Introduction

Insider trading by politicians is an immoral behavior that has attracted a lot of attention recently. It entails the purchase and sale of stocks based on information that isn’t generally known. Despite the fact that this method is prohibited, some politicians nonetheless benefit from it. It is critical to comprehend the reasons why this activity is unethical, the effects it might have, and what can be done to stop it from happening again. We can better understand the potential risks and what steps may be taken to mitigate them by looking into the many facets of this practice.

Political Insider Trading

Political insider trading refers to the practice of making unauthorized stock trades. Insider trading occurs when politicians or their associates unlawfully profit from confidential information. The process of selecting a company while in possession of sensitive data is frequent. It was restricted to people in authoritative political roles. Illegality stems from the insider’s disadvantage when engaging in such trading. It’s a technique for them to boost their earnings at the expense of other stockholders.

Therefore, securities laws prohibit it. Political insider trading has become a big problem that threatens the economy in recent years. It allows those in authority to take advantage of their positions for their own gain. Suppose an American politician is accused of insider trading and found guilty. If the accusations are proven accurate, they might be subject to life in prison. Politicians who participate in insider trading risk criminal prosecution in numerous nations.

What Regulations Have Been Put In Place For Insider Traders?

The Stop Trading in Congressional Knowledge Act (STOCK Act)

It is a violation of this act, which applies to members of Congress as well as other government employees, to use information that is not easily accessible to the general public in order to gain an unfair advantage in the stock market. This law applies to both the United States and the United Kingdom.

Ethics in Government Act

As a result of this law, certain officials in the government are subject to the responsibility of reporting to the public the various financial dealings that they participate in. This obligation applies to such officials even if the public does not specifically request this information.

The Sarbanes-Oxley Act of 2002

In order to comply with this law, publicly traded corporations have the obligation to report any probable instances of insider trading that may have taken place. According to the Securities and Exchange Commission’s Regulation 10b-5, the following kinds of behaviour are not allowed in the marketplace:

Because of this regulation, it is against the law for anybody to engage in acts that are dishonest or manipulative in connection with the buying or selling of stocks. This applies to both online and offline transactions.

The Securities and Exchange Commission’s Rule 10b-5

According to Regulation 10b-5 issued by the Securities and Exchange Commission, the following types of conduct are prohibited from being engaged within the market:

It is against the law for anybody to engage in activities that are dishonest or manipulative in connection with the purchasing or selling of stocks because of this legislation. This is true for transactions carried out both online and in person.

The Foreign Corrupt Practices Act

Because of this legislation, it is against the law for businesses that have their headquarters in the United States as well as the officers of those businesses to pay bribes to public authorities located in other countries in order to secure business. This law applies to both foreign and domestic bribery.

The Insider Trading Sanctions Act of 1984

Anyone who engages in insider trading puts themselves in a position where they could be subject to the civil and criminal penalties that are authorized by this Act. These consequences can include fines and jail time. Depending on the specifics of the case, either civil or criminal proceedings may be necessary in order to carry out the imposition of these sanctions.

Examples of Politicians Engaged in Insider Trading

Senator Richard Burr

Representative Richard Burr of North Carolina has been at the center of attention as of late because of charges of insider exchanging. On May thirteenth, 2020, the FBI executed a court order at Burr’s home in Washington, DC. The examination is centered around stock exchanges he made in February 2020, which were made with the data he had because of his job as a Congressperson.

Burr has denied any bad behavior, asserting he had no insider information on when he made the exchanges. He has likewise expressed he will step down as the Executive of the Senate Knowledge Board until the examination is finished.

Burr is the furthest down the line lawmaker to go under examination for insider exchanging. The Protections and Trade Commission has seen an ascent in the quantity of cases including individuals from Congress exchanging on inside data. The SEC as of late sought after and won bodies of evidence against Congresspersons Kelly Loeffler of Georgia, Jim Inhofe of Oklahoma, and David Schweikert of Arizona.

The SEC has expressed that insider exchanging is a serious infringement of the law and can bring about huge common and criminal punishments. All individuals from Congress and other public authorities should stick to the best expectations of moral lead. They should don’t manhandle their places of trust and act in manners that exploit their advantaged data.

