Many allege that congress frequently dabbles in insider trading. How true that is cannot be ascertained factually – but a few cases in recent years have shed some light on cases where things went awfully wrong. Congressional insider trading is a topic of much debate – both legal and economic in nature.

Let’s review the most well-known recent insider trading allegations in congress.

Nancy Pelosi’s Insider Trading Allegations

The Democratic Leader of the U.S. House of Representatives, Nancy Pelosi (D-Calif.), has admitted to a long-term relationship with a tobacco company executive. It is being investigated by the U.S. Securities and Exchange Commission (SEC) for possible insider trading. The revelation comes as a result of her husband’s involvement in a lawsuit involving tobacco companies. Which could potentially subject her to legal action if she is found guilty of wrongdoing.

According to reports, Pelosi’s husband Paul, who also serves as chairman of Goldman Sachs Asset Management, was sued by Philip Morris International Inc. One of the largest cigarette manufacturers in the world. And among those being sued by the SEC for alleged fraud and conspiracy to deceive investors regarding their financial condition.

According to The New York Times (NYT), Paul Pelosi was named in an affidavit filed by Jeffrey Wigand. He claims that he worked as an employee at Johnson from 1986 until 1992. And was then hired by Philip Morris International Inc., where he was “directed” by a lawyer named Nancy Pelosi.”

So, what Really Happened?

The U.S. Congress has been accused of insider trading since the 1980s, but it is the case of Nancy Pelosi that has garnered the most attention in recent years.

In 2008, Pelosi was accused of insider trading when she sold her stock in telecom company Qualcomm Inc. One day before the company announced that it received a $1 billion bid from rival Broadcom Ltd., Bloomberg reported at the time.

Pelosi sold her shares at $33 each. A price that was higher than what she had paid for them two years earlier. She now owns more than $100 million worth of Broadcom stock and is the largest shareholder in the company.

A Quick Timeline

Nancy Pelosi is the Democratic leader of the U.S. House of Representatives. She has been accused of insider trading by Charles Schumer, who is also a member of the US Senate.

Pelosi allegedly used insider information to make a profit on the sale of Dell Computer stock in the year 2000. She was allegedly tipped off by her husband. Paul Pelosi, who was then-president and CEO at Fidelity Investments, had a large stake in Dell’s stock. The company’s stock price rose after this information was revealed to them. Allow Nancy Pelosi to sell her shares at an increased price and make a profit for herself.

The investigation into this incident began in 2006 when it was discovered that she had purchased 100,000 shares for $4 a share on August 2nd, 2000—the day before Dell announced its acquisition by another company called Perot Systems Corporation (which itself later went bankrupt). However, no charges were ever brought against Nancy Pelosi or anyone else involved with this scandalous event. The statute of limitations has run out on any criminal activity committed during this time period.

Pelosi’s son William “Billy” Pao is also a director at Qualcomm. He stands to benefit financially from his mother’s sale as well. He owns nearly 30% of his mother’s stake in Qualcomm through their holding company, WEP Management LLC.

In 2016 Charles Schumer accused Nancy Pelosi of having violated security laws. It is by selling her shares before they reach their peak value due to her knowledge of internal company matters.

FDA Ruling on Drug Pricing Policies

The accusations when she was the speaker of the House come from a group of investors who allege they lost millions after buying stock in a pharmaceutical company that was in the process of being acquired by a larger firm. The deal was subject to approval by the Food and Drug Administration. It is controlled by the Department of Health and Human Services.

Pelosi’s husband, Paul Pelosi, served as head of the health subcommittee in 2010. He introduced legislation that would have delayed an FDA ruling on drug pricing policies related to his wife’s company. Those policies were ultimately approved by other lawmakers. But they had an unexpected effect, causing shares in AbbVie stock to plummet.

According to Politico, Nancy Pelosi’s husband purchased hundreds of thousands of dollars worth of AbbVie shares just before news broke about his wife’s role in pushing through bills that would benefit the company. Those shares plummeted from $73 each at their peak value to just over $10 per share at their lowest point.

Congressional Insider Trading: Other Instances

The 2020 congressional insider trading scandal refers to an investigation by the Securities and Exchange Commission (SEC). It is into a dozen members of Congress who are alleged to have traded on information they learned from Elon Musk in connection with his acquisition of SolarCity.

The SEC alleges that the 12 congressmen engaged in insider trading by purchasing shares in Tesla and SolarCity before news broke on August 7, 2018, that Musk was considering taking Tesla private and had secured funding for such a move.

