Introduction

The 2018 Mychal Kendricks Insider trading case rocked the worlds of professional sports and business, illuminating the far-reaching effects of illegal financial activity. The defendants in this case were former NFL player Mychal Kendricks and television writer Damilare Sonoiki. Aside from the court procedures, this case can teach citizens, investors, and lawyers a great deal about the complexities of securities legislation. Here, we go into the Mychal Kendricks Insider Trading Case and examine the important legal precedents that it set.

Mychal Kendricks Insider Trading Case

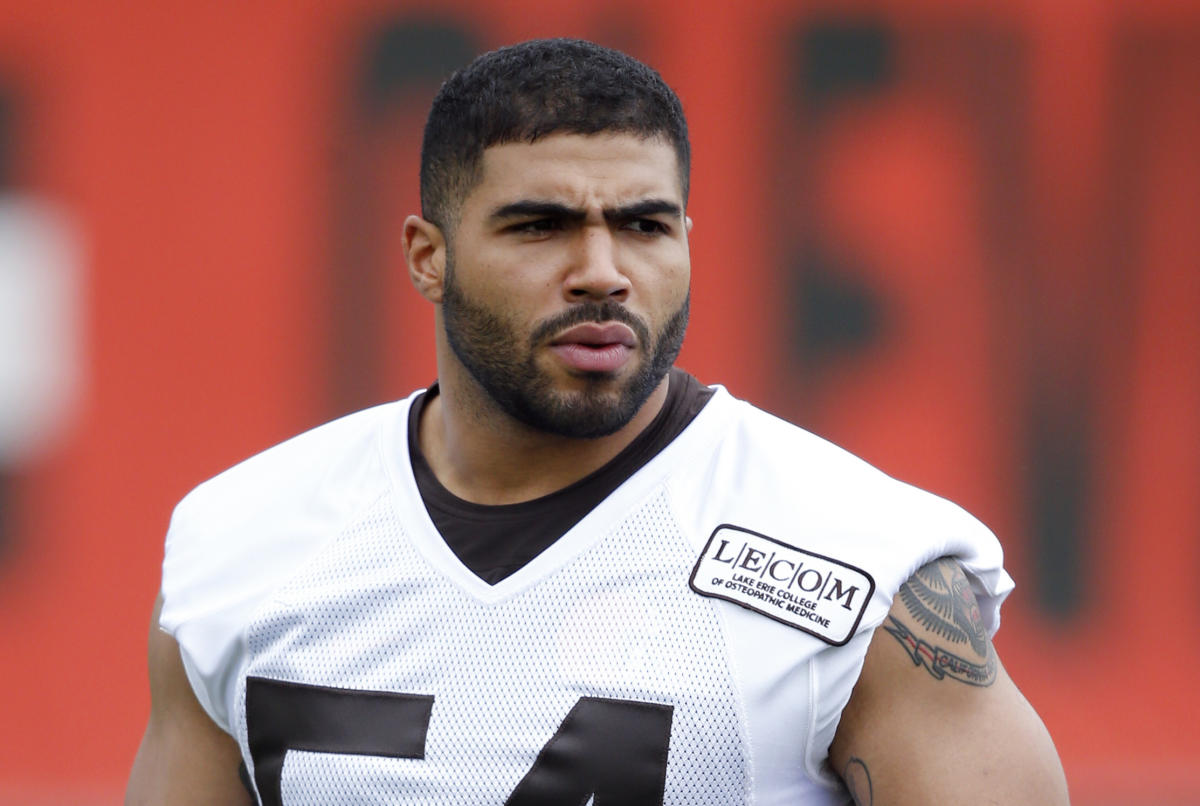

Mychal Kendricks, a linebacker for the NFL, has been accused of insider trading. According to U.S. Attorney for the Eastern District of Pennsylvania William M. McSwain, Kendricks and bank analyst Damilare Sonoiki, who is also a former writer for the television show Black-ish, allegedly devised and promoted a plan in which Sonoiki would provide Kendricks with valuable private information. Data on potential consolidations between speculation banks and how it would impact the worth of public protections was incorporated. Kendricks, who is currently 27 years of age, purportedly partook in the plan while he was an individual from the Philadelphia Hawks football crew between July 2014 and Walk 2015. In the wake of marking Kendricks as a free specialist in June, the Cleveland Browns have decided to deliver the previous Pac-12 cautious player of the year considering recent developments.

Through his lawyer Michael Schwartz, Kendricks has confessed to insider exchanging. Kendricks also admits that he was aware that his actions were “wrong,” despite not fully comprehending the nature of them. Kendricks’s statement also states that he is ready to “accept the consequences” of his actions. Kendricks’ tone and words propose he is prepared to concede liability regarding the wrongdoings he has been accused of. Kendricks also asserts that he did not “take any of the earnings for himself.”

