Introduction

One evil tactic in the intricate world of financial markets—the pump-and-dump scheme—has endured. An example of this manipulation strategy would be to provide misleading information to artificially inflate the price of a security, then quickly sell off the excess, leaving innocent investors holding the bag. A common kind of market manipulation, pump-and-dump schemes have evolved to take advantage of the internet to reach more people. We explore the murky details of this shady playbook, finding out how it affects other areas and how it threatens market honesty.

About Pump-And-Dump

The fraudulent strategy known as “pump-and-dump” aims to artificially boost the price of stocks or securities by employing deceptive advice. Individuals in power who execute the wrongdoing spread deceiving or through and through mistaken data to produce consideration. At the point when the cost goes up, they cash out, making different financial backers lose cash. There will be weighty punishments for this unlawful technique since it breaks protections guidelines. The improvement of cryptographic money has made it more straightforward for online pump-and-dump activities to spread. Tricksters can now contact more individuals through mass messages or web posts, changing the game from cold pitching to hurrying innocent financial backers to purchase specific stocks.

Making Sense Of Financial Market Pump-And-Dump Schemes

In the complex and unpredictable financial market, traders and investors use a variety of tactics to try to make a profit. Having said that, not all market strategies are lawful or ethical. The “pump and dump” method is a manipulative example of this. By dissecting pump and dump systems and looking at real-life examples. This section hopes to offer a thorough examination of these schemes and the dangers they represent.

A Few Pump And Dump Scheme Examples

The Notorious Stratton Oakmont Case From The ’90s

Stratton Oakmont, a brokerage company that was involved in fraudulent operations in the 90s. It is the subject of a notorious pump and dump scheme. The prices of several penny stocks were manipulated by Stratton Oakmont through the use of aggressive sales practices and the dissemination of false information. The company’s owners and associates sold their shares deliberately when prices surged due to artificial inflation. It is by leaving investors with stocks that were practically worthless.

Modern Pump-And-Dump Schemes In The Cryptocurrency Market

Many “pump and dump” operations have flourished in the bitcoin industry. In this setting, advocates for a particular cryptocurrency work to boost its value by spreading positive word of mouth about it. When the price of a cryptocurrency reaches a peak, the schemers quickly sell their holdings, causing the price to fall. As a consequence of this common behavior, many cryptocurrency investors have lost a lot of money.

Advice To Steer Clear Of Being A Victim

Even though it can be difficult to spot pump and dump scams. Investors can take steps to lower their chances of falling victim to them. Prior to placing cash into an organization, financial backers ought to get their work done. And take a gander at its financials, essentials, and market patterns in general. Moreover, financial backers ought to be careful about off the cuff speculation counsel or thoughts from obscure sources. Since these could be dishonest endeavors to fool them into succumbing to tricks.

The Wall Street Wolf: A Case Study

The film “The Wolf of Wall Street” illustrates Stratton Oakmont’s infamous pump-and-dump operations through a dramatized yet instructive narrative. The film exposes the firm’s use of manipulative sales tactics, high-pressure sales, and fraudulent activities; it is based on Jordan Belfort’s real-life experiences. Despite its dramatic tone, the film is a sobering reminder of the perils and repercussions of financial market pump-and-dump scams.

Protection Against Deceptive Practices In Pump-And-Dump Schemes

Coordinated Buying: Fueling A Frenzy Through Collaboration

The first step in most pump-and-dump operations is a concerted attempt to create an artificial buying frenzy for a particular item. Using online forums, social media, or private groups, the offenders push people to acquire a target asset, such as a cryptocurrency that has just been released or a low-volume stock. An inflated price is the result of artificial demand caused by the dissemination of false information or overstated claims regarding the asset’s potential.

An example of this is the rise of pump-and-dump operations in the cryptocurrency market in 2017, exemplified by the now-infamous “Centra Coin.” The cryptocurrency’s social media endorsements from celebrities stoked a purchasing frenzy. The orchestrators increased the price through using deceptive comments and endorsements from celebrities. Investors suffered heavy losses when they eventually liquidated their assets. Advice: Be wary of investment ideas that are overly optimistic or promise easy money. When investing in assets that don’t see a lot of trade activity or have little public data, it’s crucial to do your homework.

