Introduction

Bernie Madoff’s Ponzi Scheme was one of the most notorious financial scandals in history. Bernard Madoff, the scheme’s architect, utilized the funds of later investors to reimburse those who had invested with him in the past. Investors lost billions of dollars by the time this Ponzi scheme was uncovered. This post will look at how Bernie Madoff’s Ponzi Scheme worked and why it was an insider trading scandal.

Bernard Madoff’s Ponzi scheme

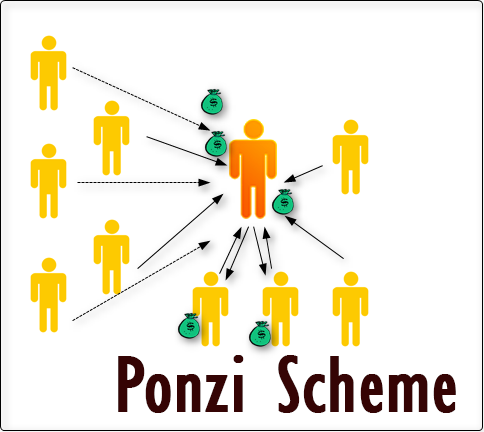

If you’re unfamiliar with the term, “Ponzi scheme” it is a fraudulent investment program in which new investors are duped into contributing money that is subsequently used to pay back the original investor and the scheme’s creator. The 2008 revelation of Bernard Madoff’s Ponzi scheme is probably the best-known example of this form of fraud.

Madoff’s scheme relied on using new investments to pay out existing investors. while at the same time lying to investors about the nature of their investments and the amount of money, they would be getting back. He assured them their money was safe by investing it in stocks and bonds. But in reality, he was running a massive pyramid scheme.

How Bernie Madoff’s Ponzi Scheme Worked

American investor Bernie Madoff used his company, Bernard L. Madoff Investment Securities LLC, to entice investors with high investment returns. Rather than putting away the cash, Madoff hushed up about it and utilized assets from new financial backers to pay for the current ones. Until his trickery was uncovered, he had the option to make it seem to be his trading company was doing great for quite a while.

He lured more investors into his scheme by promising returns that appeared too good to be true. He would show investors fake account statements indicating that their money was growing in order to make his scheme look successful. As additional financial backers saved cash into the firm, Madoff would utilize those assets to take care of prior financial backers. It was giving the impression that there were returns when there weren’t any.

Madoff’s Ponzi plot additionally included insider exchanging. He made trades for his clients using confidential information and kept the profits while they paid him high fees. Additionally, he concealed his fraudulent activities by filing false reports with the Securities and Exchange Commission (SEC). Madoff was able to keep his Bernard Madoff Ponzi scheme going for years before it was eventually exposed thanks to all of these factors.

Bernie Madoff’s Ponzi scheme was unprecedented in its scope. His fake exercises were a reminder for controllers overall and an indication of the significance of money management with alert.

The Bernard Madoff Ponzi Scheme’s False Investment Returns

Despite Madoff promising his investors high returns on their investments, he was actually using their funds to pay off other investors, giving them false investment returns.

Madoff’s casualties were guaranteed returns of up to 20% yearly. However, the truth was that Madoff was essentially paying out the cash of new financial backers to prior financial backers, providing them with a misguided feeling of safety. It became abundantly clear as the scheme unraveled that investors had not received the anticipated returns.

Madoff also lied and made up investment returns. He deceived financial backers about how much cash he had in his records. He had exaggerated how much cash he had. Investors were misled into thinking that their investments were much safer than they actually were.

The Madoff Ponzi scheme had significant repercussions. Investors suffered significant financial losses as well as Madoff’s 150-year prison sentence. Furthermore, the Bernard Madoff Ponzi conspire lastingly affected financial backer certainty and confidence in the monetary business sectors.

The Madoff Ponzi conspire is an obvious indication of the significance of financial planning with alert and cautiously investigating speculation potential open doors. False investment returns can have devastating effects, as the Madoff scandal demonstrated.

False Statements Regarding the Bernard Madoff Ponzi Scheme

Unfortunately, numerous individuals have made false statements regarding the Bernard Madoff Ponzi Scheme in an effort to take advantage of the situation’s notoriety. One example is the erroneous assertion that Madoff was a billionaire. At the point when truly he was valued at two or three million bucks. Others have guaranteed that Madoff was the driving force behind the plan. Despite the fact that he was only one of many involved, Also, certain individuals have dishonestly expressed that Madoff’s Ponzi conspire was the biggest ever. Despite the fact that it was only the largest that the government had ever discovered, Last but not least, a few people have made erroneous claims that Madoff was the only one who made money from the scheme. whereas, in actuality, the scheme helped a lot of people, including Madoff’s family, make millions of dollars. These false assertions may be popular and sensational, but they are false and ought not to be believed.

