Introduction

The Newman Insider Trading Scheme is an in-depth look at the complex and spectacularly lucrative insider trading scheme that was orchestrated and mainly operated by two individuals with ties to the financial industry, Matthew Martoma and Mathew Newman, to the tune of $354 million. The men used strategies, tactics, and techniques, as well as the tools that enabled them to escape detection by law enforcement for almost a decade before they were caught, which this account provides of the operations of the scheme.

It also shows how far financial fraud can reach, with a cast of characters that stretches from Wall Street to the biomedical research lab. Unmasking the Truth is an insightful study of the workings of the Newman insider trading scheme, offering valuable insight into the shadowy ecosystem of criminality that lurks beneath the surface of the stock market.

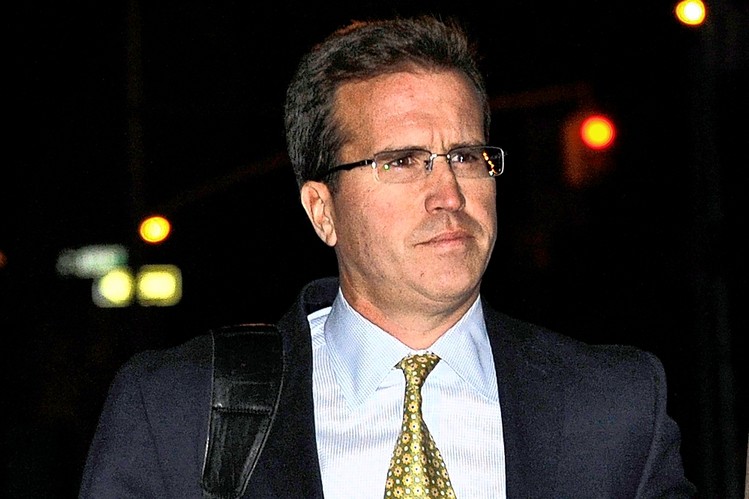

John Newman

John Newman is a portfolio manager at Diamondback Capital. Daily clients own him responsible for the management of private and public investments. This includes the management of domestic, international, and alternative investments. He is also responsible for the review and execution of portfolio management initiatives, risk assessment and analysis, and portfolio monitoring.

Newman has been with Diamondback Capital since 2013. And is known for his expertise in long, short and leverage equity investments. He has worked on multiple transactions in numerous industries. Such as financial services, energy, technology, healthcare, consumer, media, telecommunications and industry services.

The justice system brought Todd Newman, a successful hedge fund manager, to justice for insider trading, thus ending his career.

The appeals court overturned the verdict of the case, making it a watershed moment for Wall Street law.

Newman Insider Trading

Jeffrey Newman, who had allegedly traded on confidential information obtained from corporate directors and executives. Newman had been a partner at Empirica Capital LLC in Boston and was the firm’s principal portfolio manager.

The case began when the Securities and Exchange Commission (SEC) charged in April 2010. That Newman had violated federal securities laws by trading on the inside information. He was obtained from corporate directors and executives. Specifically, Newman had allegedly engaged in “front running” by purchasing securities prior to his fund making larger purchases. By front-running, Newman was able to make money for himself as well as for the funds he managed.

The SEC also charged that Newman had lied in filings and statements. It happened when he reported confidential information to his clients and to the SEC. Accusers alleged that Newman had exploited the close personal relationships he had with directors and executives, and had worked with and received inside information from them.

An Undercover Federal Agent Turned Hedge Fund Trader

Justice was brought to Todd Newman, a successful hedge fund manager, for his insider trading, which put an end to his career. The Appeals Court overturned the conviction of Wall Street law, making the case a watershed moment. A firsthand account of the experience of avoiding capitulation while under federal investigation.

Without warning, Todd Newman received a phone call that would forever alter his life. It was the first Monday of the month in November of 2010, and the time was 8:45. Newman was sitting at his desk in the Stamford, Connecticut office of Diamondback Capital Leadership, a hedge company. He had driven the 15 minutes beforehand from his house outside Boston to the firm’s office in Four Landmark Square, which happened to be a building that Newman’s father constructed years ago. Newman worked at Diamondback as a portfolio manager. He managed a long/short portfolio of around $150 million, focusing primarily on technology equities.

Newman answered the phone even though the caller ID didn’t reveal who was calling. David Makol, a 39-year-old Federal agent who, as Newman would later learn, specialized in the “art of the flip” (getting hedge fund workers to snitch on their coworkers about alleged criminal activities) was on the other end of the line. Makol warned him, “We will have some stuff happening later today that is going to affect your job, your family.” We need to take action. Please respond immediately.

