading activity by looking at this graphic, which begs the issue of why there was such a rampant dumping of company shares.

Making Sense Of Insider Trend And GF Value Predictions

According to the insider trend graphic, there has been a steady selling of shares by corporate insiders, especially high-ranking executives like Gidon Katz. The move could make investors wonder if insiders are expressing pessimism about Roku Inc.’s near-term prospects or if there are other variables at work. In the meantime, an additional layer of analysis is provided by the GF Value picture, which includes its own intrinsic value assessment. We need to look at the disconnect between the market’s perception and the company’s fundamental worth more closely because of the slight undervaluation according to GF Value.

Different Views On Insider Selling Considering

There are various perspectives from which insider selling can be understood. On one hand, insiders like Gidon Katz taking advantage of the company’s success or limiting their risk could imply a pessimistic outlook, as they may be worried about its future growth or value. A more unbiased view, on the other hand, could argue that insiders are only looking out for their own financial interests and aren’t trying to hurt the company’s future prospects. When trying to make sense of insider selling, investors should look at the bigger picture, which includes things like past performance, industry trends, and the reasons behind the sale.

Conclusion

Investors should give serious thought to the complex story revealed by the investigation of Roku Inc.’s insider trading activities. Investors assessing Roku have new challenges due to Gidon Katz’s massive sell-off, the general trend of insider sales, and the gap between market value and intrinsic value. Although insider selling is a cause for concern, it is important to put it in context by looking at the industry as a whole, past performance, and current market circumstances. If they want to make it through the streaming scandal unscathed, they need to be careful, do their homework, and consider all of their options.

Frequently Asked Questions

1. Concerning Gidon Katz, What Makes His Insider Trading At Roku Inc. Noteworthy?

At Roku Inc., Gidon Katz plays a pivotal role in his capacity as President of Consumer Experience. Possible reasons for his insider selling include his thoughts about the firm’s future or his own financial situation, both of which could influence how investors feel about the company.

2. How Does The Guru Focus Value (GF Value) Factor Into This Evaluation, And What Is It Anyway?

We evaluate the intrinsic worth using the GF worth, which is proprietary. The fact that it serves as a standard against which stock valuations are measured gives it its value. Concerns regarding market perceptions may arise when there is a notable discrepancy between the market price and GF Value.

3. What Does Roku Inc.’s Lack Of Insider Buys Mean For Investors?

One possible interpretation of the paucity of insider purchases is that firm insiders do not have faith in the stock. Nonetheless, investors must take other factors, such as tax preparation, portfolio diversification, or individual financial requirements, into account.

4. Aside From Pessimism, What Other Possible Motives Could Lead To Insider Selling?

Company executives may sell shares for diversification purposes or other motives that have nothing to do with the future of the company. For a thorough study, it is essential to understand the exact reasons behind insider selling.

5. When Dealing With Insider Trading, How Can Investors Best Handle The Unknowns?

An investor’s due diligence should take into account not just insider trading trends but also industry as a whole, firm performance, and current market circumstances. Making educated investment decisions requires a comprehensive approach.