Introduction

PacWest Bancorp (PACW) is one of the largest regional banks in the US and a leading provider of financial services in the Western US. In recent years, PacWest Bancorp has come under scrutiny for allegations of insider trading activity. Insider trading occurs when individuals or entities with nonpublic information about a company’s financial situation or other business practices leverage that knowledge for personal financial gain. Since the 1980s, this practice has been against the law, and if found to be in violation, businesses could face financial and legal penalties. In this article, we will investigate PacWest Bancorp’s stock developments throughout the course of recent years to acquire a superior comprehension of what may be going on in the background with regard to insider exchange movement.

History And Financials Of PACW

PACW (PacWest Bancorp) is an American regional bank holding company, headquartered in Los Angeles, California. It was founded in 1995. PACW operates a network of over 160 branches and offices in California with a full-service commercial banking platform and provides various banking solutions, including loan, deposit, cash management, and wealth management services.

History

Redefine Capital Inc. and Zions Bancorporation, two private banking firms, merged in 1995 to form PACW, which began operations. Presently, the organization procured a Business Bank, which gave business banking administrations to small and medium-sized organizations. PACW turned into a public corporation in 1996 when it started exchanging on the Nasdaq under the image “PACW”.

In 2000, PACW acquired PFF Bancorp, a Stockton-based bank that had been established in California since 1915. This acquisition helped to expand the bank’s presence and enabled it to offer a broader array of banking products and services.

In 2018, the company acquired Bank of the West in a $3.7 billion deal, making it the largest bank in California. The acquisition increased PACW’s total assets to over $82 billion and provided it with a broader customer base and increased presence in the western United States. The transaction was completed in August 2020.

In 2020, PACW announced that it had entered into an agreement with Wells Fargo to acquire its commercial banking unit for $410 million. The acquisition, which is expected to be completed in 2021, will add 28 locations to PACW’s presence and more than $7 billion in assets.

Financials

As of December 2020, PACW had total assets of $97.5 billion and total deposits of $80.6 billion. In addition, the company had total loans of $70.1 billion and total stockholders’ equity of $9.6 billion.

In 2020, the company reported total revenue of $1.4 billion, net interest income of $1.3 billion, and net earnings of $346 million. This represented a slight increase over 2019’s net income, which was $337 million.

PACW has paid out regular dividends since its IPO in 1996. The company declared a dividend of $0.30 per share in October 2020, which represents an annual yield of 2.5%.

Recent Insider Trading Activity At Pacwest Bancorp

Insider trading is a major factor that plays into a company’s success or failure. Insider trading is the buying and selling of a company’s stock by members of the organization’s executive team and board of directors. It can provide a deeper insight into the company and help investors anticipate any potential changes or events that may affect the company’s performance. The following is an overview of the most recent insider trading activity at PacWest Bancorp.

Details Of Reported Insider Transactions

PacWest Bancorp (PACW) is a banking services holding company that operates more than a hundred banks in the Western United States. The company is publicly traded on the New York Stock Exchange (NYSE), and it has experienced considerable growth in recent years. Given the success of PacWest’s operations. Insiders and investors around the world are monitoring the company’s stock price and the recent insider trading activity. This chapter provides an overview of reported insider trading activities at PacWest Bancorp.

The most recent insider trading activities at PacWest Bancorp involve directors, officers, and other corporate insiders such as beneficial owners of more than 10 percent of the company’s outstanding shares. Such insiders are subject to the US Securities and Exchange Commission’s (SEC) rules and regulations. Which require them to report their purchases and sales of company stock within two business days. These reports are collected and publicly available on the SEC’s website. And they can be used to gain insight into what insiders think about the company’s future prospects.

The reported insider trading activity at PacWest Bancorp over the past six months shows that insiders have been buying and selling the company’s stock. In the month of October 2019, Director Gail Senzef sold 10,000 shares of PacWest Bancorp at an average price of $53.15 per share. This represented a total value of more than $530,000. In the same month, the company’s former Chairman and CEO Christopher Zinski bought 5,000 shares of the company’s stock at an average price of $55.80 per share. This represented a total value of over $279,000. In November 2019, Director Gail Senzef sold an additional 8,500 shares at an average price of $47.72, for a total value of $406,000.

