Introduction

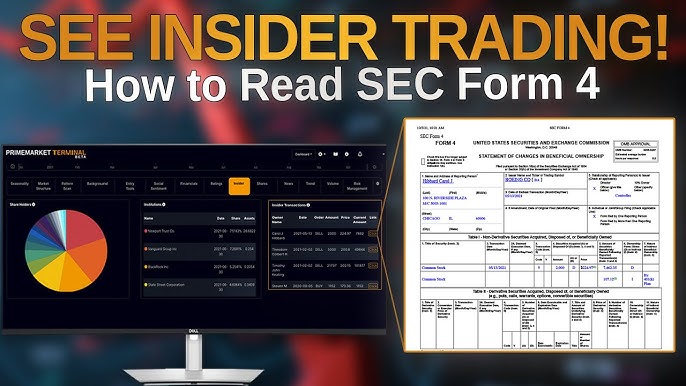

In the intricate landscape of financial markets, information is power. Investors seek every advantage, while regulators strive to maintain market fairness. One essential tool in achieving these objectives is Form 4, a document that holds the key to understanding Form 4 Insider Trading . Deciphering Form 4 Insider trading Disclosures is not merely a matter of compliance; it’s a skill that empowers investors to make informed decisions and ensures the integrity of financial markets. In this guide, we will navigate the complexities of Form 4, exploring its significance, the insights it offers, and its broader implications for both investors and market transparency.

Form 4 Overview

Structure 4 is a record expected by the U.S. Protections and Trade Commission (SEC) under Area 16(a) of the Protections Trade Demonstration of 1934. Detailing changes in the responsibility for protections by insiders is utilized. Officers, directors, and some beneficial stockholders are all considered insiders. Form 4 Insider Trading plays a vital role.

The Administrative Power Behind Structure 4 Filings

The SEC is liable for supervising and upholding the revealing prerequisites for Structure 4. The organization assumes an essential part in guaranteeing that insiders consent to these guidelines, subsequently improving straightforwardness in the business sectors.

When And How To File Form 4

Insiders must file Form 4 with the SEC within two business days of the date of the transaction. This tight time span guarantees that financial backers get convenient data about insider action. The structure should contain nitty gritty data about the exchange, including the security’s name and sum, exchange date, and the idea of the exchange.

Openness And Public Accessibility Of Structure 4 Divulgences

Structure 4 divulgences are freely accessible through the SEC’s EDGAR (Electronic Information Get-together, Examination, and Recovery) framework. This openness guarantees that financial backers, experts, and the overall population can survey and investigate insider exchanges to go with informed speculation choices.

Information In Form 4

Reporting Person’s Identification And Relationship With The Company

Structure 4 beginnings with distinguishing data about the revealing individual, including their name, title, and relationship with the organization. This segment gives clearness about who the insider is and their job inside the association.

Subtleties Of The Exchange

Structure 4 sorts exchanges in light of their tendency. Understanding the kind of exchange is vital in evaluating an insider’s goals. For instance, a critical buy might show trust in the organization’s future possibilities. The quantity of offers engaged with the exchange is a basic snippet of data. It assists financial backers with measuring the meaning of the insider’s activity and its expected effect on the stock’s cost. The exchange date and cost are fundamental in deciding the timing and cost of the insider’s activity. This data can be important for financial backers evaluating market feeling.

Clarification Of The Exchange Reason (E.G., Award, Present, Open Market Buy)

Insiders should give a concise clarification of the exchange’s inspiration. This can go from routine investment opportunities activities to critical buys or deals. Understanding the rationale behind the exchange can give experiences into the insider’s assumptions.

Changes In Useful Proprietorship And All-Out Property

Structure 4 additionally incorporates data about what the exchange means for the insider’s gainful possession and all out property of organization protections. This information permits financial backers to follow changes in an insider’s stake in the organization over the long haul.

Commentaries And Extra Divulgences

Insiders might give extra subtleties or clarifications through commentaries in Structure 4. These commentaries give setting and lucidity in regards to the exchange or any connected issues.

Interpreting Form 4 Disclosures

Timing is critical when deciphering Structure 4 divulgences. Financial backers frequently search for designs in an insider’s exchanges. For instance, a bunch of insider buys may flag a bullish point of view toward the organization’s possibilities, while an unexpected offer of countless offers could raise concerns. Structure 4 purposes explicit exchange codes to arrange insider exercises. These codes give shorthand depictions of the idea of the exchange. Understanding these codes is fundamental for precisely deciphering the structure. For example, Code P addresses an open market or confidential buy, while Code S means a deal.

