Introduction

In recent times, there has been a lot of attention on healthcare industry corporate mergers and insider trading mergers, which have shown complex relationships between financial transactions, executive choices, and possible violations of securities laws. In this story, a healthcare organization merges with another, and the complications that come from merging commercial deals with allegations of illegal trading methods are laid bare. The complex storyline surrounding the merger of companies and the supposed wrongdoing of top executives has far-reaching consequences for the companies in question as well as for larger debates about corporate responsibility, honesty in the market, and regulation.

Background Of Ontrak Inc

Healthcare Treatment Company Ontrak, Located In Santa Monica

With headquarters in Santa Monica, California, Ontrak Inc. provides healthcare treatment services. The company’s bread and butter is telehealth solutions, and it is known for its inventive and tech-driven remedies to healthcare’s many problems. By using data-driven, individualized solutions, Ontrak hopes to boost people’s health and happiness.

Ontrak, headquartered in Santa Monica, California, is a technology business that enhances patient outcomes and reduces healthcare expenses by operating within the healthcare industry. It is quite probable that the company’s forte is creating and executing telehealth programs, which provide healthcare through the use of digital platforms and remote monitoring.

The Role Of Ontrak’s Biggest Client

Key client ties, especially with Ontrak’s biggest customer, may be the key to the company’s success and financial security. Because of the size and importance of this relationship, it is worth noting that it contributes significantly to Ontrak’s revenue, perhaps even making up over half of the company’s entire income.

For any business to thrive and expand, but notably in the healthcare industry, it is essential to build and nurture connections with key clients. These partnerships, which involve contracts and agreements, often significantly impact the company’s financial well-being. The company’s biggest client probably had a significant impact on Ontrak’s overall business strategy and financial results.

How The Customer’s Termination Will Affect Ontrak’s Share Price

If the company terminates its relationship with its biggest customer, it will particularly impact the stock price of Ontrak. When a big consumer, particularly one that generates a lot of money, leaves, the market could respond negatively. Within the context of the alleged insider trading case involving Terren S. Peizer, Ontrak’s Executive Chairman, it appears that the termination of the client relationship was regarded as significant nonpublic knowledge. When Peizer allegedly began the Rule 10b5-1 trading strategies to sell Ontrak stock, neither investors nor the public knew about this information.

After announcing the client termination news on August 19, 2021, Ontrak’s stock price plummeted sharply, experiencing a decline of approximately 44%. Undisclosed critical information can have a significant influence on investor confidence and market dynamics, as this stock drop shows. The stock market crash hit regular investors, and allegations of insider trading by Peizer, in which he is accused of taking advantage of nonpublic information, raise ethical and legal questions.

Insider Trading Allegations Against Terren S. Peizer

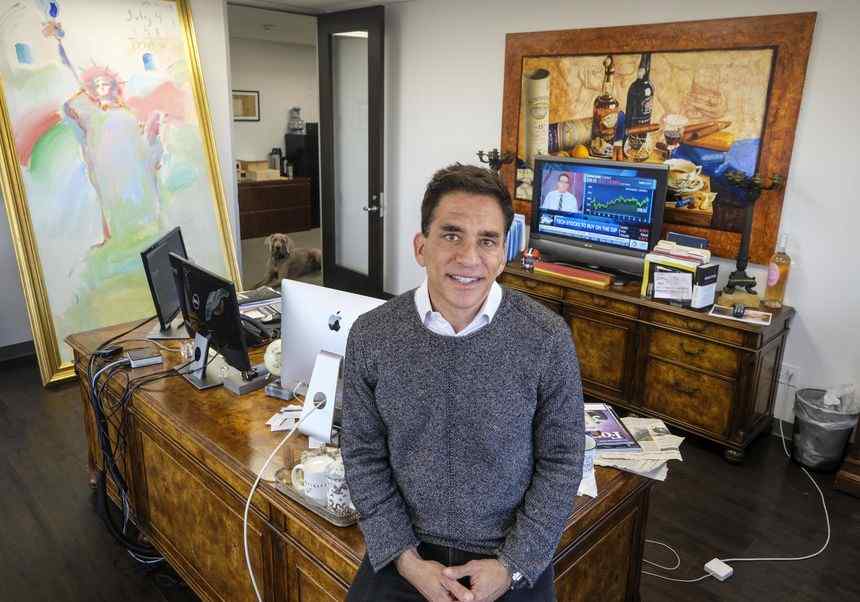

In a series of events including the creation and implementation of Rule 10b5-1 trading plans and the selling of Ontrak shares while in receipt of substantial nonpublic information, Terren S. Peizer, Executive Chairman of Ontrak Inc., is facing significant insider trading accusations.

