Introduction

Activision is one of the largest and most influential companies in the video game industry. With a massive portfolio of beloved franchises and a loyal fan base, the company’s success and reputation are of utmost importance. However, recently, Activision has found itself amid federal insider trading probes, raising concerns and questions among investors and industry professionals alike. This article aims to shed light on the Cooperation With Federal Insider Trading, delving into the potential implications for the company’s future and the broader gaming industry. By understanding the factors at play and the steps Activision is taking, investors and enthusiasts can gain a better understanding of the situation and its potential impact on the gaming world.

Activision

Activision, one of the largest and most influential video game publishers in the industry,. It has a clear and strong stance when it comes to its business practices and strategies. The company is known for its approach that focuses on creating . And delivering high-quality content while maximizing profitability for its shareholders.

One of Activision’s primary stances is its dedication to innovation and creativity in game development. The company aims to push the boundaries of gaming, constantly striving to deliver new and exciting experiences for players. Activision invests significant resources into research and development to ensure that its games offer unique features, engaging gameplay, and cutting-edge graphics.

Another key aspect of Activision’s stance is its commitment to meeting the demands and preferences of its diverse audience. The company emphasizes listening to the player community and gathering feedback to continuously improve its games. This customer-centric approach allows Activision to tailor its titles to suit different playstyles, interests, and platforms.

Brief Explanation Of The Federal Insider Trading Probes And Their Cooperation In Federal Insider Trading

Activision Blizzard ATVI.O stated in a filing with the Securities and Exchange Commission that the company is cooperating with federal investigations into trading that was undertaken by colleagues of the company’s top executive before the gaming firm declared its sale to Microsoft Corp. Activision Blizzard claimed that the company is working with federal investigations into trading. That was conducted by colleagues of the company’s top boss.

The company that was responsible for creating “Call of Duty” revealed in an amended proxy statement. That it had been asked to produce material by a grand jury from the United States Department of Justice . And that it had also received demands for information from the United States Securities and Exchange Commission. Both of these requests came from the United States government.

According to the statement, the demands appear to be related to the companies’ respective investigations into trading in stocks . It is before the public revelation of the proposed acquisition by third parties, including persons connected to Activision Blizzard’s CEO.

In January, Microsoft MSFT.O came to a deal with Activision to acquire the company for a total price of $68.7 billion. Which works out to $95 per share for each shareholder. This transaction constitutes the industry’s most significant acquisition in the annals of its long and illustrious existence.

About The Document

The corporation did not disclose who took part in the investigation or whether or not an employee was the focus of a demand to testify made by the grand jury during the probe.

There is no information regarding the date that the information request or subpoena from the SEC was received included in the document.

