Introduction

The Kodak insider trading scandal of 2020 sent shockwaves through the business and monetary world, uncovering an upsetting nexus between corporate chiefs, government authorities, and the securities exchange. Kodak, once a pioneer in photography, became embroiled in controversy when allegations of insider trading surfaced against the backdrop of the COVID-19 pandemic. Not only did this scandal have a negative impact on Kodak’s reputation, but it also raised significant concerns regarding corporate governance, the effectiveness of regulatory oversight, and the honesty of financial markets.

As examinations unfurled, it became evident that chiefs at Kodak had taken part in dubious stock buys in front of a crucial government declaration, prompting remarkable unpredictability in the organization’s stock cost. The aftermath of the outrage resounded across the business, provoking calls for more noteworthy straightforwardness, responsibility, and moral direction in corporate dealings.

About Kodak

Eastman Kodak Organization, ordinarily known as Kodak, is a renowned American multinational corporation that generally overwhelmed the photography and imaging industry. Established by George Eastman in 1888, Kodak became inseparable from photography for north of a hundred years, spearheading advancements, for example, roll film and variety photography. The organisation’s notorious yellow bundling and trademark, “Kodak Minutes,” mirrored its social importance and far and widespread consumer appeal.

However, Kodak had a hard time adapting to the digital revolution at the end of the 20th century because it had to compete with a lot of digital camera manufacturers and didn’t take advantage of new technologies. In 2012, Kodak declared bankruptcy protection, denoting a critical slump for the once-flourishing goliath. Kodak has persevered and expanded its business into areas like digital printing, graphic communications, and film production for a variety of industries despite its challenges. The organisation has kept on developing, utilising its skill in imaging innovation to remain pertinent in a quickly evolving market.

Rise Of The Scandal

Kodak’s Arrangement With The Trump Organization

While the COVID-19 pandemic was in full swing in the month of April 2020, Kodak had a meeting with White House officials, including trade adviser Peter Navarro. Some of the topics covered in these meetings included how to use Kodak’s current chemical business to make pharmaceutical ingredients that are vital in the battle against the pandemic. Kodak, an early pioneer in photography that struggled financially and tried to adapt to the digital age, saw this as a visible and significant change.

