Introduction

It was accounted for in mid 2021 that Nancy Pelosi’s significant other, Paul, was entangled in an insider trading embarrassment. Paul directs the Place of Delegates as its chief. The charges focused on Mr. Pelosi’s acquisition of call choices on innovation organization Letter set Inc. for a great many dollars in the weeks paving the way to the progression of antitrust regulation focusing on huge tech organizations like Letter set by the House Legal executive Panel. Mr. Pelosi’s conceivable admittance to non-public information on the forthcoming regulation was called into uncertainty by the planning of the exchanges.

Since the occurrence spread, there have been calls for Mr. Pelosi’s direct to be investigated. This episode has shown how significant it is for public authorities and their families to be straightforward and legit with their funds. This article will examine the insider exchanging contention including Paul Pelosi, investigating the proof and talking about the potential results for the people in question.

Who is Paul Pelosi?

The Speaker of the United States House of Representatives’ husband, Paul Pelosi, is a successful businessman and investor. Paul Pelosi has a background in finance and real estate, and he has worked in various roles throughout his career, including as an investment banker, venture capitalist, and real estate developer. In addition to his work, Mr. Pelosi has done a lot of good things for other people, especially in the fields of education and the environment. However, he has also faced criticism for his political connections and for potential conflicts of interest related to his business dealings.

How Paul Pelosi Engaged in Insider Trading

Paul Pelosi’s alleged insider trading involved purchasing call options on Alphabet Inc. and then exercising those options just days before the stock price began to rise. The timing of his trades has raised questions about whether he had access to non-public information about the draft legislation that could potentially impact the business operations of Alphabet Inc.

In December 2020, Mr. Pelosi purchased call options on Alphabet Inc. worth between $500,000 and $1 million. Call options are a type of financial contract that give the buyer the right, but not the obligation.To purchase a specific security at a predetermined price (known as the strike price) before a specific expiration date. In this case, the target price of the call options was $1,400, and they were good until March 19, 2021.

On 1 March 2021, the House Energy and Commerce Committee published a bill draft that would alter the governance of online platforms such as Google and Facebook. The draft legislation was not public at the time, and it included provisions that could potentially impact the business operations of Alphabet Inc.

The Insider Trading Scheme Concocted by Paul Pelosi

The stock cost of Letter set Inc. started to ascend soon after the public arrival of the draft regulation. On Walk 5, 2021, Paul Pelosi practiced his call choices, buying 4,000 portions of Letter set Inc. Stock at a strike cost of $1,400 per share. Following seven days, he sold the offers and made more than $5 million.

The way that Mr. Pelosi bought call choices on Letter set Inc. only a couple of months before the arrival of the draft regulation, and afterward practiced those choices only days before the stock value started to rise, has driven some to guess that he might have approached non-public data about the regulation. The Protections and Trade Commission (SEC) is at present researching the make a difference to decide if insider exchanging happened.

Important disregarding U.S. protections rules by taking part in insider exchanging is a crime. The law commands that insiders reveal their exchanges and abstain from following up on material, non-public data. The SEC energetically authorizes the Protections Trade Demonstration of 1934’s forbiddance on exchanging stocks in view of material. Non-public data to stay away from “insider exchanging.” Assume incidentally, Mr. Pelosi exchanged on inside data. He could confront major lawful and monetary consequences, like fines, punishments, and prison time.

People Involved In Paul Pelosi Insider Trading Scandal

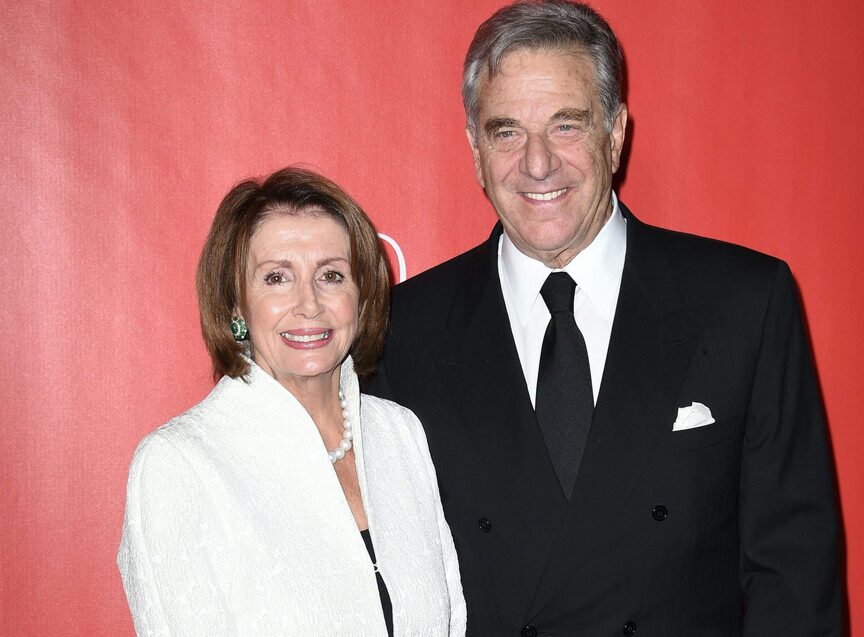

Nancy Pelosi

Nancy Pelosi, who is the Speaker of the House of Representatives, has been tied to Paul Pelosi’s insider trading scandal. Nancy’s husband, Paul Pelosi Sr., had invested in companies that made money from the coronavirus relief law. Using her influence as Speaker, she was accused of coercing her husband to give her stock advice.