Insiders are able to take part in both arranged and haphazard transactions. Arranged exchanges, for example, programmed investment opportunities works out, are regularly set up and not impacted by current economic situations. Impromptu exchanges, then again, might be more characteristic of the insider’s opinion with respect to the organization’s possibilities. It’s essential to consider their exchanging history and by and large example to acquire a more profound comprehension of an insider’s activities. For example, is this whenever the insider first has sold shares, or have they been reliably purchasing throughout the long term? Setting can be key in deciding the meaning of a specific exchange.

Structure 4 And Insider Exchanging Guidelines

Structure 4 assumes an imperative part in administrative oversight. It ensures that insiders adhere to the law by allowing the SEC and other regulatory agencies to monitor insider trading activity. Regulators benefit from the availability of this data when they investigate potential violations. Insiders who fail to file a Form 4 or provide incorrect or incomplete information risk facing severe penalties. These punishments might incorporate fines, common requirement activities, or even lawbreaker allegations. It is critical for insiders to stick to the announcing necessities to stay away from lawful repercussions.

The SEC effectively screens Structure 4 filings and researches dubious insider exchanging exercises. The organization has a track record of enforcing regulations against Form 4 Insider Trading against individuals or businesses. This implementation adds to advertise honesty and financial backer certainty.

Difficulties And Limits Of Form 4

While Structure 4 gives significant data, it may not generally offer a total image of an insider’s exercises. For instance, insiders might have various exchanges over the long run that actually should be completely uncovered in a solitary Structure 4. Furthermore, certain exchanges, for example, gifts or exchanges including non-public protections, may not be satisfactorily covered by the structure.

The two-work day announcing prerequisite for Structure 4 might bring about deferred data for financial backers. During this time, economic situations can change essentially, possibly influencing the effect of an insider’s exchange. Financial backers should know about this deferral while considering the data gave in the structure.

Transactions involving common stock are the primary focus of the role of non-traditional securities Form 4, but insiders can have intricate compensation packages that include derivatives, restricted stock units, and stock options. These modern protections may not be completely caught by Structure 4, making difficulties for financial backers looking for an extensive perspective on insider action.

Constraints In Identifying Unlawful Insider Exchanging

While Structure 4 is an incredible asset for recognizing legitimate insider exchanges, it may not be adequate to distinguish unlawful insider exchanging. Insider exchanging cases including non-public data may not be quickly clear from the structure alone, requiring further examination by administrative specialists.

Case Studies: Real-World Examples

Dissecting ongoing insider exchanging cases that were found through Structure 4 revelations can give important experiences into how this data is utilized in certifiable situations. Here are a few striking models

Martha Stewart’s Imclone Frameworks Exchange

Martha Stewart, the way of life and news head honcho, confronted charges of insider exchanging in light of her offer of ImClone Frameworks stock in 2001. She sold her portions simply a day prior to negative news about the organization’s lead medication’s FDA endorsement emerged. Her specialist’s Structure 4 revelation assumed a pivotal part in raising doubts. Stewart was viewed as at real fault for trick, hindrance of equity, and offering misleading expressions. This case highlights the meaning of timing in insider exchanging examinations. When combined with other evidence, Form 4 disclosures can provide a trail of suspicious transactions that can lead to convictions.

Sac Capital Guides Insider Exchanging Case

The SAC Capital Guides case included one of the biggest mutual funds on the planet. Based on disclosures made on Form 4 and other evidence, several of its employees were accused of insider trading. The case featured how far and wide insider exchanging can be in the monetary business. This case shows the significance of careful examinations past Structure 4 exposures. It likewise grandstands the SEC’s obligation to seeking after cases including high-profile monetary foundations.

Results, Official Procedures, And Punishments

For each contextual analysis, investigating the results of the legal procedures is fundamental. Here are the results and legal actions for the above cases:

Martha Stewart’s Imclone Frameworks Exchange

Martha Stewart was condemned to five months in jail, five months of home restriction, and two years probation. She likewise confronted a common claim from the SEC, which she settled by consenting to pay ejection and fines. Insider trading can result in both criminal and civil penalties from the law. Investors ought to be aware of the possibility of how serious such actions could be.

SAC Capital Guides Insider Exchanging Case

SAC Capital Guides consented to pay a record $1.8 billion settlement in a request concurrence with government examiners. Insider trading charges were either won or lost for a number of employees. This case shows the way that insider exchanging charges can have huge monetary repercussions for associations and people included.

Illustrations Learned And Suggestions For Financial Backers

Insiders should stick to severe consistency with announcing necessities, as infringement can prompt serious, legitimate outcomes. Financial backers ought to intently screen Structure 4 divulgences to recognize expected warnings. The planning of exchanges, particularly around material occasions or news, can be a basic figure surveying potential insider exchanges. The order of events and the context of transactions should be considered by investors. The Power of Enforcement Cases like SAC Capital Advisors demonstrates the commitment of regulatory authorities to enforcing insider trading laws. Financial backers ought to have certainty that criminal operations are effectively sought after.