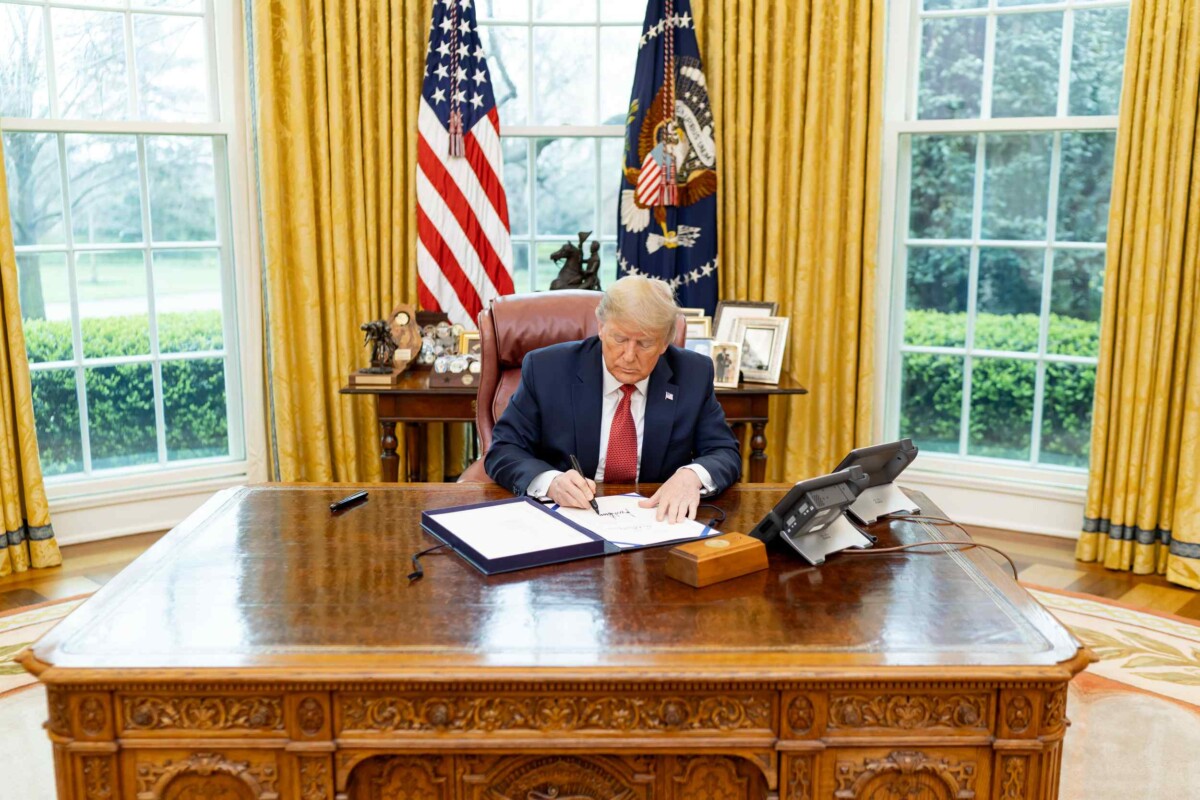

At the height of the pandemic in May 2020, then-President Trump signed a major order authorizing the U.S. Worldwide Improvement Money Enterprise (DFC) to lend funds to support domestic production and supply chains. The government singled out Kodak as a possible recipient of a $765 million loan to purchase pharmaceutical components. The strategy behind this development was to reduce reliance on foreign sources and strengthen the domestic inventory network for essential medications.

Suspicious Stock Buys By Leaders

Leader Executive Jim Continenza, Kodak’s top boss, made a substantial acquisition of Kodak shares while these conversations and negotiations were taking place. After acquiring about 47,000 shares of Kodak stock on June 23, 2020, Continenza became a major shareholder in the company. These purchases made headlines due to their timing—just weeks before the Trump organization announced their conditional approval to lend $765 million to Kodak.

There was speculation and investigation into possible insider trading in relation to the preparation of Continenza’s stock purchases and the subsequent increase in Kodak’s stock cost following the public authority’s announcement. Continenza and other insiders may have had access to material nonpublic information about the impending government loan, which investors and regulators questioned when they transacted stocks.

Initial Examinations By The Public And Investigations

Concerns about possible bad behaviour surfaced after the stock price of Kodak shot up following the announcement by the public authority. Committees in Congress and securities regulators looked into the stock price fluctuations of Kodak as well as the government loan. In connection with Kodak’s agreement with the Trump organization, the Securities and Exchange Commission (SEC) began investigating trading activities and exposures.

The media’s investigation into the matter intensified as news of Continenza’s stock purchases and Kodak’s dealings with government authorities spread. Prior to and after the public authority’s announcement, media outlets covered the questionable timing of Continenza’s mergers and acquisitions and the volatility of Kodak’s stock price. The question of whether Kodak and its executives had engaged in insider trading and disregarded protection regulations became the center of public attention.

Arguments For And Against Claims

The Attorney General Of New York’s Legal Actions

The New York State Attorney General’s office is allegedly going to sue Eastman Kodak Company Co (KODK.N) and its chief executive officer, Jim Continenza. Claims of insider trading, including stock purchases that happened before the settlement, are at the heart of the case, which Kodak reached with the Trump administration during the COVID-19 outbreak. On June 23, 2020, investigators were looking into Continenza’s purchase of about 47,000 shares in Kodak. This was weeks before the Trump administration announced a possible deal to lend the company $765 million.

The most important thing to consider is whether Continenza had any nonpublic knowledge about the government loan negotiations when he purchased the stocks. With this alleged information, the New York Lawyer General’s office is Looking into allegations of insider trading. The investigation has intensified considerably as the office of the attorney general advances with litigation preparations despite Kodak’s denials.