The Allegations Against The Defendant And The Government’s Case

A social media apology that Kendricks reportedly published does not have the same legal weight as a formal guilty plea presented to a federal judge. Neither the DOJ nor the SEC have given a comparative statement, notwithstanding Kendricks’ proclamation proposing his eagerness to completely coordinate. In point of fact, Christian Zajac, the Assistant Special Agent in Charge of the Philadelphia Division of the FBI, issued a statement in which he described Kendrick’s actions as “not simply gaming the system”. And instead as fabricating behavior that “poses a danger to the U.S. financial markets, because it undermines the public’s trust that our markets operate fairly.”

The fact that Kendricks and his lawyers are negotiating with the government about the legal repercussions of his cooperation and admission of wrongdoing, or, to put it more bluntly, whether or not Kendricks will serve time in prison and pay monetary fines, is probably the cause of the conflicting tone. Until either a settlement is reached or Kendricks enters a guilty plea in court, the legal proceedings will continue.

McSwain contends that Kendricks, subsequent to getting non-public data from Sonoiki. Bought call choices in organizations that would profit from consolidations later on. In the end, the strategy paid off handsomely. Not long after the consolidations were declared, Kendricks made a $1.2 million benefit from the offer of the choices. The options in question surged in value between the day Kendricks bought them and the day he sold them. Which is astonishing for a novice investor with access to confidential information. The public authority supposedly guarantees that Kendricks sumptuously compensated Sonoiki with generally $10,000 in real money, passes to Birds games. Admittance to premium dance club occasions, and different things that gave him monetary and reputational worth for his data.

Kendricks Is Facing Three Separate Accusations

There are a lot of details about the alleged conspiracy in McSwain’s criminal information and the SEC’s civil case in the U.S. District Court for the Eastern District of Pennsylvania. Three charges have been brought against Kendricks and Sonoiki by the federal government: scheme to commit protections misrepresentation, protections extortion, and helping and abetting. He faces extremely serious allegations. The greatest sentence for the violations with which Kendricks has been charged is 25 years in jail. In any case, as a first-time guilty party, he isn’t probably going to get a sentence even close to that extensive. Jail terms of as long as twenty years, post-discharge management of as long as three years. And fines of up to $5.3 million are on the table.

The SEC has brought civil charges against Kendricks and Sonoiki to court in the Eastern District of Pennsylvania in addition to the criminal case. Each defendant has been required to pay hefty fines and return any illegally obtained profits by the SEC. The evidence against Kendricks that the federal government has gathered must seem insurmountable. Numerous references to text message exchanges and financial transactions are included in both the data and the complaint. The public authority probably got this data through a blend of summons and the participation of witnesses. In court, Kendricks would struggle with rationalizing such dooming mechanical proof.

Evidence

The admissibility of electronic evidence will be crucial to securing a conviction if Kendrick and the prosecution cannot reach a plea agreement. Kendricks’ insider trading will require more than just a series of suspiciously timed and extremely profitable purchases and exchanges to be documented as evidence. The arraignment should demonstrate without question that Kendricks had the essential mental state. For this situation the aim to trick, control, or cheat, to convict him of insider preparing. Kendricks declared a major in social welfare during his four years as a student-athlete at UC Berkeley. It is muddled whether he would likewise say that he expected to misdirect, trick, or cheat during that time. The way that Kendricks conceded responsibility shows how monetarily uninformed he is.

If the prosecution has access to incriminating witness statements and supporting evidence. Such as emails, audio conversations, transcripts, notes, and other correspondences, they may be able to demonstrate that Kendricks illegally acted on confidential tips from Sonoiki. Prosecutors may be able to demonstrate that Kendricks had the necessary motivation by providing evidence of his “conscious avoidance. In which he acted as though he had no idea that he had committed a crime despite being aware of it.

The Prisoner’s Dilemma Involves Both Indicted Partners And Working Witnesses

Due to the likelihood that more than one individual was involved in the activities that were suspicious at the bank. Federal authorities may already have crucial testimony from cooperating witnesses. In order to clear their names, they might testify against Kendricks and Sonoiki. The police report has only ever referred to “Person#1” up until this point. Purportedly, Person#1 worked as a “support” among Kendrick and Venture Bank clients, uncovering non-public data about those clients to Kendrick and afterward utilizing that information to execute exchanges for Kendrick’s sake. One more count expresses that Person#1 planned with Kendricks to make “little, genuine exchanges Kendricks'” record to “veil the outcome of the exchanges that supposedly made based on private information presented by Sonoiki.”