Trading Strategies For Rule 10b5-1 Compliance

Rule 10b5-1 trading plans, which Peizer allegedly used, allow company executives to sell or purchase shares in a predetermined framework, supposedly to prevent charges of trading on significant nonpublic knowledge. Acuitas Group Holdings, LLC is Peizer’s investment company. In May 2021, he supposedly had key knowledge about Ontrak’s unstable relationship with its biggest customer, raising problems as the first plan was put into effect. In August 2021, the allegations against Peizer escalated as he allegedly adopted a second Rule 10b5-1 trading plan in response to growing fears of the impending termination of the critical customer relationship.

Information Regarding The Customer’s Relationship That Is Not Public

The central claim of the claims is that they assert knowledge of relevant nonpublic information about Ontrak’s relationship with its biggest customer before initiating the trading plans. For investors, this secret information was pivotal since it showed how precarious the relationship was and how it would have affected Ontrak’s bottom line.

Peizer’s Attestation Of Unawareness Of Material Nonpublic Information

Peizer seemed to be trying to sidestep accusations of insider trading when he testified that he had no knowledge of any significant nonpublic information about Ontrak when he started the trading plans. If proven untrue, this assertion adds another layer of complexity to the case, implying a deliberate attempt to deceive and use the Rule 10b5-1 plans to evade claims of unlawful trading.

Trading Plan Execution And Ontrak Share Sale

As part of the trading strategy, Peizer allegedly sold Ontrak shares at predetermined intervals in order to profit from the confidential knowledge. May 2021 saw the sale of about 600,000 shares, valued at over $19.2 million; August 2021 saw the sale of an extra 45,000 shares, valued at over $1.9 million. Peizer is accused of gaining considerable financial advantages through the alleged insider trading, which is based on these actions, as well as the later announcement of the customer contract termination and the dramatic decrease in Ontrak’s stock price.

The Fallout From Insider Trading

Termination Of Customer Contract Announcement By Ontrak On August 19, 2021

Ontrak Inc.’s public announcement of the termination of its contract with its largest customer on August 19, 2021, was the turning point in the alleged insider trading case. With the disclosure of previously hidden critical information about the precarious nature of the company’s relationship with a major revenue generator, this announcement was a big development for Ontrak and its shareholders.

A Near-44% Drop In Stock Value

Following the announcement, the stock price of Ontrak fell sharply, falling by over 44%. Investors’ reactions to the unexpected and bad news, which occurred shortly after the termination of the customer contract, directly caused this steep decline. The hidden information had a significant effect on market sentiment and investor confidence in Ontrak’s future prospects, as seen by the steep decline in stock value.

Allegedly Preventing Losses Totaling More Than $12.7 Million At Peizer

Beyond the short-term impact on the market, the suspected insider trading has far-reaching ramifications. The prosecution claims that Terren S. Peizer avoided heavy financial losses by selectively selling Ontrak shares before the public announcement by using Rule 10b5-1 trading plans. Peizer allegedly sold shares while possessing material nonpublic information, which is accused of providing him with a substantial financial benefit. The estimated sum he could have avoided is more than $12.7 million.

Participant Groups

Terren S. Peizer, Executive Chairman of Ontrak Inc., directly implicates himself in the ramifications of the suspected insider trading. He is accused of coordinating the unlawful trades for his own financial benefit. Acuitas Group Holdings, LLC, which was Peizer’s investment company and the means via which the Rule 10b5-1 trading plans were constructed, is also linked in the alleged scheme.

The chargees weren’t the only ones who lost money in the onrush of the stock price crash; regular Ontrak shareholders and investors did as well. Because events like this have the potential to damage investor faith and confidence, the purported insider trading has far-reaching consequences for the stability of the financial markets as a whole.

SEC Investigations And Proceedings

The SEC has filed accusations against Terren S. Peizer for violations of the antifraud provisions of federal securities laws, and he is currently facing claims of insider trading. Peizer is under investigation by the SEC.