Alexandria Pelosi

Alexandria Pelosi, Nancy Pelosi’s daughter, was also linked to the insider trading scandal involving her father, Paul Pelosi. Reports claimed that Alexandria made profitable stock trades after receiving insider information from her father.

Christine Pelosi

Pelosi’s daughter Christine was also implicated in Paul Sr.’s insider trading scam. Pelosi, a political strategist, has been accused of using her family’s connections to the stock market for personal gain. Pelosi has publicly disputed the charges and claimed ignorance of her father’s business operations.

Paul Pelosi Sr.

Nancy Pelosi’s husband, Paul Pelosi Sr., was at the core of the Paul Pelosi Insider Trading Scandal. The public believed that Paul had profited from insider knowledge about securities gathered during his political career. Paul denied the allegations, stating that his wife and daughters had nothing to do with the investments he had made.

John Burton

Also complicit in the same insider trading scheme as Paul Pelosi was former member of Congress John Burton. Burton Pelosi, son of Paul Pelosi Sr., allegedly utilized confidential information obtained from his father to gain money in the stock market. Burton contested those assertions by indicating he was unaware of Paul’s financial dealings.

John Podesta

The insider trading case involving Paul Pelosi has been linked to political strategist John Podesta. Podesta allegedly received confidential information from Paul Pelosi Sr. and utilized it to make profitable financial trades, as reported by the media. Podesta rejected the accusations, stating he had no idea where Paul was putting his money.

James A. Wolfe

Former assistant to the Senate Intelligence Committee James A. Comey’s name has surfaced in other scandals, such as the insider trading scheme involving Paul Pelosi. Allegations have surfaced connecting Wolfe to the Iran-Contra affair. Wolfe allegedly utilized information provided to him by Paul Pelosi Sr. in order to profit from stock trading.

Timeline Of Events Leading Up To The Scandal

Here is a detailed timeline of events leading up to the Paul Pelosi insider trading scandal:

December 2020

Paul Pelosi, husband of Speaker of the House Nancy Pelosi, purchases call options on Alphabet Inc. worth between $500,000 and $1 million. The call options have a strike price of $1,400 and an expiration date of March 19, 2021.

February 2021

The House Judiciary Committee releases a draft of legislation that could impact the business operations of tech companies, including Alphabet Inc. The draft legislation includes provisions that could make it easier for news organizations to negotiate with tech companies for the use of their content.

March 5, 2021

Mr. Pelosi exercises his call options, purchasing 4,000 shares of Alphabet Inc. stock at the strike price of $1,400 per share, for a total cost of $5.3 million.

March 12, 2021

Mr. Pelosi sells the shares he purchased just a week earlier, for a profit of over $5 million.

March 19, 2021

The expiration date for Mr. Pelosi’s call options on Alphabet Inc.

March 25, 2021

The House Judiciary Committee approves the draft legislation.

April 2021

News outlets report on Mr. Pelosi’s stock trades, raising questions about whether he had access to non-public information about the draft legislation.

May 2021

The Securities and Exchange Commission (SEC) begins an investigation into Mr. Pelosi’s stock trades to determine whether he engaged in insider trading.

Fallout and Consequences

The fallout from the Paul Pelosi insider trading scandal has been significant, both for Mr. Pelosi personally and for the broader political and financial landscape. Here is a detailed look at the consequences of the scandal:

Responses from Nancy Pelosi and others

Speaker of the House Nancy Pelosi has openly shielded her better half, expressing that his stock exchanges were lawful and made in light of public data. She has additionally called for expanded straightforwardness and responsibility in the monetary business. Different lawmakers and monetary specialists have said something regarding the matter, with a few calling for examinations and others censuring the presence of indecency. Calls for examinations and expected legitimate repercussions

The Securities and exchange commission (SEC) is presently researching Mr. Pelosi’s stock exchanges to decide if he participated in insider exchanging. Assuming incidentally, he exchanged on inside data, he could confront serious legitimate and monetary issues, like fines, expenses, and, surprisingly, criminal accusations.