Because of Person 1’s clear focal support in the exchanges, the specialists might have undermined arraignment except if Person#1 participates. What we mean by “collaboration” is that an observer will affirm after swearing to tell the truth in a manner that implicates both himself and the litigants. The cooperating witness may be asked to provide additional records, such as emails, financial records, and communications. The federal government may view Person 1 as a co-conspirator who has not been indicted. And will be charged if they do not comply or continue to cooperate.

Kendricks And Sonoiki

There is a high probability that Kendricks and Sonoiki will connect in basically the same manner as co-litigants. In situations where different respondents have been accused of connivance by the national government. Examiners will frequently attempt to arrive at request deals with a portion of the litigants. This is particularly valid for respondents whose activities were less horrifying or who are in control of proof that will assist the arraignment with getting convictions against the leftover plotters. Sonoiki is depicted by Kendricks as exploiting his ignorance. Kendricks admits that because of his impressive credentials (Harvard graduate, Goldman Sachs employee), he was overconfident in his former friend’s abilities.

According to the “prisoner’s dilemma,” all of the conspirators believe that if they keep quiet. They will be cleared of any wrongdoing. It is widely known among the schemers that if one of them “talks,” or makes an arrangement with the specialists, the others will be bound to be viewed as liable. Proof suggests that Kendricks will embroil Sonoiki in the wrongdoing in return for an arrangement with the public authority. It is unknown whether Sonoiki has blamed Kendricks similarly to prosecutors. On the other hand, Kendricks and his legal team should be very worried about this. A fast understanding is conceivable.

Impact On Kendricks’ NFL Career

Kendricks is most concerned about whether and how long he will be in prison for the insider trading charges. Whether the allegations will end his NFL profession or altogether upset it is a lot of lower on the need list. The Browns informed Kendricks, who signed a $3.5 million one-year contract in June, that he would not be attending this week’s games. Shortly after the charges were filed against him, the organization decided not to take Kendricks to the preseason game in Detroit against the Lions. The Browns made the declaration that they had delivered Kendricks that evening.

Browns Became Aware

Both the NFL and the Browns have a stake in Kendricks’ continued participation in the league. The Browns promptly ended Kendricks’ agreement when he owned up to unfortunate behavior, however not in court. Various arrangements in the ordinary NFL player contract gave the Browns the legitimate right to end their relationship with Kendricks. For instance behave both on and off the field in a manner that is sufficiently aware of the fact that the success of professional football is largely dependent on the public’s appreciation for and endorsement of those involved in the sport.” In addition, in accordance with Paragraphs 9 and 11, teams are permitted to terminate a player’s contract for “personal conduct that is reasonably judged by Club to adversely affect or reflect on Club.” The way that Kendricks confessed to taking part in insider exchanging offered the Browns a decent premise to deliver him.

The Browns might have taken a more merciful position toward Kendricks on the off chance that they so wanted. The fact that Kendricks acknowledged responsibility for his play may have been emphasized by the team. The Browns also don’t appear to have been completely caught off guard by the charges. The Related Press guarantees that the Browns realized there was an insider exchanging examination including Kendricks in June, when they marked him. However, it appears to be the Browns had no clue about that Kendricks was viewed as an individual of premium by government specialists. The linebacker presently transparently admits he committed unfortunate behavior. So it’s bewildering the way that the Browns showed up at their positive assessment of Kendricks.

Lessons Learned From Mychal Kendricks Insider Trading Case

Legal Consequences Of Mychal Kendrick’s Insider Trading Case Are Relevant To All

The case represents that insider exchanging charges can influence people from different foundations, including high-profile competitors and media outlet experts. It emphasizes that securities traders must adhere to the same legal guidelines.

The Value Of Doing Your Research

The significance of performing thorough due diligence prior to making investment decisions is one of the most important takeaways. Financial backers ought to be careful about following up on data that may not be openly accessible, as it might actually be material nonpublic data.

Strict Securities Regulations Exist

The case highlights the severe authorization of protections guidelines, particularly concerning insider exchanging. Protections regulations are intended to safeguard the respectability of monetary business sectors. And infringement can prompt serious lawful and monetary outcomes.

Sentencing Can Be Affected By Cooperation

In the case, Mychal Kendricks worked with the authorities, which may have influenced his sentence. This demonstrates that defendants may use a strategy of cooperation with law enforcement to possibly reduce penalties.

Confidentiality Requirement

The case supports the obligation of secrecy for people who have nonpublic data. It is pivotal for insiders in different enterprises to perceive the lawful and moral commitments related with such data.

Programs For Compliance Are Necessary

The case emphasizes the significance of effective compliance programs within businesses for detecting and preventing insider trading. Employees should be taught about the legal and moral ramifications of insider trading by employers. And effective controls should be implemented to prevent misconduct.