Disseminating Misinformation: Using Perception To Influence Price Movements

Spreading inflated or inaccurate information about an item is a common tactic in pump-and-dump tactics. Fake news stories, deceptive press releases, and doctored graphs and charts are just a few examples of the many ways misinformation can appear. Investors are tricked into purchasing the asset at an exorbitant price by the orchestrators’ fabrication of its value or prospects.

An example would be the 2013 pump-and-dump fraud involving the coffee company Jammin’ Java Corp., which led to charges brought by the Securities and Exchange Commission (SEC) against multiple persons. They claimed to have partnered with well-known companies and inflated the company’s growth potential in their bogus press releases. The culprits were able to cash in on their shares after these misleading claims caused the stock price to skyrocket. In order to make informed investing decisions, it is necessary to check the reliability of information. Proofread thoroughly by using authoritative sources, such as news articles and company announcements, to avoid inaccuracies.

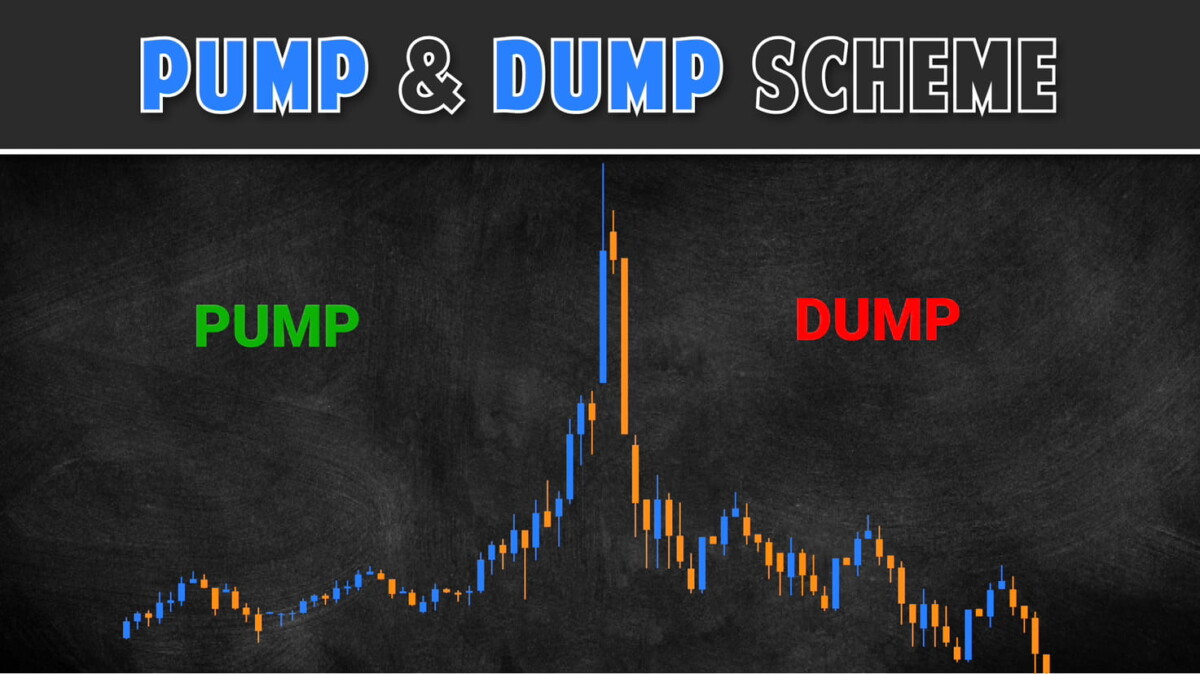

Dump Timing: How To Sell Off Everything For Maximum Impact

The “dump” part of a pump-and-dump scam involves the perpetrators selling their assets at the top of the price spike, after fraudulently inflating their value. The value of the asset drops precipitously as a result of this unexpected sell-off, which causes additional investors to fear. People that invested during the pump phase without doing their research ended up losing a lot of money.