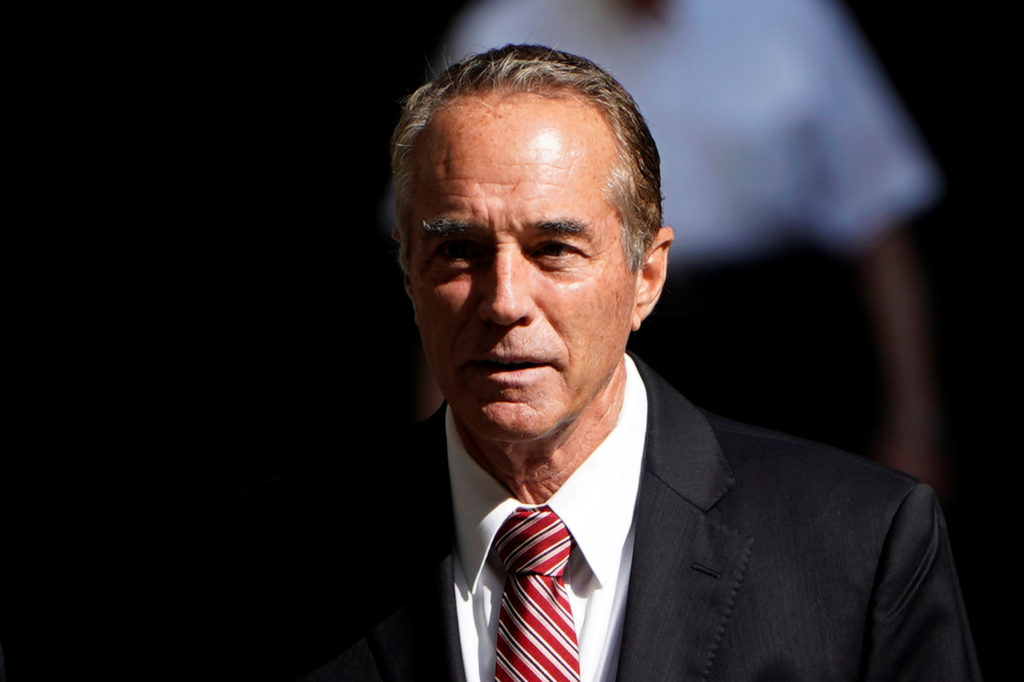

U.S. Representative Chris Collins

U.S. Delegate Chris Collins is a conservative legislator who filled in as the U.S. Delegate for New York’s 27th legislative region from 2013 to 2019. In August 2018, he was arraigned on charges of insider exchanging. Collins was blamed for utilizing non-public data to pursue venture choices. Also, giving the data to relatives and partners. He was likewise blamed for deceiving the FBI and government examiners to conceal his contribution in insider exchanging.

Collins was blamed for involving his situation as a Delegate to get non-public data about Inborn Immunotherapeutics, an Australian biotechnology firm. He then, at that point, told his child, who involved the data to make an interest in the firm and let the news out. Collins likewise bought shares in the organization for him as well as his loved ones.

In October 2019, Collins confessed to charges of insider exchanging and misleading the FBI. He was condemned to 26 months in government jail. What’s more, was requested to pay a $200,000 fine and $1.7 million in compensation. Collins left his situation as Agent in October 2019, preceding his condemning.

Collins’ contribution in insider exchanging is a useful example of the outcomes of utilizing one’s, strategic, influential place to acquire monetary advantages unlawfully. His activities show the significance of maintaining moral guidelines in the political circle and guaranteeing that people with great influence are considered responsible for their activities.

Former U.S. Representative Aaron Schock

Former U.S. Representative Aaron Schock was a politician from Illinois who served in the U.S. House of Representatives from 2009 to 2015. In March 2016, Schock was charged with 24 criminal counts of misusing public funds, wire fraud, and filing false tax returns. Schock was also investigated for potential insider trading violations.