Legitimate Counsel Is Pivotal

While confronting expected lawful issues, looking for legitimate exhortation from experienced lawyers is fundamental. Legal professionals can assist individuals in making well-informed decisions. And offer direction on how to navigate the complexities of securities laws.

Market Effect

Financial markets can be harmed by insider trading because it undermines trust and fairness. The case serves as a reminder that investor confidence and the stability of the financial system depend on market integrity.

Precedents Set By The Mychal Kendricks Insider Trading Case

The Mychal Kendricks Insider Trading Case established important legal precedents and taught important lessons about securities law and insider trading. It reinforced a number of existing legal concepts and emphasized the strict enforcement of securities regulations, despite the fact that it did not establish groundbreaking legal principles. Here are a few points of reference and key important points from the case

Participation And Condemning Alleviation

The cooperation of Mychal Kendricks with the authorities set an example of how cooperation can affect the sentence in cases involving insider trading. His participation, which included giving data and affirming against his co-respondent, Damilare Sonoiki, possible affected his condemning. This features that people having to deal with insider exchanging penalties might consider participation as a system to diminish punishments possibly.

Material Nonpublic Information’s Importance

The significance of material nonpublic information in insider trading prosecutions was reaffirmed by the case. It emphasized that no matter who is involved, trading based on such information can result in severe legal consequences.

Criminal Allegations For Tipper And Tippee

Both the tipper (Mychal Kendricks) and the tippee (Damilare Sonoiki) faced charges in the case. This highlights that people who give inside data and the individuals who get and exchange on it can both face criminal allegations. It reinforces the idea that both parties in an insider trading transaction are liable.

Protections Guidelines Are Implemented Enthusiastically

The case fills in as an update that protections guidelines, particularly those connected with insider exchanging, are upheld vivaciously by administrative specialists and policing. It demonstrates the commitment to prosecuting those who break securities laws and maintaining the integrity of financial markets.

Influence On Proficient Vocations

The case featured the possible results of insider exchanging on proficient vocations. Not only did Mychal Kendricks, a former NFL player, face legal consequences, but he also suffered reputational harm. It demonstrates that high-profile individuals are not exempt from the legal and reputational repercussions of insider trading.

Informant Insurances

Although it is not directly related to the case, it indirectly highlights the significance of financial industry whistleblower protections. People who become mindful of insider exchanging or other monetary unfortunate behavior might think about detailing such exercises, and lawful securities for informants can energize revealing unafraid of reprisal.

Conclusion

The Mychal Kendricks Insider Trading Case fills in as a piercing sign of the consistently careful focus of protections controllers and policing in maintaining market respectability and reasonableness. It has shed light on the legal principles that govern insider trading, the significance of cooperation in reducing penalties, and the severe consequences faced by those who engage in such activities, regardless of their background or profession. In addition, it emphasizes the significance of adhering to securities regulations, ethical investment practices, and due diligence in order to maintain trust and integrity in the financial markets. As people and substances explore the complicated universe of protections, the examples from this case keep on reverberating, underscoring the need of consistence, straightforwardness, and moral lead in the present monetary scene.

Frequently Asked Questions

1. In The Insider Trading Case, What Charges Were Brought Against Mychal Kendricks And Damilare Sonoiki?

Both Mychal Kendricks and Damilare Sonoiki were accused of participating in insider exchanging. Sonoiki was charged with trading on information provided by Kendricks and providing confidential information.

2. In The Insider Trading Case, How Did Mychal Kendricks’ Cooperation With Authorities Affect His Sentence?

Kendricks’ participation, which included giving data and affirming against his co-respondent, logical affected his condemning, showing the likely advantages of participation in lessening punishments.

3. What Is The Meaning Of Recognizing Material Nonpublic Data And Openly Accessible Data In Insider Exchanging Cases?

In cases involving insider trading, it is essential to distinguish between publicly available information and material nonpublic information because trading based on the former may result in legal consequences. It emphasizes the significance of performing proper due diligence and adhering to securities laws.

4. How Did The Mychal Kendricks Case Show How Insider Trading Could Affect Professional Careers?

Due to his involvement in insider trading, Mychal Kendricks, a former NFL player, was subject to not only legal sanctions but also damage to his reputation. This case demonstrates that high-profile individuals can face significant personal and professional repercussions for such actions.

5. What More Extensive Illustrations Can Be Drawn From The Mychal Kendricks Insider Exchanging Case?

The case emphasizes the necessity of adhering to securities laws to maintain trust and integrity in financial markets, the significance of ethical investment strategies, and the stringent enforcement of securities regulations. It serves as a reminder of the severe penalties that can be imposed on anyone, regardless of their background or occupation, who engages in insider trading.