The call had a disconcerting, but not worrisome, effect on Newman. He didn’t think the FBI would go after him for any good cause.

Newman Was Aware Of Investigation

Even though Newman didn’t think he was personally at risk, he was aware that the government was conducting a widespread investigation into insider trading. The FBI had arrested Raja Rajaratnam, wealthy owner of the Galleon Group hedge fund, on insider trading accusations eleven months beforehand. Preet Bharara, the United States Attorney for the Southern District of the State of New York, arrested Rajaratnam and declared that his fraud was the biggest of its kind in American history. It wasn’t long before rumors started circulating that Bharara had his sights set on another investment firm billionaire as well: Michael A. Cohen, founder and CEO of SAC Capital. Bharara prioritized investigating Cohen and anyone associated with him.

Therefore, Diamondback was a natural target for the prosecutor’s investigation. Richard Schimel and Lawrence Sapanski, two traders from SAC Capital, founded the fund a year ago. In addition, Schimel wed Cohen’s sibling. There were clear ties between Diamondback and SAC, notwithstanding the fact that Diamondback had not received initial funding from SAC. (Cohen was not prosecuted, but SAC did in 2013 when it agreed to plead guilty to dealing with insiders and pay a hefty $1.8 billion settlement.)

In addition, there were warnings that a major event was imminent. Two days prior to Newman receiving the call from Makol. The Wall Street Journal published a lengthy article under the headline “U.S. in Vast Insider Trading Probe. Detailing a three-year, Bharara-led investigation that was about to “ensnare specialists, investment bankers, hedge-fund as well as mutual-fund traders, and economists across the nation.” One area of interest was “expert networks,” with a particular emphasis on Primary Global Research, a firm that purportedly acted as a bridge between specialists in many fields (including, but not limited to, healthcare and technology) and investors seeking insight.

Investigations

In one of the most widely publicized attempts of insider trading in Australia’s corporate history, the Newman Insider Trading Scheme (NITS) saw company directors accused of misusing confidential information.

The scheme, uncovered in late 2017, involved the trading of shares in a number of listed companies on the Australian Securities Exchange (ASX). It focused on a select group of senior company executives. Including a former NSW Premier, who were accused of buying and selling shares at a profit by using information not publicly available.

A long and complex investigation, involving multiple agencies and months of painstaking work, eventually led to the identification of key individuals involved in the alleged scheme. In July 2018, two former company executives and two financial advisers were charged with insider trading and other offences.

At the heart of the investigation was a series of transactions in the shares of two companies – G8 Education Limited and Sigma Healthcare Limited. In September 2017, the Australian Securities and Investments Commission (ASIC) received a whistleblower report. It triggered an investigation into the conduct of two former senior executives of the companies.

This investigation ultimately led to the discovery of evidence connecting other individuals, specifically four identified money managers, to the alleged scheme.

ASIC Investigators

ASIC investigators examined millions of telephone and electronic records, interviewed over three hundred witnesses, and seized thousands of documents, as well as financial records and personal computers.

After gathering these records and conducting a significant amount of analysis, an in-depth investigation produced an indictment that set out the details of more than 200 separate transactions in the two companies’ shares.

It is believed that the individuals involved made profits of between $5-7 million from the alleged scheme. The two former company executives were charged with breach of sections 183 and 198 of the Corporations Act 2001, in addition to charges relating to money laundering. The four financial advisers were also charged with various offences, including insider trading, involving the two companies’ shares.

At the time of writing, the case is still pending and a trial date has yet to be set. However, the outcome of this case will have important ramifications for corporate governance and enforcement of insider trading laws in Australia.

People Involved

Jeffery J. Newman

Jeffery was the founder and CEO of Newman Fund Management. He owned 85 percent of the company’s shares and controlled the company’s decisions through his overwhelming voting power. Jeffery was engaging in insider trading by acquiring shares in publicly traded companies before offering them to his fund’s investors. He also bought his own shares on the side at a much lower price than the public, generating a profit for himself and creating a guaranteed return for his fund’s investors.

Andrew S. Hurwitz

Andrew was the chief portfolio manager of Newman Fund Management. He was responsible for researching and selecting stocks for investments and monitoring the fund’s performance. He was also involved in the trading schemes and was aware of the illegal activities taking place.

Ann Marie Ricci

Ann Marie was the chief compliance officer of Newman Fund Management. She was responsible for ensuring the company was operating within legal guidelines. She was aware of the fraudulent activities taking place but failed to report it or take any action to stop it.