Cash Outtakes from the Bernard Madoff Ponzi Scheme

The Ponzi scheme ran by Bernard Madoff was a huge scam. Thousands of people lost billions of dollars as a result. Returns to previous investors were paid out by the scheme through cash withdrawals from investors. It gives the impression of a profitable investment. Cash withdrawals from one group of investors would be used by Madoff to pay returns to another group of investors. It is making a pattern of money coursing through the plan.

Moreover, Madoff would likewise utilize a portion of the money removed to pay his very own costs. It includes costly automobiles and luxurious vacations. Sadly, the Bernard Madoff Ponzi plot was in the end revealed. Madoff was condemned to 150 years in jail for his wrongdoings. This fraud left nothing for the victims. The monetary losses they suffered continue to affect many of them.

Unregulated Activity One of the most well-known examples of unregulated activity in history was Bernard Madoff’s Ponzi scheme. For decades, Madoff operated a deceptive investment advisory firm, promising investors steady returns and high yields. In point of fact, Madoff was not investing the money of his customers as promised. but was paying out returns to earlier investors with the money of new investors. This is an exemplary illustration of a Ponzi conspire, which is an unlawful type of unregulated movement.

There was no oversight or regulation of the Bernard Madoff Ponzi scheme. It enables Madoff to carry on his fraud and defraud billions of dollars from thousands of investors. In 2009, Madoff was indicted for 11 crimes and condemned to 150 years in jail. His Ponzi scheme serves as a reminder of the significance of financial market regulation and oversight.

Unsustainable Model Madoff founded Bernard

Madoff Investment Securities LLC, which he used to steal billions of dollars from investors and financial institutions. Madoff used the scheme to get money from new investors. Also, utilizing the cash to take care of old financial backers, making the deception of steady benefits. The scheme came to an end when Madoff was unable to keep up with the payments. This impractical model was brought about by Madoff’s deceitful exercises, bringing about billions of dollars of misfortunes for financial backers. The deception had far-reaching consequences. It resulted in stricter financial institution oversight, increased public awareness, and tighter regulations.

Why Bernie Madoff’s Ponzi Scheme an Insider Trading Scandal?

Bernie Madoff’s scandalous Ponzi plot was a broad snare of trickiness, affecting a huge number of individuals and billions of dollars. This gave the appearance that his organization was performing incredibly well. Which thusly captivated more individuals to contribute with him.

Bernie Madoff’s Ponzi scheme was primarily a scandal involving insider trading. The Securities and Exchange Commission (SEC) said that Madoff broke insider trading laws by using confidential customer information for his own gain. Madoff utilized the data to trade stocks for his clients without their insight or assent. He was able to make millions of dollars from it.

Madoff was also accused by the SEC of engaging in dishonest accounting practices, such as concealing transactions from auditors and backdating trades in order to boost returns. Madoff was able to conceal his criminal activity and continue to profit from his victims by employing these strategies.

At last, Bernie Madoff’s Ponzi plot was a deplorable break of trust that left numerous people and associations monetarily crushed. His activities abused government protections regulations and hurt the trustworthiness of the financial exchange. It is an unmistakable sign of the requirement for straightforwardness in the monetary business and the results of ignoring the law. a portion of the motivations behind why this plan is insider exchanging are beneath.

Unregulated Exchanging

Madoff’s plan included persuading clueless financial backers to put away their cash with him, when as a general rule, he was utilizing new financial backer cash to pay past financial backers. He was able to make a fortune of nearly $65 billion as a result of this. Investors suffered significant losses as a result of the scheme’s failure, and Madoff received a 150-year prison term.

The financial market’s lack of regulation was the cause of the scandal. The Madoff scandal revealed system flaws, despite the fact that the Securities and Exchange Commission (SEC) is charged with overseeing stock exchanges. It specifically demonstrated how insider trading can be used to deceive investors and manipulate markets.

Directly following the embarrassment, the SEC carried out additional severe guidelines and oversight to keep such fake exercises from occurring from here on out. It likewise expected firms to keep nitty gritty records of their exchanges and report any dubious movement to the SEC. Consequently, the Madoff case is a useful reminder of the significance of regulatory oversight in the financial markets.

Bogus Commitments

Madoff had the option to con many financial backers out of billions of dollars by making them bogus commitments of significant yields and utilizing his insider information to get much more cash-flow.

Madoff’s commitment of exceptional yields was bogus, as his Ponzi conspire had no genuine ventures and was simply intended to take cash from new financial backers to take care of existing financial backers. Also, Madoff utilized his insider information on the securities exchange to get much more cash-flow for himself to the detriment of his financial backers. Madoff was able to consistently profit even when the market was in decline by manipulating stock prices and trading on inside information.