It also says the congressmen received nonpublic information from Musk in August 2018, after he told them privately that he was considering taking Tesla private, but before news of his plans became public. The SEC alleges they then purchased shares worth more than $1 million each.

2020 Congressional Insider Trading Scandal

The 2020 congressional insider trading scandal was a scandal in the United States involving 12 members of Congress and their use of nonpublic information about Tesla Motors’ (NASDAQ: TSLA) stock to buy and sell shares between March and May 2019. The scheme allegedly took place at the offices of the investment bank Morgan Stanley in New York City. Where representatives from both parties and both chambers of Congress traded on sehttps://insider-trading.org/what-is-an-illegal-insider-trading/nsitive information relating to Tesla’s Model 3 production rate, which was scheduled to be released publicly at an upcoming shareholder meeting.

The SEC announced criminal charges against two former Morgan Stanley employees and three former congressmen on August 8, 2019. The following day, the Justice Department announced that it had reached an agreement with Morgan Stanley over potential violations of insider trading laws.

The Congressional insider trading scandal is a term used to describe the allegations of congressional members and staff trading on information they learned while in office. The scandal has been described as one of the biggest scandals in American history, with at least 12 congressmen being accused of trading stocks based on information they obtained from Elon Musk.

When the news first broke out

The scandal first erupted when it was revealed that several members of Congress were selling shares before Tesla’s earnings call on August 7, 2019. The shares sold by these congressmen were worth a total of $4 million and it was revealed that they had been selling their shares days before news emerged that Tesla was facing financial difficulties due to delays in new models and production issues.

In response to the scandal, Democratic Senator Elizabeth Warren called for an investigation into whether or not Congressmen had traded stock based on information about Tesla’s financial situation, which they received from Elon Musk himself during his appearance before Congress on August 7th, 2019.

Related: Read about the insider trading case of Martha Stewart and how she was able to make millions from it. It examines the events leading up to the case, the details of the trial, and the ultimate outcome. It also offers insights into how Martha was able to capitalize on her knowledge of the stock market and how her success has impacted her career.

Should Congress Members’ Stock Trading Be Regulated?

The stock trading of members of Congress has become a major issue in recent months. The revelation that Rep. Tom Price, R-Ga., traded stocks tied to healthcare companies while voting on healthcare legislation has led to calls for his resignation as head of the Health and Human Services Department.

The controversy also has raised questions about whether Congress should regulate members’ stock trading.

An August 18, 2022, report from Brookings Institution suggested that Congress should regulate members of Congress’ stock trading because it is a conflict of interest and could lead to insider trading convictions if laws are not enforced.

But many experts say the current system already works well, at least on paper.

The current system allows members of Congress to trade stocks after they have been elected. And it leaves them free to do so without fear of prosecution.

Stock trading by members of Congress is not illegal, but it can be unethical.

Federal Advisory Committee Act

The Federal Advisory Committee Act (FACA) requires that all advisory committees in government be open to the public. And its disclosure requirements apply to stock trading as well. This is a good thing because it allows public scrutiny of potential conflicts of interest.

However, staff members of the House Ethics Committee have said that the FACA does not require disclosure of stock trades by members of Congress. They say that a member’s decision to buy or sell stocks should be based on their own financial interests. Rather than those of their family members or friends.

The issue arises from how Congress defines “family members.” Members may have dozens of relatives who live on their congressional salaries. Thus, if a lawmaker buys or sells shares for someone else, there is no way for others to know about it. Except if they are directly involved in the trade – an unlikely scenario in Washington where many lawmakers have large entourages and staffs.

Is the Congressional Stock Trading Conflict of Interest Illegal?

The stock trading of members of Congress is regulated in the same way as the stock trading of any other American citizen. In other words, if you’re a member of Congress, you can’t trade stocks or bonds in your own account, but you’re free to buy and sell a stock for your personal accounts.

The conflict of interest exists because members of Congress are required to vote on legislation that affects their personal investments. However, they aren’t personally liable for any losses that occur as a result of their votes.

Trading stocks is not illegal per se, even though there is a conflict of interest. Most Americans believe that lawmakers on committees have more information than the public to “pick winners.” Along the same line of thought, Mike Patton from Forbes exampled this as the following in an October 3, 2022 article:

Let’s say a lawmaker who serves on the Energy and Commerce Committee buys a few green energy stocks just before introducing legislation that would favor these types of companies. If the legislation became law, the member could receive a nice profit.

And this is not a new suspicion either. The public has been trying to get Congress to regulate how their own members buy and sell stocks for a few decades now. The fact that the lawmakers don’t want this to happen. It might be saying something – but there is no proof on which to base such arguments.