James M. Eckel

James was a portfolio manager at Newman Fund Management. He was responsible for researching and selecting stocks for investments. He was aware of insider trading and actively participated in it.

Peter L. Greene

Peter was an accounting manager at Newman Fund Management. He was responsible for maintaining the books and records of the company. He was aware of the false entries in the books and records and did not take any action to correct them.

Evidence

Emails

One of the most important pieces of evidence in the Newman insider trading trial was a series of emails between Newman and his associates. These emails were used to prove that Newman had knowingly purchased stock in the company on the basis of material nonpublic information obtained through his relationships with corporate executives. The emails showed that Newman had intentionally withheld this information from other investors, which allowed him to reap profits from the stock.

Phone Records

Various phone records were also used as evidence in the trial. These included phone calls between Newman and corporate sources, text messages sent from his phone to associates in which he discussed stock transactions, and records of calls made to financial advisors who facilitated the purchase of the stock in question.

Wire Transfers

Wire transfers and other documents used to execute the purchase of the stock were key evidence in the trial. These documents showed that Newman had transferred money to purchase shares of the company, which was used as evidence that he had acted deliberately on the basis of nonpublic information obtained through his contacts.

SEC Filings

The Securities and Exchange Commission’s (SEC) filings were also important evidence. These filings showed that Newman had filed the proper forms declaring his beneficial ownership in the company. This provided greater context for the other evidence presented and made it clear to the jury that Newman had not been operating secretly or otherwise trying to hide his involvement in the company.

Testimony From Witnesses

The testimony of various witnesses also played an important role in the Newman trial. Witnesses included corporate executives, financial advisors, and other associates of Newman who testified as to their knowledge of the transaction and the defendant’s involvement. Their testimony provided further corroboration and contextualized the electronic evidence presented.

Timeline

March 2013

Lawrence Newman and his son Kenneth are accused of securities fraud. They are alleged to have made hundreds of thousands of dollars in illegal profits through insider trading.

April 2013

The U.S. Securities and Exchange Commission (SEC) begins a formal investigation into the trading activities of the Newmans. They suspect that Lawrence may have had access to material, non-public information that allowed him to make lucrative trades for himself and his son.

May 2013

During the SEC’s investigation, they uncover a complex web of trading accounts, shell companies and overseas bank accounts that the Newmans used to hide their profits.

June 2013

The SEC charges both Lawrence and Kenneth Newman with multiple counts of insider trading.

July 2013

The SEC publicly reveals details of the Newman insider trading scheme in an administrative order and brings a civil action against the father and son.

December 2013

After a long battle with the SEC, Lawrence Newman is found guilty of insider trading and ordered to pay over $6 million in fines and damages. Kenneth Newman is sentenced to prison for two years.

October 2014

Lawrence Newman is sentenced to 48 months of incarceration and ordered to pay an additional $4.8 million in fines.

January 2015

The Newmans’ criminal activities damage the reputation of the financial services industry and serve as a cautionary tale for the public and regulators alike.

June 2015

Lawrence and Kenneth Newman are released from prison and their trading activities cease.

December 2015

The story of the Newman insider trading scheme becomes the subject of a movie, reminding everyone of the destructive power of greed.

Conclusion

The Newman Insider Trading Scheme Exposed provides much needed transparency into the issue of insider trading. It highlights the deceptive nature of insider trading, as well as its potential consequences. By uncovering the truth regarding Newman’s insider trading, this article serves to inform and educate investors and citizens alike about the ethics and moral implications of insider trading. After reading this article, readers should be more aware of the rules and regulations associated with insider trading and how it can potentially be abused.

Frequently Asked Questions

1. What is insider trading?

Insider trading is the buying or selling of a company’s securities based on information not available to the general public. This type of trading is illegal as it allows those in the know to gain an unfair and unlawful advantage.

2. Who is Paul Newman?

Paul Newman is a former financier and hedge fund manager at Newman Capital in New York City. He was charged and convicted in 2011 for insider trading and securities fraud.

3. What did Paul Newman do to violate insider trading laws?

Paul Newman was found guilty of using inside information to secretly purchase shares of publically-traded companies prior to the release of market-moving information. As a result, he profited illegally due to having prior knowledge of market developments.

4. What are the potential consequences of insider trading?

Individuals convicted of insider trading face potential civil and criminal penalties. These penalties include fines, jail time, and/or the forfeiture of any profits gained from the illegal activity.

5. What are the rules and regulations regarding insider trading?

The U.S. Securities and Exchange Commission has established strict regulations governing the legal and ethical aspects of insider trading. These regulations are designed to protect investors and create a level playing field for all market participants.