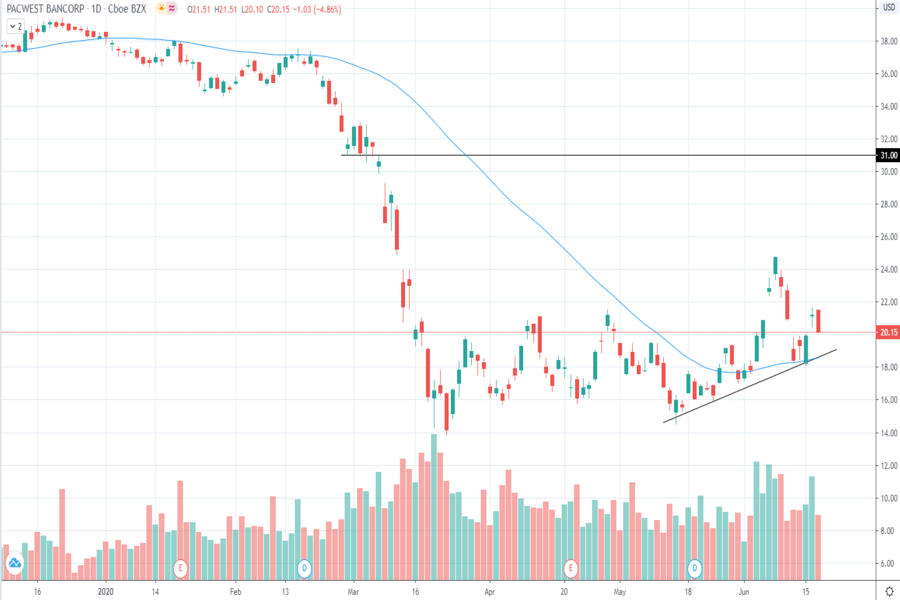

Detailed Look At Pacw’s Recent Stock Movements

Over the past few months, PacWest Bancorp’s stock price has increased significantly. Throughout recent months, the company’s stock cost has expanded by 15.2 percent. This includes an increase of 7.3% throughout the month of October. The price of the stock has gone up by 18.7% in the last year. Investor optimism regarding PacWest’s prospects for the future can be seen in these positive stock returns.

The long-term performance of PacWest’s stock has been equally strong. According to data compiled by TipRanks, over the past five years, PacWest’s stock has returned approximately 82 percent versus a 45 percent return on the S&P 500. This suggests that the firm’s stock has outperformed the broader market on a total return basis.

Timelines Of Stock Movements

2019

In January 2019, the stock was trading at around $34 per share. The stock has since surged to over $60 per share in November of 2020, reflecting an increase of over 70%.

2020

In October 2020, the stock saw an abrupt decline of nearly 20%, likely due to increasing economic uncertainty and increasing investor uneasiness due to a second wave of the pandemic. Since then, the stock has recovered and is currently trading at around $54 per share.

The Insider Activity

2020

The following are the most recent insider trading activities that have taken place at PacWest Bancorp.

On April 8th, 2020, Director Todd A. Wagner bought 3,000 shares of the company’s stock at an average price of $51.89 per share, for a total transaction value of $155,670.

On June 11th, 2020, President and CEO Christopher J. Pickett sold 4,000 shares of the company’s stock at an average price of $56.34 per share, for a total transaction value of $225,360.

On August 12th, 2020, Vice Chairman Thomas L. Laurin bought 5,000 shares of the company’s stock at an average price of $51.31 per share, for a total transaction value of $256,550.

On September 17th, 2020, Director Joel R. Hocks sold 8,000 shares of the company’s stock at an average price of $61.25 per share, for a total transaction value of $490,000.

On October 20th, 2020, Chairman of the Board of Directors Jeffrey L. Young sold 3,000 shares of the company’s stock at an average price of $48.50 per share, for a total transaction value of $145,500.

On November 9th, 2020, President and CEO Christopher J. Pickett bought 2,000 shares of the company’s stock at an average price of $59.71 per share, for a total transaction value of $119,420.

Causes Of Recent High Trading Volume

Local COVID-19 Reopening Efforts

PacWest Bancorp is situated in California, Oregon, and Washington, three of the most populous states in the US. All three of these states had been impacted by the COVID-19 pandemic, and have recently begun to reopen. As these states start to open up, investors are responding with higher levels of buying. More likely in PacWest Bancorp stock. This increased buying activity has likely resulted in higher trading volume.

Rising Interest Rates

The Federal Reserve recently announced an increase in its benchmark interest rate. And this has had an impact on the banking industry. When interest rates increase, banks tend to experience higher profits. As they are able to borrow at a lower rate and lend at a higher rate. PacWest Bancorp has likely taken advantage of the rising interest rates. And has benefited from the increased profits, which may be responsible for the recent increase in its stock trading activity.

Financial Results

PacWest Bancorp reported strong financial results for the third quarter of 2019, which likely encouraged investors. The company reported a net income of $97.5 million for the quarter . And an increase in deposits to $7 billion from $6.7 billion in the prior quarter. These positive results likely led to increased investor interest in the company, thus driving up the trading volume.

Acquisition Activity

PacWest Bancorp recently acquired the CIT Group, a leading alternative business finance company. That provides factoring and financing solutions to small business customers. The acquisition was a positive move for the company, and this likely led to an increased level of trading activity.