An example of a pump-and-dump strategy was brought to light in 2018 with respect to Cynk Technology Corp., a small-cap stock. By using fictitious social media profiles and false claims, the orchestrators manipulated the market to increase the stock price. The culprits sold their shares once the price peaked, sending the stock tumbling from $21 to a few pennies in a matter of days. Advice: Do your homework before buying assets during abrupt price rises. If an investment promises unrealistically high profits too soon, you should be wary since it could be a sign of manipulation.

Exposing The Players In Pump And Dump Schemes: A Comprehensive Investigation

The Advocates: Experts In Cultivating Lies

The promoters, masterminds behind the deceitful pump and dump scams, are in the vanguard. These persons are in charge of starting the manipulation and coordinating the spread of misleading or overstated information about a particular stock. Promoters build buzz and interest in the targeted stock by using a variety of channels, including social media, online forums, and direct email marketing. Their strategy is to inflate the stock price artificially by luring in unwary investors with promises of quick and significant riches.

One such example is the notorious Stratton Oakmont case, which was made famous by the film “The Wolf of Wall Street.” In order to artificially inflate the prices of penny stocks, Jordan Belfort and his associates used aggressive sales strategies, such as cold calling and high-pressure selling. This highlights the significance of being wary of unsolicited investment advice from someone you don’t know.

Those On The Inside: Protectors Of Secret Knowledge

Pump and dump methods rely heavily on insiders because of the sensitive knowledge they have about the company. Executives, directors, and staff with access to confidential information fall within this category. In order to manipulate the stock price, insiders and promoters work together by disclosing confidential information. In order to lure investors into the market, insiders can artificially inflate the stock’s perceived worth by deliberately leaking positive news or financial data.

Renowned American entrepreneur Martha Stewart was accused of being involved in a pump and dump scheme when she sold her shares of ImClone Systems following her knowledge that the FDA had rejected the company’s new medication application. The stock’s value plummeted as a result of Stewart’s activities, highlighting the fallout from insider involvement in such scams.

The Dumpers: Timing Experts Who Maximize Profits

As the last note in the “pump and dump” symphony, “dumpers” take advantage of the promoters’ manipulation of the stock price to their advantage. In order to maximize their profits before the market drop, these smart investors sell their shares when prices are high. Dumpers are skilled investors who hold a large number of shares and know just when to sell, causing other investors to lose a lot of money.

Several people were indicted by the SEC in 2017 for their roles in a pump-and-dump scam that affected the stock of Jammin’ Java Corp. By spreading misleading information, the group boosted the stock price artificially and then sold their shares quickly when it peaked. Substantial financial losses were left to other investors as a result of this. Be wary of large price swings that happen out of nowhere, especially if they aren’t based on solid fundamentals. Always think twice before putting your money into stocks that have sudden and unexplained price spikes. This way, investors won’t be as vulnerable to the profit-driven tactics used by dumpers.

Standard Methods Used By Pump And Dump Schemes

Disseminating Misinformation

One common tactic is spreading misleading information about a specific cryptocurrency or stock. The criminals generate interest in the asset by posting about it on social media, in online forums, and even on fake news websites. Scammers may exaggerate the investment’s potential profits or make up favorable events that are about to happen by using numerous false accounts to pretend to be insiders. The goal of spreading this false information is to get others to buy into the asset by making them believe in its positive future.

Controlling The Amount In The Market

In order to make it seem as though there is more demand for their targeted asset than there actually is, pump and dump schemers will often manipulate market volume. An important component is coordinated buying, wherein fraudsters buy at the same time to generate a spike in trading activity and artificially inflate prices. When trading activity spikes, it piques the interest of other investors who may see it as a signal of a promising opportunity. The schemers quickly sell their assets after the false inflation has taken place, causing prices to plummet. Markets with less liquidity or cryptocurrencies with a smaller capitalization are ideal for this tactic.