In any case, this potential conflict of interest isn’t illegal. In fact, even proven conflicts of interest aren’t illegal. That could be ignored by lawmakers in most cases where no wrongdoing was found.

Following Capitol Trades: Valuable Trading Insights or Nothing Special?

So, does this mean you can follow the trading patterns of Capitol Hill politicians to derive valuable insights? Well, many do exactly that. We cannot ascertain how useful that is.

But if there’s an ongoing trend in these trades while you have no knowledge of what’s going down, it might be worth looking into.

Capitol Hill trades are a tried and true method of trading. They are also very popular among retail investors who want to make better stock trading decisions.

While Capitol Hill trades have been around for a long time. They’re still one of the most effective methods of stock trading out there.

But what exactly are Capitol Hill trades? How can you use them to make better stock trading decisions? It’s not just about making better stock trading decisions. It’s about being able to back up your claims with verifiable facts.

Why Politicians Aren’t Good Stock Dealers

It is not uncommon for Congress members to trade stocks in their personal portfolios. This type of trade is illegal under the STOCK (Stop Trading on Congressional Knowledge) Act. It requires members to disclose trade on Capitol Hill.

However, some lawmakers have been able to skirt the rules by using spouses or aides as traders. These trades are shrouded in secrecy and can be very lucrative.

The main reason politicians don’t make good stock traders is that they tend to be risk-averse and have little knowledge of the market. They have spent years in office, making political decisions, and don’t feel the need to take risks on speculative investments. This is why most members of Congress trade very little in stocks or options.

But large-scale trends in this spectrum of trade can hint toward some signs and hard facts as per insider knowledge. And these might be worth following. Keeping an eye on these happenings might turn out to be profitable – though this is not financial advice. You can use the Capitol Hills tracker to stay in the know.

In Conclusion

There have been several scandals involving congressional insider trading. From trading stocks of Elon Musk’s companies to allegations against Pelosi – congress has recently been in a lot of press due to inside trading allegations and full-scale scandals.

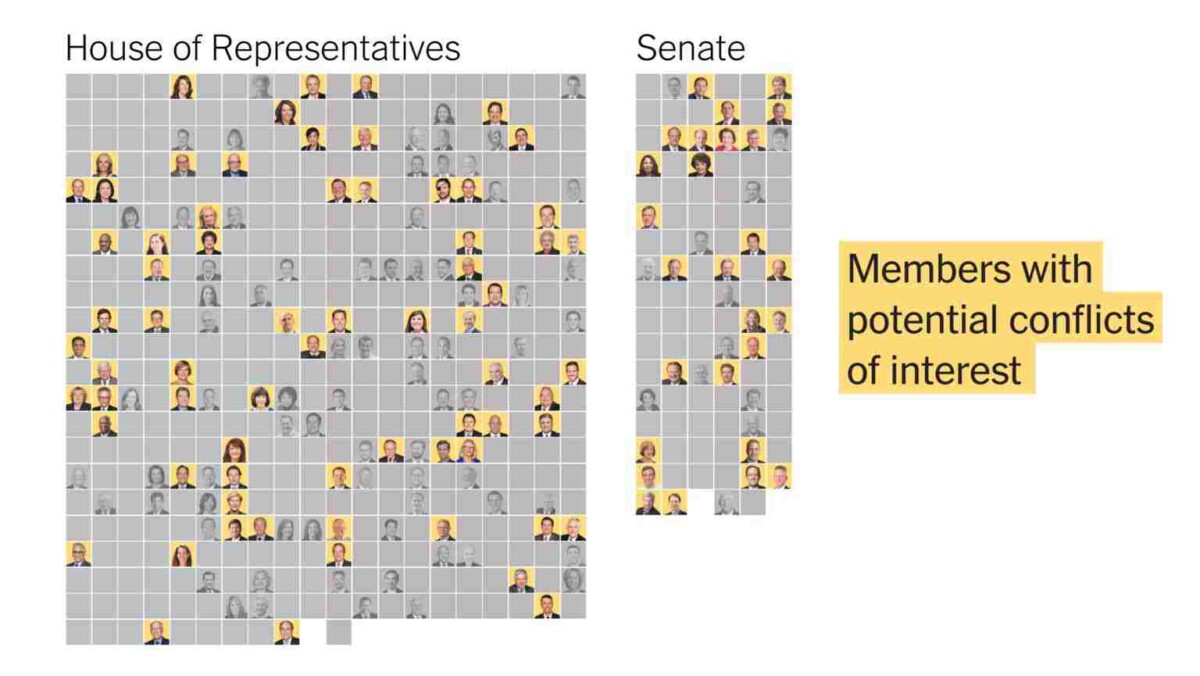

In a recent article, NY Times covered how 97 lawmakers of someone from their family had bought or sold assets in the last 3 years from companies involved in industries that are influenced by their legislative work.