In July 2017, it was announced that the U.S. Securities and Exchange Commission (SEC) was looking into allegations that Schock had engaged in insider trading. According to the SEC, Schock had bought stock in a company shortly before it was acquired by a larger company. This allowed Schock to reap a large profit from the acquisition. The SEC also alleged that Schock had received information about the acquisition from a source inside the company. And that the source had likely tipped him off about the acquisition.

SEC’s investigation

The SEC’s investigation into Schock’s stock trades concluded in November 2018 when Schock agreed to pay a $19,000 civil penalty to settle the SEC’s charges. Schock neither admitted nor denied any of the SEC’s allegations.

Despite being investigated for insider trading, Schock was never criminally charged for the conduct. This may be because the SEC’s investigation determined that Schock had not received any inside information when trading the stock. However, Schock’s agreement with the SEC did not exonerate him from criminal charges. The SEC’s findings may have been used as evidence in a criminal case against him.

In April 2019, Schock pleaded guilty to one count of wire fraud and one count of making false statements to the government in connection with his misuse of public funds. He was sentenced to three years of probation and ordered to pay $68,000 in restitution. Schock also agreed to never seek public office again.

The case of former U.S. Representative Aaron Schock serves as a reminder that insider trading is a serious violation of securities law. And can carry serious consequences. Schock’s case also serves as an example of how even a seemingly minor violation of securities law. It can lead to criminal charges if the conduct is egregious enough.

Former U.S. Representative Jesse Jackson Jr.

Jesse Jackson Jr., the previous U.S. delegate, was blamed for participating in insider exchanging while in office. In 2013, Jackson and his better half Sandi were arraigned by the U.S. Branch of Equity for misrepresentation, intrigue, and misleading maltreatment crusade reserves.

The couple was blamed for utilizing $750,000 of mission cash to pay for individual extravagances. Jackson was likewise accused of wrongfully utilizing his legislative staff to do individual tasks. For example, buying a $43,350 Rolex watch.

Furthermore, Jackson was accused of insider exchanging. He was blamed for exchanging on nonpublic data about an organization called USEC Inc. It is a thermal power firm whose shares he had bought. The charges claimed that Jackson bought the stock in light of data he had gotten from a lobbyist. It was not openly accessible.

Jackson at last conceded to the charges and was condemned to 30 months in jail, as well as 3 years of managed discharge. His better half was condemned to a year in jail, trailed by year and a half of regulated discharge. The two people were additionally requested to pay compensation.

The Jackson case fills in as a sign of the significance of keeping the regulations that oversee insider exchanging and other monetary violations. It likewise fills in as a sign of the requirement for straightforwardness and responsibility in government.

Nancy Pelosi

House Speaker Nancy Pelosi is a well-known politician in the United States. Since she is a public figure, Pelosi’s business dealings have been scrutinized, with some claiming she engaged in insider trading.

A form of market manipulation, insider trading occurs when a person in possession of non-public knowledge trades on it. An individual who knows that a firm is likely to announce a merger can acquire shares in the target company in anticipation of the deal’s announcement and the subsequent boost in the share price.

When Visa went public in 2011, Pelosi was accused of insider trading for buying a stock just before the IPO. She allegedly bought Visa stock before it went public after receiving insider information from her husband, a board member of the corporation.

U.S. Securities and Exchange Commission looked into the allegations but eventually decided not to pursue the matter. Pelosi defended herself by saying that she had acted on the advice of a financial counselor. And had not received any non-public information from her husband.

Pelosi’s rumored involvement in the insider trading incident prompted calls for greater transparency in the financial transactions of public people despite a lack of evidence. Moreover, it demonstrated that not even the most influential politicians are safe from accusations of unethical behavior.

Unethical Practices in Insider Trading

Use of Confidential Information

While negotiating deals, politicians can exploit information that is not available to the public to their advantage. Taking advantage of private information to obtain a competitive edge in the stock market may fall under this category. Examples of such knowledge include impending mergers, acquisitions, or earnings releases.

Speculation Based on Tips

When it comes to making trades, politicians have the ability to get inside information from brokers and other professionals working in the financial industry, which they can then use to their advantage. It is against the law for them to do this because it provides them an unfair advantage over other investors.

Using One’s Political Contacts for Financial Gain

There is a possibility that politicians have access to confidential political information. It could provide them with a competitive advantage in the market. This can involve access to political intel or news that has the potential to affect the stock market.