Influence on Mr. Pelosi’s Standing and Vocation

Regardless of whether Mr. Pelosi is excused of insider exchanging, the doubt and examination concerning his exchanges might have seriously harmed his standing and vocation. Any allegations of wrongdoing made against the life partner of a couple of the main forerunners in the nation would be dependent upon extraordinary examination and could have serious political repercussions.

Suggestions for the monetary business

The supposed insider exchanging by Mr. Pelosi features the requirement for expanded straightforwardness and moral direct in the monetary business. It additionally brings up issues about the adequacy of existing regulations and guidelines in forestalling insider exchanging and different types of monetary unfortunate behavior. Expanded examination of monetary practices and potential changes to forestall future outrages might result from the outcome of the ongoing one.

Significance of straightforwardness and moral lead

The Paul Pelosi insider exchanging embarrassment highlights the significance of straightforwardness and moral direct in every aspect of public life, including legislative issues and money. Straightforwardness and making the best choice are significant for keeping the public’s trust and trust in our establishments. Any deviation from these norms should be conscious and lawful.

Potential changes to forestall future insider exchanging outrages

The supposed insider exchanging by Mr. Pelosi could prompt potential changes pointed toward forestalling future outrages. These changes could incorporate stricter exposure necessities for individuals from Congress and their companions, expanded implementation endeavors by administrative organizations like the SEC, and expanded straightforwardness and responsibility in monetary exchanges.

Lessons Learned

The Paul Pelosi insider trading scandal highlights several important lessons for the financial industry and for the broader public. Here are some of the most important lessons:

Transparency Is Crucial

The scandal underscores the importance of transparency in all financial transactions, especially those involving public officials or their family members. The more information that is publicly available about financial transactions, the less likely it is that impropriety will go unnoticed. Increased transparency can also help to rebuild public trust and confidence in financial institutions.

Ethical Conduct Is Essential

The controversy has highlighted the significance of acting ethically in economic and political settings. Every monetary exchange must be carried out in the utmost integrity. Public officials and their families have a duty to act in an honest way and to avoid. Doing anything that could make it look like they are using their roles for their own benefit.

Existing Laws And Regulations May Be Insufficient

The scandal raises questions about the effectiveness of existing laws and regulations in preventing insider trading and other forms of financial misconduct. There may need to be more rules and enforcement to make sure that financial deals are fair and clear. It may be necessary for the public and government to collaborate to enforce the law and restore public trust.

Public Officials And Their Families Should Be Held To Higher Standards

Public officials and their family members should be held to a higher standard when it comes to financial transactions. They are influential because they have access to knowledge the general public does not.This necessitates an explanation for any behavior that could be interpreted as exploitative of their financial situation.

Reforms May Be Necessary

The Paul Pelosi insider trading scandal could lead to potential reforms aimed at preventing future scandals. These reforms could include stricter disclosure requirements for members of Congress and their spouse. Increased enforcement efforts by regulatory agencies like the SEC, and increased transparency and accountability in financial transactions. Trust can be rebuilt and rules can be followed if the government and the people work together.

Conclusion

The Paul Pelosi insider trading scandal has brought attention to the importance of transparency. And ethical conduct in the financial industry and government. While investigations are ongoing, the fallout from the scandal has had significant consequences for Pelosi and others implicated in the scandal, leading to calls for reforms to prevent insider trading by elected officials. The scandal highlights the need for continued monitoring and accountability of elected officials to prevent future scandals and promote greater transparency and ethical conduct.

Frequently Asked Questions

1. Did Mr. Pelosi have access to non-public information about the draft legislation?

The fact that he purchased call options on Alphabet Inc. just months before the release of the draft legislation. And then exercised those options just days before the stock price began to rise, has led some to speculate that he may have had access to non-public information.

2. Was Mr. Pelosi’s purchase of call options on Alphabet Inc. a coincidence or a calculated investment strategy?

While the purchase and sale of call options is a legal investment strategy. The timing of Mr. Pelosi’s trades is concerning and has led to questions about whether he was using non-public information to make investment decisions.

3. Did Mr. Pelosi violate any laws or regulations?

The Securities and Exchange Commission (SEC) is currently investigating the matter to determine whether Mr. Pelosi engaged in insider trading, which is illegal under U.S. securities laws.

4. What impact will the investigation have on Mr. Pelosi’s reputation and career?

The mere investigation and conjecture about Mr. Pelosi’s trades may have a severe impact on his reputation and career. Regardless of whether or not he was found to have engaged in insider trading. He could be in serious legal and financial trouble if he is discovered to have engaged in insider trading.

5. What steps can be taken to prevent future insider trading scandals?

The alleged insider trading by Mr. Pelosi highlights the need for increased transparency and ethical conduct in the financial industry. Possible reforms could include stricter disclosure requirements for members of Congress and their spouses. As well as increased enforcement efforts by regulatory agencies like the SEC.