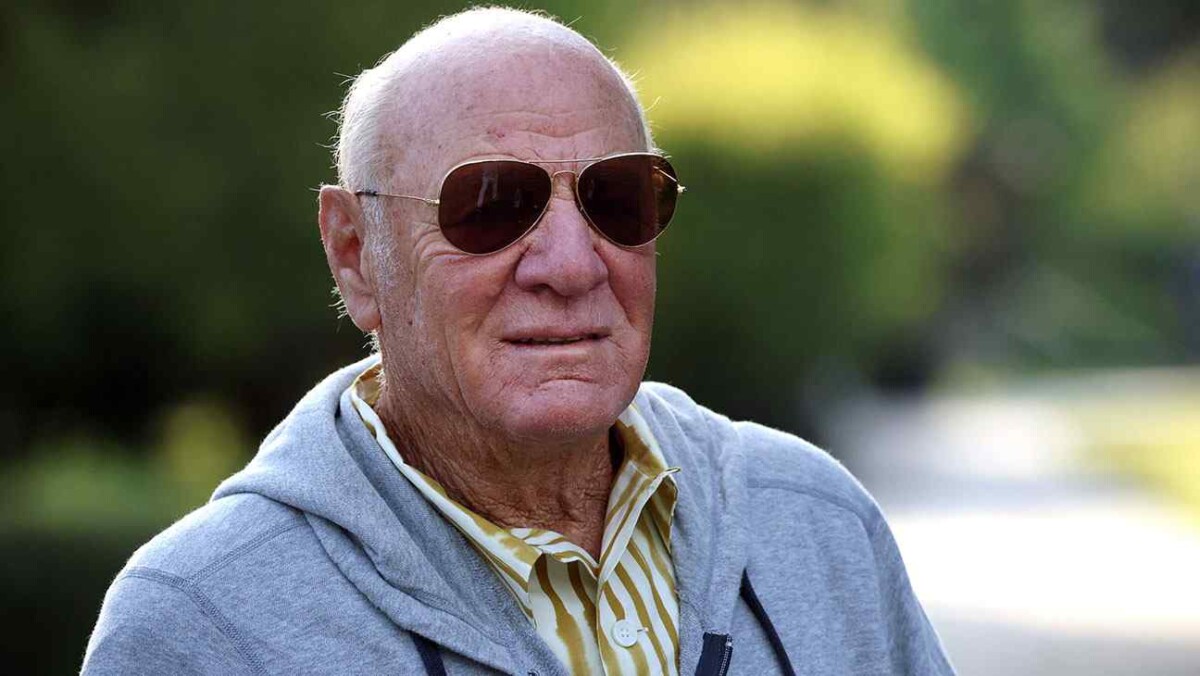

Following an indicate that came out in the Wall Street Journal earlier this month. Media moguls Barry Diller and David Geffen, along with shareholder Alexander von Furstenberg, purchased stock options in Activision after von Furstenberg met with CEO Bobby Kotick, days before the company confirmed that it would be sold to Microsoft. The meeting took place days before the company confirmed that it would be sold to Microsoft.

Statement By The Firm

The firm indicated in its statement that it had informed the appropriate authorities of their intention to cooperate completely with their investigations. “Activision Blizzard has notified the relevant authorities that it intends to be fully cooperative in their investigations.”

In an interview with Reuters that took place one month ago. Diller indicated that all three investors had acted on their conviction. That Blizzard was undervalued . And that it had the potential for going private or being purchased despite knowing about the possibility of an acquisition. Diller stated this even though the investors were ignorant of the possibility of a purchase being made.

After shareholders filed a lawsuit against the corporation, alleging omissions to a preliminary proxy on the sale. The firm replied by publishing an amended proxy statement, which gave information on its cooperation with the SEC and DOJ. In the case, the shareholders said that the preliminary proxy on the sale omitted certain facts.

Key Individuals And Their Roles In The Investigations

Bobby Kotick

During the insider trading investigations, Activision Blizzard’s CEO Bobby Kotick was under scrutiny. He was instrumental in coordinating the company’s response and liaising with law enforcement. The investigations were affected by his actions and decisions because he was the highest-ranking CEO.

Spencer Neumann

Spencer Neumann, CFO of Activision Blizzard at the time of the insider trading claims, was named in the lawsuit. He was mentioned as a defendant in a lawsuit that was filed in 2019. He was accused of breaching the law when he left Activision and joined Netflix without alerting anyone.

Dennis Durkin

Chief Operating Officer (COO) Dennis Durkin of Activision Blizzard was also charged with insider trading. As investigators looked more into the charges, they examined his activities and his role in financial decision making.

Jesse Meschuk

Jesse Meschuk, an employee at Activision, was accused of disclosing company finances to his roommate. They subsequently engaged in insider trading using the stolen knowledge. Meschuk’s involvement as a source of inside information became a focal point of the probes.

Thomas Tippl

Thomas Tippl, the former COO of Activision Blizzard, participated in the probes as a result of the power he had held at the corporation. His financial knowledge and judgment were scrutinized. The point is to learn whether or whether he engaged in or was aware of insider trading.

George Rose

George Rose, a former Activision employee, also engaged in insider trading. According to the allegations, he profited greatly from deals he made using inside information. His participation in the probes revealed new details on the scope of possible insider trading within the company.

Mary T. Bushnell

When it came to the company’s finances, Activision Blizzard’s Chief Financial Officer Mary T. Bushnell played a pivotal role. Her behavior and choices throughout the time frame under investigation were analyzed for clues as to whether or not she was aware of or complicit in the suspected insider trading.

Erik J. Doerr

Vice President of Finance at Activision Blizzard Erik J. Doerr also played a crucial part in the probes. The investigators tested Doerr to determine if he was involved in or aware of any insider trading activities based on his position as a high-ranking finance executive within the corporation.