Though there’s no conclusive proof that this was done intentionally, let alone if this ended up as profits in the pockets of the lawmakers themselves, this is still something the SEC should take a closer look at.

Lawmakers of all types involved in a specific industry and creating policies for that industry are insiders by some definitions. They can easily capitalize on the information they unearth as part of their regular legislative committee work.

Insider trading in congress is a very controversial subject. It is not illegal for members of congress to buy or sell stocks based on information they receive from their staff. However, there is a possible conflict of interest when they trade stocks based on such information.

Insider trading in congress has been a hot topic in Washington since 2008. The issue involves the possibility that congressional staff may have leaked information to their bosses about companies that are doing business with the government and thus giving them an unfair advantage over other investors. In 2008, it was revealed that Rep.

Rick Renzi (R-AZ) had purchased large amounts of stock in several companies after he learned about new restrictions being placed on them by government regulators.

Congress Insider Trading: Unethical Stock Trading Practices

Impact of Congress Insider Trading

Congressional insider trading is an unethical practice that allows members of Congress to trade stocks and other investments using non-public information obtained through their positions in government.

This creates a conflict of interest in which politicians are able to use their public positions for personal gain. By exploiting the power of their public office, these officials are taking advantage of their constituents and undermining the integrity of our government.

The impact of Congress insider trading is felt not only by the citizens who entrust their elected representatives with their best interests but also by the stock markets.

The practice skews the markets, giving members of Congress an unfair advantage that can be used to manipulate prices and buy shares at lower prices. Additionally, it creates a perception of unfairness, which can deter investors from investing in certain companies or industries.

Finally, it undermines the trust that citizens have in their representatives and in the political system as a whole. By allowing those in power to exploit their positions for personal gain, it undermines the entire democratic process.

Congress is Held to the Highest Ethical Standards

As such, it is important that Congress pass legislation to ensure that this type of unethical behavior is prohibited and punished. Only then will we be able to restore confidence in our political system and ensure that our representatives are serving the public interest?

Moreover, it is important that members of Congress are held to the highest standards of ethical conduct. The public must be made aware that insider trading is prohibited, and those who engage in this behavior will be held accountable.

This can be accomplished through a combination of increased media coverage, greater transparency, and increased sanctions for offenders. Additionally, those in Congress should be encouraged to use the power of their position to advocate for ethical investing and the disclosure of non-public information.

How Does it Affect the Stock Market?

The unethical practice of Congress insider trading has a significant effect on the stock market. When members of Congress use their inside information to buy and sell stocks, it creates an uneven playing field for other investors. Insider trading is illegal, but it’s not always easy to prove it was done intentionally and maliciously.

Insider trading puts regular investors at a disadvantage, as they don’t have access to the same information that members of Congress have. This can lead to members of Congress making more money on the stock market than ordinary investors. Even if the trades are eventually found out and punished, it often takes time before the truth comes to light and the trades are reversed.

Insider trading also causes increased volatility in the stock market as traders try to capitalize on the insider information they have. Increased volatility can lead to higher risks for investors, which can make investing less attractive.

Finally, insider trading creates mistrust in the stock market. If the public thinks that powerful individuals with inside information are manipulating the system, they are less likely to buy stocks. This reduces overall investment in the market, leading to fewer returns for everyone.

Ultimately, Congress insider trading has a major impact on the stock market and its participants. It creates an unfair playing field and leads to increased volatility and mistrust in the market. All of these factors can have a negative effect on investors and the market as a whole.

How Does it Affect the Public’s Perception of Congress?

The issue of Congress insider trading has been one that has raised much public concern and debate in recent years. Insider trading is illegal in the private sector, and many people have argued believe that it ought to be illegal in the public sector as well.

Though it is a complicated issue, Congress insider trading can have a significant effect on the public’s perception of Congress. One reason is that using one’s position in Congress for personal gain is completely unethical. The public may feel that those in Congress are taking advantage of their privileged positions to make money off of confidential information rather than serving the public good.

Another issue is the potential for conflicts of interest when members of Congress engage in insider trading. If a member of Congress is able to obtain non-public information about an upcoming vote or decision, they may use that information to buy or sell stocks accordingly, which could potentially lead to a conflict of interest with their congressional duties. This could lead to losing public faith in Congress and feeling like the institution is not working in its best interests.