Sadly, Madoff’s victims have not yet received full compensation for their losses. The U.S. government has frozen Madoff’s resources, however it is indistinct assuming that cash will at any point be gotten back to the people in question. The Ponzi scheme and scandal of Madoff serve as a reminder of the significance of performing due diligence prior to investing, despite the insider trading and false promises.

Insider Information

Madoff, a former financial executive, orchestrated the scheme by utilizing insider information to profit illegally from investments and securities. He worked his plan for almost twenty years, making billions of dollars from clueless financial backers.

Madoff’s use of insider information to conduct fraudulent trades was at the heart of the scheme. He would purchase stocks at costs beneath those proposed to people in general and afterward exchange them at a more exorbitant cost to his financial backers. He had access to private information that was not available to the general public, such as stock prices and corporate earnings, which made his scheme so successful.

Madoff’s plan additionally elaborate a perplexing trap of seaward records and shell organizations, which he used to conceal his benefits. Additionally, he concealed the true scope of his illegal activities by employing falsified accounting.

In the end, Madoff’s scheme was found in December 2008, and he was taken into custody and charged with securities fraud, money laundering, and other related offenses. He was condemned to 150 years in jail, and his resources were exchanged to take care of the casualties of his plan.

The Ponzi scheme run by Madoff serves as a reminder of the significance of comprehending the dangers associated with insider trading and the need to always invest with caution. It also emphasizes the importance of strict regulation and oversight to safeguard investors and prevent similar fraudulent schemes from occurring again.

Deceitful Action

Bernie Madoff’s Ponzi plot is perhaps of the most famous and expensive monetary misrepresentation ever. Former Nasdaq chairman Bernie Madoff was accused of running a massive scam in which he promised investors high returns on their investments but instead used the money to pay off other investors and fund his own lifestyle. In 2008, evidence that Madoff had been operating a Ponzi scheme for years led federal investigators to realize that he had committed fraud. He was eventually found guilty of eleven counts of fraud and given a 150-year prison term.

Insider exchanging is one more type of monetary extortion that has been utilized to advance people to the detriment of financial backers. Insider exchanging happens when somebody utilizes material, non-public data to trade protections to create a gain. This sort of misrepresentation can be committed by corporate leaders, representatives, or any other individual with admittance to private data. At times, the data used to make the exchanges is gotten unlawfully, for example, by hacking into an organization’s PC framework.

Securities and Exchange Commission (SEC)

Since the 1980s, the Securities and Exchange Commission (SEC) has successfully taken legal action against numerous individuals and businesses for insider trading. In 2012, former Goldman Sachs director Rajat Gupta was found guilty of insider trading and given a two-year prison term in one of the most notable cases. The SEC additionally brought charges against a few of Madoff’s partners for their contribution in the Ponzi plot, including his children Andrew and Imprint.

In cases involving insider trading, the SEC has the authority to seek civil penalties in addition to the criminal ones, such as monetary fines and the return of ill-gotten profits. Investors have been able to recover some of their losses as a result of these actions. In addition, the SEC collaborates with other agencies to assist in bringing those responsible for the fraudulent activity to justice.

The numerous insider trading cases that have followed the Bernie Madoff Ponzi scheme serve as a reminder of the significance of conducting due diligence on any investments. Before investing any funds, investors should always be aware of the risks involved and investigate any potential investment opportunities. Additionally, investors ought to be aware of any red flags that may indicate fraudulent activity, such as assurances of high returns with minimal or no risk. By avoiding potential risk, financial backers can assist with safeguarding themselves from becoming casualties of monetary misrepresentation.

Lack of Transparency

The scheme’s success was primarily due to its lack of transparency. Madoff had the option to involve his situation as a regarded Money Road financial backer to conceal reality from financial backers and controllers the same.

To conceal the fact that he was using money from new investors to pay off existing investors, Madoff established a complex network of shell companies. He also made use of his connections and power to hide the truth even more and get access to confidential information that helped him make money from insider trading.

Madoff was able to operate undetected for years before the fraud was finally discovered due to the scheme’s lack of transparency. Regulators’ lack of oversight and investors’ lack of due diligence contributed to this lack of transparency.

The Bernie Madoff outrage fills in as an update that monetary cheats must find success in the event that they are covered in mystery. Investors must conduct their due diligence with extreme caution, and regulators must maintain unwavering vigilance in their supervision and enforcement. Without straightforwardness, it is almost difficult to identify and stop monetary cheats.

Bernard Madoff Ponzi scheme victims

Madoff’s Ponzi was the biggest. The worst fraud damaged market investors. Shareholders ruled Ponzi victims. Madoff ruined HSBC.

HSBC lent to hedge funds seeking Madoff investments. Madoff’s $500 million investors lent $1 billion. If Madoff’s wealth is found, US authorities will first repay HSBC to limit their loss.