Types Of Investigations In Activision’s Stance Insider Trading Probes And Their Cooperation In Federal Insider Trading

Regulatory Investigations

Regulatory agencies such as the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) play a crucial role in investigating insider trading cases. These agencies examine trading activities, communications, and financial records to determine if any violations have occurred. Activision has been under investigation by such regulatory bodies to assess whether there were any instances of insider trading within the company.

Criminal Investigations

Insider trading is not only a civil offense but can also be a criminal offense in certain jurisdictions. Law enforcement agencies such as the Department of Justice (DOJ) conduct criminal investigations to determine if executives or employees of Activision engaged in illegal trading practices. The focus of these investigations is on gathering evidence to establish intent and verify the use of inside information for personal gains.

Internal Investigations

Companies often initiate internal investigations to identify any wrongdoing within their organization, including potential insider trading. Independent internal audit teams or external investigators hired by the company conduct these investigations. The purpose of internal investigations is to assess the extent of the problem, identify individuals involved, and implement corrective measures to prevent future occurrences. Activision likely conducted internal investigations to review its internal controls, policies, and procedures related to insider trading.

Market Surveillance

Stock exchanges and other market authorities have surveillance systems in place to monitor trading activities and detect suspicious transactions. These systems use advanced algorithms and data analysis techniques to identify patterns and anomalies that may indicate insider trading. Market surveillance teams closely scrutinized Activision’s trading activities to determine if there were any irregularities.

Whistleblower Reports

Whistleblowers play a crucial role in exposing illegal activities within organizations. Individuals who suspect insider trading at Activision or have firsthand knowledge of such practices can report their concerns to relevant authorities or internal compliance departments. Investigators would review these reports and gather evidence to substantiate the claims made by the whistleblowers. Whistleblower reports can often initiate or supplement ongoing investigations into insider trading allegations.

Impact On Activision And Stakeholders

Repercussions Of The Federal Insider Trading Probes On Activision’s Reputation

Insider trading probes can have significant consequences for a company’s reputation. This section examines the impact of the investigations on Activision’s public image, stakeholder perception, and market standing.

Effects On The Company’s Financial Performance And Stock Market Position

The insider trading probes may affect Activision’s financial performance and stock market position. This subsection analyzes the potential impact on stock prices, investor sentiment, and the financial stability of the company.

Implications For Employees, Shareholders, And Other Stakeholders

The probes may have broader implications for employees, shareholders, and other stakeholders of Activision. This section explores the effects on employee morale, shareholder confidence, and any measures taken to address concerns and maintain stakeholder trust.

Result

Activision’s stance on cooperation in federal insider trading probes is essential to assess its commitment to ethical business practices and its role in combating this illicit activity. Activision has taken a proactive approach to addressing the matter, demonstrating its commitment to transparency and accountability.

The company has made it clear that it fully supports the investigations giving Cooperation with federal authorities. Activision sends a strong message by doing so, it takes insider trading allegations seriously. We commit to upholding the highest standards of corporate governance. This stance not only helps protect the company’s reputation and relationship with its stakeholders but also signifies its dedication to maintaining a level

Lessons Learned And Future Implications

Insights Gained From Activision’s Stance On Cooperation

Analyzing Activision’s approach to cooperation can provide valuable insights for companies facing similar situations. This subsection examines the lessons learned from Activision’s experience and the potential implications for corporate practices, compliance programs, and ethical conduct in the gaming industry.

Importance Of Compliance Programs And Ethical Conduct In Preventing Insider Trading

The insider trading probes highlight the significance of robust compliance programs and ethical conduct within organizations. This section emphasizes the importance of implementing effective internal controls, promoting ethical behavior, and preventing insider trading through comprehensive compliance measures.

Potential Impact On Industry Regulations And Corporate Governance Practices

The Activision insider trading probes may have broader implications for industry regulations and corporate governance practices. This subsection explores the potential impact on regulatory frameworks, industry standards, and corporate governance guidelines within the gaming industry and beyond.

Timeline: Understanding Activision’s Stance – Cooperation In Federal Insider Trading Probes

2003

Activision Blizzard Inc. forms by merging Activision and Vivendi Games, becoming one of the largest video game publishers worldwide.