Tips For Investors And Traders

How Investors Can Use Form 4 Data To Make Decisions

Investors can use Form 4 data to make better decisions about investments. By intently checking insider exchanges, financial backers can measure the opinion of corporate insiders, distinguish drifts, and separate between routine exchanges and critical activities that might flag certainty or concern. This information can give significant experiences into the organization’s future possibilities and assist financial backers with adjusting their procedures likewise.

Things To Keep In Mind When Interpreting Insider Transactions

The process of interpreting insider transactions is not one-size-fits-all. Financial backers should think about different variables, including an insider’s authentic exchanging designs, the monetary wellbeing of the organization, and more extensive industry patterns. Perceiving the setting behind every exchange is essential to keep away from confusion and pursue all around informed speculation decisions.

The Significance Of Expanding Data Sources

While Structure 4 exposures offer important bits of knowledge, financial backers should depend on something other than this information. Investors must diversify their information sources in order to get a complete picture of a company’s health and potential investment opportunities. This involves looking at budget summaries for a profound plunge into an organization’s monetary wellbeing, remaining refreshed with news reports for the most recent turns of events, and directing industry investigations to figure out area explicit elements.

Structure 4 And Market Straightforwardness

The More Extensive Effect Of Structure 4 On Market Honesty

Structure 4’s importance stretches out past individual exchanges; it assumes an essential part in maintaining the uprightness of monetary business sectors. By guaranteeing that insider exchanges are quickly uncovered and open to all market members, Structure 4 cultivates decency, evens the odds, and ingrains certainty among financial backers. This straightforwardness mitigates the gamble of out of line benefits and supports trust in the commercial center.

Promotion For Expanded Straightforwardness And Revealing Improvement

Promoters of market straightforwardness call for nonstop enhancements to Frame 4 exposures. They propose constant answering to lessen deferrals and backer for more extensive divulgence necessities that offer further bits of knowledge into insider activities. Investors can make better-informed decisions thanks to the updated and context-rich data these enhancements aim to provide.

Proposed Changes And Industry Best Practices

To reinforce market straightforwardness, industry partners are considering a few changes and best practices. These incorporate supporting the authorization of insider exchanging guidelines, instructing corporate insiders about revealing necessities, and executing informant projects to energize announcing while at the same time safeguarding the people who approach. These actions on the whole intend to upgrade market honesty and keep up with financial backer trust.

Conclusion

In the ever-evolving world of finance, understanding Form 4 Insider Trading Disclosures is a skill that can set investors apart and bolster market integrity. It is more than deciphering numbers and codes; it’s about unraveling the intentions of corporate insiders and navigating the nuances of market transparency. By grasping the significance of Form 4, investors can make more informed choices, ensuring that they are not just participants but informed and empowered players in the dynamic world of financial markets.

Frequently Asked Questions

1. What Is Form 4 And Why Is It Important In The Financial Industry?

Structure 4 is a record commanded by the U.S. Protections and Trade Commission (SEC) that insiders, for example, organization leaders and chiefs, should document to report their exchanges including organization protections. It’s huge in light of the fact that it gives straightforwardness into insider exchanging exercises, which can impact stock costs and speculation choices.

2. How Could Financial Backers Utilize Structure 4 Information For Their Potential Benefit?

Financial backers can utilize Structure 4 information to measure the opinion of corporate insiders. By following their trading exercises, financial backers can recognize drifts and survey the degree of certainty insiders have in their organization’s future possibilities, helping with pursuing more educated venture choices.

3. What Are A Few Normal Difficulties Related to deciphering Structure 4 Divulgences?

Form 4 disclosures can be difficult to understand. Challenges incorporate inadequate data, postponed announcing, and the need to consider more extensive market and industry factors. Moreover, recognizing arranged and impromptu exchanges can be a challenge.

4. How, In All Actuality, Does Frame 4 Add To Advertise Straightforwardness And Decency?

Structure 4 revelations add to advertise straightforwardness by guaranteeing that all members approach opportune data about insider exchanges. This evens the odds, forestalling unreasonable benefits and encouraging financial backer trust in the decency of monetary business sectors.

5. Are There Proposed Changes To Upgrade Shape 4 Revelations?

Indeed, there are progressing conversations about expected changes. In order to provide investors with a richer context regarding the actions of insiders, some call for real-time reporting of insider transactions, while others call for more extensive disclosure requirements. These changes mean to upgrade market straightforwardness further.