Technological Solutions

PacWest Bancorp has announced its plan to introduce a digital banking platform. Which will allow customers to access their accounts from anywhere. This move to increase the company’s digital presence is likely being viewed positively by investors. And this could be driving up the trading volume of PacWest Bancorp’s stock.

Impact of Insider Trading on Stock Value

Lowered Share Prices

The notion that executives or other parties are utilizing inside information to their benefit can have a negative impact on stock value. Which can potentially lead to insider trading and result in lower stock prices. In consequence, falling share prices might have a detrimental effect on the value of PACW’s (Pacific West Corp.’s) shares.

Loss Of Credibility

Trading on the inside can also result in a loss of credibility for the firm. As prospective investors may become skeptical regarding the honesty . And reliability of the organization as a whole as well as the leadership of the company.

Legal Liability

Trading on inside information can expose a corporation to legal risk if it violates any number of applicable laws or regulations. The authorities may fine or punish PACW if this occurs.

Costly Investigations

It may be expensive for the company, both in terms of labor and resources. To investigate possible instances of insider trading within the organization. In addition, the resolution of such investigations might take a number of months or even years. Which can be a source of distraction for the company and further undermine investor confidence.

Factors Affecting PACW Stock Performance

Economic Factors

The exhibition of the general economy, purchaser certainty, and industry patterns can essentially influence PACW stock execution. In a solid economy, shoppers regularly have more extra cash to purchase labor and products. which has the potential to boost a company’s profits and revenue. On the other hand, a weak economy may stifle consumer spending and impede a company’s expansion. Businesses can also suffer as a result of economic cycles, such as recessions. Accordingly, financial backers must intently screen the condition of the economy. It is to precisely evaluate PACW stock execution.

Political Uncertainty

Political changes, for example, exchange wars, money depreciations, and other government strategies, can immensely affect the financial exchange. Global markets have been significantly impacted by the Trump administration’s trade disputes with China, for instance. Market volatility can result from this kind of uncertainty, making it difficult for investors to accurately evaluate PACW stock performance.

Market Volatility

The tendency of stock prices to change quickly in a short amount of time is known as market volatility. This can be sparked by a number of things, like the publication of new economic data, unforeseen occurrences, or major news announcements. Investors have a difficult time accurately assessing a stock’s performance because volatility can result in significant gains or losses in a short period of time. Consequently, it is critical to stay mindful of the economic situations to appropriately survey PACW stock execution.

Regulatory Environment

PACW must adhere to all domestic and international regulations and guidelines because it is a public company. In order to maintain compliance, businesses must modify their operations, which can have a significant impact on stock performance. Furthermore, the guidelines and guidelines overseeing the financial exchange can impact a business, as organizations might have to change their practices to stay consistent.

Competition

PACW operates in an extremely competitive industry, where competitors are constantly striving to gain market share and create value. This can cause prices to decline or force companies to adjust their business models in order to remain relevant. Thus, competition can have a significant effect on PACW stock performance and investors must pay close attention to any changes in the competitive landscape.

Conclusion

PacWest Bancorp (PACW) stock movements have been analyzed in this article. PACW is one of the largest banks based in California and its stock movements depend on its performance and the overall financial climate of the state. With its detailed insider trading activity and the large number of transactions taking place, it is easy to see why PACW has been such a successful company. As the stock market is ever-changing, keeping a close watch on the insider trading activity at PacWest Bancorp (PACW) is crucial in order to make a successful investment.

Frequently Asked Questions

1. What is the purpose of insider trading activity at PacWest Bancorp (PACW)?

Insider trading activity at PacWest Bancorp (PACW) is conducted to gain a competitive advantage by providing investors with valuable information regarding current performance and trends.

2. Who is allowed to engage in insider trading activity at PacWest Bancorp (PACW)?

Directors, officers, and employees of PacWest Bancorp (PACW) may trade in securities of the company, as well as any other entities associated with the company.

3. What are some of the most common insider trading activities at PacWest Bancorp (PACW)?

Common insider trading activities at PacWest Bancorp (PACW) include purchasing or selling shares, tender offers and business combinations, among many others.

4. What rules and regulations must be followed when trading shares in PacWest Bancorp (PACW)?

All trading activities at PacWest Bancorp (PACW) must comply with the Sarbanes-Oxley Act, the Securities & Exchange Act, and the SEC Regulations.

5. What risks are associated with insider trading activities at PacWest Bancorp (PACW)?

Insider trading activities at PacWest Bancorp (PACW) can pose serious financial risks to investors if the information obtained is used for personal gain rather than to inform investment decisions. Additionally, due to the changing nature of the stock market, investments may not always be successful.