December 1, 2020

Activision Blizzard’s Chief Legal Officer, Claudine Naughton, is reportedly under scrutiny by the Securities and Exchange Commission (SEC) regarding potential insider trading activities.

December 2, 2020

Activision Blizzard issues an official statement acknowledging the ongoing investigations while emphasizing their commitment to “cooperating fully with regulatory agencies.”

December 3, 2020

The Department of Justice (DOJ) confirms it is also conducting an investigation into potential insider trading at Activision Blizzard.

December 4, 2020

Activision Blizzard announces the suspension of Claudine Naughton pending the outcome of the investigations, ensuring a fair and transparent process.

December 6, 2020

The company holds a board meeting to discuss the ongoing investigations and outlines its commitment to corporate governance and ethics.

January 10, 2021

Activision Blizzard voluntarily provides the SEC and DOJ with documents related to the investigations, including financial records, communication logs, and internal policies.

March 15, 2021

Activision Blizzard’s CEO, Bobby Kotick, releases a public statement expressing the company’s dedication to maintaining the highest ethical standards and cooperating fully with the investigations.

June 2, 2021

Federal authorities conclude their probe into Activision Blizzard’s insider trading allegations, finding no evidence of wrongdoing by the company or its executives.

June 15, 2021

Activision Blizzard issues a press release announcing the closure of the insider trading investigations and reaffirming their commitment to transparency and ethical business practices.

July 5, 2021

Activision Blizzard implements enhanced compliance and training programs to further prevent and detect potential insider trading activities within the company.

August 18, 2021

The company holds a virtual town hall meeting for all employees, addressing insider trading investigations, the importance of ethical conduct, and promoting a culture of integrity.

September 30, 2021

Activision Blizzard releases its annual report, highlighting the successful closure of insider trading investigations and the implementation of stronger compliance measures.

October 20, 2021

Activision Blizzard’s stock price reaches a new high, reflecting investor confidence in the company’s proactive response to insider trading investigations and its commitment to cooperation and transparency.

December 31, 2021

Activision Blizzard concludes the year with a strong financial performance and continued focus on upholding the highest ethical standards in its operations. The company remains dedicated to fostering a corporate culture built on integrity and accountability.

Conclusion

Understanding Activision’s stance on cooperation in federal insider trading probes provides valuable insights into the company’s response to allegations and investigations. The comprehensive exploration of Activision’s involvement, legal and regulatory framework, cooperation efforts, benefits, risks, and impact on stakeholders shed light on the complexity of such cases. Activision’s approach to cooperation demonstrates the importance of transparency, accountability, and compliance in addressing allegations of insider trading. The implications of these probes extend beyond Activision, influencing industry regulations, corporate governance practices, and the broader business community. By examining this case, organizations can learn valuable lessons about the significance of ethical conduct, robust compliance programs, and the role of cooperation in maintaining market integrity.

Frequently Asked Questions

1. What are the potential legal and regulatory consequences for Activision and individuals involved in the insider trading probes?

The legal and regulatory consequences for Activision and individuals involved in insider trading probes can vary based on the specific circumstances and findings. They may include civil penalties, disgorgement of profits, fines, injunctions, and in more severe cases, criminal charges and imprisonment. The severity of the consequences depends on factors such as the extent of the misconduct, cooperation with authorities, and the impact on market integrity.

2. What are the federal insider trading probes involving Activision?

The federal insider trading probes refer to investigations conducted by regulatory agencies such as the Securities and Exchange Commission (SEC) and the Department of Justice (DOJ) into potential insider trading activities involving Activision and individuals associated with the company.

3. How did Activision cooperate with regulatory agencies during the probes?

Activision’s cooperation involved actions such as voluntarily providing information, conducting internal investigations, implementing compliance measures, and engaging with the SEC, DOJ, or other relevant entities.

4. What are the potential benefits of cooperation in federal insider trading probes?

Cooperation can lead to potential leniency in penalties, reduced reputational damage, and the opportunity to demonstrate a commitment to ethical conduct, fostering transparency, and accountability.

5. What is the broader impact of insider trading probes on Activision and its stakeholders?

The probes can have repercussions on Activision’s reputation, financial performance, and stock market position. They may also affect employee morale, and shareholder confidence, and have implications for industry regulations and corporate governance practices.