Insider Trading in Congress is a Complicated Problem

Finally, the issue of Congress insider trading raises questions of fairness. As it may give certain members of Congress access to information that others do not have. One could argue that this gives those with confidential information an advantage over the general public. They are unable to take advantage of this knowledge. This could lead to perception. That the government is only working for those in power rather than for all citizens equally.

Congress insider trading is a complex issue with numerous implications for the public’s perception of Congress. From questions of ethics and fairness to possible conflicts of interest, it is important to consider all aspects when discussing this issue. It is clear that it has the potential to damage public trust in Congress. And create a perception that those in power are taking advantage of their positions.

Potential Solutions

The issue of Congress insider trading is a serious one and requires an effective solution to be put in place. One of the primary solutions that have been suggested is to pass the STOCK (Stop Trading on Congressional Knowledge) Act. This would prevent members of Congress from using any non-public information they gain through their official duties to purchase or sell stocks.

Another potential solution is to give the Securities and Exchange Commission (SEC) additional resources and power to investigate suspicious trading activity in the stock market. This could help detect and prevent Congress members from engaging in insider trading.

Finally, it has also been suggested that all stock trades of members of Congress should be reported publicly. This would enable the public to track any suspicious trading activity. And could help deter those who are tempted to engage in insider trading.

Overall, it’s clear that Congress insider trading is a serious issue that requires attention. By taking steps such as passing the STOCK Act, giving the SEC more power, and increasing public disclosure of Congressional stock trades, we can ensure that unethical stock trading practices are discouraged and stopped.

More Strict Regulations

The practice of insider trading has been seen as unethical for a long time. In the case of Congress, it is no different. With the recent scandals surrounding some members of Congress using insider information to their advantage to make money on the stock market. It is obvious that additional rules are necessary to stop this kind of unethical behavior.

One way to deter this behaviour is to impose stricter penalties on those who are caught engaging in insider trading. This could include revoking Congressional membership, as well as jail time and heavy fines. Additionally, all stock trades made by Congress members should be tracked and reported to the Securities and Exchange Commission (SEC). This will allow the SEC to monitor any suspicious activity. And take action against any member found to be participating in such activities.

Another solution is to impose limits on the types of investments members of Congress can make. For example, members may be restricted from investing in stocks or industries related to their area of expertise or legislation they are working on. This will ensure that Congress members are not trading based on privileged information.

Finally, some have suggested that Congress members should be held to a higher ethical standard than ordinary citizens. This means that any breach of ethics would be taken more seriously, and any resulting punishment would be harsher.

Though the issue of Congress insider trading is complex and difficult to address. It is clear that something must be done to prevent this unethical behaviour from continuing. With stronger regulations, more transparency, and higher standards, Congress members can be held accountable for their actions. And help restore trust in our nation’s political system.

Increased Transparency

With the increase in reports of Congress members using their insider knowledge of pending legislation to make stock trades. It has become increasingly important for Congress to take steps to ensure more transparency in these activities. While there are some ethical rules in place to prevent legislators from trading stocks based on insider information. There is still a need for increased transparency.

One way Congress can provide this increased transparency is through the use of online stock trading logs. The public should have access to these logs . So that anyone can see when and how much Congress members are trading in stocks. This will provide an important source of oversight. It helps to ensure that legislators are not engaging in any unethical behavior when it comes to stock trading.

In addition to making stock trading logs available. Congress should also require members to publicly disclose any potential conflicts of interest they may have related to their stock trades.

For example, if a member has investments in a company that may be affected by pending legislation. They should be required to disclose this information. So that the public can see whether or not the trade was based on insider information.

Frequently Asked Questions

Is Congress exempt from insider trading?

No, Congress is not exempt from insider trading. Congress is subject to the same laws and regulations as all other investors. Insider trading is a federal crime that applies to all investors, regardless of their position or role.

Why is Congress allowed to do insider trading?

Unlike other investors, however, Congress is allowed to do some kind of insider trading under a special exemption known as the STOCK Act. This exemption permits members of Congress and their staff to buy and sell securities based on non-public information obtained through their official duties. This exemption does not, however, apply to any information obtained through private sources or outside work.

Why is congressional insider trading legal and profitable?

Congressional insider trading is legal and profitable because the STOCK Act gives members of Congress access to information about upcoming legislation or government policy that other investors may not have. This information can be used to make profitable trades, as members of Congress may have a better understanding of how certain stocks may be affected by new laws or policies. However, it is important to note that Congress is still subject to insider trading laws and must not trade on any information that is not publicly available.