Not Following Federal Securities Laws’ Anti-Fraud Requirements

To maintain honest and open financial markets, the SEC claims Peizer broke antifraud regulations. According to the allegations, Peizer manipulated the Rule 10b5-1 trading plans despite having access to material nonpublic information concerning Ontrak’s biggest customer, which is the basis for the violation in this case. By enabling Peizer to benefit while other investors were oblivious to the crucial information, such conduct, if proven, damage the integrity of the securities markets.

A Redress Request From The SEC

In its complaint against Peizer, the SEC has detailed a number of remedies it seeks in response to the alleged violations.

Long-Term Restraining Orders

A court order for permanent injunctive relief is expected to be sought by the SEC. This would make it such that Peizer can’t break the securities rules. Especially those that pertain to insider trading, in the future. The purpose of the injunction is to safeguard market integrity by discouraging Peizer from engaging in similar misconduct in the future.

Raising Money For Unjustified Gains With Interest On Judgment

Peizer is facing allegations of insider trading, and the SEC is requesting that he pay back any illegally obtained profits. Reimbursement of illicitly acquired gains to the SEC is what is known as disgorgement. The court may apply prejudgment interest to the principle amount to account for the time value of the ill-gotten gains.

Fines And Sanctions

In most cases, the SEC will pursue civil fines against those who violate securities laws. In addition to punishing the infraction, these fines also function as a deterrent. Civil penalties can range from a few thousand dollars to several million dollars. It depends on the gravity of the infractions and the losses suffered by the impacted investors.

For Terren S. Peizer, The Officer And Director Of The Bar

An officer and director bar against Terren S. Peizer is requested in the SEC’s complaint. If this injunction were to be upheld, Peizer would be unable to hold the position of director or officer in any publicly traded firm. It is common practice to implement such a step in order to safeguard the public and investors from executives who have displayed unethical behavior while serving in that role.

Criminal Cases Filed By The Department Of Justice

Concurrent Efforts By The United States Division Of Justice

The United States Department of Justice (DOJ) has also announced criminal charges against Terren S. Peizer, in parallel with the allegations brought by the Securities and Exchange Commission (SEC). This two-pronged strategy reflects the gravity of the charges and the cooperation of regulatory agencies and law enforcement in investigating any breaches of civil and criminal statutes.

Terren S. Peizer Faces Criminal Charges

Terren S. Peizer’s criminal charges filed by the DOJ indicate that the government is going to court for more than just a civil remedy. Peizer faces serious consequences, including fines and maybe jail time. It will be if found guilty of the allegations, which reflect a greater level of wrongdoing. Authorities anticipate basing these charges on alleged insider trading and potential violations of federal securities laws. The specifics of these charges will be revealed as the judicial proceedings unfold.

Retaliation And Countermeasures

Terren S. Peizer’s Lawyer’s Innocence Statement

A statement denying the accusations was released by Terren S. Peizer’s legal team. Peizer’s conviction that he did not break any laws is probably emphasized in the statement. As a first line of defense against the accusations, such claims are typical in legal defenses.

Say The Feds Have Gone Too Far In This Case

It’s possible that Peizer may argue that the government has gone too far in its prosecution of him. Such an action may include casting doubt on the veracity of the facts offered, raising doubts about the ethics of the investigation. Or disagreeing with the application of securities regulations. Peizer may use assertions of governmental overreach as part of his defense strategy to cast doubt on the allegations’ veracity.

The Effect On The Market And The Confidence Of Investors

The Case’s Importance In Undermining Market Trust

There are far-reaching consequences for market dynamics and investor confidence in the Terren S. Peizer case. Claims of insider trading by a high-profile healthcare executive have the potential to damage investor trust. Since they imply that those in positions of power may use their knowledge for their own benefit. The healthcare industry’s reputation and the investment climate as a whole could take a hit if this happens. Since it erodes the basic premise of honest and open markets.

Gary Gensler, Chair Of The SEC, Remarks On The Case And Reforms To Rule 10b5-1

The case is significant within the context of Rule 10b5-1 revisions, as highlighted by SEC Chair Gary Gensler’s remarks. To stop executives from using trading strategies to do illegal things based on nonpublic information, Gensler probably stresses the need of regulatory actions. There may be more talks about tightening restrictions to improve market integrity. And avoid future instances like this one as a result of this case.

Ongoing Investigation

Where Does The SEC Stand With Their Current Investigation?