Synced Purchases And Sales

Pump and dump methods rely heavily on coordinated purchasing and selling. The market is whipped into an artificial frenzy when fraudsters work together to make trades all at once. When buyers act in unison, the asset’s price spikes, drawing in more buyers who are lured by the illusion of a profit wave. The schemers plan coordinated sales, which causes prices to drop dramatically all of a sudden, after they have made a lot of money. Those who invested naively during the orchestrated spike have lost a lot of money.

Capitalizing On FOMO

Pump and dump schemes frequently use the FOMO (fear of missing out) approach. By using tactics such as press releases, webinars, or lavish events, perpetrators generate a sense of urgency and enthusiasm for a particular asset. They get people to spend quickly without doing their homework by making them afraid they will lose out on a potentially profitable chance. Once the asset’s value has been artificially inflated, the schemers will leave the market, taking all of their victims’ money with them.

Centrala (CTR) Cryptocurrency Scheme: A Case Study (2017)

The “Centra” (CTR) cryptocurrency was involved in a high-profile case in 2017 that illustrates the evil dynamics of a pump-and-dump scam in the cryptocurrency market. The Centra founders were indicted for fraud for allegedly using misleading tactics to market their Initial Coin Offering (ICO), which included making false assertions about ties with big banks. They caused the price of CTR to surge by generating enormous enthusiasm around their initiative through the use of celebrity endorsements and intense social media campaigns. Deceived investors lost millions of dollars as the value of the cryptocurrency crashed when the scam was revealed.

Learning From Past Incidents

The Wall Street Wolf

The notorious pump-and-dump operation portrayed in “The Wolf of Wall Street” revolved around Jordan Belfort, a broker who dealt in penny stocks. In order to lure investors, Belfort and his partners artificially increased prices. Then, they quickly sold their shares for a tidy profit. Be wary of unsolicited investment advice, particularly if it comes from an unknown source and promises you the moon. It is essential to conduct extensive study and seek advice from reliable financial consultants before making any investing decisions.

Longfin Corp

The announcement of Longfin Corp’s acquisition of a blockchain startup in 2017 caused a dramatic increase in the stock price of the company. Unfortunately, the stock price crashed once the transaction was exposed as a hoax and the company was accused of fraud by the SEC. The Longfin Corp case study shows how important it is to check corporate announcements and news before investing, particularly in new technological areas where pump-and-dump scams are common.

Bitconnect

Bitconnect was an online portal that offered cryptocurrencies and loan programs with the promise of big profits. The aggressive marketing and referral structure caused the cryptocurrency’s value to drop after it was revealed as a Ponzi scheme. Be wary of investing in cryptocurrencies because of the high degree of market volatility and the possibility of price manipulation. Before putting your money into bitcoin initiatives, be sure they are legitimate.

Vemma

The energy drink and supplement distributor Vemma ran a pyramid scheme that prioritized new recruits above actual revenue. The Federal Trade Commission (FTC) took legal action, which caused Vemma to cease down. He used product-focused business models and the need to identify real multi-level marketing (MLM) organizations from pyramid schemes.

Regulatory Measures: A Comprehensive Overview For Investor Protection

Proceedings Of The Securities And Exchange Commission

The SEC investigates and prosecutes those engaged in pump-and-dump schemes as part of its active enforcement of securities laws. As an example of SEC action, the case of Jordan Belfort led to convictions for money laundering and securities fraud, as well as incarceration and restitution orders.

Anti-Fraud Laws

The broadcast of misleading information and the manipulation of stock prices are criminalized under anti-fraud laws passed by several nations. The FCA is responsible for investigating questionable trade practices and levying fines in order to prevent market manipulation in the United Kingdom.

Technological Market Surveillance

In order to keep tabs on the trading activity, regulatory organizations use cutting-edge surveillance techniques and technologies. Regulators can proactively identify possible pump-and-dump schemes with the help of algorithmic trading surveillance tools, which detect anomalous actions.