Trading in One’s Own Interests

Politicians have the ability to profit from their positions by engaging in business activities on their own behalf. This could involve trading on the stocks of firms in which they have a financial stake. It could involve providing information to members of the investor’s family or circle of friends so that they can make trades.

Abusing Power

Politicians have the ability to use their power to exert pressure or exert influence market participants to take particular stances. This could involve making a promise or utilizing a threat in order to convince someone to strike a deal that would be beneficial to the politician.

Dealing With Securities That Have Not Been Enrolled

Politicians are allowed to trade on unregistered securities with the Securities and Exchange Commission (SEC). Trading on equities that are not available to the general public or trading in private investments are examples of what this could entail.

Front Run

When politicians know about impending trades, they have an advantage over other people. It is because they can make trading before everyone else. Because doing so provides the politician with an unfair advantage in the market, this conduct is prohibited.

Politicians are in a position of power and can use that influence to their advantage by indulging in any of these immoral behaviors. This allows them to manipulate the stock market for their own personal gain. It is essential to have knowledge of these practices and to report anything that seems fishy to the appropriate authorities immediately.

The Consequences of Politician’s Insider Trading

The effects of public trust and confidence

At the point when legislators take part in insider exchanging, they put themselves at risk for confronting cruel repercussions. Loss of public trust and confidence in the political framework is one of the repercussions that should be visible very quickly subsequently. At the point when individuals from the public figure out that legislators have been enjoying insider exchanging, they might begin to scrutinize the trustworthiness of their chiefs. This can bring about a deficiency of trust in the organization along with a decrease in elector turnout, the two of which can have huge ramifications for the general public being referred to.

Exchanging on inside data can likewise bring about a breakdown of certainty between the political foundation and the citizens. This could bring about electors losing confidence in the popularity-based process since they might start to be uncertain that their chosen authorities are acting to their greatest advantage. This can bring about a decrease in political contribution since electors might turn out to be less ready to partake in equitable cycles as an immediate result.

Financial penalties

There is additionally the potential for serious monetary repercussions for lawmakers who participate in insider exchange. Insider exchanging might be a wrongdoing that is deserving of significant punishments or potentially time spent in prison, nonetheless, this differs from purview to country. Under particular conditions, individuals from the overall population may likewise be qualified for document a legitimate case against a lawmaker for pay for misfortunes supported because of insider exchanging. These disciplines can possibly be extremely serious, and they can possibly impact the standing and vocation of a legislator.

Conclusion

Government officials’ insider exchanging is a mind-boggling and exploitative practice that has made various people and organizations experience monetary misfortunes. Notwithstanding the guidelines set up to safeguard against it, the training keeps on being an issue in the political circle. It means a lot to proceed to screen and uphold existing standards to assist with guaranteeing that lawmakers don’t utilize their, key, influential places to acquire uncalled-for benefits in the financial exchange. With expanded examination, we can pursue a more moral and straightforward political framework.

Frequently Asked Questions

1. What is Government Officials’ Insider Exchanging?

Lawmakers’ insider exchanging is the act of buying protections or different resources in view of data that isn’t accessible to the overall population.

2. Is Lawmakers’ Insider Exchanging unlawful?

Indeed, lawmakers’ insider exchange is unlawful in both the US and in numerous different nations.

3. What are the results of Legislators’ Insider Exchanging?

The results of lawmakers’ insider exchanging incorporate fines, prison time, and moral and reputational harm.

4. Are there any regulations or guidelines set up to forestall Lawmakers’ Insider Exchanges?

Indeed, there are regulations and guidelines set up to forestall lawmakers’ insider exchange. These incorporate the Insider Exchanging Approvals Demonstration of 1984 and the Sarbanes-Oxley Demonstration of 2002.

5. What are a portion of the ways of distinguishing Legislators’ Insider Exchanging?

A portion of the ways of recognizing legislators’ insider exchanging incorporates searching for dubiously coordinated exchanges and unexpected changes in the cost of a specific security or resource. It is likewise vital to screen the individual exchange exercises of legislators and others who approach classified data.