A Review Of Kodak’s Compliance And Continenza Purchases

Kodak passionately defended the matter, asserting that Continenza’s stock transactions complied with the company’s insider-trading regulations and applicable laws. Investigating the matter, the outside legal counsel for Kodak, Akin Forrest Gump Strauss Hauer & Feld LLP, concluded that Continenza’s mergers and acquisitions had the approval of general counsel and followed all internal protocols.

Furthermore, Kodak highlights Continenza’s history of reliably purchasing stock within permitted time frames and never selling any of his shares. Continenza did not possess any material nonpublic information when he acquired the shares, according to the firm’s denial of the insider trading allegations. As the lawsuit is about to be filed, Kodak’s defense is emphasizing that the company believes Continenza’s actions are legitimate and right.

Gray Stiles And Andrew Face Sec Allegations

While this was going on, the SEC was pressing charges of insider trading in Kodak shares against Andrew Stiles and his cousin Gray Stiles. While employed by a pharmaceutical supply chain company, Andrew Stiles allegedly had access to sensitive information regarding Kodak’s efforts to secure a $765 million government loan. Armed with this information, Andrew Stiles purchased over 95,000 shares of Kodak stock. He then informed Gray Stiles, who subsequently purchased over 45,000 shares. Cousin Stiles allegedly made around $1.5 million from these dubious dealings.

And Andrew Stiles, who allegedly traded Novavax Inc. shares while knowing substantial nonpublic information about the company’s COVID-19 vaccine development efforts, is also facing charges from the Securities and Exchange Commission. These allegations draw attention to the fact that insider trading has been subject to heightened regulatory scrutiny following the market volatility caused by the pandemic.

Inquiry Into Kodak’s Government Contract Reporting By The SEC

At the same time, Kodak’s disclosure policies in relation to its government arrangement to produce pharmaceutical components are being investigated by the SEC. The major focuses of the investigation are any irregularities or violations of securities laws and the dissemination of information by Kodak regarding the U.S. government loan. Still in its early phases, the probe reflects regulatory worries regarding the openness and honesty of company disclosures, especially in high-profile instances with major market ramifications.

Lawful And Regulative Ramifications

Insider Trading Regulations, Including The Martin Act, And How They Are Applied

After the Kodak insider trading scandal, many expressed concerns that government insider trading regulations and the Martin Act wouldn’t be upheld as expected. The Martin Act, a regulation established by the New York state governing body, allows authorities to investigate and punish instances of financial misrepresentation without requiring proof of intent or knowledge of wrongdoing. Under this expansive power, the principal legal officer’s office can indict any serious distortion or careless demonstration relating to the buy or offer of protection.

As part of its investigation into the company’s ties to the Trump administration and the possibility of insider trading, the New York Attorney General’s office is preparing to sue Kodak and its CEO in civil court. The primary focus of the investigation into Executive Chairman Jim Continenza’s recent purchase of Kodak shares is the government’s disclosure of a tentative contract to lend the company $765 million for the production of pharmaceuticals during the COVID-19 epidemic.

The SEC authorizes government insider trading guidelines, which make it against the law to trade shares utilizing significant nonpublic data. Regarding Kodak’s administration organization in drug fixing creation, the SEC has charged people, specifically Dim and Andrew Stiles, with insider trading. These charges could have significant repercussions for those whose lives are at stake.

Potential Repercussions

There are numerous potential repercussions for Kodak, its executives, and anyone else involved in this insider trading scandal. A conviction for Kodak for securities law violations could result in substantial fines, severe penalties, and harm to the company’s reputation. Executives found guilty of insider trading may face civil and criminal sanctions, including fines, forfeiture of profits, and imprisonment.

That, yet the scandal can hurt Kodak’s picture with financial backers and with administrative bodies. The allegations have previously caused stock cost variance, and the organization’s monetary exhibition and market status could be significantly more hurt on the off chance that legal cycles proceed. Kodak and its employees may also face regulatory penalties, such as increased surveillance from the SEC and other regulatory bodies, in addition to potential legal repercussions. To prevent this sort of bad behavior from reoccurring, it could need to support its consistency, corporate administration, and inside controls.