This century-old fraud affected Fairfield Greenwich Group the most. Fairfield Sentry Ltd. lost $7.3 billion. A Zurich-based NPB New Private Bank Ltd. marketing booklet claims Fairfield Sentry, which has a 15-year track record of 4–6% over benchmark interest rates. During 1990–2000 interest rates were 6.4%–9.8%. “Split-strike conversion” forces investment managers to buy large US firm shares and option contracts to reduce risk.

Fairfield Sentry Ltd Fixed Asset Management and opened a $400 million Madoff Ponzi account. Lawyers cheated. Madoff’s Ponzi scheme have affected BNP Paribas, Tokyo-based Nomura Holding Inc., and Zurich’s Neue Privat Bank. New York-based Tremont Capital Management and Fairfield Greenwich Group lost more than two hedge fund capital raisers.

Madoff cost Kingate Management Ltd. $2.5 billion. Madoff cost Santander $3.1 billion. Santander’s institutional investors and international private-banking clients hold 2 billion euros.

Madoff hurt more families Through Bernard Madoff Ponzi scheme

Madoff’s collapse hurt big investors. The Times reported that an American family lost their riches overnight. Five years later, the financial advisor told a woman they lost money on December 11, 2008. They unwittingly supported Bernard Madoff’s huge swindle. They invested in their divorce settlement and had limited earnings after selling their property in the market.

The Times reported that a Madoff network organizer oversaw their investment. His 40-year accomplishment intrigued them. Madoff’s scam appealed because his wife’s family had been in the business for decades.

Madoff hurt more families. In 1989 Madoff’s investments enriched them. Ira Roth’s family suffered $1,000,000. Ira invested because his mother-in-law lived off investments. Most victims were unaware. However, Madoff owns Wall Street’s largest market maker.

What Happened to the Money in Bernard Madoff’s Ponzi scheme?

Many people felt cheated when Bernie Madoff’s Ponzi scheme was uncovered. After all, in Bernard Madoff’s Ponzi scam, investors’ funds were never revealed. Instead, it was utilized to reimburse previous investors.

Following the collapse of the scheme, the court-appointed a trustee named Irving Picard, who led an investigation to identify funds and return them to investors who had suffered losses. Picard was able to locate and seize assets worth over $12 billion from various entities and accounts associated with the Madoff family.

The money was distributed among victims of Bernard Madoff’s Ponzi scheme in the form of a payout. In 2014, the final round of payments went out to the remaining claimants who had yet to receive any money back from their investments.

The US Department of Justice also announced its completion of a settlement program and disbursed more than $4 billion to victims of the fraud.

But for some of Bernie Madoff’s investors, getting their money back was not enough. Many victims are still working to recover financially after the terrible impact of the hoax. While many individuals were lucky enough to get some of their money back, they remain affected by the Bernard Madoff Ponzi scheme to this day.

Lessons Learned From Bernard Madoff’s Ponzi scheme

Bernie Madoff’s Ponzi scheme has served as a reminder of the importance of financial regulation and investor protection. It demonstrated that investors must be aware of their investments and exercise due diligence when making decisions. Additionally, Madoff’s scheme highlighted the need for careful monitoring of financial advisors and institutions. Finally, it underscored the dangers of insider trading and the importance of having systems in place to detect and prevent it.

Madoff’s Ponzi scheme was one of the largest financial frauds in history and caused billions of dollars in losses. This tragic event serves as a cautionary tale for investors around the world: always research an investment thoroughly and verify the credentials of any financial advisor you may choose to work with. Knowing the risks associated with investing and how to protect your money is essential in today’s market. By understanding the Bernard Madoff Ponzi scheme, investors can become more informed and make better decisions with their money.

Frequently Asked Questions

1. What was Bernie Madoff’s Ponzi Scheme?

Bernie Madoff’s Ponzi Scheme was a fraudulent investment operation whereby he falsely promised investors large returns based on fabricated trades. He used the money from new investors to pay off returns to existing investors, creating the illusion of a successful business.

2. How did Bernie Madoff make money?

Bernie Madoff made money by luring investors into his Ponzi Scheme, using money from new investors to pay off returns to existing investors. He did not invest the money but instead kept it for himself.

3. How did Bernie Madoff’s Ponzi Scheme involve insider trading?

Bernie Madoff used insider information to make trades that were not available to the general public. He used this information to make trades that would benefit himself and his investors.

4. What evidence was used to prove Bernie Madoff’s Ponzi Scheme?

Evidence used to prove Bernie Madoff’s Ponzi Scheme included financial records and documents, emails, and interviews with investors.

5. How did Bernie Madoff’s Ponzi Scheme end?

Bernie Madoff’s Ponzi Scheme ended when he was arrested in the year 2008, she was accused of committing securities fraud. He admitted guilt and is now serving a 150-year prison term.