Raising Awareness And Educating Investors

To lessen the blow of pump-and-dump scams, regulatory agencies stress the importance of investor education. In order to help investors recognize and stay away from fraudulent activity, the SEC offers educational tools and resources.

Considering The Consequences Of Price Manipulation

The Unraveling Of Market Volatility

Manipulating prices, especially through pump-and-dump schemes, causes market volatility by injecting artificial inflation. A precipitous and extreme decline in pricing occurs when the plan falls apart due to unsustainable and artificially inflated prices. The market becomes even more unstable as a result of this, as panic selling ensues. Because of this, real investors have a harder time making decisions, and people lose faith in the market’s capacity to remain stable in the long run.

The Foundation’s Impact On Investor Confidence

The sneaky practice of manipulating prices erodes trust among investors. Investors may become wary of getting involved or staying in the market if they suspect price manipulation. The market’s growth and development are hindered by decreasing trading volumes, liquidity issues, and this general lack of confidence.

The Authorities’ Keen Observation Of Regulations

Schemes to manipulate prices attract the notice of regulatory agencies. As soon as they become aware of a crime, authorities step in to conduct an investigation and bring those responsible to justice. Penalties might vary from monetary fines to formal criminal charges. The increased regulatory monitoring creates a sense of unease among those who could try to manipulate the market, which in turn discourages illegal conduct.

Negative Impact On Reputation: Persistent Spots

Companies whose names are associated with manipulating prices take a major hit to their credibility. Once revealed, the public’s and investors’ faith in the system begins to decline, which has long-lasting effects. Possible legal ramifications, challenges in obtaining investors, and other implications are on the list. The entity’s position in the market is affected by the lingering scar of a damaged reputation.

Negative Impact On Market Efficiency

Manipulating prices causes a waste of resources because it interferes with the inherent dynamics of supply and demand. Inflated prices make it harder for investors to determine what an asset or security is really worth. The market’s general health and functionality are impacted by this capital misallocation, which impairs market efficiency.

Conclusion

Financial market exploitation tactics are constantly developing to keep up with the times. Investors must be vigilant and regulators must respond strongly to the continuous threat of pump-and-dump scheme. Safeguarding the integrity of financial markets for all participants requires a joint effort to educate, detect, and counteract these misleading methods of modern market manipulation.

Frequently Asked Questions

1. Could You At Any Point Make Sense Of A Pump And-Dump Investigation?

By disseminating inaccurate or misleading information, a pump-and-dump strategy seeks to deceive investors into believing that an asset is worth more than it actually is. When assets are quickly sold after a brief increase in value, the price falls, leaving unsuspecting investors with significant losses.

2. How Do Con Artists In The Present Market Do Pump And-Dump Schemes?

In the present computerized world, crooks often use email, virtual entertainment, and other web-based stages to spread bogus data and create fervor about a particular security. These controllers are very educated, and they utilize the web for their potential benefit.

3. What Results Do Pump And-Dump Schemes Include?

Some of the far-reaching effects of pump-and-dump Schemes include market instability, decreased investor trust, regulatory scrutiny, reputational harm, and diminished market efficiency. Both experienced and unpracticed financial backers are impacted by the sudden changes in cost, which upset the ordinary progression of the market.

4. How Could Standard Individuals Try Not To Be Manipulated Into Pump And-Dump Tricks?

Careful exploration ought to constantly go before financial planning choices for the financial backer’s wellbeing. Precaution methodologies incorporate being careful about spontaneous data, especially from obscure sources, and staying aware of market improvements. Moreover, it is basic to know about the signs of market control.

5. Is There Any Regulation To Forestall Pump And-Dump Plans?

To forestall Pump and-dump tasks, administrative offices watch out for the business sectors and rebuff those included lawfully. An individual might have to deal with both common and criminal damages. To forestall extortion and safeguard the trustworthiness of the market, controllers are getting serious harder on organizations.