Looks For Additional Oversight And Assessment

Various individuals are attempting to persuade firms to be more open and mindful by requesting more guidelines and investigating insider trading occasion. One of the lawmakers who have advocated for a thorough investigation into Kodak’s government partnerships and related trading practices by regulatory agencies is Senator Elizabeth Warren. These requests rotate around the requirement for monetary market believability and the need for protection policing.

Public And Political Reactions

Senator Elizabeth Warren’s Involvement

The controversy has received a significant boost in political scrutiny as a result of Senator Warren’s involvement in the Kodak insider trading scandal. As a noticeable backer for monetary responsibility and straightforwardness, Warren has been vocal in calling for examinations concerning potential bad behavior encompassing Kodak’s administration bargain and the ensuing stock cost changes.

Warren’s interests originate from the suspicious trading action seen before the authority declaration of Kodak’s advance concurrence with the Trump organization. Warren questioned the possibility of insider trading and the unauthorized disclosure of material nonpublic information in an open letter to the Securities and Exchange Commission (SEC). She featured occurrences of unusual trading activity going before the public declaration, proposing that people might have taken advantage of favored data for monetary profit.

The involvement of the senator demonstrates the scandal’s broader implications beyond corporate misconduct. Warren’s standing as a committed promoter of responsibility in the monetary area enhances the tension on administrative bodies to explore the matter completely. Her activities signal a promise to consider organizations and people responsible for possible breaks of protections, regulations, and moral norms.

Sentiments Of The Market And Investors

The Kodak insider trading scandal has reverberated throughout the market, resulting in increased investor skepticism and stock price volatility. The disclosure of dubious stock buys by leaders and ensuing examinations have dissolved financial backer trust in Kodak’s corporate administration, and straightforwardness rehearses.

The market’s response to the embarrassment has been described by expanded vulnerability and hazard avoidance. Financial backers are careful about likely legitimate and administrative repercussions, as well as the more extensive ramifications for Kodak’s monetary solidness and notoriety. The sharp vacillations in Kodak’s stock cost following the declaration of the public authority bargain mirror the market’s aversion to saw anomalies and insider trading claims.

Moreover, the scandal has highlighted the significance of moral leadership and administrative consistency in keeping up with financial backing, trust, and market honesty. Financial backers are intently observing advancements in the examination and looking for affirmations that suitable measures will be taken to address any bad behavior and reestablish trust in Kodak’s activities.

Suggestions For Government-Business Connections

The Kodak insider trading embarrassment has raised worries about the honesty of government-business connections and the potential for unjustifiable impact in open confidential organizations. The Trump organization’s support of Kodak’s advance consent to help drug creation during the Coronavirus pandemic has gone under investigation in the midst of charges of insider trading and irreconcilable situations.

The scandal has brought to light the dangers of government intervention in the private sector and the need for effective mechanisms for oversight and accountability. The transparency and fairness of the process that led to the government’s approval of Kodak’s loan agreement, as well as the sufficiency of safeguards to prevent misconduct and abuse, have been questioned.

The scandal may cause policymakers to reevaluate the regulatory framework that governs interactions between businesses and the government and to enhance safeguards to prevent potential abuses in the future. It highlights the significance of straightforwardness, responsibility, and moral leadership in cultivating trust and validity in open, confidential organizations, which are geared toward tending to basic cultural difficulties.

Key Events And Timeline

Events Of Kodak’s Communications With Government Specialists

The organization’s conversations with White House authorities, including exchange consultant Peter Navarro, in April 2020 denoted the start of Kodak’s Connections with government authorities. Utilizing Kodak’s synthetics division to create drug fixings to aid in the fight against the coronavirus pandemic was The topic of these discussions. In May 2020, then-President Donald Trump signed an executive order allowing the U.S. International Development Finance Corporation (DFC) to lend money to support domestic production and supply chains in the fight against the pandemic.

The DFC, an organization that typically provides funding to the developing world, was pointed out to Kodak as the company’s conversations with government officials progressed. Be that as it may, when a subsequent call with Navarro was dropped, and a less senior DFC official turned into Kodak’s fundamental contact, leaders at Kodak, including Chief Director Jim Continenza, became negative about getting support.