As of this writing, Terren S. Peizer is still the subject of the SEC’s continuing investigation into insider trading claims. Regulatory authorities are busy collecting evidence, interviewing witnesses, and analyzing Peizer’s financial activities to construct a thorough case against him. But the investigation’s situation is still fluid. Verifying the claims’ validity and assessing the scope of any securities law violations are expected to be the primary concerns of the SEC.

A Data-Driven Approach To Executive Trading In Compliance With 10b5-1 Plans

The SEC’s probe into executive trading in accordance with Rule 10b5-1 plans is a subset of a larger data-driven effort into this area. Under the leadership of SEC Chair Gary Gensler, this effort demonstrates a proactive stance toward investigating. And prosecuting corporate insider trading, particularly that which is carried out in accordance with predetermined trading plans. A dedication to improving market surveillance and implementing rules meant to preserve open and honest markets. It is evident in the SEC’s attempts to use data analysis to discover possible cases of insider trading.

Press Attention

The Chief Executive Officer Of Ontrak Is Facing Insider Trading Charges, According To A Reuters Report

Reuters reported that Terren S. Peizer, CEO of Ontrak, was charged with insider trading by US authorities. The main points of the accusations, Peizer’s alleged conduct, and the possible consequences for Ontrak Inc. These are probably laid out in this report. As the case progresses and regulatory and law enforcement agencies pursue legal action. The media coverage updates the public, investors, and industry stakeholders.

The Indictment And Stock Sales As Covered By The Wall Street Journal

Terren S. Peizer’s indictment and stock transactions have been covered by the Wall Street Journal. Which has helped to clarify the details of the alleged insider trading. Details about the sequence of events, the size of stock sales, and the responses of Ontrak and the wider financial community may be included in the coverage. Credible news articles published in respected publications. Such as The Wall Street Journal, have a significant impact on the case’s public perception, dissemination of information, and ethical and legal debates.

Conclusion

Intertwined narratives in healthcare firm mergers and insider trading mergers highlight the need for strong regulatory control, ethical leadership, and increased scrutiny. The healthcare industry and regulatory agencies must work together to uphold the values of openness, justice. And responsibility as stakeholders deal with the fallout of these accusations. Not only will these accusations affect the corporations directly involved. But the results of the investigations into them will also spark discussions about the moral foundations of corporate behavior and the rules that regulate it.

Frequently Asked Questions

1. When Two Medical Organizations Join, How Could Insider Trading Claims Influence The Arrangement?

Claims of insider trading during a medical care firm consolidation cast uncertainty on the honesty of the consolidation an expected level of effort interaction. And bring up issues about the fitting utilization of classified data. Due to the gravity of the cases, chiefs partaking in such exchanges are expected to act morally and legitimately consistently.

2. In What Ways Does The Consolidation System Introduce Opportunities For Insider Trading, Or Hindrances To It?

The executives might approach significant nonpublic data during the consolidation cycle. Because of the delicate idea of the discussions, monetary appraisals, and vital choices that are involved. On the off chance that this information is taken advantage of for corrupt purposes. For example, insider trading, it could think twice about consolidation’s honesty, hurt investors’ inclinations, and the market in general.

3. When Healthcare Companies Merge, How Do Regulatory Agencies Like The Sec Deal With Claims Of Insider Trading?

Examining and indicting infringement of insider trading is a significant obligation of administrative specialists. Especially the Protections and Trade Commission (SEC). To keep the market alert and aware and ensure consistence with protections administers, the SEC explores medical services firm consolidations by seeing exchanging examples, divulgences, and exchanges.

4. What Impact Do Allegations Of Insider Trading Have On Financial Backer Confidence In A Medical Organization’s Consolidation?

Cases of insider trading can possibly harm financial backer trust, particularly during a consolidation. For financial backers to make instructed choices, there should be no excessive benefit through unlawful exchanging techniques. If not, financial backers might lose confidence on the lookout and the blending firms.

5. With Regards To Consolidations, Are There Any New Regulations Or Decides That Arrangement With Insider Trading?

As new issues emerge, the administrative scene changes likewise. Recently, there have been discussions regarding potential modifications. That would bring rules like Rule 10b5-1 up to date. And make it more difficult for insiders to profit from mergers and other delicate business situations. These changes aim to protect investors and preserve market equity.