Despite this uncertainty, the DFC decided to sign a non-binding letter of interest with Kodak regarding the loan. On July 28, 2020, promptly toward the beginning of the day, this declaration was made. Kodak’s stock prices nearly exploded after the announcement. President Trump hailed the contingent plan as a “jump forward” before long, further supporting Kodak’s stock expense.

In any case, the enthusiasm enveloping the game plan was momentary. Due to outrageous unpredictability, trading in Kodak’s stock was halted on multiple occasions the following day. The stock expense experienced wild changes, coming to as high as $60 before closing at $33.20. The frenzy, including Kodak’s stock, caught the eye of managerial bodies and began assessments concerning potential insider exchange and the association’s disclosure practices.

Stock Value Variances And Trading Patterns

On July 28, 2020, the announcement of Kodak’s potential government credit triggered a significant increase in the company’s stock cost. Shares took off by over 1,000% from their past closing expense. Kodak became one of the most traded stocks on platforms like Robinhood as retail financial backers scrambled to capitalize on the news.

The ridiculous unconventionality in Kodak’s stock worth provoked exchanging stops on different occasions on July 29, 2020. Despite the fundamental strength, the stock price experienced a sharp decline shortly after the announcement due to concerns regarding the agreement’s authenticity and allegations of insider trading. A sizeable portion of the gains made during the initial surge were erased when Kodak’s stock price fell.

Impact On Kodaks’s Position And Financial Performance

Kodak’s monetary exhibition and notoriety endured because of the insider exchanging embarrassment and resulting examinations. The association, when a blue-chip photography pioneer, defied all over examination and examination for its treatment of the public power credit statement and cases of insider exchanging by pioneers.

The dispute enveloping Kodak provoked basic unconventionality in its stock expense, causing wobbliness and weakness for monetary sponsors. Financial backer certainty and investor esteem were additionally influenced because of the organization’s powerlessness to get the public authority credit.

Conclusion

The Kodak insider trading scandal fills in as a useful example for organizations and financial backers, featuring the dangers related to dishonest ways of behaving and administrative rebelliousness. The scandal’s aftermath demonstrated the importance of strong corporate governance practices, effective regulatory oversight, and a commitment to financial market transparency and integrity. While this episode might have discolored Kodak’s standing, the examples learned can assist with forestalling comparable occurrences later on and encourage more prominent trust in the local business area.

Frequently Asked Questions

1. What Exactly Is Insider Trading, And Why Is It Against The Law?

Insider exchanging alludes to the trading of a public corporation’s stock by somebody who has nonpublic, material data about that stock. It is unlawful on the grounds that it subverts the reasonableness and honesty of monetary business sectors, giving specific people an out-of-line advantage over different financial backers.

2. What Is The Martin Act, And How Can It Connect With The Kodak Insider Trading Scandal Embarrassment?

Financial fraud cases can now be investigated and prosecuted by the attorney general without the need to prove intent or knowledge of wrongdoing. On account of Kodak, the principal legal officer’s office is utilizing the Martin Act to seek after claims of insider trading against organization chiefs.

3. What Were The Key Events Leading Up To The Kodak Insider Trading Scandal?

Key occasions incorporate Kodak’s conversations with government authorities about a likely credit to deliver drug fixings, the declaration of the advance understanding, the ensuing flood and unpredictability in Kodak’s stock cost, and the examinations concerning claims of insider exchanging.

4. What Effects Did The Kodak Insider Trading Scandal Have?

The embarrassment harmed Kodak’s standing, prompted administrative examination and examinations, and brought about critical unpredictability in the organization’s stock cost. It likewise raised more extensive worries about corporate administration, administrative oversight, and the honesty of monetary business sectors.

5. What Lessons Can Be Gained From The Kodak Insider Trading Scandal?

The scandal highlights the significance of moral lead, straightforwardness, and consistency with securities regulations in corporate dealings. Additionally, it emphasizes the necessity of efficient regulatory enforcement and enforcement mechanisms to maintain the fairness and integrity of financial markets.